Free Credit Report Access: Unlock Your Financial Insights Today

Understanding your credit report is crucial for managing your financial health. Accessing a free credit report can empower you to make informed decisions.

In today’s world, knowing your credit status is essential. A free credit report can help you monitor your financial standing and spot potential errors or fraud. It’s a tool that provides insight into your credit history and can guide you in improving your credit score. Whether you’re planning to apply for a loan, rent an apartment, or invest in real estate, having access to your credit report is a significant first step. Ready to explore how you can obtain your free credit report? Let’s dive into the details and start empowering your financial journey. For more resources on real estate investing and creative financing, check out Subto.

Introduction To Free Credit Report Access

Understanding your credit report is crucial for financial health. Free credit report access allows you to stay informed and make better financial decisions. This blog post will explore what a credit report is and the importance of accessing it regularly.

What Is A Credit Report?

A credit report is a detailed record of your credit history. It includes:

- Personal Information: Name, address, and social security number.

- Credit Accounts: Credit cards, loans, and their balances.

- Credit Inquiries: Requests for your credit report.

- Public Records: Bankruptcies, foreclosures, and other legal actions.

This report is compiled by credit bureaus and used by lenders to assess your creditworthiness.

Importance Of Accessing Your Credit Report

Regularly accessing your credit report is vital. Here are a few reasons why:

- Detect Errors: Ensure your credit information is accurate.

- Prevent Identity Theft: Spot unusual activity early.

- Understand Your Credit Score: Know where you stand financially.

- Improve Financial Health: Identify areas for credit improvement.

By keeping track of your credit report, you can take control of your financial future.

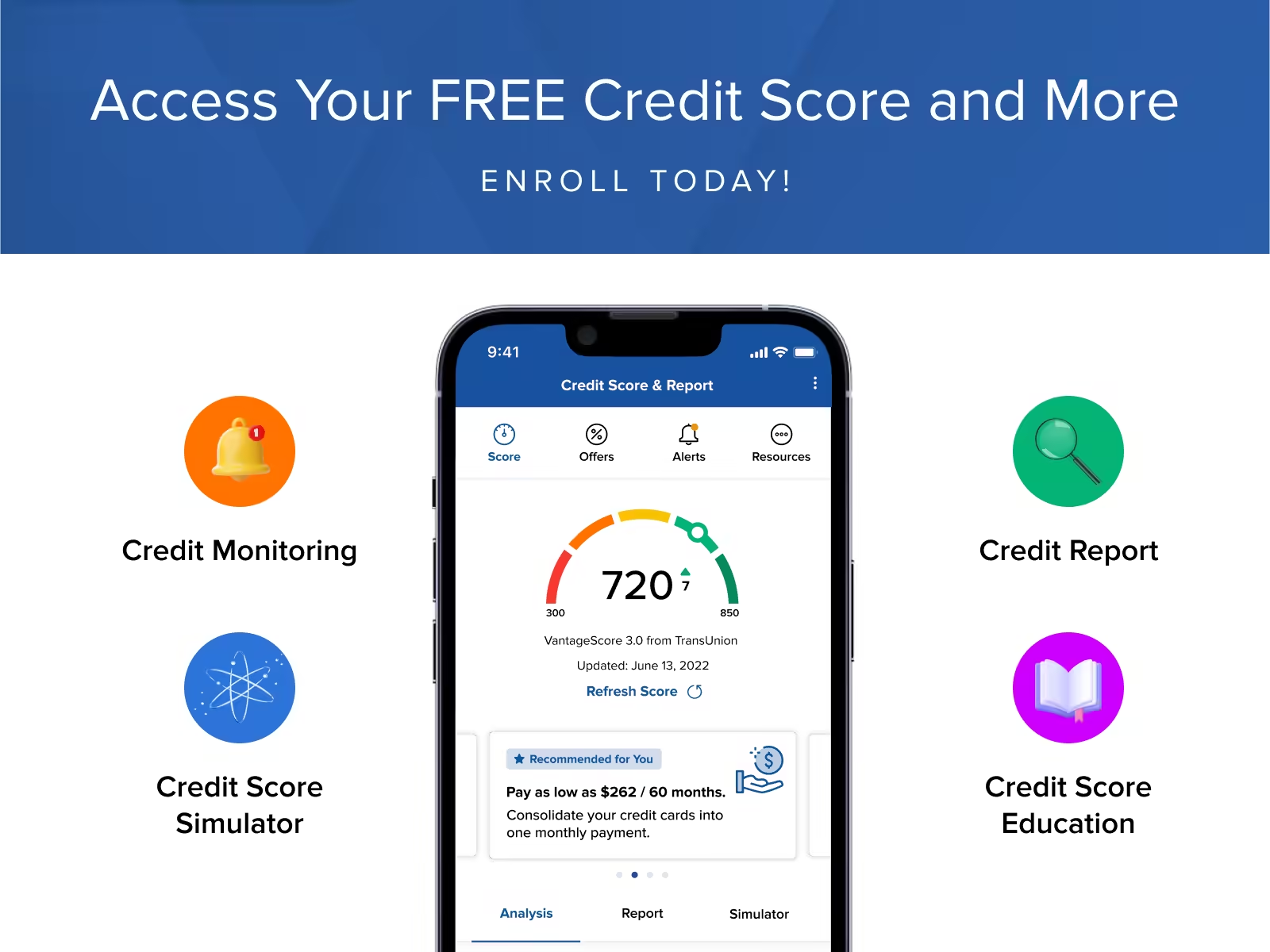

Key Features Of Free Credit Report Access

Understanding your credit score is crucial for managing your finances. Free credit report access has several features that make it easy to stay informed about your credit health. Let’s explore the key features that make free credit report access beneficial.

Regular Monitoring

Free credit report access allows you to monitor your credit regularly. This helps you stay aware of any changes or discrepancies in your credit report. Regular monitoring can help you spot potential fraud or errors early. Maintaining a healthy credit score becomes easier with consistent monitoring.

Comprehensive Credit Information

With free credit report access, you get comprehensive information about your credit. This includes your credit history, current debts, and payment patterns. Understanding these details can help you make informed financial decisions. Comprehensive credit information provides a clear picture of your financial health.

User-friendly Interface

Accessing your credit report should be simple and hassle-free. Free credit report services offer a user-friendly interface. This makes it easy for anyone to navigate and understand their credit information. A clear and intuitive interface ensures that users can find what they need quickly.

Alerts And Notifications

Staying updated is crucial when it comes to your credit report. Free credit report access includes alerts and notifications. These can inform you of significant changes, such as new accounts or hard inquiries. Alerts and notifications help you act swiftly to protect your credit score.

In summary, regular monitoring, comprehensive credit information, a user-friendly interface, and timely alerts are key features of free credit report access. These features help you maintain and improve your credit health efficiently.

Pricing And Affordability

Understanding the costs associated with accessing a credit report is crucial. This section will discuss the differences between truly free services and paid options. It will also highlight hidden costs to be aware of.

Truly Free Vs. Paid Services

Many services claim to offer free credit reports, but not all are truly free. Some may provide a complimentary report initially but later charge for additional features or updates.

- Truly Free Services: These platforms offer a credit report at no cost. Examples include annualcreditreport.com, which provides one free report per year from each of the three major credit bureaus.

- Paid Services: These services often provide extra features like credit monitoring, identity theft protection, or more frequent updates. They may charge a monthly or annual fee.

Hidden Costs To Watch Out For

While some services advertise free credit reports, hidden costs can surprise you. These costs may include:

- Subscription Fees: Some services might offer a free trial but automatically enroll you in a subscription plan unless canceled.

- Additional Reports: After the initial free report, you may be charged for subsequent reports.

- Premium Features: Features like credit monitoring or detailed credit analysis often come with extra fees.

To avoid unexpected charges, always read the terms and conditions carefully. Look for any mentions of subscriptions, fees, and the duration of any free trials.

Pros And Cons Of Free Credit Report Access

Understanding the advantages and disadvantages of accessing free credit reports is crucial. It helps you manage your finances better and make informed decisions. Let’s explore the benefits and limitations of free credit report access.

Benefits Of Using Free Credit Reports

Free credit reports offer numerous advantages:

- Cost-effective: Accessing your credit report for free saves money.

- Financial Awareness: Regularly checking your credit report keeps you informed about your financial status.

- Identifying Errors: You can spot and correct errors on your report quickly.

- Fraud Detection: Regular checks help you detect and address fraudulent activities.

- Improving Credit Score: Understanding your credit report helps you work on improving your score.

Limitations And Drawbacks

Despite the benefits, there are some limitations to consider:

- Limited Information: Free reports may not provide all the details that paid services offer.

- Frequency: Free access might be limited to once a year, which may not be sufficient for active monitoring.

- Basic Analysis: Free reports often lack in-depth analysis and personalized advice.

- Potential Upgrades: Some free services might push you towards paid upgrades for more features.

| Pros | Cons |

|---|---|

| Saves Money | Limited Information |

| Financial Awareness | Frequency Limit |

| Identifying Errors | Basic Analysis |

| Fraud Detection | Potential Upgrades |

| Improving Credit Score |

By weighing these pros and cons, you can decide whether free credit report access meets your needs. Remember, staying informed about your credit status is essential for financial health.

Specific Recommendations For Ideal Users

Free credit report access can be a valuable tool for many. It helps users understand their credit standing and make better financial decisions. Here are some specific recommendations for ideal users of free credit reports.

Who Should Use Free Credit Reports?

Not everyone knows the importance of checking their credit report. Here’s a list of who should use it:

- First-time homebuyers: Understand your credit score before applying for a mortgage.

- Real estate investors: Ensure your credit report is accurate to secure better financing options.

- Individuals with past credit issues: Monitor your progress and verify corrections.

- Students and young adults: Start building and maintaining a healthy credit history early.

- Anyone planning a large purchase: Check your credit to avoid surprises when applying for loans.

Best Scenarios For Utilizing Free Credit Reports

Free credit reports can be beneficial in various scenarios. Here are some of the best:

- Preparing to apply for a loan: Review your credit report to ensure all information is accurate. This helps increase your chances of approval.

- Monitoring for identity theft: Regularly check your credit report for any unauthorized accounts or activities.

- Improving your credit score: Identify areas that need improvement and take action to boost your score.

- Assessing your financial health: Use your credit report to get a complete picture of your financial standing.

- Disputing errors: Find and correct mistakes on your credit report that could negatively affect your score.

Accessing your free credit report is simple. It provides essential insights for better financial management. Whether you’re buying a home or monitoring your credit, make sure to utilize this valuable resource.

Frequently Asked Questions

How To Get A Free Credit Report?

You can get a free credit report from AnnualCreditReport. com. It’s the only official site authorized by federal law.

How Often Can I Access My Free Credit Report?

You can access your free credit report once every 12 months from each of the three major credit bureaus.

What Information Is On A Free Credit Report?

A free credit report includes your credit history, credit accounts, payment history, and any public records.

Does Checking My Free Credit Report Affect My Credit Score?

No, checking your own free credit report does not affect your credit score. It’s considered a soft inquiry.

Conclusion

Getting a free credit report is essential for managing your financial health. It helps track your credit score and detect potential issues early. Interested in creative financing and real estate investing? SubTo offers comprehensive resources and support. Learn more about SubTo by visiting their website here. Take control of your credit and explore new investment opportunities today.