Hassle-Free Credit Building: Easy Steps to Boost Your Score

Building your credit doesn’t have to be stressful. With the right tools, it can be simple and effective.

Introducing the Cheese Credit Builder Account, a hassle-free way to boost your credit score without using a credit card. It’s designed to make the process smooth and secure, reporting to all three major credit bureaus—Experian, Equifax, and TransUnion. With no hidden fees and the flexibility to choose your deposit amount and term length, Cheese ensures that you can build your credit at your own pace. Plus, there’s no credit check required, so your score won’t be affected when you open an account. Ready to take control of your financial future? Discover how Cheese can help you achieve your credit goals effortlessly. Learn more about the Cheese Credit Builder Account here.

Introduction To Credit Building

Building a strong credit profile is essential for financial stability. A good credit score opens the door to better loan rates and can even impact job opportunities. Let’s dive into the basics of credit building.

Understanding Credit Scores

A credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850, with higher scores indicating better credit. Major credit bureaus like Experian, Equifax, and TransUnion calculate these scores based on your credit history.

Several factors influence your credit score:

- Payment history: Timely payments boost your score.

- Credit utilization: Low balances relative to credit limits help.

- Credit age: Older accounts improve your score.

- Credit mix: A variety of credit types is beneficial.

- New credit: Too many new accounts can hurt your score.

Importance Of A Good Credit Score

A good credit score can save you money and provide peace of mind. Here’s why:

- Lower interest rates: Good scores mean better loan rates.

- Easier approval: Banks trust those with higher scores.

- Better terms: More favorable loan terms are available.

- Credit card benefits: Access to premium cards with rewards.

- Job prospects: Some employers check credit scores.

Using tools like the Cheese Credit Builder Account can help you build your credit without a credit card. This account reports to all three major credit bureaus and offers flexible deposit amounts and term lengths. It is secure, fee-free, and requires no credit check.

Opt for hands-off credit building with Cheese. Set up auto-pay, and let Cheese manage the rest. Your funds are protected and returned at the end of the term, minus the interest.

Credit: www.facebook.com

Key Features Of Hassle-free Credit Building

Building credit can be daunting, but with the right tools, it becomes simpler. Cheese Credit Builder Account offers a streamlined approach to help users improve their credit scores. Here’s a closer look at the key features that make it hassle-free.

Simple Steps For Beginners

Starting your credit-building journey with Cheese Credit Builder is straightforward. Follow these simple steps:

- Open a Cheese Credit Builder Account without a credit check.

- Choose a deposit amount: $500, $1,000, or $2,000.

- Select a term length: 12 or 24 months.

- Set up auto-pay to ensure on-time payments.

These steps make it easy for beginners to build credit without complications. No need to worry about hidden fees or admin costs.

Automated Tools And Services

The Cheese Credit Builder Account provides automated tools for a hands-off experience:

- Auto-pay: Ensures timely payments to avoid missed deadlines.

- Credit Monitoring: Track your credit score with ease.

- Customizable Goals: Tailor your plan to meet specific credit targets.

These tools simplify the process, making credit building stress-free and efficient.

Monitoring And Alerts

Staying informed about your credit status is crucial. Cheese Credit Builder offers robust monitoring and alert features:

- Credit Reports: Get regular updates from all three major credit bureaus.

- Spot Issues: Identify and address problems quickly.

- Alerts: Receive notifications about changes in your credit score.

These features help you stay on top of your credit health and make informed decisions.

With Cheese Credit Builder, improving your credit score is straightforward and accessible. Visit the Cheese Official Website to learn more.

Step-by-step Guide To Boosting Your Credit Score

Boosting your credit score can open up new financial opportunities. Follow this guide to improve your credit score effectively and efficiently.

Check Your Credit Report Regularly

Start by checking your credit report regularly. You can get free annual reports from major bureaus like Experian, Equifax, and TransUnion. Look for any discrepancies or errors that might affect your score.

Correcting Errors On Your Credit Report

Errors on your credit report can lower your score. Contact the credit bureau to correct any mistakes. Provide evidence to support your claims. This can help improve your credit score quickly.

Paying Bills On Time

Paying bills on time is crucial. Late payments can significantly lower your credit score. Set up automatic payments to ensure you never miss a due date. This shows lenders you are responsible and reliable.

Reducing Outstanding Debt

Reduce your outstanding debt to improve your credit score. Focus on paying down high-interest credit card debt first. Create a budget to allocate more funds toward debt repayment.

Limiting Hard Inquiries

Too many hard inquiries can negatively impact your credit score. Limit applications for new credit. Each hard inquiry can lower your score by a few points. Be selective about applying for new credit lines.

Utilizing Credit-building Products

Consider using credit-building products like the Cheese Credit Builder Account. It helps you build credit by saving and making on-time payments. The best part? It reports to all three major credit bureaus without a credit check.

| Feature | Details |

|---|---|

| Build with all 3 credit bureaus | Reports to Experian, Equifax, and TransUnion |

| No admin or membership fee | No hidden costs |

| No credit check required | Does not affect your credit score |

| Deposit amount flexibility | Choose from $500, $1,000, or $2,000 |

| Term length options | Choose between 12 or 24 months |

| Credit monitoring | Track your credit score and spot issues easily |

With Cheese Credit Builder Account, you can set up auto-pay, and Cheese manages the rest. Your funds are secured in a bank account and returned at the end of the term. Plus, there is no hard pull, so your credit score remains unaffected. Fixed low APR ensures affordability, and you can customize your goals to improve your credit score for specific objectives like buying a home.

Boost your credit score with these steps and take control of your financial future today.

Credit: www.paautosales.com

Pricing And Affordability Of Credit-building Tools

Building credit can be a daunting task, especially with so many tools available. Understanding the pricing and affordability of these tools is crucial. The Cheese Credit Builder Account offers a straightforward, fee-free way to build credit without a credit card.

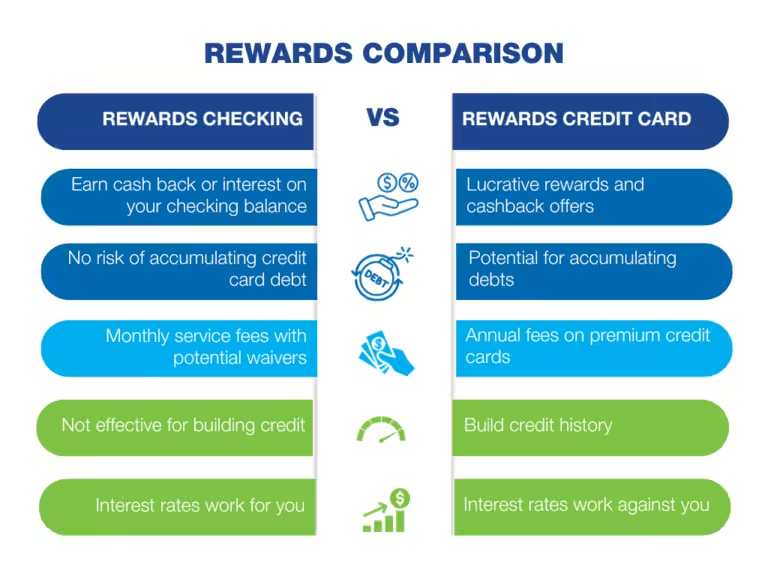

Free Vs. Paid Services

Many credit-building tools come in two varieties: free and paid. Free services might seem appealing but often lack comprehensive features. Paid services like the Cheese Credit Builder Account offer extensive benefits. For example, Cheese reports to all three major credit bureaus: Experian, Equifax, and TransUnion.

Unlike some free tools, Cheese has no hidden fees. It does not require a credit check, making it accessible without affecting your score. The monthly payment starts at $24, depending on your chosen deposit and term length. This ensures transparency and affordability.

Cost-effective Strategies

Using cost-effective strategies to build credit is essential. The Cheese Credit Builder Account provides a flexible deposit amount, starting from $500. Users can choose terms of either 12 or 24 months. This flexibility allows you to tailor your credit-building plan to your financial situation.

To maximize affordability, Cheese offers fixed and low APR rates. This ensures interest costs remain manageable. The funds deposited are secured in a bank account and returned at the end of the term minus the interest. This guarantees your money is protected.

Another cost-effective strategy is to use auto-pay. By setting up auto-pay, you ensure on-time payments, which positively impacts your credit score. Cheese handles the rest, making it a hassle-free experience.

Here is a summary of the pricing details for Cheese Credit Builder Account:

| Feature | Details |

|---|---|

| Monthly Payment | Starting at $24 |

| Deposit Amount | $500, $1,000, or $2,000 |

| Term Length | 12 or 24 months |

| APR | Fixed and low |

By understanding the pricing and employing cost-effective strategies, you can build credit without breaking the bank. The Cheese Credit Builder Account is an excellent example of a tool that balances affordability and effectiveness.

For more information, visit the Cheese Official Website.

Pros And Cons Of Various Credit-building Methods

Building credit can be challenging. Understanding different methods can help you choose the best strategy. This section explores the pros and cons of traditional methods, modern digital tools, and the short-term vs. long-term benefits of each.

Traditional Methods

Traditional credit-building methods include secured credit cards, personal loans, and becoming an authorized user on someone else’s account. These methods have been around for a long time and have their advantages and disadvantages.

| Method | Pros | Cons |

|---|---|---|

| Secured Credit Cards |

|

|

| Personal Loans |

|

|

| Authorized User |

|

|

Modern Digital Tools

Modern digital tools provide new ways to build credit. One such tool is the Cheese Credit Builder Account. This method is simple, secure, and fee-free, without needing a credit card.

Pros:

- Reports to all three credit bureaus: Experian, Equifax, and TransUnion

- No credit check required

- Flexible deposit amounts: $500, $1,000, or $2,000

- Term lengths of 12 or 24 months

- Credit monitoring included

- Hands-off credit building with auto-pay

- Funds secured in a bank account

- No hard pull on your credit score

Cons:

- Monthly payments starting at $24

- Interest is charged, though kept low

Short-term Vs. Long-term Benefits

Each credit-building method offers different benefits over time. Traditional methods like secured credit cards can show results quickly but may have higher costs. Modern tools like the Cheese Credit Builder Account provide a gradual increase in credit score with low risk.

Short-Term Benefits:

- Quick credit score improvement with secured credit cards

- Immediate credit history boost as an authorized user

Long-Term Benefits:

- Stable credit growth with Cheese Credit Builder

- Continuous credit monitoring and security

- Customizable goals for future financial plans

Choosing the right method depends on your financial situation and goals. Evaluating the pros and cons helps make an informed decision.

Recommendations For Ideal Users And Scenarios

The Cheese Credit Builder Account offers a simple, secure, and fee-free way to build credit. It suits various individuals and scenarios. Whether you are a student, someone with poor credit, or planning to buy a home, Cheese has a plan for you.

Students And Young Adults

For students and young adults, starting a credit history early is crucial. The Cheese Credit Builder Account helps by reporting to all three major credit bureaus: Experian, Equifax, and TransUnion. This means your on-time payments will be reflected on your credit report.

- No credit check required, so it won’t affect your credit score.

- Flexible deposit amounts of $500, $1,000, or $2,000.

- Term lengths of 12 or 24 months.

This flexibility makes it easier for young adults to manage their finances while building credit. The hands-off approach with auto-pay ensures consistent on-time payments.

Individuals With Poor Credit

For individuals with poor credit, rebuilding credit can be challenging. The Cheese Credit Builder Account offers a low-risk solution.

| Feature | Benefit |

|---|---|

| No hard pull | Opening an account does not hurt your credit score. |

| Fixed and low APR | Affordable interest rates keep costs manageable. |

| Credit monitoring | Track your progress and spot issues easily. |

The money protection feature ensures that your funds are secure and returned at the end of the term, making it a safe option for rebuilding credit.

Homebuyers And Loan Seekers

For homebuyers and loan seekers, a good credit score is essential. The Cheese Credit Builder Account helps you customize your goals to improve your credit score for specific objectives like buying a home.

- Set up auto-pay for hands-off credit building.

- Choose a term that fits your financial plan.

- Monitor your credit score to stay on track.

This tailored approach helps ensure your credit score meets the requirements for mortgages or other loans. With over 48,000 users, Cheese has proven effective in helping individuals achieve their credit goals.

Conclusion And Final Tips

Building credit can seem daunting, but with the right tools and habits, it becomes manageable. The Cheese Credit Builder Account offers a streamlined, fee-free way to enhance your credit score without a credit card. Below is a recap of essential steps and some final tips to maintain good credit habits.

Recap Of Essential Steps

- Choose the right deposit amount: Select from $500, $1,000, or $2,000 based on your comfort level.

- Select a term length: Opt for either 12 or 24 months.

- Set up auto-pay: Ensure on-time payments by automating them.

- Monitor your credit: Use Cheese’s credit monitoring tools to track your progress.

- Stay informed: Regularly check your credit reports from Experian, Equifax, and TransUnion.

Maintaining Good Credit Habits

Consistent good habits are crucial for sustaining a healthy credit score. Here are a few tips:

- Pay bills on time: Late payments can significantly impact your credit score.

- Keep balances low: Aim to use less than 30% of your available credit.

- Avoid opening too many accounts: Each inquiry can lower your score temporarily.

- Review credit reports regularly: Spot and dispute any errors promptly.

- Maintain old accounts: Length of credit history can positively affect your score.

The Cheese Credit Builder Account simplifies the credit building process by reporting to all three major credit bureaus and offering flexible deposit and term options. With no hidden fees and the ability to cancel anytime, it’s a stress-free way to improve your credit score.

For more information, visit the Cheese Official Website.

Credit: www.instagram.com

Frequently Asked Questions

How To Start Building Credit?

Start by obtaining a secured credit card. Use it responsibly. Pay your bills on time. Monitor your credit report regularly.

What Is A Secured Credit Card?

A secured credit card requires a cash deposit as collateral. It’s a great tool for building credit. Use it wisely.

How Long Does Credit Building Take?

Building credit takes time. Typically, you might see results in six months. Consistency and responsible usage are key.

Can I Build Credit Without A Credit Card?

Yes, you can build credit without a credit card. Use options like credit-builder loans, secured loans, or report rent payments.

Conclusion

Building your credit doesn’t have to be stressful. With Cheese Credit Builder, it’s easy. No credit card needed. No hidden fees. Just simple, secure credit building. Set your goals and watch your credit score improve. Ready to start? Sign up for the Cheese Credit Builder Account today and take control of your financial future. It’s time to make credit building hassle-free and effective. Try it now!