Get Approved For Credit Cards: 7 Proven Tips for Instant Success

Getting approved for credit cards can seem like a tough task. But it’s easier than you think.

With the right approach, you can boost your chances of approval. In this blog, we will explore key tips and strategies to help you get approved for credit cards. Understanding the credit card approval process is crucial. It involves knowing your credit score, managing your finances, and choosing the right card. Whether you are a small business owner or an individual, the right credit card can provide many benefits. For example, the Revenued Business Card Visa® Commercial Card offers businesses flexible working capital. This card is not a traditional credit card or loan. Instead, it provides revenue-based financing, giving you immediate access to funds as your business grows. Ready to learn more? Let’s dive in and explore how you can get approved for credit cards and make the best choice for your financial needs. For more information about Revenued Business Card Visa® Commercial Card, visit their site here.

Introduction To Credit Card Approval

Getting approved for a credit card can seem daunting. Understanding the process helps. Below, we will explore the importance of credit cards and common challenges in getting approved.

Understanding The Importance Of Credit Cards

Credit cards play a vital role in personal and business finance. They offer convenience, security, and flexibility. Here are some key benefits:

- Convenience: Easy to carry and use for various transactions.

- Security: Protection against fraud and loss.

- Credit Building: Helps build and improve credit scores.

- Rewards: Earn points, cash back, or travel miles.

For businesses, credit cards like the Revenued Business Card Visa® Commercial Card provide immediate access to working capital. This card offers revenue-based financing, making it easier for businesses to manage cash flow.

Common Challenges In Getting Approved

Several challenges can prevent approval for credit cards. Here are some common ones:

- Poor Credit Score: A low credit score reduces approval chances.

- High Debt-to-Income Ratio: High debts relative to income are a red flag.

- Limited Credit History: Having no or limited credit history affects approval.

- Errors on Credit Report: Mistakes on your report can harm your chances.

The Revenued Business Card Visa® Commercial Card addresses these challenges with its high approval rate. Its revenue-based financing does not rely on traditional credit checks, offering more businesses the opportunity to access funds.

Using the Revenued Business Card Visa® Commercial Card, businesses can enjoy features like dynamic spending limits and dedicated support. This makes managing finances easier and more efficient.

Tip 1: Know Your Credit Score

Understanding your credit score is essential. It determines your eligibility for credit cards. Knowing your score helps you apply for cards that match your credit profile.

How To Check Your Credit Score

You can check your credit score through various methods. Many banks and financial institutions offer this service for free. You can also use online platforms.

For instance, websites like Credit Karma or Experian provide free credit scores. Regularly checking your score helps you stay informed and manage your credit wisely.

Why Your Credit Score Matters

Your credit score is a crucial factor in getting approved for credit cards. It shows your creditworthiness to lenders.

Higher scores increase your chances of approval and better terms. Lower scores can limit your options and result in higher interest rates.

Maintaining a good credit score is vital for accessing financial products like the Revenued Business Card Visa® Commercial Card. This card offers unique benefits, including revenue-based financing and dynamic spending limits.

Understanding your credit score and its impact helps you make informed decisions and find the best financial products for your needs.

Tip 2: Improve Your Credit Score

Improving your credit score is crucial for getting approved for credit cards. A higher credit score increases your chances of approval and can lead to better terms and interest rates.

Pay Off Existing Debts

Paying off existing debts can significantly boost your credit score. Start by making a list of all your debts. Prioritize paying off high-interest debts first. Consider creating a budget to allocate more funds towards paying off these debts.

- List all your debts

- Prioritize high-interest debts

- Create a budget for debt repayment

Paying off debts shows lenders that you are responsible with credit. It can also reduce your credit utilization ratio, which positively impacts your score.

Correct Any Errors On Your Credit Report

Errors on your credit report can drag down your score. Regularly check your credit report for any inaccuracies. Dispute any errors you find immediately.

- Request a copy of your credit report

- Review the report for errors

- Dispute inaccuracies with the credit bureau

Correcting errors can quickly improve your credit score. It ensures that your credit history accurately reflects your financial behavior.

By paying off existing debts and correcting errors, you can improve your credit score. This, in turn, enhances your chances of getting approved for credit cards.

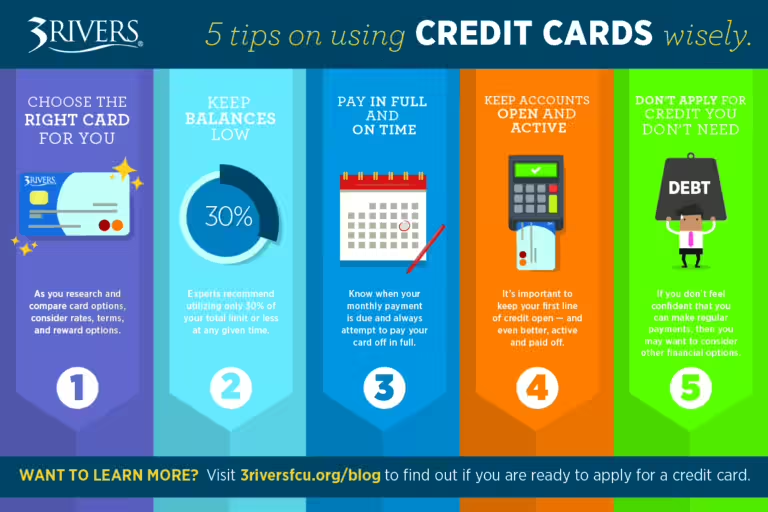

Tip 3: Choose The Right Credit Card

Choosing the right credit card is crucial for your financial success. With numerous options available, it’s essential to find a card that matches your specific needs and financial goals. Here are some tips to help you make the right choice.

Types Of Credit Cards Available

Understanding the different types of credit cards can help you make an informed decision. Below are some common types of credit cards:

- Rewards Cards: Earn points, miles, or cashback on purchases.

- Balance Transfer Cards: Low or zero interest on transferred balances.

- Secured Cards: Require a cash deposit as collateral, suitable for building credit.

- Business Cards: Designed for business expenses with features like expense tracking.

- Student Cards: Tailored for students, often with lower credit limits and rewards for good grades.

Matching Your Needs With The Right Card

Not all credit cards are created equal. Matching your needs with the right card can save you money and enhance your financial health.

| Need | Recommended Card Type |

|---|---|

| Earn Rewards | Rewards Card |

| Transfer Debt | Balance Transfer Card |

| Build Credit | Secured Card |

| Business Expenses | Business Card |

| Student Needs | Student Card |

For example, the Revenued Business Card Visa® Commercial Card is ideal for businesses needing flexible working capital. It offers:

- Flex Line: Access to working capital on demand through a mobile app.

- Revenue-Based Financing: Financing based on future receivables, not a traditional loan.

- Dynamic Spending Limits: Limits adjust according to business performance and revenue growth.

- Dedicated Support: Each account receives a dedicated Account Manager.

- Easy Application: Fast online application with quick funding decisions.

- Mobile App: Manage transactions and payment history easily.

Choosing the right card like the Revenued Business Card can help streamline your business finances and provide flexible funding options. Consider your specific needs and select a card that offers the best benefits for your situation.

Tip 4: Limit Your Applications

Applying for multiple credit cards can seem tempting, but it can harm your credit score. It’s crucial to be strategic and limit your applications. This approach helps maintain a healthy credit profile and increases your approval chances. Let’s explore why this is important and how to time your applications effectively.

The Impact Of Multiple Applications

Each time you apply for a credit card, the issuer performs a hard inquiry on your credit report. These inquiries can lower your credit score by a few points. Multiple applications in a short period can have a more significant impact.

Having several hard inquiries on your report can make you seem desperate for credit. This perception can make lenders less likely to approve your application. It’s essential to be mindful of how often you apply for new credit.

| Number of Inquiries | Potential Impact |

|---|---|

| 1-2 | Minimal |

| 3-4 | Moderate |

| 5 or more | Significant |

Timing Your Applications Wisely

Timing plays a crucial role in managing your credit applications. Space out your credit card applications to avoid multiple hard inquiries in a short period. Ideally, wait at least six months between applications.

Consider your upcoming financial needs and apply for new credit cards only when necessary. This approach ensures that your credit score remains stable and increases your chances of approval.

For business owners, products like the Revenued Business Card Visa® Commercial Card offer a unique advantage. It provides revenue-based financing without the need for multiple credit inquiries. This feature can be beneficial for maintaining a healthy credit profile while accessing necessary funds.

Key benefits of the Revenued Business Card Visa® Commercial Card:

- Immediate access to working capital.

- Financing based on future receivables.

- Dynamic spending limits.

- High approval rate.

By managing your credit applications wisely and considering alternative financing options, you can maintain a strong credit profile and secure the funds you need.

Tip 5: Provide Accurate Information

Applying for a credit card requires careful attention to detail. Ensuring that you provide accurate information can greatly increase your chances of approval. It also helps in maintaining a good relationship with your credit card issuer. Let’s dive into the importance of honesty in applications and common mistakes to avoid.

Importance Of Honesty In Applications

Honesty is crucial when applying for credit cards. Lenders rely on the information you provide to assess your creditworthiness. If the details are inaccurate, it could lead to delays or even rejection of your application. Providing accurate information helps to:

- Build Trust: Lenders trust applicants who are transparent.

- Avoid Legal Issues: Inaccurate information can lead to legal consequences.

- Get Accurate Offers: Accurate details ensure you receive offers suited to your financial profile.

Common Mistakes To Avoid

Many applicants make mistakes that can hinder their chances of approval. Here are some common mistakes and how to avoid them:

| Mistake | How to Avoid |

|---|---|

| Providing Incorrect Income | Double-check your income details before submitting. |

| Omitting Existing Debts | Ensure all debts are accurately listed. |

| Using an Old Address | Update your address to the current one. |

By avoiding these mistakes, you can increase your chances of getting approved. Always double-check your application to ensure all information is correct and up-to-date.

Remember, accurate information is key to a smooth and successful credit card application process.

Tip 6: Show A Stable Financial History

Getting approved for credit cards can be challenging. One effective tip is to show a stable financial history. Lenders want to see reliable financial habits. This makes you a less risky borrower. Let’s dive into the importance of steady income and how job stability can affect approval.

Importance Of Steady Income

A steady income is crucial for credit card approval. Lenders need to know you can repay borrowed money. Regular income shows financial reliability. It proves you can handle monthly payments. Without it, getting approved becomes difficult.

Regular income also impacts your credit score. A good score increases approval chances. Here are some key points:

- Consistent paychecks build trust with lenders.

- It helps maintain a positive cash flow.

- Higher income can lead to higher credit limits.

How Job Stability Can Affect Approval

Job stability plays a significant role in credit card approval. Lenders prefer applicants with long-term employment. Stable employment history shows financial security. Frequent job changes can raise red flags.

Let’s break down why job stability matters:

| Factor | Impact |

|---|---|

| Long-term Employment | Shows financial reliability |

| Frequent Job Changes | May indicate financial instability |

| Higher Position | Often equates to higher income |

Consider these tips for job stability:

- Stick to one job for a longer period.

- Show career growth and promotions.

- Avoid long gaps between employments.

By maintaining a stable financial history, you increase your chances of credit card approval. Lenders look for reliable borrowers. Steady income and job stability are key factors. Follow these tips to improve your approval chances.

Tip 7: Use Pre-approval Options

Pre-approval options can significantly increase your chances of getting approved for credit cards. By exploring pre-approval offers, you can find credit cards tailored to your financial profile. This proactive approach helps you avoid hard inquiries that can impact your credit score.

Benefits Of Pre-approval

- No Hard Inquiry: Pre-approval checks your eligibility without affecting your credit score.

- Tailored Offers: Receive offers that match your credit profile and financial needs.

- Higher Approval Chances: Pre-approved offers are more likely to result in actual approvals.

- Time-Saving: Quickly identify credit cards you are likely to get approved for.

How To Get Pre-approved

- Check Your Credit Score: Ensure your credit report is accurate and up-to-date.

- Visit Card Issuer Websites: Many credit card issuers offer pre-approval tools online.

- Submit Basic Information: Provide necessary details like income and address for pre-approval checks.

- Review Offers: Evaluate the pre-approved offers and choose the best one for your needs.

- Apply for the Card: Proceed with the full application for the selected pre-approved card.

The Revenued Business Card Visa® Commercial Card is an excellent example of a flexible financing solution. It offers revenue-based financing, dynamic spending limits, and a dedicated account manager. The application process is quick, typically providing funding decisions within an hour.

| Main Features | Benefits |

|---|---|

| Flex Line | Access to working capital on demand through a mobile app. |

| Revenue-Based Financing | Financing based on future receivables, not a traditional loan. |

| Dynamic Spending Limits | Limits adjust according to business performance and revenue growth. |

| Dedicated Support | Each account receives a dedicated Account Manager for personalized assistance. |

| Easy Application | Fast online application process with funding decisions typically within an hour. |

| Mobile App | Manage transactions and payment history easily through the app. |

Using pre-approval options can help you find credit cards like the Revenued Business Card Visa® Commercial Card, which offers high approval rates due to revenue-based financing. This can be a game-changer for businesses needing immediate access to funds with flexible usage.

Pros And Cons Of Getting A Credit Card

Getting a credit card can be a significant financial decision. It comes with both advantages and potential drawbacks. Understanding these can help you make an informed choice. Let’s explore the pros and cons of having a credit card.

Advantages Of Having A Credit Card

- Convenience: Credit cards are easy to use and widely accepted.

- Build Credit: Responsible use can help build your credit score.

- Rewards and Perks: Many cards offer cash back, points, or travel rewards.

- Purchase Protection: Credit cards often provide fraud protection and purchase insurance.

- Emergency Funds: They can be a useful source of funds in emergencies.

Potential Drawbacks To Consider

- High-Interest Rates: Carrying a balance can lead to significant interest charges.

- Debt Risk: It can be easy to accumulate debt if not managed properly.

- Fees: Annual fees, late payment fees, and foreign transaction fees can add up.

- Credit Score Impact: Late payments can negatively affect your credit score.

- Spending Temptation: The ease of use can lead to overspending.

In conclusion, while credit cards offer numerous benefits, they also come with potential risks. Being aware of these can help you use credit cards wisely and avoid financial pitfalls.

Conclusion: Achieving Instant Success

Getting approved for a credit card can be a game-changer for both personal and business finances. The process, though sometimes daunting, becomes easier with the right strategies and tools. Here, we recap the proven tips for getting approved and provide final thoughts and encouragement to keep you motivated on your journey.

Recap Of Proven Tips

- Check Your Credit Score: Ensure your credit score is accurate and up-to-date.

- Clear Outstanding Debts: Pay off existing debts to improve your creditworthiness.

- Apply for the Right Card: Choose a card that matches your credit profile and spending habits.

- Prepare Necessary Documents: Have your financial documents ready for the application process.

- Use Revenued Business Card: Consider the Revenued Business Card Visa® Commercial Card for business financing.

- Maintain Good Financial Habits: Consistently manage your finances responsibly.

Final Thoughts And Encouragement

Achieving instant success in credit card approval is within reach. Follow the proven tips, stay organized, and choose the right tools. The Revenued Business Card Visa® Commercial Card offers a great option for businesses. It provides immediate access to funds with dynamic spending limits based on revenue growth.

Remember, every small step counts. Whether it’s maintaining a good credit score or choosing the right card, every effort brings you closer to your goal. Stay positive, stay informed, and keep pushing forward.

With dedication and the right approach, you can achieve your financial goals and enjoy the benefits of credit card approval.

Frequently Asked Questions

How Can I Improve My Credit Score Fast?

Improving your credit score fast involves paying bills on time, reducing debt, and correcting errors on your credit report. Regularly monitoring your credit can also help.

What Credit Score Is Needed For Approval?

A credit score of 700 or higher is typically required for approval. However, some cards accept scores as low as 600.

Do Credit Inquiries Hurt My Score?

Yes, credit inquiries can slightly lower your score. Limiting applications can help maintain your credit score.

Can I Get A Credit Card With Bad Credit?

Yes, you can get a credit card with bad credit. Consider secured credit cards or cards specifically designed for low credit scores.

Conclusion

Getting approved for credit cards can seem challenging. Yet, with the right approach, it’s achievable. Remember to maintain a good credit score and understand your financial needs. Use reliable resources for guidance. If you need immediate access to working capital, consider the Revenued Business Card Visa® Commercial Card. It offers flexible financing based on future receivables. This unique card adapts to your business growth and provides dedicated support. Take control of your financial future today. Apply now and secure the credit you need to grow your business.