Flexible Payment Options: Enhance Customer Satisfaction Today

Flexible payment options are more important than ever. They offer convenience and financial flexibility for consumers.

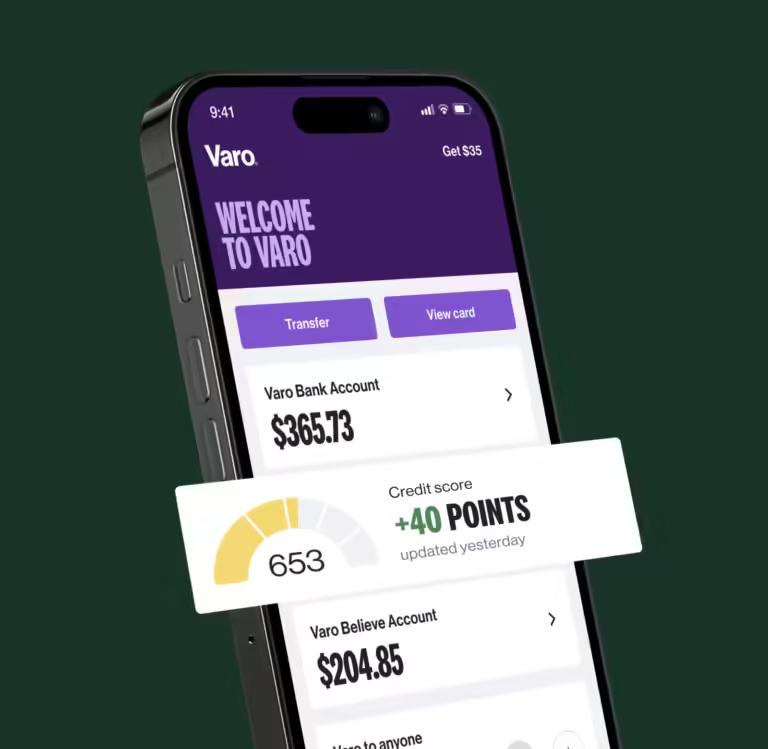

Imagine shopping for your favorite products without the stress of immediate payment. With Perpay, this dream becomes a reality. Perpay provides an easy way to shop, build credit, and manage your finances. You can buy top brands in electronics, home goods, and more, all with a $1,000 credit limit. Payments are deducted directly from your paycheck, making it hassle-free and interest-free. Plus, you’ll see your credit score improve on average by 36 points within three months. Discover how Perpay can simplify your shopping experience and boost your credit score.

Introduction To Flexible Payment Options

Flexible payment options have become a cornerstone of modern financial services. They offer consumers the ability to manage their finances with ease and convenience. In this section, we will explore what flexible payment options are, and why they are essential for today’s businesses.

What Are Flexible Payment Options?

Flexible payment options enable consumers to pay for goods and services over time. These options can include interest-free installments, credit-building tools, and deductions directly from paychecks. They provide a variety of ways to make purchases more manageable.

- Interest-Free Installments: Pay for purchases in smaller, interest-free payments.

- Credit Building: Improve your credit score with consistent, on-time payments.

- Paycheck Deductions: Automatic payments directly from your paycheck for seamless management.

An example of a service offering these features is Perpay. Perpay allows users to shop for essential items, build credit, and pay over time with automatic paycheck deductions.

Why Flexible Payment Options Are Essential For Modern Businesses

Modern businesses benefit greatly from offering flexible payment options. These methods cater to the diverse financial situations of consumers. They help attract a broader customer base by making purchases more accessible.

| Benefit | Explanation |

|---|---|

| Increased Sales | More customers can afford products, leading to higher sales. |

| Customer Loyalty | Flexible payments build trust and encourage repeat business. |

| Positive Reviews | Happy customers share their experiences, enhancing brand reputation. |

For instance, Perpay’s interest-free payment plans and credit-building features have received positive customer reviews. Users appreciate the fast shipping, excellent customer service, and the ability to improve their credit scores.

Offering flexible payment options like Perpay can significantly enhance customer satisfaction and business success.

Key Features Of Flexible Payment Options

Flexible payment options offer convenience and affordability. They help manage purchases and payments efficiently. Understanding the key features can enhance your shopping experience and credit building. Below are the essential aspects of flexible payment options:

Multiple Payment Methods

Providing multiple payment methods is crucial. It allows customers to choose the most suitable option. Perpay offers a variety of methods, including:

- Credit Cards

- Debit Cards

- PayPal

This flexibility ensures a seamless shopping experience.

Installment Plans

Installment plans break down the total cost into smaller, manageable payments. Perpay’s interest-free and fee-free plans make it easier. Automatic deductions from your paycheck simplify this further. This method is ideal for budgeting and making larger purchases affordable.

Subscription Models

Subscription models provide regular access to services or products. They often come with added perks. Perpay allows you to use its credit card anywhere Mastercard is accepted. You can earn rewards and shop on the Perpay Marketplace. This model encourages consistent use and benefits.

Buy Now, Pay Later (bnpl)

Buy Now, Pay Later (BNPL) options offer immediate purchase with delayed payment. Perpay’s BNPL feature allows you to shop now and pay over time directly from your paycheck. This helps in managing cash flow without the need for upfront payment.

Digital Wallet Integration

Digital wallets provide quick and secure transactions. Integrating digital wallets with Perpay offers a smoother shopping experience. You can use wallets like Apple Pay or Google Wallet for your purchases. This integration enhances convenience and security.

| Payment Option | Features | Benefits |

|---|---|---|

| Multiple Payment Methods | Credit Cards, Debit Cards, PayPal | Flexible and convenient payment options |

| Installment Plans | Interest-free, automatic paycheck deductions | Manageable payments, easy credit building |

| Subscription Models | Regular access, earn rewards | Consistent use, added benefits |

| Buy Now, Pay Later (BNPL) | Immediate purchase, delayed payment | Improved cash flow management |

| Digital Wallet Integration | Supports Apple Pay, Google Wallet | Quick and secure transactions |

Pricing And Affordability Breakdown

Understanding the pricing and affordability of flexible payment options is crucial. This breakdown will help you make informed decisions. It covers the costs, comparisons, and potential ROI for businesses.

Cost Of Implementing Flexible Payment Options

The cost of implementing flexible payment options varies. For Perpay, there are no interest or fees for making purchases. The only potential cost may come from the Perpay+ credit building program. Businesses need to consider setup and maintenance costs. These might include:

- Initial setup fees

- Transaction fees

- Maintenance and support costs

Despite these costs, the benefits of offering flexible payments often outweigh the expenses.

Comparing Different Payment Solutions

Comparing different payment solutions helps find the best fit for your business. Here is a table comparing Perpay with other common options:

| Feature | Perpay | Traditional Credit Cards | Buy Now, Pay Later (BNPL) |

|---|---|---|---|

| Interest Fees | None | Varies | Varies |

| Credit Building | Yes | Yes | No |

| Automatic Payments | Yes | No | Optional |

Perpay stands out with interest-free payments and credit building. Traditional credit cards and BNPL services may have varying fees and limited credit benefits.

Return On Investment (roi) For Businesses

Offering flexible payment options can lead to significant ROI for businesses. Here are some potential benefits:

- Increased sales: Customers are more likely to buy when they can pay over time.

- Improved customer loyalty: Flexible payments can enhance customer satisfaction and retention.

- Higher average order value: Customers may spend more when given flexible payment options.

Perpay also offers a unique advantage. Its credit building feature encourages responsible spending and timely payments. This can lead to lower default rates and better financial health for customers.

Implementing flexible payment solutions like Perpay can be a smart investment. It can drive sales, improve customer loyalty, and provide substantial ROI.

Pros And Cons Of Flexible Payment Options

Flexible payment options provide customers and businesses with numerous benefits and challenges. Understanding these pros and cons helps make informed financial decisions. Here’s a detailed look at the advantages and potential drawbacks.

Advantages For Customers

Flexible payment options like Perpay offer several advantages for customers:

- Interest-free and fee-free plans: Avoid additional costs while purchasing.

- Credit building: Improve credit scores with automatic paycheck deductions.

- Access to various products: Shop top brands in electronics, home goods, apparel, and more.

- Positive customer experiences: Fast shipping and great customer service.

These benefits make flexible payment options attractive to many shoppers, especially those looking to build or improve their credit scores.

Advantages For Businesses

Businesses can also gain from offering flexible payment options:

- Increased sales: Customers are more likely to purchase when they can pay over time.

- Customer loyalty: Positive experiences can lead to repeat business.

- Reduced cart abandonment: Flexible payments encourage customers to complete purchases.

- Enhanced market reach: Appeal to a broader audience, including those with limited immediate funds.

By providing flexible payment options, businesses can improve their overall sales performance and customer satisfaction.

Potential Drawbacks And Challenges

Despite the benefits, there are some potential drawbacks and challenges to consider:

- Missed payments: Can negatively impact credit scores.

- Eligibility restrictions: Not all customers may qualify for flexible payment options.

- Credit profile effects: Information obtained may affect your credit profile with alternative bureaus.

- Uncertain credit improvements: Credit score increases vary based on individual financial behavior.

Understanding these challenges can help both customers and businesses make better decisions regarding flexible payment options.

Specific Recommendations For Ideal Users Or Scenarios

Flexible payment options can greatly benefit diverse user groups and scenarios. Here, we outline specific recommendations to help you determine the best use cases for Perpay’s services.

Best For E-commerce And Online Retailers

Perpay provides a seamless solution for e-commerce and online retailers. With access to the Perpay Marketplace, users can shop for top brands in electronics, home goods, apparel, and more. The $1,000 credit limit allows for significant purchases without interest. Automatic paycheck deductions ensure payments are made on time, fostering positive customer experiences.

Ideal For Subscription-based Services

Perpay is ideal for subscription-based services. The automatic payment feature ensures consistent and timely payments, which are crucial for maintaining subscriptions. Users can enjoy their subscriptions without the stress of missed payments, while also building their credit scores.

Perfect For High-ticket Items And Services

For those seeking to purchase high-ticket items or services, Perpay offers a practical solution. The Perpay Credit Card, accepted anywhere Mastercard is, allows users to make substantial purchases while earning 2% rewards. These rewards can be used to shop more on the Perpay Marketplace, creating a beneficial cycle of spending and saving.

Recommendations For Small Businesses

Small businesses can benefit from using Perpay for their purchases. The interest-free and fee-free payment plans mean businesses can manage their cash flow better. Automatic paycheck deductions ensure no missed payments, which is vital for maintaining a positive credit history. Access to a wide variety of products helps small businesses source essential items efficiently.

Perpay is a versatile financial service that can cater to various needs, from individual consumers to small businesses. By understanding these specific recommendations, you can make an informed decision on how to best utilize Perpay’s flexible payment options.

Frequently Asked Questions

What Are Flexible Payment Options?

Flexible payment options allow customers to choose different methods to pay for their purchases. These options can include credit cards, debit cards, installment plans, and digital wallets.

Why Are Flexible Payment Options Important?

Flexible payment options are important because they offer convenience and accessibility. They cater to different financial situations, making it easier for customers to complete their purchases.

How Do Flexible Payment Options Benefit Businesses?

Flexible payment options can increase sales and customer satisfaction. They provide customers with more choices, leading to higher conversion rates and repeat business.

Can Flexible Payment Options Improve Customer Loyalty?

Yes, flexible payment options can improve customer loyalty. Offering various payment methods can enhance the shopping experience, encouraging customers to return.

Conclusion

Exploring flexible payment options is essential for managing finances effectively. Perpay offers a unique solution for everyday shopping and credit building. With interest-free plans, it simplifies purchases and helps improve credit scores. Users can shop top brands with ease and enjoy automatic paycheck deductions. To learn more, visit Perpay. Start your journey to better financial health today!