How to Avoid Interest Charges on Student Credit Cards

To avoid interest charges on student credit cards, always pay your balance in full each month. Set up automatic payments to ensure timely payments.

Student credit cards can be a valuable tool for building credit. Interest charges can add up quickly if balances aren’t managed properly. Paying off your balance in full each month is essential to avoid these charges. Setting up automatic payments can help ensure you never miss a due date.

Responsible credit card use also helps improve your credit score. This will benefit you in the long run when applying for loans or other credit products. Understanding how to manage your student credit card effectively is crucial for financial health and stability.

Choosing The Right Card

Choosing the right credit card can save you from high interest charges. Students have unique needs, so picking a suitable card is crucial. This section will guide you on how to select the best student credit card.

Low-interest Options

Start by looking for low-interest options. These cards charge less interest on balances. Here’s a quick comparison table:

| Card Name | Interest Rate |

|---|---|

| Card A | 12.99% |

| Card B | 14.99%</td |

| Card C | 16.99% |

Choosing a card with a low interest rate can help you save money. Always read the fine print before applying.

Student-friendly Terms

Many cards offer student-friendly terms. These can include:

- No annual fees

- Low or no penalty fees

- Rewards for good grades

Some cards even offer cash back on purchases. This can help you manage your expenses better. Look for cards with rewards that match your spending habits.

Here are some examples of student-friendly cards:

- Student Card A: No annual fee, 1% cash back

- Student Card B: Low penalty fees, rewards for good grades

- Student Card C: 2% cash back on groceries and gas

By choosing the right card, you can avoid many interest charges. Make sure to research and compare different options. This way, you can find a card that suits your needs best.

Understanding Interest Rates

Understanding interest rates is crucial for managing student credit cards. It helps you avoid unnecessary interest charges. By knowing how interest rates work, you can save money. Learn about the different types of rates and how they affect you.

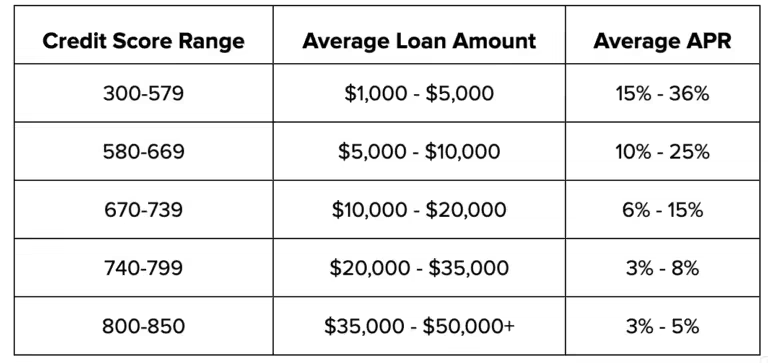

Apr Basics

The Annual Percentage Rate (APR) is the yearly cost of borrowing. It includes interest and other fees. The APR tells you how much you’ll pay for using credit. A lower APR means lower costs. Always check the APR before applying for a card.

Variable Vs. Fixed Rates

Credit cards can have either variable or fixed interest rates.

| Type | Description |

|---|---|

| Variable Rate | The rate changes with the market. It can go up or down. |

| Fixed Rate | The rate stays the same. It does not change over time. |

Variable rates can be risky. Your payments might increase suddenly. Fixed rates offer stability. You know what to expect each month.

- Choose fixed rates for predictable payments.

- Monitor variable rates closely to avoid surprises.

Understanding these basics helps you make smart credit choices. Always read the terms and conditions of your credit card. This ensures you know your responsibilities and rights.

Effective Budgeting

Effective budgeting helps manage your money. It helps avoid interest charges on student credit cards. A budget keeps track of your income and expenses. It ensures you spend within your means. Let’s explore key steps for effective budgeting.

Monthly Expenses

Knowing your monthly expenses is crucial. List all your regular expenses. This includes rent, groceries, and utilities. Here’s a simple table to help you:

| Expense | Amount |

|---|---|

| Rent | $500 |

| Groceries | $200 |

| Utilities | $100 |

| Transportation | $50 |

Add all your expenses. Compare them to your income. Ensure your income covers all your expenses.

Tracking Spending

Tracking your spending helps avoid overspending. Use a notebook or an app to track daily expenses. Every time you buy something, write it down. This keeps you aware of your spending habits.

Here are some tips to track your spending:

- Keep receipts.

- Review your bank statements.

- Set spending limits.

By tracking your spending, you can see where your money goes. This helps you adjust your budget to avoid interest charges.

Paying Your Balance In Full

Paying your balance in full is key to avoiding interest charges on student credit cards. This habit helps maintain a good credit score. It also keeps your debt in check.

Due Dates

Knowing your due dates is crucial. Mark them on your calendar. Set reminders on your phone. Missing a due date can lead to late fees. It can also harm your credit score.

Paying your balance by the due date ensures you don’t pay interest. Credit card companies charge interest on unpaid balances. By paying in full, you avoid these charges.

Payment Strategies

Use effective payment strategies to manage your student credit card. Try to pay your balance weekly. This keeps your debt low and manageable.

Another strategy is to automate your payments. Set up automatic transfers from your bank. This ensures you never miss a payment.

| Strategy | Benefit |

|---|---|

| Weekly Payments | Lower balances, easier management |

| Automated Payments | Never miss a payment |

By using these strategies, you can stay on top of your finances. You’ll avoid interest charges and keep your credit score high.

- Pay your balance in full.

- Know your due dates.

- Use weekly payments.

- Set up automated payments.

These steps will help you manage your student credit card effectively. Stay disciplined and watch your finances improve.

Setting Up Automatic Payments

Setting up automatic payments on your student credit card can save you from unwanted interest charges. It ensures your payments are always on time, helping you maintain a good credit score.

Payment Reminders

Even with automatic payments, setting up payment reminders is helpful. These reminders notify you a few days before the due date. You can set these reminders on your phone or through your bank’s app.

Avoiding Late Fees

Late fees can add up quickly and hurt your credit score. By setting up automatic payments, you avoid these fees altogether. This simple step keeps your finances in check and saves you money.

| Benefit | Description |

|---|---|

| Timely Payments | Ensures payments are made on time, every time. |

| Better Credit Score | Avoids missed payments, helping to improve your credit score. |

| Peace of Mind | Reduces stress by automating financial tasks. |

- Set up automatic payments through your bank or credit card’s website.

- Monitor your account to ensure payments are processed correctly.

- Adjust payment amounts if your balance changes.

- Log in to your bank or credit card account.

- Navigate to the automatic payments section.

- Set the payment amount to the full balance or minimum due.

- Confirm and save your settings.

Utilizing Grace Periods

Using student credit cards wisely can prevent hefty interest charges. One effective strategy is utilizing grace periods. Here’s how to make the most of it.

How Grace Periods Work

Grace periods allow you to pay your balance without interest. Usually, it lasts 21-25 days after your billing cycle ends. During this time, you can pay off your balance in full. If you do, you won’t accrue any interest.

Here’s an example:

| Event | Date |

|---|---|

| Billing cycle ends | July 1 |

| Grace period ends | July 21 |

Pay your balance by July 21, and you avoid interest charges.

Maximizing Benefits

To maximize benefits, always pay your balance during the grace period. Set reminders to pay your bills on time. This helps you avoid missing the grace period.

Consider the following tips:

- Track your billing cycles and due dates.

- Set up automatic payments.

- Keep your spending within your budget.

Using these tips ensures you avoid interest charges and keep your credit score healthy.

Avoiding Cash Advances

Using cash advances on student credit cards can be expensive. Knowing how to avoid these can save you money. Here, we explore the high fees and alternatives.

High Fees

Cash advances come with high fees. These fees include:

- A fee for taking the advance, usually 3-5% of the amount.

- Higher interest rates than regular purchases.

- Interest starts accruing immediately, no grace period.

Here is a table to show the costs:

| Fee Type | Amount |

|---|---|

| Advance Fee | 3-5% of the cash amount |

| Higher Interest Rate | 20-25% |

| No Grace Period | Interest starts immediately |

These fees can add up quickly. Avoid cash advances to save money.

Alternatives

Consider these alternatives to cash advances:

- Use a debit card for cash needs.

- Borrow from friends or family.

- Seek a short-term loan from a bank.

- Use your savings.

These options can help you avoid high fees. Using these alternatives can save you money and keep you out of debt.

Monitoring Your Credit Score

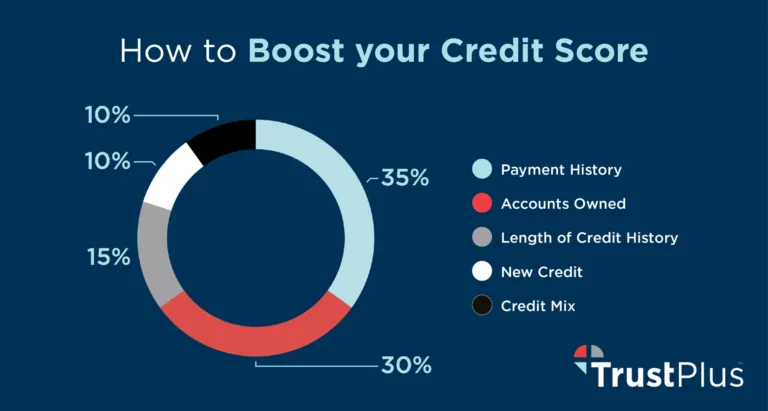

Monitoring your credit score is crucial in avoiding interest charges on student credit cards. A good credit score can save you money. It reflects your financial behavior and can impact your interest rates.

Impact Of Interest Charges

Interest charges can significantly affect your finances. High interest rates can lead to increased debt. This makes it harder to pay off your credit card balance. Understanding the impact of interest charges is essential.

- High interest rates can increase your total debt.

- Paying only the minimum amount can lead to more interest.

- Interest can accumulate quickly, making it hard to manage debt.

Using a student credit card wisely helps you avoid these charges. Pay your balance in full each month to avoid interest. Monitoring your credit score helps you understand your financial health.

Maintaining Good Credit

Maintaining good credit is key to avoiding high interest rates. A higher credit score can lead to lower interest rates. This makes it easier to pay off your balance.

- Pay your bills on time.

- Keep your credit card balance low.

- Monitor your credit report regularly.

Using these strategies can help maintain good credit. A good credit score can save you money on interest charges. It also opens up more financial opportunities for you in the future.

| Action | Impact on Credit Score |

|---|---|

| Pay bills on time | Positive |

| High credit card balance | Negative |

| Monitor credit report | Positive |

By monitoring your credit score, you can better manage your finances. It helps you avoid unnecessary interest charges and maintain good credit. Stay aware of your credit score and take steps to improve it regularly.

Frequently Asked Questions

What Are Interest Charges On Student Credit Cards?

Interest charges are fees you pay for carrying a balance on your student credit card. These charges accumulate daily.

How Can I Avoid Interest Charges?

Pay your balance in full each month before the due date. This prevents interest from accruing on your account.

Does Paying The Minimum Avoid Interest?

No, paying only the minimum results in interest charges on the remaining balance. Always aim to pay in full.

Are There Any Grace Periods For Student Credit Cards?

Yes, most student credit cards offer a grace period. Paying in full within this period helps avoid interest charges.

Conclusion

Avoiding interest charges on student credit cards requires discipline and awareness. Pay your balance in full each month. Set up payment reminders to stay on track. Always monitor your spending and stick to a budget. By following these tips, you can manage your credit card responsibly and avoid unnecessary interest charges.