How to Manage a Student Credit Card

To manage a student credit card effectively, monitor spending and pay off the balance monthly. Avoid unnecessary purchases and set a budget.

A student credit card can be a valuable tool for building credit and learning financial responsibility. Many students, though, struggle with managing their cards efficiently. Establishing good habits early is essential to avoid debt and maintain a healthy credit score.

Begin by tracking your expenses and understanding where your money goes. Use budgeting apps to help you stay within your financial limits. Always aim to pay your credit card balance in full each month to avoid interest charges. By following these practices, students can enjoy the benefits of credit without the pitfalls of debt.

Choosing The Right Card

Choosing the right student credit card is crucial for financial health. A well-chosen card can offer rewards and build credit scores. Here are key factors to consider:

Understanding Interest Rates

Interest rates define how much you pay to borrow money. A lower interest rate means less cost over time. Check the Annual Percentage Rate (APR) before applying. Some cards offer 0% APR for an initial period. After this period, the regular APR applies. Always read the terms and conditions.

Evaluating Rewards Programs

Rewards programs can offer cashback, points, or travel miles. Choose a program that fits your spending habits. Here are common types of rewards:

- Cashback: Earn a percentage back on every purchase.

- Points: Accumulate points for every dollar spent.

- Travel Miles: Earn miles for travel-related expenses.

Some cards offer extra rewards for specific categories. For example, you might earn more points on groceries or gas. Always check the reward structure before deciding.

| Card Type | Interest Rate (APR) | Rewards |

|---|---|---|

| Card A | 15% APR | 1% Cashback |

| Card B | 18% APR | 2x Points on Groceries |

| Card C | 12% APR | 1 Mile per $1 Spent |

Choosing the right card involves comparing these features. Always pick a card that meets your financial needs.

Setting Up A Budget

Managing a student credit card starts with setting up a budget. A well-planned budget helps keep track of expenses. It ensures you use your credit card wisely. Here’s how to get started.

Tracking Expenses

Tracking expenses is vital. It helps you see where your money goes. Use a notebook or an app to record every purchase. List all monthly expenses:

- Food

- Books

- Transport

- Entertainment

Update your list daily. This habit makes managing your budget easier.

Allocating Funds

Allocating funds means deciding how much to spend. Split your income into categories. Here’s a simple table to help:

| Category | Percentage of Income |

|---|---|

| Essentials (Food, Rent) | 50% |

| Education (Books, Supplies) | 20% |

| Savings | 20% |

| Fun (Movies, Dining Out) | 10% |

Stick to these percentages. It helps you avoid overspending. Always leave some room for unexpected costs.

Building Credit Responsibly

Managing a student credit card can be tricky. It’s important to build credit responsibly. This means using your card wisely. Follow these tips to ensure you develop good credit habits.

Making Timely Payments

Always pay your credit card bill on time. This helps build a good credit score. Set up reminders to avoid missing a payment. You can also set up automatic payments. This ensures your bill is paid every month.

Timely payments show lenders you are responsible. It also helps you avoid late fees. Late fees can add up quickly and hurt your credit score.

Keeping Balances Low

Keep your credit card balances low. Aim to use less than 30% of your credit limit. This shows you can manage your credit well. High balances can hurt your credit score.

If you have a $1,000 limit, try to keep your balance below $300. Paying off your balance each month is ideal. This avoids interest charges and keeps your debt in check.

| Credit Limit | Recommended Balance |

|---|---|

| $500 | < $150 |

| $1,000 | < $300 |

| $1,500 | < $450 |

By following these tips, you can manage your student credit card well. This will help you build a strong credit history.

Understanding Fees And Penalties

Managing a student credit card can be tricky. Understanding fees and penalties is essential. These charges can add up quickly. Knowing how to avoid them helps you stay financially healthy.

Avoiding Late Fees

Late fees occur if you miss your payment due date. These fees can range from $25 to $35. To avoid late fees:

- Set up automatic payments.

- Use calendar reminders.

- Pay at least the minimum amount due.

Paying on time helps maintain a good credit score. It also saves you money. Keep track of your payment dates.

Managing Over-limit Fees

Over-limit fees apply if you exceed your credit limit. These fees can cost up to $40. To manage over-limit fees:

| Tip | Action |

|---|---|

| Check your balance | Regularly monitor your credit card balance. |

| Set alerts | Enable spending alerts through your bank’s app. |

| Stick to a budget | Create and follow a monthly budget. |

Staying within your credit limit avoids extra charges. It also keeps your credit utilization low. This is good for your credit score.

Using Credit Wisely

Managing a student credit card can be challenging. By using credit wisely, students can build a strong financial foundation. Proper management helps in maintaining a good credit score and avoiding debt. Below are some essential tips to use credit wisely.

When To Use Credit

It’s crucial to know when to use credit. Use your credit card for small, necessary purchases. This helps in building a credit history. Always pay off the balance in full each month. This avoids interest charges. Use your card for recurring expenses like groceries or gas. This keeps your spending in check.

Avoiding Impulse Purchases

Impulse purchases can lead to debt. Create a budget and stick to it. Avoid buying things you don’t need. Make a list before you shop. This helps in avoiding unnecessary items. If you see something you want, wait 24 hours. This cooling-off period often reduces the urge to buy.

| Do’s | Don’ts |

|---|---|

| Use credit for essential items | Avoid using credit for luxury items |

| Pay off the balance monthly | Don’t carry a balance |

| Create a budget | Avoid impulse buys |

| Track your spending | Don’t ignore your statements |

- Build a credit history: Use credit responsibly to build a good credit score.

- Avoid debt: Pay off the balance to avoid interest.

- Create a budget: Stick to a budget to control spending.

- Track spending: Keep an eye on your expenses to avoid overspending.

Monitoring Your Credit Score

Managing a student credit card involves several key steps. One crucial step is monitoring your credit score. Keeping track of your credit score helps you understand your financial health. It also helps you make better decisions about your spending and credit usage.

Regularly Checking Reports

Regularly check your credit reports to spot any changes. You can get a free report from each of the three major credit bureaus. These are Equifax, Experian, and TransUnion. Make it a habit to review these reports at least once a year.

Monitoring your reports helps you see your credit utilization and payment history. Both are crucial for maintaining a good credit score. If you see any negative marks, address them quickly.

| Credit Bureau | Website | Frequency |

|---|---|---|

| Equifax | equifax.com | Once a Year |

| Experian | experian.com | Once a Year |

| TransUnion | transunion.com | Once a Year |

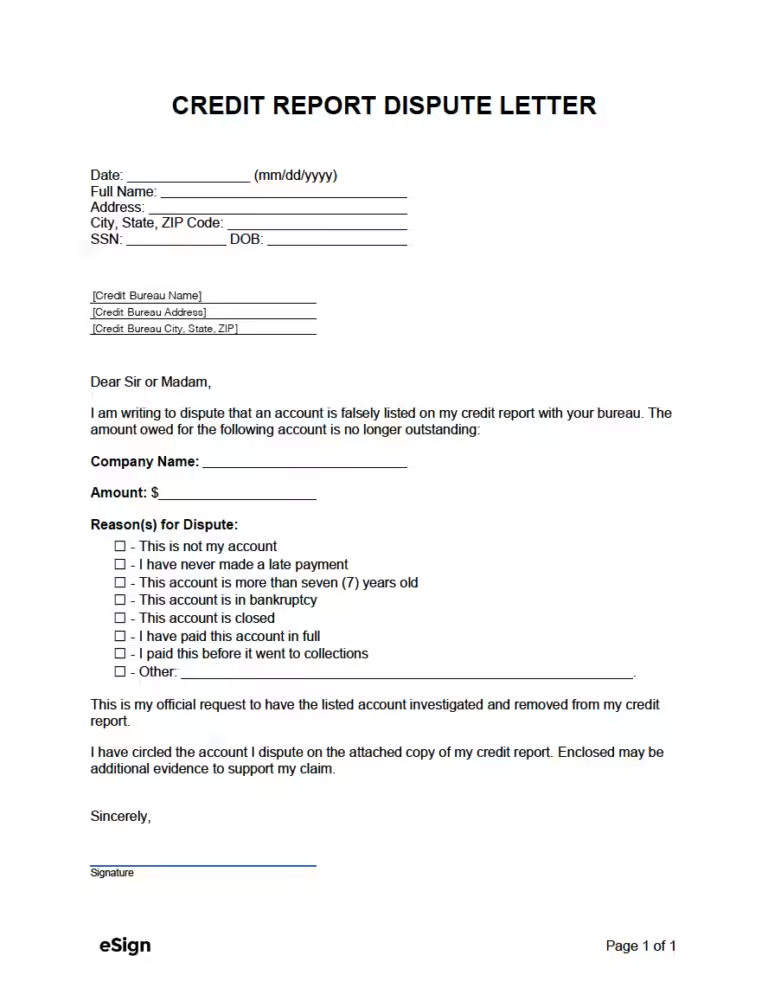

Correcting Errors

Errors on your credit report can lower your score. It is important to correct them quickly. If you spot any mistakes, report them to the credit bureau immediately. Provide supporting documents to prove your claim.

Here is a simple process to dispute errors:

- Identify the error on your credit report.

- Gather documents to support your claim.

- Submit a dispute to the credit bureau.

- Wait for the bureau to investigate and respond.

- Check for updates and confirm the correction.

Correcting errors ensures your credit score reflects your true financial health. This can help you get better interest rates and loan approvals in the future.

Handling Emergencies

Managing a student credit card can be challenging, especially during emergencies. Knowing how to handle such situations can save you from financial stress. Let’s discuss two crucial aspects of handling emergencies with a student credit card.

Emergency Fund Planning

It’s vital to have an emergency fund set aside. This fund acts as a safety net during unexpected situations. Start by saving a small amount each month. Aim for at least $500 in this fund.

Consider these steps to build your emergency fund:

- Open a separate savings account.

- Set up automatic transfers from your checking account.

- Cut down on non-essential expenses.

- Regularly review and adjust your savings goals.

Having an emergency fund reduces the need to use your credit card. This helps you avoid high-interest debt during crises.

Using Credit In Emergencies

Sometimes, using your credit card in emergencies is unavoidable. It’s essential to use it wisely. Only charge what you can pay off quickly. Avoid maxing out your credit limit.

Follow these tips when using credit in emergencies:

- Prioritize necessary expenses: Focus on essentials like medical bills or car repairs.

- Track your spending: Keep a record of all emergency expenses.

- Pay off the balance: Aim to pay off the emergency charges as soon as possible.

- Communicate with your credit card issuer: They may offer temporary relief or flexible payment options.

Using your student credit card responsibly during emergencies can prevent long-term financial issues. Always plan and use credit as a last resort.

Planning For The Future

Managing a student credit card well today sets up a better financial future. This section will guide you on how to plan for a stable financial future. Focus on setting financial goals and transitioning to a regular credit card.

Setting Financial Goals

Setting financial goals is essential for long-term success. Start by identifying your short-term and long-term goals. Here is a simple table to help you distinguish between them:

| Short-Term Goals | Long-Term Goals |

|---|---|

| Pay off monthly credit card bills | Save for a car or house |

| Build a small emergency fund | Plan for retirement savings |

Keep your goals achievable and specific. Here are a few tips:

- Track your spending habits regularly.

- Create a monthly budget and stick to it.

- Set aside a portion of your income for savings.

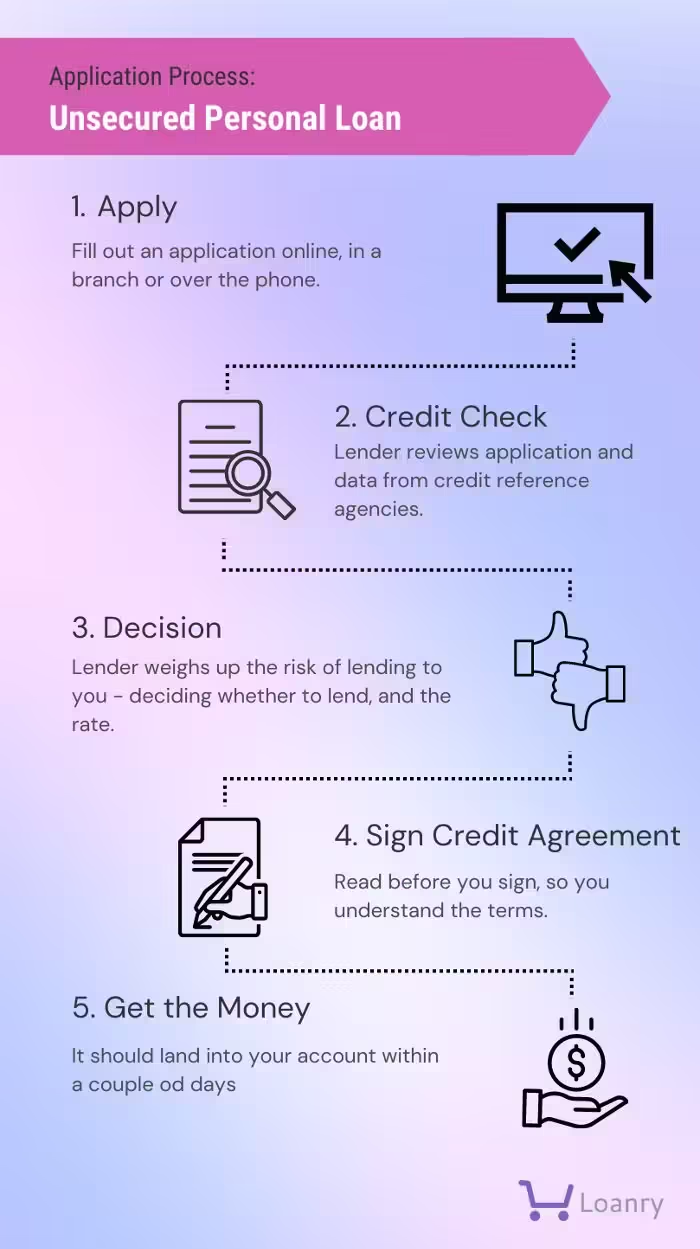

Transitioning To A Regular Credit Card

As you progress, consider transitioning to a regular credit card. This can offer more benefits and opportunities. Follow these steps to ensure a smooth transition:

- Check your credit score regularly.

- Compare different credit card offers.

- Choose a card with low-interest rates and good rewards.

- Read the terms and conditions carefully.

Maintaining a good credit score is vital. It opens up better credit opportunities. Always pay your bills on time and keep your credit utilization low. This ensures you have a strong credit history when you transition.

Frequently Asked Questions

How To Apply For A Student Credit Card?

Applying for a student credit card is simple. Visit your bank’s website and fill out the application. You may need to provide proof of student status and income.

What Are The Benefits Of A Student Credit Card?

Student credit cards offer benefits like building credit history, cashback rewards, and lower interest rates. They also often come with educational resources to help you manage credit.

How To Manage Student Credit Card Debt?

To manage student credit card debt, always pay more than the minimum balance. Avoid unnecessary purchases and keep track of your spending. Use budgeting tools if necessary.

Can I Get A Student Credit Card With No Credit History?

Yes, you can get a student credit card with no credit history. Many banks offer cards specifically designed for students without prior credit experience.

Conclusion

Mastering a student credit card takes discipline and planning. Always pay on time and track your spending. Create a budget to avoid overspending. Build good habits now for a strong financial future. Remember, responsible use can boost your credit score.

Start managing your student credit card wisely today.