Flex Credit Card Features: Unleash Financial Freedom Today

Are you looking for a credit card that adapts to your needs? Flex Credit Card offers unique features designed for flexibility and convenience.

In today’s fast-paced world, having a versatile credit card can make life much easier. The Flex Credit Card is tailored to cater to various financial needs, whether for personal or business use. With its range of features, it helps manage expenses efficiently, providing peace of mind. This blog post will explore what makes the Flex Credit Card stand out and why it could be a valuable addition to your wallet. To learn more, visit the official site here.

Introduction To Flex Credit Card

The Flex Credit Card offers unique benefits tailored for businesses. It aims to simplify financial management while providing flexibility and convenience. Explore what makes this card a valuable tool for your business needs.

What Is Flex Credit Card?

The Flex Credit Card is designed for businesses. It provides various financial services to streamline expenses and manage cash flow efficiently. This card offers features that are tailored to the needs of modern businesses.

Purpose And Target Audience

The Flex Credit Card targets business owners and managers. It aims to help them manage company finances effortlessly. The card is suitable for small to medium-sized enterprises. It provides a convenient way to handle business transactions and expenses.

Key Features Of Flex Credit Card

The Flex Credit Card offers a range of features designed to provide flexibility and value. Below are the key features that set the Flex Credit Card apart, helping you make the most of your financial decisions.

With the Flex Credit Card, enjoy flexible credit limits tailored to your financial needs. Adjust your limit as your spending habits change, ensuring you always have the right amount of credit available.

Earn points with every purchase. The Flex Credit Card comes with a cashback and rewards program that lets you earn points on daily expenses. Redeem these points for exciting rewards, travel perks, or cash back.

Save more with the Flex Credit Card’s low-interest rates. Whether you’re making a large purchase or paying off your balance, benefit from competitive rates that help you manage your finances more effectively.

The Flex Credit Card has no annual fees. Enjoy the benefits of the card without worrying about extra costs. This makes it an ideal choice for those looking to save on credit card expenses.

Your security is a priority. The Flex Credit Card includes advanced security features to protect your transactions. Benefit from real-time fraud alerts, secure online shopping, and enhanced data protection.

Flexible Credit Limits

The Flex Credit Card offers flexible credit limits that adapt to your needs. This feature sets Flex apart from traditional credit cards. Adjustable credit limits empower users to manage their finances better.

Benefits Of Adjustable Credit Limits

Adjustable credit limits come with several benefits:

- Custom Control: Tailor your credit limit based on your spending habits.

- Better Budgeting: Helps in maintaining a budget by setting a limit that works for you.

- Financial Flexibility: Adjust your limit during different times of the year or for special occasions.

How To Customize Your Credit Limit

Customizing your credit limit with Flex is simple:

- Log in: Access your Flex account online.

- Navigate to Settings: Go to the credit limit settings.

- Adjust Your Limit: Use the slider or input field to set your desired limit.

- Confirm: Save your changes and enjoy your new limit.

Ideal Users For Flexible Limits

Flexible credit limits are perfect for:

- Frequent Travelers: Adjust limits based on travel expenses.

- Business Owners: Manage business expenses more effectively.

- Seasonal Shoppers: Increase limits during holiday seasons and reduce them later.

Flex Credit Card’s adaptable features make it a valuable tool for various users.

Cashback And Rewards Program

The Flex Credit Card offers an exciting cashback and rewards program designed to give you more value from your spending. Whether you are making everyday purchases or paying business expenses, Flex ensures you earn while you spend.

Overview Of Cashback Offers

With the Flex Credit Card, you can enjoy generous cashback offers on various categories. These categories include:

- Groceries

- Dining

- Travel

- Online Shopping

For example, you can earn 2% cashback on groceries and dining, and 1% cashback on all other purchases. This helps you save money on your regular expenses and make the most of your budget.

Exclusive Rewards For Cardholders

Flex Credit Cardholders also gain access to exclusive rewards. These rewards include:

- Travel discounts

- Access to VIP events

- Special promotions

These rewards are designed to provide extra benefits and enhance your overall experience with the Flex Credit Card.

Redeeming Your Rewards

Redeeming your rewards with Flex is simple and straightforward. Follow these steps to enjoy your earned rewards:

- Log into your Flex account on the official website.

- Navigate to the ‘Rewards’ section.

- Select the rewards you want to redeem.

- Confirm your selection and enjoy your rewards.

Flex offers various redemption options, including statement credits, gift cards, and travel bookings. Choose the one that suits you best and make the most of your rewards.

Low-interest Rates

Flex credit cards offer a standout feature: low-interest rates. This can make a significant difference in how much you pay over time. Let’s delve into how Flex’s low-interest rates compare with standard credit cards and how you can maximize your savings.

Comparison With Standard Credit Cards

Many standard credit cards come with high-interest rates, often between 15% to 25%. In contrast, Flex credit cards offer substantially lower rates. This difference can save you a lot of money, especially if you carry a balance month to month.

Here’s a simple comparison:

| Card Type | Interest Rate |

|---|---|

| Standard Credit Card | 15% – 25% |

| Flex Credit Card | 5% – 10% |

How Low-interest Rates Save You Money

Low-interest rates mean you pay less in interest charges. Here are a few ways this benefits you:

- Lower monthly payments: Less interest means a smaller portion of your payment goes to interest.

- Reduced total cost: Over time, you’ll pay less for items purchased with the card.

- More money for savings: The money saved on interest can be directed towards savings or other expenses.

Best Practices For Maximizing Savings

To make the most out of Flex’s low-interest rates, follow these best practices:

- Pay more than the minimum: This reduces your balance faster and decreases the interest paid over time.

- Use the card for necessary expenses: Avoid unnecessary spending to keep your balance manageable.

- Monitor your spending: Keep track of your expenses to avoid overspending and accumulating debt.

- Set up automatic payments: This ensures you never miss a payment, avoiding late fees and higher interest rates.

By following these tips, you can maximize the benefits of Flex’s low-interest rates and save money effectively.

No Annual Fees

One of the most attractive features of the Flex Credit Card is the absence of annual fees. This means you can enjoy all the benefits of the card without worrying about yearly charges. For many users, this translates to significant savings and more value from their credit card.

Advantages Of No Annual Fees

With the Flex Credit Card, you won’t have to pay any annual fees. This feature offers numerous advantages:

- Cost-effective: Save money each year by avoiding annual charges.

- Accessible: Easier to maintain, especially for those new to credit cards.

- Flexible: More freedom to use the card without worrying about extra costs.

Cost Savings Over Time

Not having to pay annual fees can lead to significant cost savings over time. Here’s a breakdown of potential savings:

| Years | Savings |

|---|---|

| 1 Year | $50 – $100 |

| 5 Years | $250 – $500 |

| 10 Years | $500 – $1000 |

Over a decade, you could save hundreds of dollars. This money can be redirected to other expenses or savings.

Who Benefits The Most

Several groups of people benefit from credit cards with no annual fees:

- New Users: Those new to credit cards find it easier to manage without extra costs.

- Budget-Conscious Individuals: People looking to save money appreciate the absence of annual fees.

- Occasional Users: Those who use their card sporadically benefit from not having to justify a yearly fee.

The Flex Credit Card is designed for these users, offering value without the burden of extra charges.

Advanced Security Features

With the Flex Credit Card, your security is our top priority. We have integrated advanced security features to ensure your transactions are safe and secure. Read on to learn about these features and how they protect you.

Real-time Fraud Alerts

The Flex Credit Card offers real-time fraud alerts to keep you informed. Whenever there is suspicious activity on your account, you will get an instant notification. This helps you take immediate action to prevent any unauthorized transactions.

Benefits of real-time fraud alerts:

- Immediate notifications

- Quick response to suspicious activities

- Enhanced account protection

Secure Online Transactions

Online shopping with the Flex Credit Card is safer than ever. Our card uses advanced encryption technology to secure your data. This ensures that your personal and financial information remains private and protected.

Key features of secure online transactions:

- Advanced encryption

- Protection against data breaches

- Safe and private online shopping

How To Activate Security Features

Activating the security features on your Flex Credit Card is easy. Follow these simple steps:

- Log in to your Flex account.

- Go to the settings menu.

- Select the security options.

- Enable real-time fraud alerts and other security features.

By following these steps, you can ensure that your Flex Credit Card is fully protected.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of the Flex Credit Card is crucial. This section will help you make an informed decision about its financial benefits. Let’s break down the costs and compare them with other options in the market.

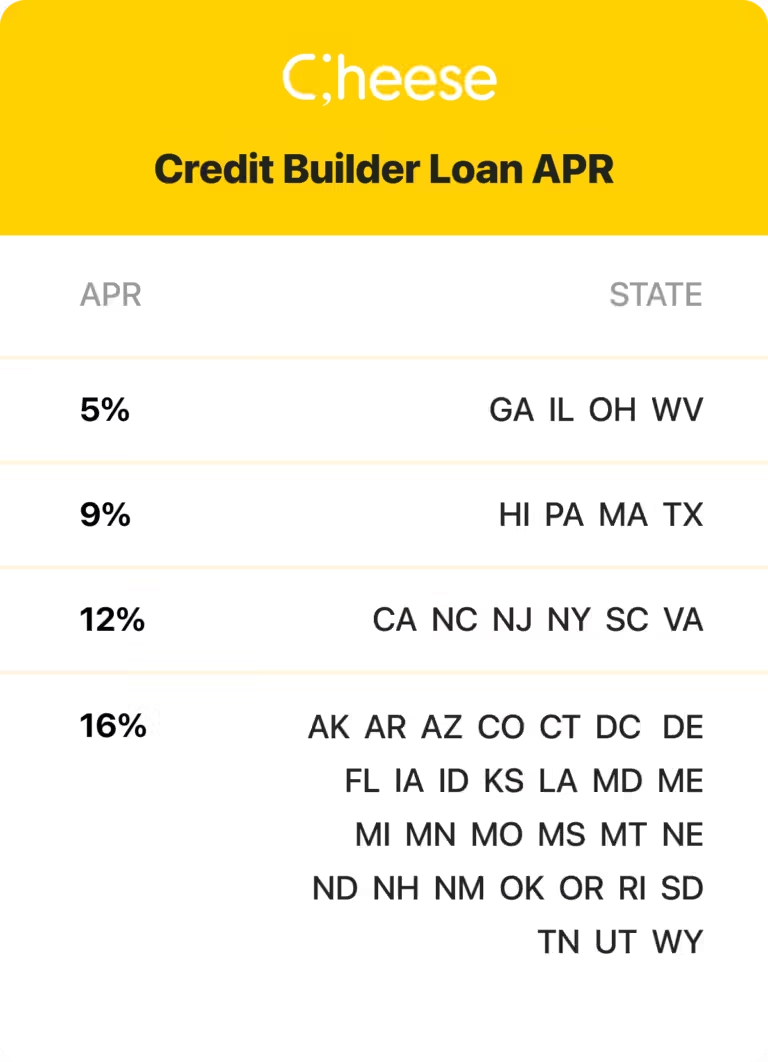

Interest Rates And Fees

The interest rates and fees are critical to consider. Here is a detailed breakdown of the Flex Credit Card’s costs:

| Feature | Cost |

|---|---|

| Annual Percentage Rate (APR) | Variable, based on creditworthiness |

| Annual Fee | No annual fee |

| Late Payment Fee | $35 |

| Foreign Transaction Fee | 3% of the transaction amount |

Comparison With Competitors

It’s essential to compare the Flex Credit Card with other business credit cards. This helps identify its unique advantages.

- Flex Credit Card: No annual fee, variable APR, $35 late payment fee, 3% foreign transaction fee.

- Card X: $95 annual fee, fixed APR, $39 late payment fee, no foreign transaction fee.

- Card Y: No annual fee, variable APR, $40 late payment fee, 2% foreign transaction fee.

Value For Money

The Flex Credit Card offers great value for businesses. With no annual fee and competitive interest rates, it stands out. The low fees can save your business money over time.

Here are some key points:

- No annual fee means immediate savings.

- Competitive APR based on your creditworthiness.

- Reasonable late payment and foreign transaction fees.

Overall, the Flex Credit Card provides excellent affordability and value for money. It is a smart choice for businesses looking to manage expenses effectively.

Pros And Cons Of Flex Credit Card

The Flex Credit Card offers various features and benefits, but it’s essential to understand its advantages and potential drawbacks. This section provides a detailed look at the pros and cons of using the Flex Credit Card.

Pros Of Using Flex Credit Card

- Flexible Spending Limits: Adjust your spending limits based on your needs.

- Rewards Program: Earn points for every purchase made with the card.

- Low Interest Rates: Enjoy competitive interest rates on outstanding balances.

- Easy Application Process: Quick and straightforward application process.

- Enhanced Security: Advanced security features to protect your transactions.

Cons And Potential Drawbacks

- Annual Fees: Some users may find the annual fees high.

- Limited Acceptance: Not all merchants may accept the Flex Credit Card.

- Foreign Transaction Fees: Additional fees for international purchases.

- Credit Score Impact: Late payments can negatively affect your credit score.

- Complex Rewards Redemption: The rewards program might be challenging to understand.

User Testimonials And Reviews

Here are a few testimonials from users of the Flex Credit Card:

John D.: “The Flex Credit Card has helped me manage my expenses better. The rewards program is a nice bonus.”

Sarah L.: “I appreciate the low interest rates, but the annual fees are a bit steep.”

Michael T.: “The security features give me peace of mind, but I wish more stores accepted it.”

Ideal Users And Scenarios

The Flex Credit Card offers unique benefits for different types of users and situations. Understanding who should use it and the best scenarios for its use can help you maximize its potential.

Who Should Use Flex Credit Card?

The Flex Credit Card is perfect for business owners and frequent travelers. This card offers benefits that align with their needs. Here are some ideal users:

- Small Business Owners: Flex Credit Card can help manage expenses efficiently.

- Frequent Travelers: It offers rewards and benefits suited for travel.

- Online Shoppers: This card provides security and rewards for online purchases.

Best Situations To Utilize Flex Credit Card

The Flex Credit Card shines in specific scenarios. Here are the best situations to use it:

- Business Expenses: Track and manage business-related expenses easily.

- Travel Bookings: Earn rewards on flights, hotels, and car rentals.

- Online Shopping: Enjoy security features and earn points for every purchase.

Final Recommendations

To make the most of the Flex Credit Card, consider the following tips:

- Use it for business expenses to keep track of spending.

- Take advantage of travel rewards by booking flights and hotels.

- Shop online with the card to earn extra points.

By understanding the ideal users and scenarios, you can get the most out of the Flex Credit Card.

Frequently Asked Questions

What Is The Flex Credit Card?

The Flex Credit Card is a versatile financial tool offering flexible spending limits, rewards, and exclusive benefits.

How Does Flex Credit Card Rewards Work?

Flex Credit Card rewards you for every purchase with cashback, points, or travel miles, redeemable through their portal.

Are There Annual Fees For Flex Credit Card?

The Flex Credit Card typically has no annual fees, making it cost-effective for users.

Can I Manage Flex Credit Card Online?

Yes, you can easily manage your Flex Credit Card through the online portal or mobile app.

Conclusion

Exploring the Flex Credit Card offers valuable insights. Its features cater to various business needs. Flex provides flexibility and convenience for financial transactions. Consider the benefits it might bring to your business. For more detailed information, visit the official Flex Credit Card page by clicking here. Make an informed decision to enhance your business financial management.