Holistic Credit Solutions: Transform Your Financial Health Today

Managing credit can be challenging, especially with so many options available. Holistic credit solutions offer a comprehensive approach to handle all your credit needs effectively.

In today’s fast-paced world, having a clear financial strategy is vital. Holistic credit solutions aim to provide an all-encompassing way to manage, improve, and optimize your credit. These solutions not only focus on repairing your credit score but also offer tools and advice for better financial health. Whether you are a business owner looking to streamline credit processes or an individual seeking to boost your credit score, holistic approaches can cater to varied needs. Explore how holistic credit solutions can simplify your financial life and help you achieve your credit goals. For a trusted solution, check out Fabrick for comprehensive credit solutions.

Introduction To Holistic Credit Solutions

In today’s complex financial landscape, many individuals and businesses seek comprehensive ways to manage their credit. Holistic Credit Solutions offer a unique approach to understanding and improving credit health. This method goes beyond traditional credit repair by addressing multiple aspects of a person’s or company’s financial profile.

Understanding Holistic Credit Solutions

Holistic Credit Solutions involve a detailed evaluation of various financial components. The goal is to provide a well-rounded strategy for credit improvement. This approach considers factors such as:

- Credit score analysis

- Debt management

- Financial education

- Long-term credit planning

By addressing these areas, individuals and businesses can achieve a more sustainable and healthy credit status.

Purpose And Goals

The main purpose of Holistic Credit Solutions is to foster financial stability. It aims to provide clients with tools and knowledge to maintain good credit health. The goals include:

- Improving credit scores

- Reducing debt

- Enhancing financial literacy

- Creating long-term financial plans

These goals help clients not only to repair their credit but also to build a strong financial future.

Key Features Of Holistic Credit Solutions

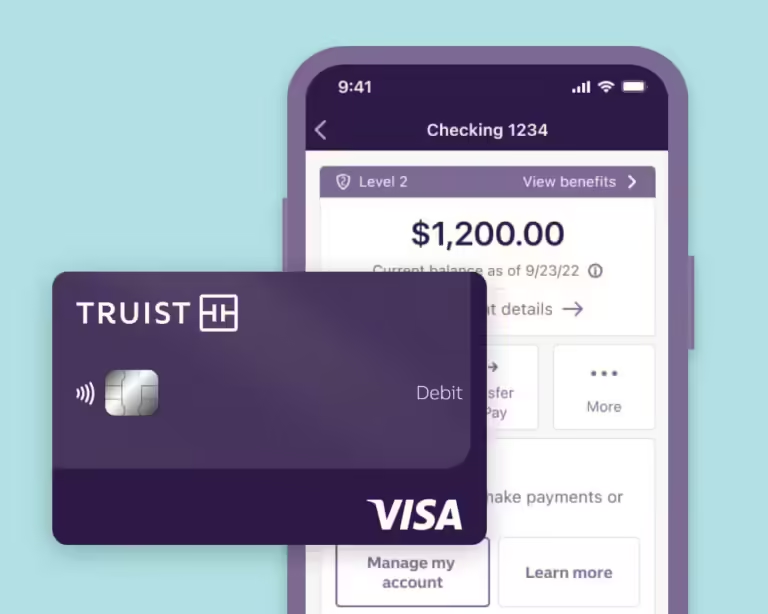

Holistic Credit Solutions, such as Fabrick, offer a comprehensive approach to managing your credit. These solutions provide tools and strategies to help you understand, improve, and maintain your credit score. Below are some key features that make these solutions effective.

Comprehensive Credit Analysis

Holistic Credit Solutions provide a comprehensive credit analysis. This involves a detailed review of your credit report. It identifies areas that need improvement. A thorough analysis helps you understand the factors affecting your credit score. With this information, you can make informed decisions to enhance your credit profile.

Personalized Financial Planning

Another key feature is personalized financial planning. This includes creating a tailored financial plan based on your individual needs and goals. Personalized planning helps you manage your finances more effectively. It ensures you stay on track with your credit improvement journey.

Credit Score Tracking And Improvement Tools

Holistic Credit Solutions offer credit score tracking and improvement tools. These tools enable you to monitor your credit score regularly. Tracking helps you see the impact of your financial actions. Improvement tools provide specific steps to boost your credit score. Consistent tracking and improvement lead to better credit health over time.

Debt Management Strategies

Effective debt management strategies are crucial for maintaining a good credit score. Holistic Credit Solutions help you develop strategies to manage your debt. This may include creating a budget, consolidating debts, or negotiating with creditors. Proper debt management reduces financial stress and improves your creditworthiness.

By utilizing these key features, you can take control of your credit and achieve financial stability. Holistic Credit Solutions like Fabrick provide the tools and guidance you need for a healthier credit profile.

Pricing And Affordability

Understanding the pricing and affordability of Fabrick is crucial for businesses. This section will cover subscription plans, cost-benefit analysis, and free vs. premium features.

Subscription Plans

Fabrick offers various subscription plans tailored to meet diverse business needs. These plans are designed to provide flexibility and value:

- Basic Plan: Ideal for startups and small businesses.

- Standard Plan: Suitable for growing businesses with moderate needs.

- Premium Plan: Best for large enterprises requiring comprehensive features.

| Plan | Monthly Cost | Annual Cost |

|---|---|---|

| Basic | $10 | $100 |

| Standard | $30 | $300 |

| Premium | $50 | $500 |

Cost-benefit Analysis

Conducting a cost-benefit analysis helps businesses understand the value of Fabrick’s services. Consider the following points:

- Evaluate the business needs and match them with the appropriate plan.

- Compare the costs of the plans to the benefits offered.

- Analyze potential savings and efficiencies gained using Fabrick.

For example, the Premium Plan may seem costly but offers advanced features that can save time and enhance productivity.

Free Vs. Premium Features

Fabrick provides both free and premium features to cater to different users:

- Basic credit card management

- Standard reporting tools

- Limited customer support

- Advanced analytics and reporting

- Priority customer support

- Customizable business solutions

- Extended data storage

The free version offers essential tools for managing credit cards, while premium plans provide enhanced functionalities. Businesses can start with the free plan and upgrade as their needs grow.

Pros And Cons Of Holistic Credit Solutions

Holistic credit solutions, like Fabrick, offer comprehensive services for managing credit. Understanding their advantages and disadvantages is essential for making an informed decision.

Benefits For Users

- Comprehensive Management: Fabrick provides a wide range of services to manage credit effectively.

- Improved Credit Scores: Users see an improvement in their credit scores with consistent use.

- User-friendly Interface: The platform is easy to navigate, even for non-tech-savvy individuals.

- Cost-effective: The pricing structure is designed to be affordable for businesses of all sizes.

Potential Drawbacks

- Learning Curve: Some users may find it challenging to grasp all features initially.

- Internet Dependence: The platform requires a stable internet connection for optimal performance.

- Limited Customization: Certain features might not be customizable to specific business needs.

User Testimonials And Real-world Usage

Here are some user experiences with Fabrick:

| User | Testimonial |

|---|---|

| John D. | “Fabrick helped improve my credit score by 50 points in six months.” |

| Sarah K. | “The platform is intuitive and has all the tools I need for managing my business credit.” |

| Mike L. | “Initially, I struggled with the features, but the customer support was excellent.” |

These testimonials highlight the practical benefits and some challenges users face. They provide a balanced view of what to expect from Fabrick.

Recommendations For Ideal Users

Fabrick’s Holistic Credit Solutions are designed to cater to a wide range of users. Understanding the ideal users can help you maximize the benefits. Below are some recommendations for who can benefit the most, scenarios where these solutions excel, and real-life success stories.

Who Can Benefit The Most?

- Small Business Owners: Managing cash flow and credit efficiently is crucial for growth.

- Freelancers: They need flexible credit options to handle variable incomes.

- Start-ups: Access to credit can help fund initial operations and scale quickly.

- Individuals with Average Credit Scores: Improve financial health with better credit management.

Scenarios Where Holistic Credit Solutions Excel

Fabrick’s solutions shine in various financial scenarios:

| Scenario | Benefits |

|---|---|

| Debt Consolidation | Combining multiple debts into one lowers interest rates and simplifies payments. |

| Credit Building | Using the right credit tools can help improve your credit score over time. |

| Emergency Funding | Quick access to credit helps manage unforeseen expenses without stress. |

Case Studies And Success Stories

Real-life examples illustrate the effectiveness of Fabrick’s Holistic Credit Solutions:

Case Study 1: A small business owner used Fabrick to manage cash flow more efficiently. Within six months, the business saw a 20% increase in revenue.

Case Study 2: A freelancer used Fabrick’s flexible credit options to handle variable incomes. This led to improved financial stability and the ability to take on more projects.

Case Study 3: A start-up utilized Fabrick to fund initial operations. This facilitated rapid scaling, allowing the company to secure additional investment within a year.

Fabrick’s solutions are versatile and beneficial in many scenarios. Whether you are a small business owner, freelancer, or start-up, these credit solutions can help you achieve your financial goals.

Conclusion: Transform Your Financial Health Today

Taking control of your financial health starts with the right tools. Fabrick’s Holistic Credit Solutions offers the perfect platform to achieve this goal. By integrating a range of unique features and benefits, it supports both individuals and businesses in managing their credit efficiently.

Summary Of Benefits

Using Fabrick can lead to numerous advantages:

- Comprehensive Credit Management: Monitor and manage all your credit cards in one place.

- Easy Monitoring: Stay on top of your credit score with real-time updates.

- Expense Tracking: Track your spending to avoid overspending.

- Custom Alerts: Receive notifications for due payments and low balance alerts.

- Business Solutions: Tailored credit solutions for businesses to manage their finances better.

Call To Action

Ready to transform your financial health? Try Fabrick today and experience the benefits of holistic credit management. Sign up now and take the first step towards financial stability.

Final Thoughts

Financial health is crucial for peace of mind. With Fabrick, you gain the tools needed to manage your credit effectively. Invest in your financial future today and enjoy a more secure tomorrow.

Frequently Asked Questions

What Are Holistic Credit Solutions?

Holistic credit solutions are comprehensive strategies for managing credit. They address credit scores, debt management, and financial wellness. These solutions aim to provide a complete approach.

How Do Holistic Credit Solutions Work?

Holistic credit solutions work by assessing your entire financial situation. They offer personalized strategies for improving credit, reducing debt, and enhancing financial health.

Why Choose Holistic Credit Solutions?

Choose holistic credit solutions for a well-rounded approach to credit management. They provide tailored strategies, addressing all aspects of your financial health.

Who Can Benefit From Holistic Credit Solutions?

Anyone looking to improve their credit and financial situation can benefit. These solutions are ideal for individuals seeking comprehensive financial wellness.

Conclusion

Holistic credit solutions offer a balanced approach to managing finances. Fabrick provides comprehensive tools for credit card and business needs. It helps streamline financial operations effectively. Check out Fabrick’s offerings here for more details. Make informed choices for a secure financial future. Stay ahead with tailored credit solutions.