Funding Societies Testimonials: Real Success Stories Revealed

Funding Societies is Southeast Asia’s leading SME digital financing platform. It offers quick and flexible funding solutions for small businesses.

Are you curious about what real users think about Funding Societies? In this post, we’ll explore testimonials from both investors and SMEs who have benefited from this platform. Since its launch in 2015, Funding Societies has been a game-changer for small businesses, providing them with much-needed financial support. Investors also find it appealing due to its promising returns and short investment tenors. By sharing these testimonials, we aim to shed light on the real-life experiences and successes of those who have trusted Funding Societies. Read on to discover how this platform has impacted their financial journeys. For more information, visit the Funding Societies website.

Introduction To Funding Societies

Funding Societies is a leading digital financing and debt investment platform in Southeast Asia. Established in 2015, it provides short-term financing for SMEs. This platform is supported by individual and institutional investors.

What Is Funding Societies?

Funding Societies is the largest SME digital financing platform in Southeast Asia. It offers a range of financing options tailored for small and medium-sized enterprises. The platform focuses on providing quick access to funds, helping businesses grow and thrive.

Purpose And Mission

The primary goal of Funding Societies is to support SMEs by offering them equitable financial access. The platform aims to contribute to the economic growth of Southeast Asia. It does this by enabling SMEs, which are crucial to the region’s economies.

Overview Of Services

Funding Societies offers various financing services to meet the diverse needs of SMEs. These services include:

- Micro Loan: Fast loans with approval within 24 hours. Ideal for small businesses needing urgent financing.

- Term Loan: Funds designed for working capital, business expansion, and more. Larger financing amounts are available.

- Short Investment Tenors: Ranging from 1 to 12 months with periodic repayments.

The platform also provides attractive opportunities for investors. They can earn returns through periodic repayments and diversify their investment portfolio. In 2020, the weighted average investment return in Singapore was 7.28%.

With a minimum investment of S$ 20, over 25,000 investors in Singapore have already joined Funding Societies. This demonstrates the platform’s reliability and the trust it has built over the years.

| Service | Details |

|---|---|

| Micro Loan | Fast approval within 24 hours |

| Term Loan | Larger financing amounts available |

| Investment | Minimum investment of S$ 20 |

Funding Societies is backed by notable investors like SoftBank Ventures Asia Corp and Sequoia India. To date, it has facilitated over S$2 billion in business loans regionally. The platform is committed to making a positive impact on societies across Southeast Asia.

How Funding Societies Works

Funding Societies is Southeast Asia’s largest SME digital financing platform. Launched in 2015, it specializes in providing short-term financing to SMEs, funded by individual and institutional investors. Here’s a closer look at how it operates.

The Funding Process

Funding Societies offers a streamlined process for both borrowers and investors. SMEs can apply for Micro Loans or Term Loans, depending on their needs. Micro Loans are ideal for small businesses needing urgent financing, with approval within 24 hours. Term Loans are designed for larger financing needs such as working capital and business expansion.

| Type of Loan | Approval Time | Purpose |

|---|---|---|

| Micro Loan | 24 hours | Urgent financing |

| Term Loan | Varies | Working capital, expansion |

Investors can start with a minimum investment of S$ 20. Investment tenors range from 1 to 12 months with periodic repayments, offering returns around 7.28% (Singapore weighted average in 2020).

Eligibility Criteria

To qualify for financing, SMEs must meet certain criteria. These include:

- Being a registered business in Southeast Asia.

- Having a minimum operational history (usually around 1 year).

- Providing necessary financial documents for assessment.

Investors need to register and verify their accounts to participate. Over 25,000 investors have registered in Singapore alone.

User Experience And Interface

The platform is designed to be user-friendly for both SMEs and investors. The application process is straightforward, with clear instructions and minimal paperwork.

For investors, the interface offers easy navigation through investment options. They can track their portfolio performance and receive periodic repayments directly to their accounts.

Overall, Funding Societies aims to provide equitable financial access, supporting the growth of SMEs and contributing to the economic development of Southeast Asia.

Key Features Of Funding Societies

Funding Societies is a leading SME digital financing platform in Southeast Asia. It offers various features that benefit both small businesses and investors. Let’s explore the key features that make Funding Societies a preferred choice.

Peer-to-peer Lending

Funding Societies operates on a peer-to-peer lending model. This allows individual and institutional investors to fund small and medium enterprises (SMEs). It creates a win-win scenario where SMEs get quick access to funds, and investors earn returns.

- Micro Loan: Fast loans with approval within 24 hours.

- Term Loan: Larger financing amounts for business expansion.

- Short Investment Tenors: 1 – 12 months with periodic repayments.

- Investment Returns: Weighted average of 7.28% in Singapore (2020).

- Minimum Investment: S$ 20.

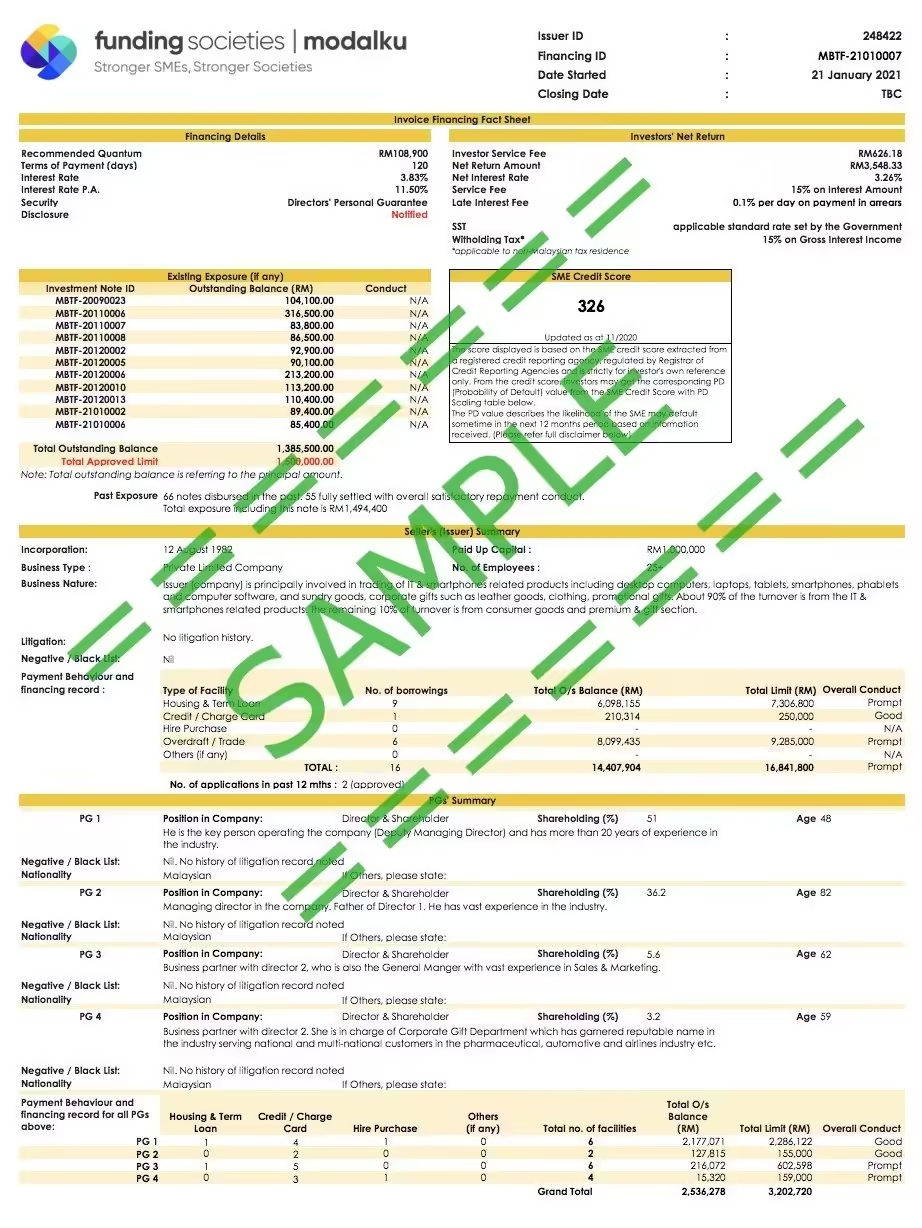

Credit Assessment And Risk Management

Funding Societies employs robust credit assessment and risk management practices. This ensures that both borrowers and investors are protected. Each loan application undergoes a thorough evaluation process.

| Feature | Description |

|---|---|

| Credit Assessment | Detailed evaluation of SME’s financial health. |

| Risk Management | Minimizes potential losses for investors. |

Flexible Financing Options

Funding Societies offers various flexible financing options. These are designed to meet the diverse needs of SMEs. Whether a business needs urgent funds or long-term capital, Funding Societies has a solution.

- Micro Loan: Suitable for small businesses needing quick funds.

- Term Loan: Ideal for working capital and business expansion.

With these features, Funding Societies ensures that SMEs get the necessary support to grow. Investors also benefit by diversifying their portfolios and earning periodic returns.

Pricing And Affordability

Understanding the pricing and affordability of Funding Societies is crucial for both SMEs and investors. This section breaks down the fee structure, interest rates, and compares Funding Societies with traditional financing options.

Fee Structure

Funding Societies offers a clear fee structure for their financing services. Here’s a breakdown:

- Micro Loan: Fast loans with approval within 24 hours. Specific fees are not disclosed.

- Term Loan: Larger financing amounts available. Fees vary based on the loan amount and tenure.

- Investment: Minimum investment of S$ 20. Investors earn through periodic repayments.

Interest Rates

Interest rates are a key factor in determining the affordability of financing options. Funding Societies provides competitive rates:

- Micro Loan: Specific interest rates are not detailed but are designed to be affordable for small businesses.

- Term Loan: Interest rates depend on the loan amount and duration. Tailored to meet business needs.

- Investment Returns: Average investment returns of 7.28% in Singapore (2020).

Comparison With Traditional Financing

Funding Societies offers several advantages over traditional financing methods:

| Criteria | Funding Societies | Traditional Financing |

|---|---|---|

| Approval Time | Within 24 hours for Micro Loans | Several days to weeks |

| Minimum Investment | S$ 20 | Often higher |

| Interest Rates | Competitive and tailored | Varies, typically higher |

| Flexibility | Short investment tenors (1-12 months) | Longer, less flexible terms |

Funding Societies provides a more flexible and accessible financing option, especially for SMEs, compared to traditional banks.

Pros And Cons Of Funding Societies

Funding Societies, Southeast Asia’s largest SME digital financing platform, offers various benefits and drawbacks for both borrowers and investors. Understanding these can help in making informed decisions.

Advantages For Borrowers

Borrowers enjoy several advantages with Funding Societies:

- Quick Access to Funds: Small businesses can get fast loans with approval within 24 hours. This is ideal for urgent financing needs.

- Flexible Loan Options: Micro loans and term loans are available. These cater to different financial requirements, from working capital to business expansion.

- Short Investment Tenors: Loans range from 1 to 12 months. This allows businesses to manage their repayment schedules more effectively.

Advantages For Investors

Investors also gain several benefits through Funding Societies:

- Attractive Returns: The platform offers an average return of 7.28% for investors in Singapore. This is a competitive rate in the market.

- Low Minimum Investment: Investors can start with as low as S$ 20. This makes it accessible for many individuals.

- Diversification: Investing in SMEs allows for portfolio diversification. This can reduce overall investment risk.

Potential Drawbacks

Despite the benefits, there are some potential drawbacks to consider:

- Risk of Default: Investing in SMEs carries the risk of default. Investors need to be aware of this before committing funds.

- Specific Pricing Details: The platform does not provide detailed pricing for loans. Borrowers may find it challenging to assess the total cost upfront.

- Refund Policies: Specific refund or return policies are not detailed. This may leave some investors uncertain about their protection.

By weighing these pros and cons, both borrowers and investors can make more informed decisions about using Funding Societies.

Real Success Stories

Funding Societies has empowered many individuals and businesses. Their testimonials highlight real success stories. These stories showcase the platform’s impact on small business growth, personal financial milestones, and community development.

Small Business Growth

Many small businesses have thrived with the help of Funding Societies. For instance, a local bakery in Singapore received a Micro Loan for urgent expenses. The approval came within 24 hours. This quick access to funds allowed the bakery to purchase essential ingredients. Consequently, they increased their production and met customer demands promptly.

Another example is a tech startup in Malaysia. They secured a Term Loan to expand their operations. The loan helped them hire more staff and invest in new technology. As a result, their business growth skyrocketed, and they achieved their annual targets.

Personal Financial Milestones

Individual investors have also shared their positive experiences. One investor from Indonesia started with a minimum investment of S$20. Over time, they diversified their portfolio and saw consistent returns. The periodic repayments provided a steady income stream. This investor now uses these returns to fund personal projects and goals.

Another investor, based in Vietnam, emphasized the platform’s short investment tenors. They appreciated the flexibility to invest for 1-12 months. This allowed them to manage their finances better and plan for future investments. Achieving these personal financial milestones has been life-changing for many.

Community Impact

Funding Societies’ impact extends beyond individual success. The platform has contributed significantly to community development. For example, in Thailand, several small businesses received funding. These businesses, in turn, created job opportunities within their communities. This ripple effect has boosted local economies and improved living standards.

Moreover, supporting SMEs helps build a robust economic foundation. By enabling equitable financial access, Funding Societies plays a vital role in the region’s economic growth. Their vision of making a positive impact on societies is evident in these community success stories.

Ideal Users And Scenarios

Funding Societies SME Digital Financing Platform caters to a variety of users and scenarios. This section explores the ideal users and how they can benefit from the platform’s features.

Best For Small To Medium Enterprises

Small to Medium Enterprises (SMEs) are the backbone of Southeast Asia’s economy. Funding Societies offers quick access to necessary funds for these businesses. SMEs can benefit from:

- Micro Loans: Fast approval within 24 hours, perfect for urgent financing needs.

- Term Loans: Larger amounts for business expansion or working capital.

With over S$2 billion in business loans regionally, SMEs can trust Funding Societies to support their growth and operations.

Entrepreneurs And Startups

Entrepreneurs and Startups often face challenges in securing traditional financing. Funding Societies provides a solution with:

- Short Investment Tenors: Ranging from 1 to 12 months, allowing flexibility.

- Periodic Repayments: Making it easier to manage cash flow.

Startups can leverage these features to kickstart their ventures and scale quickly without the lengthy processes of conventional loans.

Investors Seeking Diversification

Investors looking to diversify their portfolios can find value in Funding Societies. With over 25,000 registered investors in Singapore alone, the platform offers:

- Investment Returns: Average returns of 7.28% in Singapore (2020).

- Low Minimum Investment: Starting from S$20, making it accessible for all investors.

Investing in SMEs through Funding Societies not only diversifies portfolios but also contributes to economic growth in Southeast Asia.

Frequently Asked Questions

What Is Funding Societies?

Funding Societies is a peer-to-peer lending platform. It connects small businesses with investors. It provides funding solutions for SMEs.

Are Funding Societies Testimonials Reliable?

Yes, they are reliable. Testimonials are from verified users. They reflect genuine experiences of borrowers and investors.

How Do Investors Benefit From Funding Societies?

Investors earn attractive returns. They diversify their investment portfolio. They support small and medium enterprises (SMEs).

Why Choose Funding Societies For Business Loans?

Funding Societies offers quick and easy loan approval. They provide flexible repayment options. They have competitive interest rates.

Conclusion

Funding Societies has transformed SME financing in Southeast Asia. Their platform offers quick, reliable funding for small businesses. Investors benefit from competitive returns and diverse portfolios. SMEs gain essential financial support for growth. Interested? Visit Funding Societies for more details. Explore how this platform can meet your business or investment needs.