Financial Wellness: Achieve Stability and Peace of Mind

Financial wellness is key to a balanced, stress-free life. It means managing your money in a way that supports your well-being.

Understanding financial wellness involves more than just budgeting and saving. It’s about having a clear plan for the future, reducing financial stress, and making smart financial choices. Whether it’s managing debt, planning for retirement, or investing wisely, financial wellness can greatly impact your life. Tools like Upstart Personal Loans can offer support by providing access to resources and secure platforms for better financial management. Explore how you can achieve financial wellness and take control of your financial future with smart planning and the right tools. To learn more about personal loans and financial planning, visit Upstart Personal Loans.

Introduction To Financial Wellness

Financial wellness is the state of having a healthy financial life. It encompasses managing your money, planning for the future, and being prepared for unexpected expenses. This blog post will delve into the key aspects of financial wellness and why it is crucial in today’s world.

Defining Financial Wellness

Financial wellness means having control over your day-to-day finances. It is the ability to meet your financial goals and handle any financial setbacks. Financial wellness includes:

- Effective money management

- Debt management

- Long-term planning

- Savings and investments

Being financially well does not mean being rich. It means being able to live comfortably, without constant financial stress.

The Importance Of Financial Wellness In Modern Life

In today’s fast-paced world, financial wellness has become essential. The modern lifestyle demands a strong financial foundation. Here are some reasons why:

| Reason | Explanation |

|---|---|

| Stress Reduction | Managing finances well reduces stress and improves mental health. |

| Future Security | Proper planning ensures a secure future and a comfortable retirement. |

| Emergency Preparedness | Being financially prepared helps handle unexpected expenses effectively. |

| Life Quality | Good financial health improves overall quality of life. |

Financial wellness is a journey, not a destination. It requires ongoing attention and adjustments to maintain a healthy financial life.

Key Components Of Financial Wellness

Understanding financial wellness is essential for a stable and fulfilling life. It encompasses various aspects, such as budgeting, saving, managing debt, and investing. These elements help you achieve financial health and peace of mind. Let’s explore the key components of financial wellness.

Budgeting And Expense Management

Budgeting is the foundation of financial wellness. It involves creating a plan for your income and expenses. This plan helps you track your spending and ensure you live within your means. Effective expense management allows you to allocate funds for necessities, savings, and discretionary spending.

Here are some tips for effective budgeting:

- Track your expenses: Record every purchase to understand your spending habits.

- Create a budget: Allocate your income to various categories, such as housing, groceries, and entertainment.

- Stick to your budget: Avoid unnecessary expenses and adjust your budget as needed.

Savings And Emergency Funds

Having savings and an emergency fund is crucial for financial stability. Savings help you achieve your financial goals, such as buying a house or taking a vacation. An emergency fund provides a financial cushion for unexpected expenses, such as medical bills or car repairs.

Consider the following steps to build your savings and emergency fund:

- Set savings goals: Determine how much you need for your goals and emergency fund.

- Automate savings: Set up automatic transfers to your savings account.

- Review and adjust: Regularly check your progress and adjust your savings plan as needed.

Debt Management

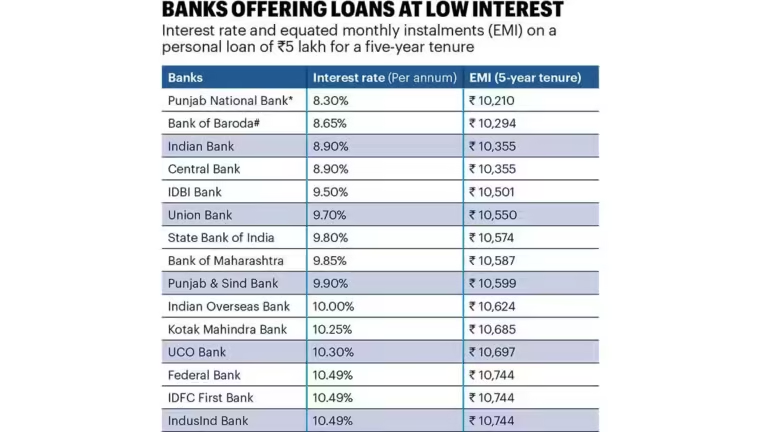

Managing debt is a vital part of financial wellness. High debt levels can cause financial stress and limit your ability to save and invest. Effective debt management involves creating a plan to pay off debt and avoid accumulating new debt.

Here are some strategies for managing debt:

- Create a debt repayment plan: List all your debts and prioritize them based on interest rates.

- Pay more than the minimum: Whenever possible, pay more than the minimum payment to reduce debt faster.

- Avoid new debt: Limit the use of credit cards and avoid taking on new loans.

Investing For The Future

Investing is essential for long-term financial wellness. It allows your money to grow over time and helps you achieve your financial goals, such as retirement. Understanding different investment options and strategies can help you make informed decisions.

Consider the following tips for successful investing:

- Start early: The earlier you start investing, the more time your money has to grow.

- Diversify your investments: Spread your investments across different asset classes to reduce risk.

- Regularly review your portfolio: Keep track of your investments and make adjustments as needed.

Creating A Personalized Financial Plan

Creating a personalized financial plan is essential for achieving financial wellness. It helps you understand your current financial situation, set realistic goals, and develop a strategy to reach those goals. Here’s a step-by-step guide to help you get started.

Assessing Your Current Financial Situation

Before creating a financial plan, assess your current financial situation. This involves taking a close look at your income, expenses, debts, and savings. Here are some steps to follow:

- List all sources of income, including salary, investments, and side gigs.

- Track your monthly expenses, such as rent, utilities, groceries, and entertainment.

- Calculate your total debt, including credit cards, loans, and mortgages.

- Check your savings and investments, including emergency funds and retirement accounts.

Use a simple table to summarize your finances:

| Category | Amount |

|---|---|

| Income | $X,XXX |

| Expenses | $X,XXX |

| Debt | $X,XXX |

| Savings | $X,XXX |

Setting Realistic Financial Goals

Setting realistic financial goals is crucial for your financial plan. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Consider the following types of goals:

- Short-term goals: Save for a vacation or pay off a small debt within a year.

- Medium-term goals: Save for a down payment on a house or start an emergency fund within 3-5 years.

- Long-term goals: Plan for retirement or save for your children’s education within 10-20 years.

Write down your goals and set deadlines for achieving them:

| Goal | Deadline |

|---|---|

| Save $X,XXX for vacation | 12 months |

| Pay off $X,XXX credit card debt | 6 months |

| Save $X,XXX for down payment | 5 years |

Developing A Strategy To Achieve Your Goals

Develop a strategy to achieve your financial goals. This involves creating a budget, reducing expenses, increasing income, and managing debt. Here are some tips:

- Create a budget to track your income and expenses.

- Cut unnecessary expenses, like dining out or subscription services.

- Increase your income through side gigs or asking for a raise.

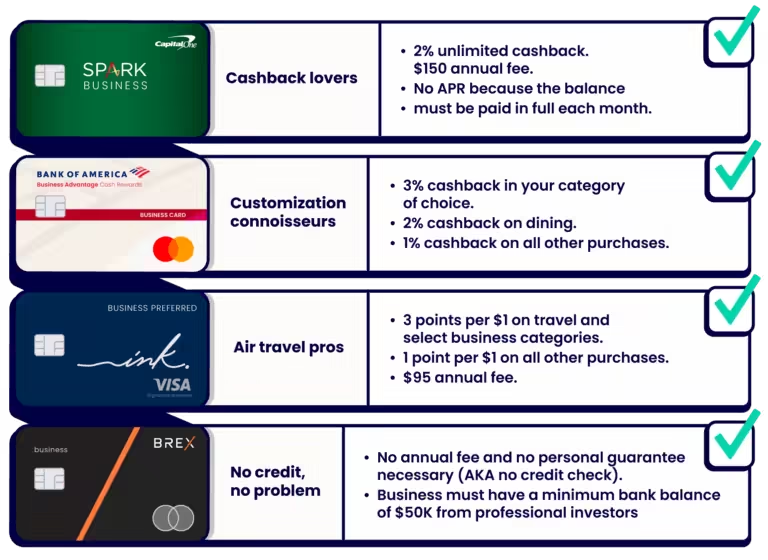

- Use tools like Upstart Personal Loans to consolidate and manage debt effectively.

Regularly review and adjust your strategy to ensure you stay on track with your financial goals.

Tools And Resources For Financial Wellness

Achieving financial wellness requires the right tools and resources. This section explores some essential aids that can help you manage your finances effectively.

Budgeting Apps And Software

Budgeting apps and software are excellent tools to keep track of your finances. They help you monitor income, expenses, and savings. Popular budgeting apps include Mint, YNAB (You Need a Budget), and EveryDollar.

- Mint: Automatically syncs with your bank accounts and categorizes expenses.

- YNAB: Encourages proactive budgeting by assigning every dollar a job.

- EveryDollar: Uses the zero-based budgeting method to help you manage your finances.

These tools provide insights into your spending habits and offer tips for saving money.

Financial Advisors And Planners

Consulting a financial advisor or planner can provide personalized advice. They help create customized financial plans based on your goals. Advisors can assist with:

- Investment strategies

- Retirement planning

- Debt management

Using an advisor ensures you have expert guidance to make informed decisions.

Online Courses And Workshops

Online courses and workshops are valuable for learning about personal finance. They cover topics such as budgeting, investing, and credit management. Platforms like Coursera, Udemy, and edX offer courses from reputable institutions.

- Coursera: Offers courses from universities like Yale and Stanford.

- Udemy: Provides affordable courses on various financial topics.

- edX: Features courses from institutions like MIT and Harvard.

These resources help you gain knowledge and confidence in managing your finances.

For more information on personal loans, visit Upstart Personal Loans.

The Role Of Mindset In Financial Wellness

Financial wellness goes beyond having enough money to cover expenses. It encompasses a healthy relationship with finances, reducing stress related to money, and continually learning about personal finance. A positive mindset plays a crucial role in achieving financial wellness.

Building A Positive Relationship With Money

Creating a healthy financial mindset starts with understanding your relationship with money. Reflect on your financial habits and beliefs. Are you often anxious about spending? Do you avoid looking at your bank statements?

Developing a positive relationship involves:

- Setting realistic financial goals

- Tracking your spending

- Practicing gratitude for what you have

These steps can help you feel more in control and less stressed about your finances.

Overcoming Financial Stress And Anxiety

Financial stress can significantly impact your overall well-being. To overcome this stress, start by identifying the sources of your financial anxiety. Is it debt? Lack of savings? Uncertain income?

Once identified, create a plan to address these issues. This could involve:

- Creating a budget

- Building an emergency fund

- Seeking professional financial advice

Managing these aspects can reduce stress and improve your financial outlook.

The Impact Of Financial Education

Understanding financial concepts is vital for making informed decisions. Financial education empowers you to manage your money effectively. It covers topics such as budgeting, saving, investing, and understanding credit.

Consider these benefits of financial education:

| Benefit | Description |

|---|---|

| Increased Confidence | Knowledge reduces fear and uncertainty. |

| Better Decision-Making | You can make informed financial choices. |

| Long-term Planning | Understanding finances helps with future planning. |

Invest time in learning about personal finance. It will pay off in the long run.

Pros And Cons Of Financial Wellness Practices

Financial wellness practices offer numerous advantages, but they also present certain challenges. Understanding both sides can help you manage your finances better and avoid common pitfalls.

Benefits Of Financial Planning And Management

Effective financial planning and management provide several key benefits:

- Improved Savings: A well-structured financial plan helps you save systematically for future needs.

- Debt Reduction: Managing your finances can reduce debt and improve your credit score.

- Investment Growth: Strategic investment planning can help grow your wealth over time.

- Emergency Fund: Financial planning ensures you have funds set aside for emergencies.

- Retirement Preparedness: Planning helps secure your financial future post-retirement.

Challenges And Common Pitfalls

While there are many benefits, financial wellness practices also come with challenges:

- Complexity: Financial planning can be complex and overwhelming for beginners.

- Discipline: Sticking to a financial plan requires a high level of discipline and consistency.

- Unexpected Expenses: Unplanned expenses can disrupt your financial plan.

- Market Risks: Investments are subject to market risks which can impact returns.

- Information Overload: Too much information can make decision-making difficult.

By understanding these pros and cons, you can better navigate the path to financial wellness.

Recommendations For Achieving Financial Wellness

Achieving financial wellness is a crucial aspect of leading a balanced life. It involves managing your finances efficiently, planning for the future, and ensuring financial stability. Here are some recommendations tailored to different life stages and specific financial situations to help you achieve financial wellness.

Tips For Different Life Stages (students, Working Adults, Retirees)

Students

- Create a budget: Track your income and expenses.

- Limit unnecessary spending: Focus on needs over wants.

- Build an emergency fund: Save a small amount regularly.

- Use student discounts: Take advantage of offers and deals.

Working Adults

- Automate savings: Set up automatic transfers to savings accounts.

- Invest wisely: Diversify your investment portfolio.

- Plan for retirement: Contribute to retirement accounts.

- Review and adjust budget: Regularly update your financial plan.

Retirees

- Manage withdrawals: Plan how you will withdraw from retirement accounts.

- Control expenses: Stick to a budget that matches your income.

- Consider downsizing: Reduce living costs by moving to a smaller home.

- Stay informed: Keep up with financial news and trends.

Advice For Specific Financial Situations (high Debt, Low Income, Etc.)

High Debt

- Create a repayment plan: Focus on high-interest debts first.

- Consolidate debts: Consider a debt consolidation loan.

- Cut unnecessary expenses: Redirect savings to debt repayment.

- Seek professional advice: Consult a financial advisor.

Low Income

- Maximize income: Explore side hustles or part-time jobs.

- Utilize assistance programs: Apply for government aid or grants.

- Prioritize spending: Focus on essential expenses.

- Build a budget: Ensure every dollar is accounted for.

Unforeseen Financial Emergencies

- Emergency fund: Aim to save at least three months’ worth of expenses.

- Insurance: Ensure adequate health, home, and life insurance coverage.

- Access to credit: Maintain a good credit score for emergency loans.

- Review financial plans: Adjust goals and budgets as needed.

For more information on managing your finances and achieving financial wellness, consider exploring resources like Upstart Personal Loans for tailored financial solutions.

Conclusion: Achieving Stability And Peace Of Mind

Reaching financial wellness is a journey. It requires consistent effort and informed decisions. By focusing on key principles and taking actionable steps, you can achieve stability and peace of mind.

Recap Of Key Points

- Budgeting and Saving: Create a budget and stick to it. Save a portion of your income regularly.

- Debt Management: Prioritize paying off high-interest debt. Use strategies like the debt snowball or avalanche method.

- Emergency Fund: Build an emergency fund to cover unexpected expenses. Aim for three to six months’ worth of living expenses.

- Investing: Start investing early. Diversify your investments to spread risk.

- Retirement Planning: Contribute to retirement accounts. Take advantage of employer matches if available.

- Financial Education: Continuously educate yourself about personal finance. Use resources like books, blogs, and courses.

Encouragement To Take The First Steps Towards Financial Wellness

Starting your journey towards financial wellness may seem daunting. Break it down into small, manageable steps. Begin with creating a budget and identifying areas to save. Gradually work on reducing debt and building an emergency fund.

Consider using tools and resources to help you stay on track. Platforms like Upstart Personal Loans offer support for managing finances. These resources can provide the guidance you need to make informed decisions.

Remember, every small step counts. Consistent effort leads to long-term financial stability. Begin your journey today and take control of your financial future.

Frequently Asked Questions

What Is Financial Wellness?

Financial wellness is the state of managing your finances efficiently. It includes budgeting, saving, and planning for the future.

How Can I Improve Financial Wellness?

Improving financial wellness involves creating a budget, reducing debts, and saving regularly. Seek professional advice if needed.

Why Is Financial Wellness Important?

Financial wellness reduces stress and improves overall well-being. It ensures you are prepared for future financial challenges.

What Are The Benefits Of Financial Wellness?

Benefits include reduced financial stress, better savings, and improved financial stability. It also enhances your overall quality of life.

Conclusion

Achieving financial wellness is within your reach. Start by setting clear goals. Track your spending and save regularly. Seek advice if needed. Consider reliable tools and resources like Upstart Personal Loans. Their secure platform connects entrepreneurs with investors, offering support and resources. Remember, small steps lead to big changes. Stay committed and watch your financial health improve.