Financial Wellness Programs: Boosting Employee Productivity & Health

Financial wellness programs are essential for achieving financial stability and peace of mind. They offer various tools and resources to help individuals manage their finances effectively.

In today’s fast-paced world, managing personal finances can be challenging. Many people struggle with budgeting, saving, and understanding credit scores. Financial wellness programs aim to address these issues. They provide education, support, and tools to help individuals improve their financial health. These programs often include personalized advice, credit monitoring, and access to financial products tailored to individual needs. By participating in financial wellness programs, individuals can make informed decisions, reduce financial stress, and work towards long-term financial goals. Understanding and utilizing these programs can lead to a healthier financial future for you and your family. For instance, Credit Sesame is a reliable service in this niche. It offers free daily credit score updates, personalized credit advice, and other useful tools. You can check it out here.

Introduction To Financial Wellness Programs

Financial wellness programs have gained popularity in recent years. They help individuals manage their finances better. Companies are now offering these programs to their employees. This initiative benefits both the employer and the workforce.

What Are Financial Wellness Programs?

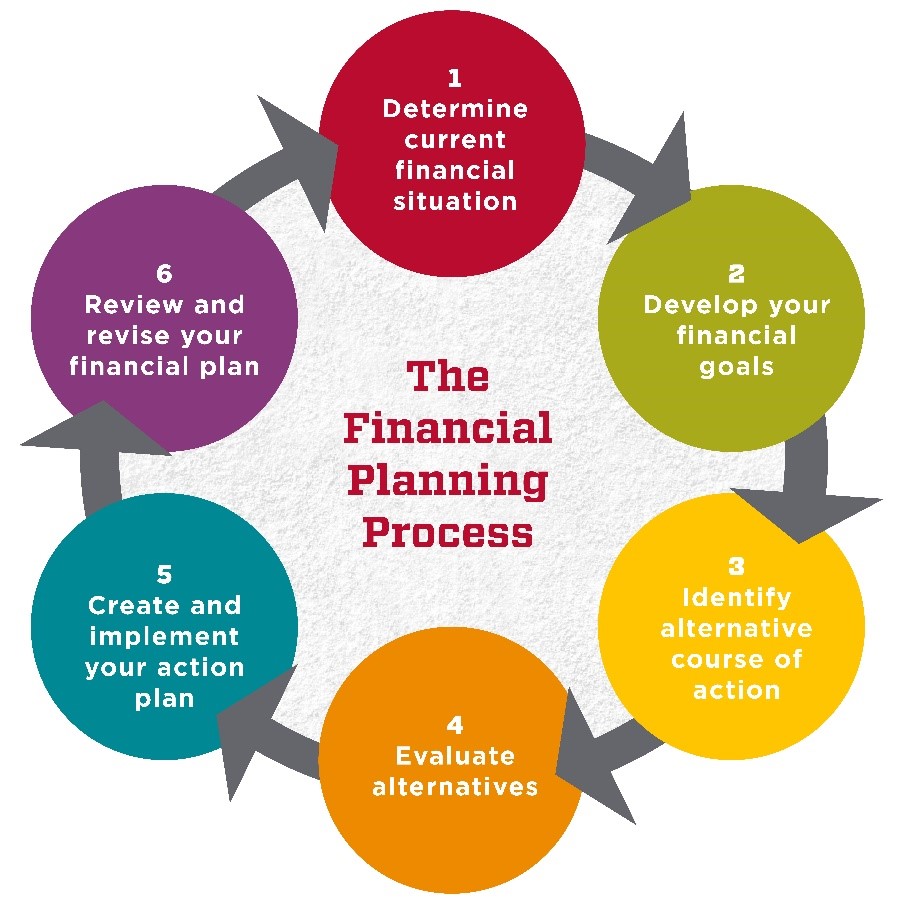

Financial wellness programs provide education and tools to improve financial health. These programs include budgeting advice, debt management, and investment planning. The goal is to empower individuals with the knowledge to make informed financial decisions.

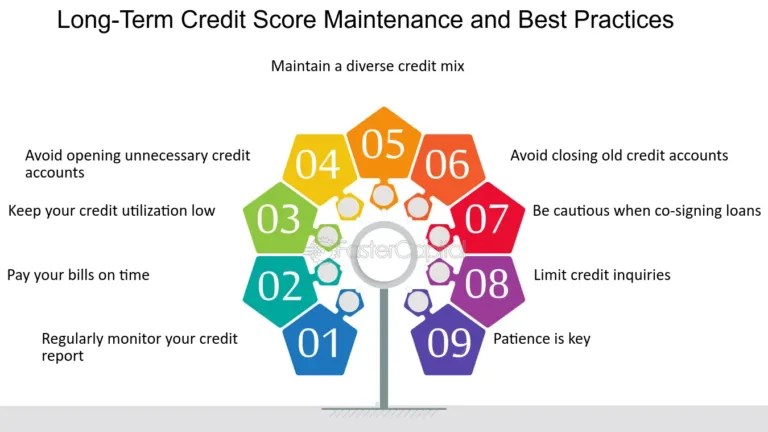

Programs like Credit Sesame offer daily credit score updates and personalized credit advice. They help users manage and improve their credit scores. Features include:

- Daily Credit Score Updates: Check your credit score daily.

- Credit Report Summary: View a summary of your credit report.

- Sesame Grade: Get a letter grade based on five major factors impacting your credit score.

- Personalized Actions: Receive tailored advice to improve your credit score.

- Credit Offers: Find the best credit offers with high approval odds based on your credit profile.

- Credit Builder Program: Build credit using everyday purchases with a Sesame Cash account.

The Growing Importance Of Financial Wellness In The Workplace

Financial stress affects employee productivity and health. Employers recognize this impact. They are now providing financial wellness programs to help their staff. These programs offer benefits such as:

- Reduced Stress: Financial stability leads to lower stress levels.

- Increased Productivity: Less financial worry means better focus at work.

- Higher Job Satisfaction: Employees value support in managing their finances.

Employers find that financial wellness programs improve overall workplace morale. They are investing in tools like Credit Sesame to support their employees’ financial health. This investment results in a healthier, happier, and more productive workforce.

Key Features Of Effective Financial Wellness Programs

Financial wellness programs are designed to help individuals achieve financial stability and security. Effective programs offer various features that address different aspects of financial health. Below are some key features of successful financial wellness programs:

Personalized Financial Coaching

Personalized financial coaching is a cornerstone of effective financial wellness programs. Coaches work with individuals to create customized plans based on their unique financial situations. This one-on-one guidance helps participants set realistic goals and develop strategies to achieve them. Regular check-ins ensure progress and adjustments as needed.

Educational Workshops And Seminars

Educational workshops and seminars provide valuable information on various financial topics. These sessions cover budgeting, saving, investing, and credit management. Interactive and engaging, they help participants gain practical knowledge and skills. Workshops often include Q&A sessions, ensuring participants can address specific concerns.

Access To Financial Tools And Resources

Access to financial tools and resources is essential for managing personal finances effectively. Tools like budget calculators, financial planning software, and credit monitoring services empower individuals to make informed decisions. Resources may also include access to articles, guides, and webinars on financial topics.

Debt Management Solutions

Debt management solutions are critical for those struggling with debt. Programs offer strategies to reduce and manage debt, such as consolidation and negotiation with creditors. Participants receive support to create a debt repayment plan tailored to their financial situation. Ongoing guidance helps them stay on track to becoming debt-free.

Retirement Planning Assistance

Retirement planning assistance helps individuals prepare for their future financial needs. Programs offer advice on saving for retirement, understanding retirement accounts, and making investment choices. Personalized plans ensure participants can achieve their retirement goals. Regular reviews and updates keep their retirement strategy aligned with their evolving financial situation.

Benefits Of Financial Wellness Programs For Employees

Financial wellness programs offer many advantages for employees. These programs help in managing finances, reducing stress, and improving overall well-being. Let’s delve into the benefits that these programs provide.

Reduced Financial Stress

Financial stress is a common issue among employees. High levels of debt, poor financial planning, and unexpected expenses can lead to significant stress. Financial wellness programs help employees manage these stressors by offering tools and resources.

For example, services like Credit Sesame provide daily credit score updates and personalized credit advice. By monitoring their credit score, employees can take proactive steps to improve their financial health.

Improved Mental Health

Reduced financial stress leads to better mental health. When employees are not worried about their finances, they experience less anxiety and depression. This improvement in mental health translates to higher productivity and morale at work.

Credit Sesame’s personalized actions and advice can guide employees to make better financial decisions. This guidance helps reduce financial anxiety, leading to improved mental health.

Enhanced Job Satisfaction And Engagement

Financial wellness programs contribute to increased job satisfaction and engagement. When employees feel supported in managing their finances, they are more likely to be engaged and satisfied with their jobs.

Tools like Credit Sesame’s credit builder program can be a part of these wellness programs. By using everyday purchases to build credit, employees feel more secure and valued by their employers.

Better Financial Literacy And Decision-making

Financial literacy is crucial for making informed decisions. Financial wellness programs educate employees on managing credit, saving, and investing. This education empowers them to make better financial choices.

Credit Sesame offers comprehensive credit management and personalized recommendations. These resources help employees understand their credit profile and improve their financial literacy.

Overall, financial wellness programs, supported by tools like Credit Sesame, provide significant benefits for employees. They reduce financial stress, improve mental health, enhance job satisfaction, and boost financial literacy.

Benefits Of Financial Wellness Programs For Employers

Implementing financial wellness programs can provide numerous advantages for employers. These programs not only enhance employee well-being but also contribute significantly to the overall success of the organization. Below are some key benefits of financial wellness programs for employers:

Increased Employee Productivity

Financial stress can severely impact an employee’s ability to focus and perform at their best. By offering financial wellness programs, employers can help employees manage their finances more effectively. This leads to reduced stress and increased employee productivity. Employees can focus better on their work, resulting in higher output and improved performance.

Lower Absenteeism And Turnover Rates

High levels of financial stress can lead to increased absenteeism and higher turnover rates. Financial wellness programs provide employees with the tools and resources they need to manage their financial challenges. This results in lower absenteeism and reduced turnover rates. Employees feel more secure and valued, leading to higher job satisfaction and loyalty.

Enhanced Company Reputation

Companies that offer financial wellness programs are often seen as caring and supportive employers. This enhances the company’s reputation, making it more attractive to potential employees. A strong reputation can also improve relationships with clients and partners, contributing to overall business success.

Cost Savings On Healthcare

Financial stress can contribute to health problems, leading to increased healthcare costs for employers. By helping employees manage their finances, employers can reduce the impact of financial stress on health. This can lead to significant cost savings on healthcare expenses. Healthy employees are more productive and engaged, further benefiting the organization.

Overall, financial wellness programs offer a win-win solution for both employers and employees. They enhance employee well-being and contribute to the organization’s success.

Pricing And Affordability Of Financial Wellness Programs

Understanding the pricing and affordability of financial wellness programs is crucial for employers. These programs can offer significant benefits, but cost remains a key consideration. This section breaks down the cost structures, potential ROI, and available discounts.

Cost Structures: Subscription Vs. One-time Fees

Financial wellness programs typically offer two main cost structures:

| Cost Structure | Details |

|---|---|

| Subscription | Recurring monthly or annual fees. Includes ongoing access to features and updates. |

| One-Time Fees | A single payment for lifetime access. Best for programs that do not require continuous updates. |

Roi And Long-term Financial Benefits For Employers

Investing in financial wellness programs can offer a significant Return on Investment (ROI) for employers. Here are some long-term benefits:

- Reduced Employee Stress: Financial stability leads to less stress and higher productivity.

- Lower Absenteeism: Employees facing fewer financial worries are less likely to miss work.

- Higher Retention Rates: Employees value employer-provided financial support, increasing loyalty.

Employers can see substantial financial benefits from supporting their employees’ financial health.

Available Discounts And Incentives

Many providers offer discounts and incentives to make financial wellness programs more affordable:

- Bulk Discounts: Reduced rates for companies enrolling large groups of employees.

- Seasonal Promotions: Special pricing during certain times of the year.

- Referral Programs: Discounts for referring new clients to the provider.

- Activity-Based Waivers: Fees waived when employees meet specific activity requirements.

These discounts and incentives can significantly reduce overall costs, making financial wellness programs more accessible to all employers.

Pros And Cons Of Implementing Financial Wellness Programs

Implementing Financial Wellness Programs can significantly impact employees’ financial health and overall well-being. These programs offer various benefits and challenges that organizations must carefully weigh.

Pros: Comprehensive Support For Employees

- Improved Financial Literacy: Employees gain essential knowledge to manage their finances better.

- Reduced Stress: Financial stability leads to lower stress levels and higher productivity.

- Increased Job Satisfaction: Access to financial wellness programs can boost morale and loyalty.

One key advantage is the comprehensive support provided. Programs like Credit Sesame offer tools to monitor credit scores, provide personalized advice, and help manage and improve financial health.

Cons: Initial Setup Costs And Resources Required

Financial wellness programs require significant initial investment. Costs can include:

| Expense Type | Details |

|---|---|

| Program Development | Creating and customizing the wellness program. |

| Training | Educating staff to effectively deliver the program. |

| Technology | Implementing necessary software and tools. |

These costs can be substantial, but the long-term benefits, such as increased productivity and reduced employee turnover, often justify the investment.

Balancing Privacy And Personalized Support

Providing personalized support while maintaining employee privacy can be challenging. Programs like Credit Sesame offer:

- Secure Data Protection: Using 256-bit encryption to protect personal information.

- Personalized Recommendations: Tailored advice without compromising privacy.

Balancing these aspects ensures employees feel comfortable using the services, leading to better engagement and outcomes.

Ideal Scenarios For Implementing Financial Wellness Programs

Financial wellness programs can offer significant benefits to both employees and employers. Implementing these programs can improve productivity, reduce stress, and increase overall job satisfaction. Below are some ideal scenarios for introducing financial wellness programs.

Best Fit For Large Corporations Vs. Small Businesses

Large corporations often have the resources to provide comprehensive financial wellness programs. They can offer a range of services including personalized financial advice, retirement planning, and debt management.

Small businesses, on the other hand, may have limited resources but can still benefit from implementing basic financial wellness programs. Simple initiatives like providing access to financial education materials or partnering with services like Credit Sesame can be very effective.

| Company Size | Potential Initiatives |

|---|---|

| Large Corporations |

|

| Small Businesses |

|

Targeting High-stress Industries

Industries like healthcare, finance, and tech often have high-stress environments. Employees in these fields may benefit greatly from financial wellness programs. Stress can impact productivity and job satisfaction, making these programs crucial.

Offering services such as daily credit score updates and personalized credit advice through platforms like Credit Sesame can help employees manage financial stress.

Supporting Diverse Workforce Needs

A diverse workforce has varied financial needs. Tailored financial wellness programs can address these unique requirements. For example, younger employees might need help with student loans and first-time credit cards. Older employees might focus on retirement planning and debt reduction.

Programs can include:

- Personalized credit advice

- Access to tailored financial products

- Educational content on financial management

Services like Credit Sesame offer personalized recommendations and tools to improve credit scores, making them a valuable resource for diverse financial needs.

Conclusion: The Future Of Financial Wellness Programs

The landscape of financial wellness programs is rapidly changing. Employers understand the importance of supporting their employees’ financial well-being. With advancements in technology and a greater focus on holistic wellness, financial wellness programs are set to evolve significantly.

Evolving Trends And Innovations

One of the main trends in financial wellness programs is the use of personalized digital tools. Platforms like Credit Sesame offer daily credit score updates, credit report summaries, and personalized credit advice. These tools help employees manage their finances more effectively.

Another innovation is the integration of financial education into wellness programs. Employers provide resources such as tips and guides on using credit, building credit, and understanding credit scores. This comprehensive approach ensures employees are well-informed and capable of making sound financial decisions.

Additionally, the rise of AI and machine learning allows for more tailored financial advice. This technology assesses individual financial situations and provides personalized recommendations to improve credit scores and financial health.

Long-term Impact On Workplace Culture And Employee Well-being

Implementing financial wellness programs has a profound impact on workplace culture. Employees feel valued and supported, leading to increased job satisfaction and loyalty. These programs contribute to a positive work environment.

The long-term benefits of financial wellness programs extend to employee well-being. Financial stress is a significant concern for many workers. By providing tools and resources to manage finances, employers help reduce this stress. This leads to improved mental health and overall well-being.

Moreover, financial wellness programs can lead to better productivity. When employees are not worried about their finances, they can focus more on their work. This results in higher efficiency and better performance.

In conclusion, the future of financial wellness programs looks promising. With evolving trends and innovations, these programs will continue to enhance workplace culture and employee well-being. Employers who invest in these programs will see significant benefits for both their employees and their organization.

Frequently Asked Questions

What Are Financial Wellness Programs?

Financial wellness programs are initiatives designed to help individuals manage their finances effectively. They provide tools and resources for budgeting, saving, and investing. These programs aim to reduce financial stress and improve overall well-being.

Why Are Financial Wellness Programs Important?

Financial wellness programs are important because they help individuals make informed financial decisions. They reduce financial stress, increase savings, and improve overall financial health. These programs also support employees, leading to higher productivity and satisfaction.

How Do Financial Wellness Programs Work?

Financial wellness programs work by offering education, tools, and resources. They may include workshops, online resources, and personalized coaching. These programs help individuals understand their finances and develop effective strategies for managing money.

Who Can Benefit From Financial Wellness Programs?

Everyone can benefit from financial wellness programs. Employees, students, and retirees can all improve their financial health. These programs provide valuable knowledge and resources for managing money effectively.

Conclusion

Financial wellness programs offer valuable support for managing personal finances. They provide tools and resources to help you improve your financial health. For those looking to enhance their credit score, Credit Sesame is a great resource. It offers free credit score updates and personalized advice. Secure, user-friendly, and without needing a credit card, it’s a helpful tool. Remember, a strong financial foundation leads to a stress-free life. Invest time in financial wellness programs today. Your future self will thank you.