Flexible Payment Options Credit Card: Unlock Financial Freedom

In today’s fast-paced business world, having flexible payment options can be a game-changer. Credit cards with adaptable payment terms provide businesses the financial freedom they need to thrive.

Introducing Flex, a financial platform designed to accelerate business growth. Flex integrates various back-office functions into one seamless, easy-to-use platform. With features like simplified banking, expense management, and individual employee cards at no extra cost, Flex stands out. It offers net-60 on all purchases with 0% interest for 60 days, making it an ideal choice for businesses looking to optimize their cash flow. Flex also provides robust security measures, including multi-factor authentication and FDIC insurance up to $3M. Discover how Flex can simplify your financial management and support your business growth by visiting Flex today.

Introduction To Flexible Payment Options Credit Card

The Flex Credit Card offers businesses a robust solution for managing their finances. With features like 0% interest for 60 days, flexible credit limits, and comprehensive security measures, Flex is designed to support business growth and simplify financial management.

What Is A Flexible Payment Options Credit Card?

A Flexible Payment Options Credit Card, like the Flex Credit Card, allows businesses to make purchases without immediate financial pressure. With a net-60 payment term, companies have 60 days to pay off their purchases without incurring interest. This type of card offers significant advantages for managing cash flow efficiently.

Purpose And Benefits Of Flexible Payment Options

The primary purpose of the Flex Credit Card is to provide businesses with a financial tool that supports growth. Here are some key benefits:

- 0% Interest for 60 Days: Businesses can enjoy an interest-free period, easing the financial burden.

- Flexible Credit Limits: Credit limits grow with your business, ensuring you have access to the funds you need.

- Individual Employee Cards: Provide team members with their own cards at no extra cost.

- High-Interest Earnings: Earn up to 2.99% APY on idle cash, maximizing your financial resources.

- Enhanced Security: Advanced security features, including robust encryption and multi-factor authentication, ensure your financial data is safe.

Using the Flex Credit Card, businesses can streamline their expense management and take advantage of interest-free periods to optimize their cash flow. Additionally, the platform offers banking services, receipt capture, and free ACH/wire payments, making it a comprehensive financial solution for modern businesses.

| Feature | Description |

|---|---|

| Interest-Free Period | 0% interest for 60 days on all purchases |

| Credit Limits | Grow with your business |

| Employee Cards | Individual cards at no extra cost |

| Interest Earnings | Earn up to 2.99% APY on cash |

| Security | Proactive protection, encryption, MFA |

Key Features Of Flexible Payment Options Credit Card

The Flex Credit Card offers a range of features designed to help businesses manage finances effectively. From customizable payment plans to rewards programs, Flex provides essential tools for business growth.

With Flex, businesses can enjoy Net-60 on all purchases. This means you have 60 days to pay off your balance without any interest. This flexibility allows you to manage cash flow better and plan payments according to your business cycle.

The Flex Credit Card offers 0% interest for 60 days if the full balance is paid within the interest-free grace period. This low-interest feature helps businesses save on finance charges and invest more in growth activities.

Flex provides attractive rewards and cashback programs to its users. These incentives can add significant value to your business by reducing overall expenses and rewarding everyday purchases.

One of the best features of the Flex Credit Card is that it comes with no annual fees. This means more savings for your business, allowing you to allocate resources where they are needed most.

Flex offers credit limits that grow with your business. As your business expands, so does your credit capacity, ensuring you always have access to the funds you need.

| Feature | Details |

|---|---|

| Customizable Payment Plans | Net-60 on all purchases |

| Low Interest Rates | 0% interest for 60 days |

| Rewards and Cashback Programs | Incentives for everyday purchases |

| No Annual Fees | No extra cost |

| Flexible Credit Limits | Limits grow with your business |

Customizable Payment Plans

Flex offers customizable payment plans tailored to the needs of businesses. These plans provide flexibility in managing finances, making it easier to handle expenses and cash flow. Understanding how these plans work and their benefits can greatly assist in financial management.

How Customizable Payment Plans Work

Customizable payment plans with Flex allow businesses to choose payment schedules that fit their cash flow needs. With net-60 on all purchases, companies have 60 days to pay their balance with 0% interest if the full balance is paid within the interest-free grace period. This flexibility helps businesses manage their finances more efficiently.

| Feature | Description |

|---|---|

| Net-60 Terms | 60 days to pay purchases with 0% interest. |

| Interest-Free Period | 0% interest if balance paid within grace period. |

| Credit Limits | Limits that grow with your business. |

Benefits Of Customizable Payment Plans

- Improved Cash Flow: Longer payment terms help manage cash flow better.

- Expense Management: Simplified tracking and managing of expenses with team cards.

- Financial Growth: Credit limits increase as your business grows, offering more flexibility.

- Security: Robust encryption and proactive protection ensure financial safety.

Solving Financial Management Issues

Flex’s customizable payment plans address common financial management problems. Businesses often face cash flow challenges. The net-60 terms provide a cushion, allowing more time to gather funds for payments without incurring interest.

Additionally, Flex offers individual employee cards at no extra cost, making it easier to track and manage expenses across the team. With features like free ACH/wire payments and streamlined receipt capture, managing finances becomes less stressful and more organized.

The platform also enhances security with features like multi-factor authentication and automated fraud monitoring. This ensures that your business transactions are protected, reducing the risk of financial fraud.

Flex integrates various back-office functions into one platform, making it a comprehensive solution for businesses looking to streamline their financial operations and improve efficiency.

Low Interest Rates

Credit cards can be a powerful tool for managing business finances. One key feature to consider is the interest rate. Low interest rates can save businesses significant amounts of money over time.

Understanding Interest Rates

Interest rates determine how much extra you pay when you don’t clear your balance. They are expressed as a percentage of the amount borrowed. Lower interest rates mean lower additional costs.

For example, the Flex Credit Card offers 0% interest for the first 60 days. If you pay off your balance within this period, you won’t incur any interest charges. This is an excellent opportunity to manage cash flow without worrying about high costs.

Why Low Interest Rates Matter

- Reduced Financial Burden: Lower interest rates mean you pay less over time.

- Improved Cash Flow: With lower costs, more funds are available for business operations.

- Increased Savings: Savings from lower interest can be reinvested into the business.

Flex offers competitive rates, making it easier for businesses to manage their finances effectively.

Impact On Long-term Financial Health

Using credit cards with low interest rates can positively impact your business’s financial health. Paying less in interest means you can allocate more funds to growth initiatives.

Here’s how it benefits:

- Debt Management: Lower interest rates make it easier to manage and pay down debt.

- Financial Stability: Less interest means more predictable expenses, contributing to financial stability.

- Investment Opportunities: Savings from interest payments can be invested back into the business for growth.

Choosing a credit card like Flex with low interest rates can be a strategic move for long-term financial success. It helps maintain a healthy balance sheet and supports sustainable business growth.

Rewards And Cashback Programs

The Flex Credit Card offers a variety of rewards and cashback programs designed to benefit businesses. These programs help businesses save money while making purchases. This section explores the types of rewards available, how to maximize cashback benefits, and how these rewards enhance financial flexibility.

Types Of Rewards Available

Flex provides different types of rewards tailored to suit business needs. These include:

- Cashback Rewards: Earn a percentage of your purchases back as cash. This is a simple way to save money on everyday expenses.

- Travel Rewards: Accumulate points that can be used for business travel. This is ideal for companies with frequent travel needs.

- Discounts and Offers: Get exclusive discounts on various business services and products. This helps reduce operational costs.

Maximizing Cashback Benefits

To get the most out of the cashback programs, follow these tips:

- Use the Card for Regular Expenses: Pay for routine business expenses with the Flex Credit Card to earn consistent rewards.

- Pay Off the Balance: Ensure you pay off the balance within the 60-day interest-free period. This avoids interest charges and maximizes savings.

- Track Rewards: Regularly monitor your rewards. Use the Flex platform to keep track of accumulated cashback and plan your spending.

How Rewards Enhance Financial Flexibility

Rewards programs offer significant benefits that enhance financial flexibility. Here’s how:

| Benefit | Description |

|---|---|

| Cost Savings | Cashback rewards reduce overall expenses, freeing up funds for other business needs. |

| Financial Planning | Predictable rewards help in better financial planning and budgeting. |

| Increased Liquidity | Rewards improve cash flow, providing additional liquidity for business operations. |

Using the Flex Credit Card’s rewards and cashback programs can lead to substantial savings. This enables businesses to allocate resources more effectively and grow efficiently.

No Annual Fees

One of the standout features of the Flex Credit Card is its No Annual Fees. For many businesses, this can make a significant difference in their financial management strategy. By eliminating annual fees, Flex ensures that businesses can allocate their resources more effectively without the burden of additional costs.

Advantages Of No Annual Fees

Having a credit card with no annual fees offers several advantages:

- Cost Savings: Businesses can save money that would otherwise be spent on annual fees, allowing them to invest in other areas.

- Accessibility: More businesses can benefit from the Flex Credit Card without worrying about the extra cost.

- Simplicity: Managing finances becomes easier without the need to track and budget for annual fees.

Comparative Analysis With Other Cards

| Card Type | Annual Fee | Interest Rate | Credit Limit |

|---|---|---|---|

| Flex Credit Card | None | 0% for 60 days | Grows with your business |

| Standard Business Card | $95 | 15.99% APR | Fixed limit |

| Premium Business Card | $250 | 12.99% APR | High fixed limit |

Cost-saving Benefits

By choosing the Flex Credit Card, businesses can reap significant cost-saving benefits:

- No Annual Fees: Save up to $250 annually compared to premium cards.

- 0% Interest for 60 Days: Take advantage of interest-free financing for two months.

- Flexible Credit Limits: Avoid the need for multiple cards or loans, as Flex grows with your business.

These cost-saving benefits make the Flex Credit Card a smart choice for businesses of all sizes, looking to optimize their financial management.

Flexible Credit Limits

Flex offers flexible credit limits designed to grow with your business needs. This flexibility is crucial for businesses aiming to manage cash flow efficiently. Flex allows businesses to adjust their credit limits, ensuring they have the right amount of credit at any given time.

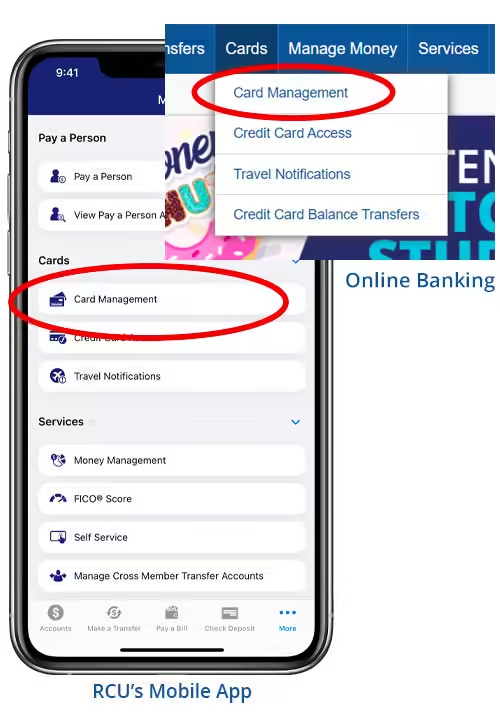

Adjusting Credit Limits To Fit Your Needs

With Flex, you can adjust your credit limits based on your business requirements. Whether you need to increase your limit for a large purchase or reduce it to manage spending, Flex provides the tools to do so.

- Increase limits for unexpected expenses.

- Decrease limits to control spending.

- Adjust based on business growth.

This flexibility helps businesses stay agile and responsive to changing financial demands.

Managing Credit Responsibly

Responsible credit management is essential for maintaining a healthy financial status. Flex supports businesses in managing their credit effectively.

- Regularly review your credit limit.

- Set up alerts for approaching limits.

- Pay off balances within the interest-free period to avoid charges.

Using these strategies, businesses can maintain good credit health and avoid unnecessary debt.

Benefits For Different Financial Situations

Flex’s credit options cater to various financial situations. Here are some benefits for different scenarios:

| Situation | Benefit |

|---|---|

| Startups | Access to necessary credit without a high initial limit. |

| Growing Businesses | Increased credit limits to support expansion. |

| Established Companies | Flexibility to adjust limits based on cash flow needs. |

By offering tailored credit options, Flex ensures businesses have the financial support they need at every stage of growth.

Pricing And Affordability Breakdown

The Flex Credit Card offers a variety of flexible payment options for businesses. This section provides a detailed look at the pricing and affordability of the Flex Credit Card, helping you understand its value and how it compares to other credit cards.

Detailed Cost Analysis

The Flex Credit Card comes with 0% interest for 60 days. This means businesses can make purchases without paying any interest for the first two months, as long as the full balance is paid within this period. Here’s a breakdown of the costs:

- 0% interest for 60 days on all purchases.

- Interest accrues if the balance is not paid by the end of the bi-monthly billing period.

- Individual employee cards at no extra cost.

Additionally, businesses can earn up to 2.99% APY on idle cash, depending on the account balance:

| Account Tier | Average Daily Balance | APY |

|---|---|---|

| Tier 3 | Greater than $1,000,000 | 2.99% |

| Tier 2 | Greater than $100,000 | 1.65% |

Comparing Value With Other Credit Cards

When comparing the Flex Credit Card with other business credit cards, several key benefits stand out:

- 0% interest for 60 days: Many other cards offer a shorter interest-free period.

- Credit limits that grow with your business: Unlike some cards with fixed limits.

- Free ACH/wire payments: This reduces additional transaction costs.

These features make the Flex Credit Card a valuable option for businesses looking for flexibility and cost savings.

Balancing Costs And Benefits

The Flex Credit Card balances costs and benefits effectively. While the interest-free period provides immediate savings, the ability to earn high-interest rates on idle cash adds long-term value. Here are the key benefits:

- Simplified financial management through the Flex platform.

- Enhanced security with advanced protection measures.

- FDIC insurance up to $3M, providing added financial security.

This combination of features ensures that businesses can manage their finances efficiently while maximizing their savings and security.

Pros And Cons Based On Real-world Usage

The Flex credit card offers various benefits and some drawbacks. Real-world usage reveals insights that are valuable for potential users. Let’s explore these aspects through user testimonials, commonly reported advantages, and frequently mentioned drawbacks.

User Testimonials And Reviews

Many users praise the Flex credit card for its 0% interest for 60 days. Small business owners find the Net-60 payment terms very beneficial. Here are a few testimonials:

“Flex has simplified our expense management. The 60-day interest-free period helps manage our cash flow better.” – Jane D.

“The individual employee cards at no extra cost have been a game-changer for our team.” – Mark T.

Commonly Reported Advantages

- 0% interest for 60 days: Users enjoy the interest-free grace period.

- Net-60 terms: Provides flexibility in managing payments.

- High credit limits: Limits grow with the business, accommodating expansion.

- Security features: Robust encryption and multi-factor authentication enhance safety.

- Interest earnings: Up to 2.99% APY on idle cash.

Frequently Mentioned Drawbacks

While Flex has many advantages, users have noted some drawbacks:

- Interest accrual: Interest begins if the balance is not paid within the 60 days.

- Eligibility criteria: Some businesses may not qualify for high credit limits initially.

- Specific terms: Users need to understand detailed terms in the cardholder agreement.

Recommendations For Ideal Users

Understanding who can benefit most from a Flexible Payment Options Credit Card like Flex is essential. This section will outline the best users, scenarios, and tips to maximize the card’s benefits.

Who Should Use A Flexible Payment Options Credit Card?

Small Business Owners: Flex is perfect for small business owners needing flexibility in managing expenses. The net-60 payment terms and 0% interest for 60 days provide breathing room in cash flow management.

Growing Businesses: Companies expanding their operations will find the card’s credit limits that grow with their business highly beneficial.

Teams with Multiple Employees: Businesses with multiple employees will benefit from the individual employee cards at no extra cost.

Best Scenarios For Its Use

- Managing Operational Expenses: Use Flex to cover daily operational costs, ensuring smooth business operations without immediate cash outflow.

- Large Purchases: The net-60 terms make it ideal for financing larger purchases and investments.

- Expense Tracking: Simplify tracking and managing expenses with the card’s streamlined receipt capture feature.

Tips For Getting The Most Out Of Your Card

- Pay Within the Grace Period: Always aim to pay off the balance within the 60-day interest-free period to avoid interest charges.

- Utilize Employee Cards: Issue individual cards to employees for better expense tracking and management.

- Monitor Cash Flow: Keep an eye on your cash flow to ensure you can meet payment deadlines.

- Take Advantage of Interest Earnings: Maintain an average daily balance in your account to earn up to 2.99% APY on cash on hand.

Frequently Asked Questions

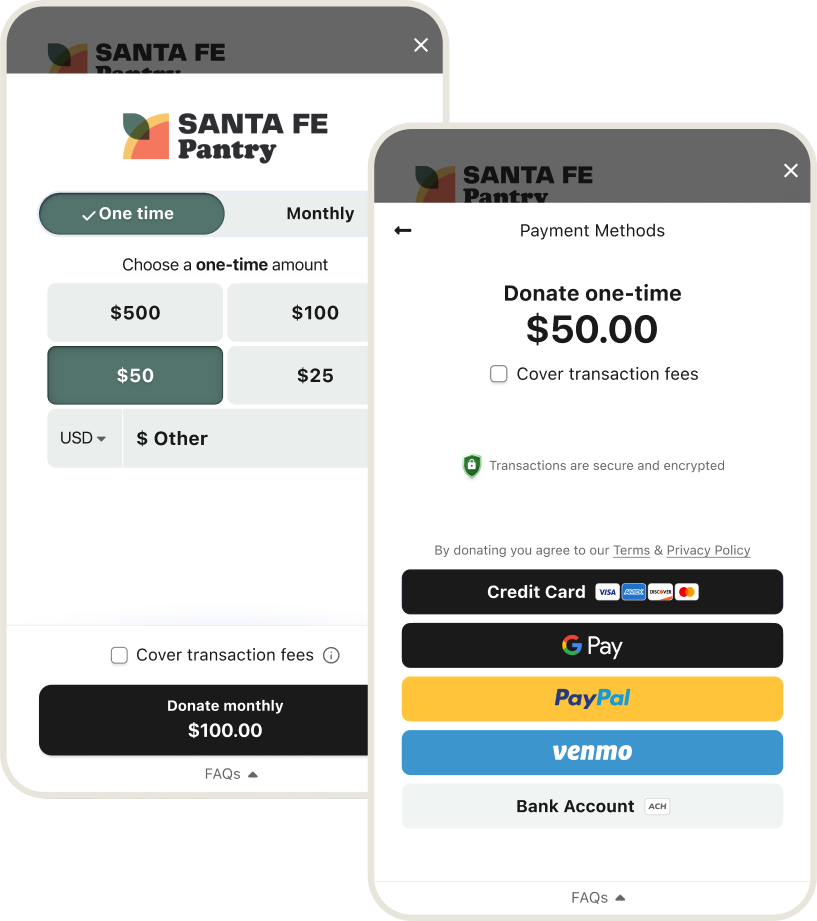

What Are Flexible Payment Options?

Flexible payment options allow you to choose different ways to pay your credit card bill. These options include paying in full, setting up an installment plan, or making minimum payments. They provide greater financial flexibility.

Can I Change My Payment Plan Anytime?

Yes, most credit card issuers allow you to change your payment plan anytime. You can switch between paying in full, making minimum payments, or setting up an installment plan based on your financial situation.

Are There Fees For Flexible Payment Options?

Some flexible payment options may have fees. For example, installment plans often come with interest charges. It’s important to check with your credit card issuer to understand any associated fees.

How Do Flexible Payment Options Affect My Credit Score?

Flexible payment options can impact your credit score. Paying on time, even if only the minimum, helps maintain a good score. However, consistently carrying a high balance might negatively impact your score.

Conclusion

Choosing flexible payment options with the Flex credit card offers many benefits. Businesses enjoy simplified financial management and secure transactions. High-interest earnings and flexible credit terms provide additional advantages. For more details, visit the Flex website. Take control of your business finances today!