Financial Reporting Tools: Streamline Your Business Analysis

Financial reporting tools are essential for businesses to track and analyze their financial performance. They help in making informed decisions and ensuring compliance with regulations.

In today’s fast-paced business environment, having the right financial reporting tools can make a significant difference. These tools not only simplify the process of financial management but also provide valuable insights into a company’s financial health. From tracking expenses to generating comprehensive financial reports, these tools are indispensable for businesses of all sizes. With the right tools, you can streamline your financial operations, save time, and reduce errors. As you explore various options, consider tools that offer features like integration with other systems, real-time data analysis, and user-friendly interfaces. One such solution is Ava Credit Builder, designed to help users improve their credit profile quickly. To learn more about Ava Credit Builder, visit Ava Finance.

Introduction To Financial Reporting Tools

In the world of finance, precise and timely reporting is essential. Financial reporting tools help companies track their financial performance. These tools provide insights that guide strategic decisions and ensure compliance with regulations.

What Are Financial Reporting Tools?

Financial reporting tools are software applications used to gather, analyze, and present financial data. These tools help businesses create reports that summarize their financial status. They often include features like data visualization, automated report generation, and real-time data integration.

| Feature | Description |

|---|---|

| Data Visualization | Graphs and charts to simplify financial data. |

| Automated Reports | Generate reports without manual input. |

| Real-Time Data | Update reports with the latest financial data. |

Purpose And Importance Of Financial Reporting Tools

The purpose of financial reporting tools is to provide accurate and timely financial information. This helps stakeholders make informed decisions. Using these tools ensures that financial data is reliable and consistent. This is crucial for maintaining investor trust.

- Compliance: Ensure adherence to financial regulations.

- Decision Making: Provide insights for strategic planning.

- Transparency: Increase trust with clear financial reporting.

In summary, financial reporting tools are vital for managing finances effectively. They help companies stay compliant, make better decisions, and maintain transparency.

Key Features Of Financial Reporting Tools

Financial reporting tools offer essential features for businesses to manage and analyze their financial data efficiently. These features ensure accuracy, compliance, and provide valuable insights for decision-making. Below are some of the key features that make financial reporting tools indispensable.

Automated Data Collection And Integration

Automated data collection and integration streamline the process of gathering financial data from various sources. This feature reduces manual errors and saves time. Financial reporting tools can connect to different financial systems and databases, ensuring that all relevant data is included in the reports.

Customizable Reporting Templates

Customizable reporting templates allow users to create reports that meet their specific needs. These templates can be tailored to include only the most relevant data, making the reports more useful and easier to understand. Users can modify layouts, add or remove data fields, and apply different styles to match their branding.

Real-time Financial Analysis

Real-time financial analysis provides up-to-the-minute insights into a company’s financial health. This feature allows businesses to monitor their financial performance continuously and make informed decisions quickly. Real-time analysis helps in identifying trends, spotting potential issues early, and reacting to market changes promptly.

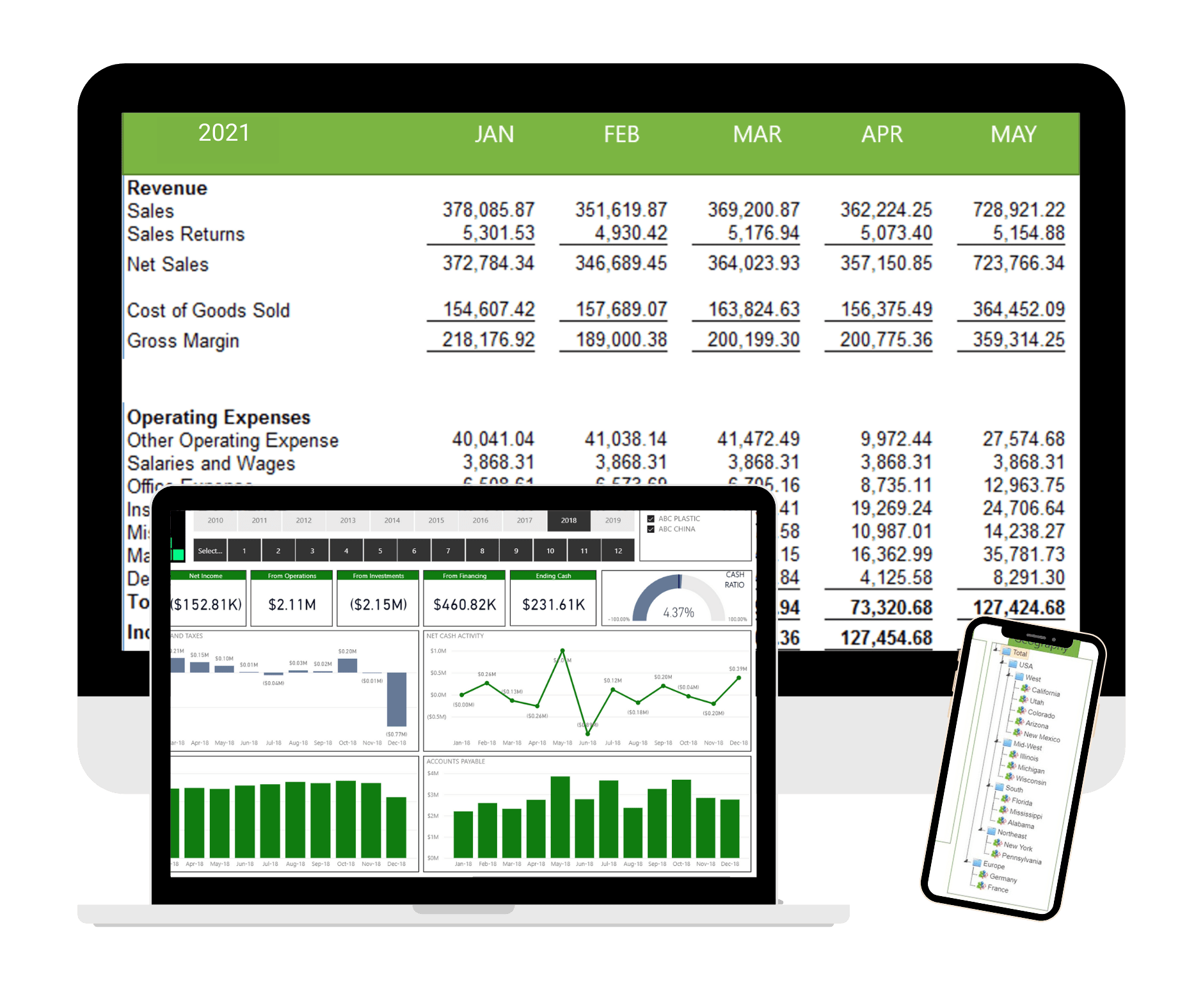

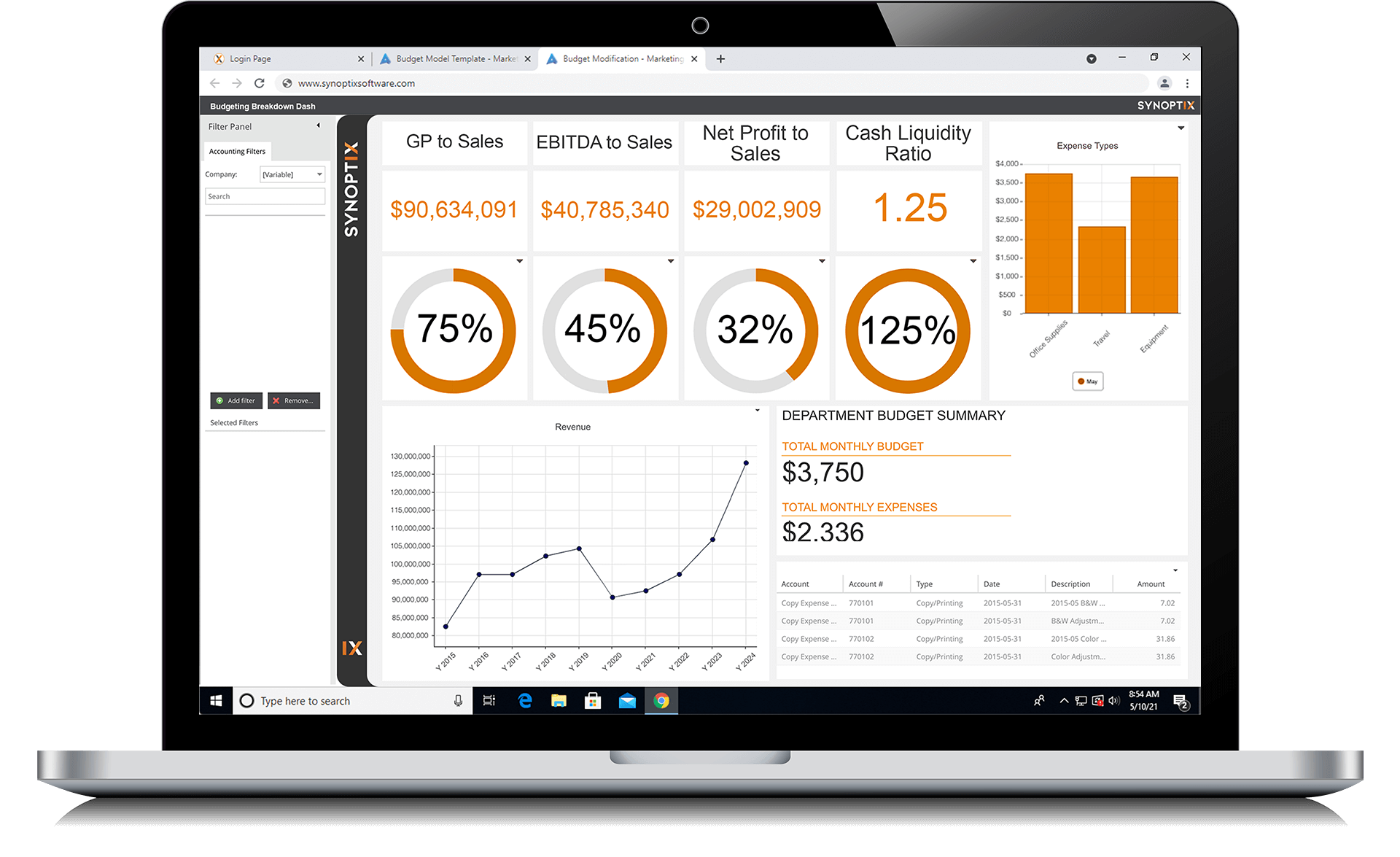

Advanced Data Visualization

Advanced data visualization transforms complex financial data into easy-to-understand visual formats. Charts, graphs, and dashboards make it easier to interpret and communicate financial information. Visual representations of data help stakeholders grasp key insights without needing to delve into detailed reports.

Compliance And Regulatory Reporting

Compliance and regulatory reporting ensure that financial reports adhere to legal and industry standards. These tools help businesses stay compliant with regulations by providing templates and guidelines for required reports. Automated compliance checks and updates ensure that the reports meet the latest standards, reducing the risk of penalties and legal issues.

| Feature | Benefits |

|---|---|

| Automated Data Collection | Reduces manual errors, saves time |

| Customizable Templates | Creates tailored, relevant reports |

| Real-time Analysis | Enables quick decision-making |

| Advanced Visualization | Enhances data interpretation |

| Compliance Reporting | Ensures legal and industry compliance |

These key features make financial reporting tools an essential asset for any business. They enhance the accuracy, efficiency, and value of financial data, leading to better decision-making and improved financial management.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of financial reporting tools is crucial. Many tools offer various features at different price points. This section will break down the costs, subscription models, and the differences between free and paid versions.

Cost Comparison Among Popular Tools

When comparing financial reporting tools, it’s important to look at what you get for your money. Here’s a breakdown of some popular tools:

| Tool | Basic Plan | Standard Plan | Premium Plan |

|---|---|---|---|

| Tool A | $10/month | $20/month | $30/month |

| Tool B | $15/month | $25/month | $35/month |

| Tool C | $12/month | $22/month | $32/month |

Subscription Models And Payment Plans

Most financial reporting tools offer flexible subscription models. These models typically include:

- Monthly Subscriptions: Pay month-to-month with the option to cancel anytime.

- Annual Subscriptions: Pay upfront for the year and often get a discount.

Some tools also provide customizable payment plans. These can cater to businesses of different sizes and needs.

Free Vs. Paid Versions

Many financial reporting tools offer both free and paid versions. The free versions usually have limited features. The paid versions unlock advanced functionalities.

Here’s a quick look at the differences:

| Feature | Free Version | Paid Version |

|---|---|---|

| Basic Reporting | Included | Included |

| Advanced Analytics | Not Included | Included |

| Custom Reports | Not Included | Included |

| Customer Support | Limited | Priority Support |

Choosing between free and paid versions depends on your needs. For basic use, the free version might be enough. For more advanced features, consider investing in a paid version.

Pros And Cons Of Financial Reporting Tools

Financial reporting tools are essential for businesses to track and manage their finances. These tools can help companies make informed decisions, but they also come with their own set of challenges. Let’s explore the pros and cons of using financial reporting tools.

Advantages Of Using Financial Reporting Tools

Financial reporting tools offer numerous benefits:

- Accuracy: Automated tools reduce the risk of human error.

- Time-Saving: These tools can process data quickly, saving time for analysts.

- Real-Time Data: Access to up-to-date financial information helps in timely decision-making.

- Comprehensive Reports: They provide detailed and customizable reports, suitable for various stakeholders.

- Compliance: Ensures adherence to financial regulations and standards.

Businesses using tools like Ava Finance can experience better financial management and improved decision-making. Ava Finance, for instance, offers robust features such as reporting to all three major credit bureaus and no late fees.

Common Drawbacks And Limitations

Despite the advantages, financial reporting tools have some limitations:

- Cost: High-quality tools can be expensive, affecting the budget.

- Complexity: Some tools have a steep learning curve, requiring training.

- Data Security: There’s always a risk of data breaches, despite encryption measures.

- Dependence on Technology: Technical issues can disrupt financial reporting processes.

Even with tools like Ava Finance, which uses 256-bit encryption for data security, businesses must remain vigilant about potential risks.

User Experience And Feedback

User feedback is crucial in assessing the effectiveness of financial reporting tools:

- Many users appreciate the ease of use and accuracy of these tools.

- Positive reviews often highlight the time-saving aspects and real-time data access.

- On the downside, some users mention the high cost and complexity of certain tools.

For instance, Ava Finance has received a 4.9-star rating from over 13,000 reviews on the App Store. Users have reported significant credit score improvements and praised the app’s effectiveness and ease of use.

Recommendations For Ideal Users Or Scenarios

Financial reporting tools are essential for various business sizes and industries. Understanding which tool fits your specific needs can save time and resources. Here, we will explore ideal scenarios and user recommendations for these tools.

Best Fit For Small Businesses

Small businesses often have limited resources and need cost-effective solutions. Financial reporting tools like Ava Finance are ideal for these settings. They provide simple and efficient reporting capabilities without the need for extensive training.

Key benefits for small businesses:

- Cost-effective pricing

- Easy integration with existing systems

- Minimal training required

- Improved financial accuracy and insights

Suitability For Large Enterprises

Large enterprises require robust and scalable solutions. Financial reporting tools designed for large enterprises offer advanced features, such as:

- Comprehensive data analytics

- Customizable reporting options

- Integration with multiple financial systems

- Enhanced security and compliance measures

These tools support the complex financial needs of large organizations, ensuring accurate and timely reporting.

Industry-specific Recommendations

Different industries have unique financial reporting needs. Here are some recommendations:

| Industry | Recommended Features |

|---|---|

| Manufacturing | Inventory management, cost accounting |

| Retail | Sales tracking, customer analytics |

| Healthcare | Compliance reporting, patient billing |

| Finance | Investment tracking, risk management |

Scenarios Where Financial Reporting Tools Provide Maximum Benefit

Financial reporting tools are most beneficial in scenarios where:

- Accurate and timely financial data is crucial for decision-making.

- Businesses need to comply with industry-specific regulations.

- Organizations seek to improve financial transparency and accountability.

- Companies aim to streamline financial operations and reduce manual errors.

For instance, Ava Credit Builder helps users improve their credit profiles quickly. It reports to all three major credit bureaus, ensuring that users’ credit scores are updated promptly.

In summary, choosing the right financial reporting tool depends on your specific needs and business size. Whether you’re a small business or a large enterprise, there’s a tool designed to enhance your financial reporting capabilities.

.webp)

Frequently Asked Questions

What Are Financial Reporting Tools?

Financial reporting tools are software applications that help businesses generate financial statements and reports. They automate data collection and analysis, ensuring accuracy.

Why Use Financial Reporting Tools?

Financial reporting tools streamline the reporting process, saving time and reducing errors. They also provide real-time insights, aiding better decision-making.

How Do Financial Reporting Tools Work?

Financial reporting tools collect, process, and analyze financial data from various sources. They then generate comprehensive reports, helping businesses monitor their financial health.

Are Financial Reporting Tools Secure?

Yes, most financial reporting tools use advanced security measures to protect data. They ensure your financial information remains confidential and safe from breaches.

Conclusion

Financial reporting tools simplify managing your finances. They offer clear insights. Ava Finance stands out in this field. Ava Credit Builder helps improve credit scores quickly. No credit checks, no late fees. Reports to all major bureaus. Secure with 256-bit encryption. Users love it, with a 4.9-star rating. For more details, visit Ava Finance. Enhance your financial health today.