Firstbase Credit Solutions: Boost Your Credit Score Today

Starting a business can be tough. Firstbase Credit Solutions aims to simplify this process.

Firstbase One is your all-in-one startup solution. It helps with incorporation, compliance, bookkeeping, and taxes. This platform is designed for entrepreneurs who want to manage their businesses efficiently. It automates many tasks, saving you time and effort. You get a virtual mailbox, registered agent services, and full-service bookkeeping. Plus, it helps with tax filing and payroll registration. Firstbase also offers global support and access to many perks. Entrepreneurs worldwide can benefit from its services. For more details, visit Firstbase. Discover how it can help you grow and manage your business effectively.

Introduction To Firstbase Credit Solutions

Welcome to Firstbase Credit Solutions, where simplifying business credit processes is our top priority. Our comprehensive solutions are tailored for startups and entrepreneurs, ensuring smooth and efficient management of business financials. Discover how we can help you take control of your company’s credit needs.

Overview Of The Company

Firstbase Credit Solutions, known for its all-in-one startup operating system, Firstbase One, assists in various business operations. This includes incorporation, compliance, bookkeeping, and taxes. We have supported over 30,000 companies across 191 countries, enabling them to raise $3 billion in funding. Our goal is to make business processes simple and accessible for everyone.

Purpose And Mission Of The Service

Our mission is to democratize access to business tools, ensuring that all entrepreneurs, regardless of location, can start and manage their businesses effectively. We provide a range of services aimed at reducing manual effort and increasing accuracy through automation. Our platform includes features such as:

- Incorporation: Automates the formation of LLCs or C-Corps.

- Mailroom: Provides a physical US address and virtual mailbox.

- Agent: Ensures compliance with registered agent services.

- Accounting: Offers full-service bookkeeping and financial reporting.

- Tax Filing: Facilitates easy filing of state and federal taxes.

- Payroll Tax Registration: Supports hiring with payroll registrations.

Our purpose is to provide an all-in-one platform that combines multiple business tools, saving time and reducing the need for separate services. We also offer global support, assisting founders in 188 countries.

With Firstbase Credit Solutions, you gain access to $350,000 in perks from partners and integrations, including banking, payment processing, and equity management. We strive to provide the best support and resources to help your business thrive.

Key Features Of Firstbase Credit Solutions

Firstbase Credit Solutions offers a wide range of features to help individuals and businesses manage and improve their credit. Here are some of the key features that make Firstbase Credit Solutions stand out:

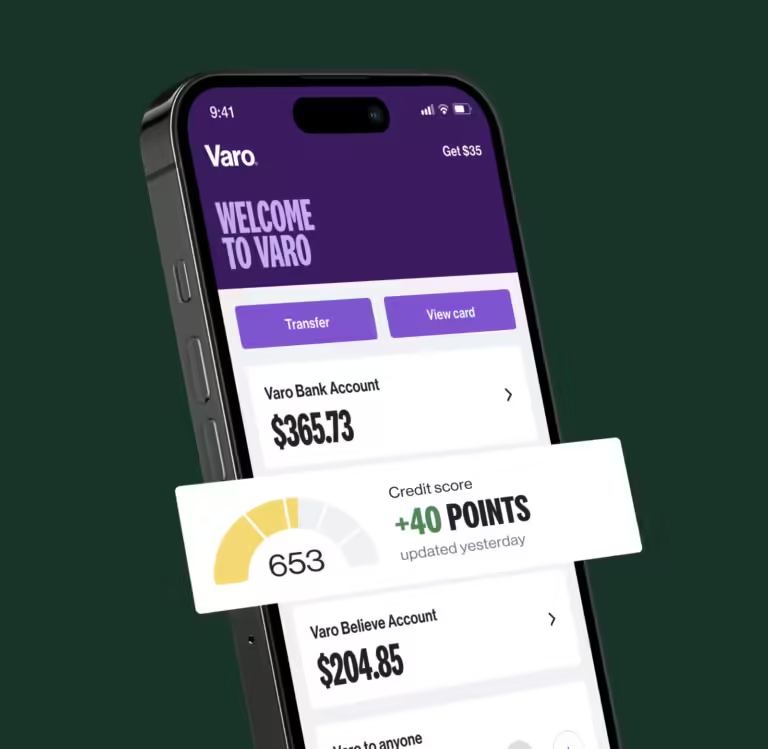

Credit Score Monitoring

Firstbase Credit Solutions provides real-time credit score monitoring. Users can track their credit score daily and receive alerts for any changes. This helps in staying on top of credit health and making informed financial decisions.

Personalized Credit Improvement Plans

Each user gets a customized credit improvement plan. These plans are tailored to the user’s unique credit profile, offering actionable steps to improve their credit score. The personalized approach ensures targeted and effective credit improvement.

Access To Credit Education Resources

Firstbase Credit Solutions offers extensive credit education resources. Users have access to tutorials, articles, and guides that cover a wide range of credit-related topics. This empowers users with the knowledge they need to manage their credit effectively.

Dispute Resolution Assistance

Users can benefit from dispute resolution assistance. Firstbase Credit Solutions helps users identify inaccuracies in their credit reports and provides support in disputing these errors. This service is crucial for maintaining accurate credit records.

Credit Report Analysis

Firstbase Credit Solutions offers detailed credit report analysis. This feature breaks down the user’s credit report, highlighting key areas that need attention. The analysis is easy to understand and provides valuable insights into the user’s credit status.

How Each Feature Benefits You

Firstbase Credit Solutions offers a range of features designed to help you manage and improve your credit. Understanding how each feature benefits you is crucial for making informed decisions about your financial health.

Enhanced Credit Score Monitoring For Proactive Management

With enhanced credit score monitoring, you can stay on top of your credit score. This feature provides real-time alerts about any changes to your credit report. It helps you detect any suspicious activities early. This proactive approach allows you to address potential issues before they become significant problems.

Tailored Credit Improvement Plans For Individual Needs

Firstbase Credit Solutions creates personalized credit improvement plans. These plans are designed to meet your specific financial situation. By analyzing your credit history, the service provides targeted recommendations. This tailored approach ensures that you are taking the most effective steps to improve your credit score.

Comprehensive Credit Education For Informed Decisions

Comprehensive credit education is a vital feature. It empowers you with the knowledge to make informed financial decisions. Firstbase Credit Solutions offers a wealth of educational resources. These include articles, tutorials, and expert advice. This helps you understand the factors that affect your credit score and how to manage your credit responsibly.

Effective Dispute Resolution For Accurate Credit Reports

Errors on your credit report can negatively impact your credit score. Firstbase Credit Solutions provides effective dispute resolution services. This feature helps you identify and correct inaccuracies on your credit report. By ensuring your report is accurate, you can maintain a healthy credit profile.

In-depth Credit Report Analysis For Better Financial Understanding

In-depth credit report analysis is another valuable feature. It gives you a detailed breakdown of your credit report. This analysis helps you understand the various factors affecting your credit score. With this knowledge, you can make better financial decisions and work towards achieving your credit goals.

| Feature | Benefit |

|---|---|

| Enhanced credit score monitoring | Proactive management of your credit score with real-time alerts |

| Tailored credit improvement plans | Personalized recommendations based on your financial situation |

| Comprehensive credit education | Empowers you with knowledge to make informed financial decisions |

| Effective dispute resolution | Corrects inaccuracies on your credit report to maintain a healthy profile |

| In-depth credit report analysis | Detailed breakdown of your credit report for better financial understanding |

Pricing And Affordability

Understanding the pricing structure of Firstbase One is key to determining its value. This section will dive into the different pricing tiers, analyze the cost-benefit, and assess affordability for various budget levels.

Overview Of Pricing Tiers

Firstbase One offers a comprehensive package that includes all its features, aimed at simplifying business operations. The package is designed to save users $1,950 compared to using multiple services separately. Specific pricing details are not provided, but the value proposition is clear from the features and benefits included.

Cost-benefit Analysis

The cost-benefit analysis of Firstbase One highlights significant savings and efficiency gains. Here are some key points:

- All-in-One Platform: Combines multiple business tools into a single platform.

- Automation: Reduces manual effort and speeds up processes.

- Global Support: Accessible to founders in 188 countries.

- Rewards and Perks: Access to $350,000 in perks from partners.

- Banking and Payments: Quick approval for US bank accounts and no Stripe fee for first $20,000.

- Equity Management: Easy captable creation and free 83(B) filings.

These features provide a high return on investment, especially for startups looking to streamline their operations.

Affordability For Different Budget Levels

Firstbase One’s pricing is designed to be affordable for various budget levels. Here’s a breakdown:

| Budget Level | Affordability |

|---|---|

| Low Budget | Significant savings by consolidating services into one package. |

| Medium Budget | Enhanced value with access to extensive perks and support. |

| High Budget | Comprehensive features that support growth and scalability. |

Firstbase One caters to startups of all sizes, ensuring they can efficiently manage incorporation, compliance, bookkeeping, and taxes.

Pros And Cons Of Firstbase Credit Solutions

Firstbase Credit Solutions provides a robust platform for startups. Understanding the pros and cons can help you decide if it suits your business needs. Below, we delve into the advantages and limitations based on user feedback.

Advantages Based On User Feedback

- All-in-One Platform: Users appreciate the combination of multiple tools into one platform, saving time and reducing the need for separate services.

- Automation: The automation of services like incorporation and tax filing is faster and more accurate, minimizing manual effort.

- Global Support: The platform offers support to founders in 188 countries, making it accessible and helpful regardless of location.

- Rewards and Perks: Users benefit from access to $350,000 in perks from various partners, which includes banking, payment processing, and legal credits.

- Banking and Payments: Quick approval for US bank accounts and no Stripe processing fee for the first $20,000 in transactions are significant advantages.

- Equity Management: Easy creation of a captable in Carta and free 83(B) filings streamline the equity management process.

Limitations And Potential Drawbacks

- Pricing Details: Specific pricing details are not provided, which can make it difficult for potential users to assess the cost upfront.

- Refund Policies: There are no specific refund or return policies mentioned, which might be a concern for some users.

- Complexity for Small Businesses: The wide range of features might be overwhelming for very small businesses or solo entrepreneurs.

- Dependence on Platform: Relying entirely on Firstbase for multiple business functions might create dependency, making it difficult to switch services.

Ideal Users And Scenarios

Firstbase One is a comprehensive solution designed for entrepreneurs who seek to streamline their business operations. It offers a wide range of features that cater to various needs, making it an ideal choice for many users and situations.

Who Would Benefit The Most?

Firstbase One is perfect for startups and small businesses that need to manage multiple aspects of their operations efficiently. Here are some specific groups that would benefit the most:

- Entrepreneurs looking to incorporate their business quickly and without hassle.

- Founders who need compliance support across different states.

- Businesses that require full-service bookkeeping and tax filing.

- Startups seeking global support in over 188 countries.

- Companies needing a premium US address and virtual mailbox.

Best Scenarios For Using Firstbase Credit Solutions

There are several scenarios where Firstbase One can be particularly beneficial:

| Scenario | Benefits |

|---|---|

| Incorporation | Automates the formation of LLCs or C-Corps, eliminating paperwork and legal complexities. |

| Mailroom | Provides a premium, physical US address and virtual mailbox to manage all business mail. |

| Compliance | Ensures compliance with registered agent services, franchise tax, and annual report filings. |

| Accounting | Offers full-service accrual bookkeeping, tax-ready financials, and investor-ready reports. |

| Tax Filing | Facilitates easy filing of state and federal taxes for LLCs and C-Corps. |

| Payroll | Supports hiring in all 50 states with state and city-level payroll registrations. |

These scenarios demonstrate the versatility and comprehensive nature of Firstbase One, making it an invaluable resource for businesses at various stages of growth.

Frequently Asked Questions

What Is Firstbase Credit Solutions?

Firstbase Credit Solutions is a financial service company. They specialize in credit repair and improvement. They help clients enhance their credit scores.

How Does Firstbase Credit Solutions Work?

Firstbase Credit Solutions analyzes your credit report. They identify negative items affecting your score. They then dispute these items with credit bureaus.

Is Firstbase Credit Solutions Legit?

Yes, Firstbase Credit Solutions is a legitimate company. They have a proven track record. Their clients have successfully improved their credit scores.

How Long Does Credit Repair Take?

Credit repair with Firstbase Credit Solutions varies. It typically takes a few months. The exact time depends on your specific situation.

Conclusion

Firstbase simplifies business management with its all-in-one platform. Entrepreneurs can easily incorporate, comply, and handle taxes. The benefits are clear: automation, global support, and valuable perks. This tool saves time and reduces hassle. Discover how Firstbase One can assist your startup here.