Financial Planning For Renters: Strategies to Build Wealth

Renting a home comes with its own set of financial challenges and opportunities. While renters don’t worry about mortgage payments, they still need a solid financial plan.

Financial planning for renters involves budgeting, saving, and making wise financial choices. It’s about managing expenses, setting aside savings, and preparing for future goals. Renters need to be mindful of their spending and make the most of their financial resources. This blog post will help you understand the essential aspects of financial planning as a renter. We will also introduce you to tools like the Bilt World Elite Mastercard®, which can help you earn rewards and save money. Whether you are new to renting or looking to improve your financial situation, these tips will guide you in making smart decisions.

Introduction To Financial Planning For Renters

Financial planning is crucial for everyone, but it can be especially important for renters. Renters face unique financial challenges and opportunities. Understanding these can help in making smarter financial decisions.

Understanding The Importance Of Financial Planning

Financial planning helps you manage your money effectively. It ensures you can pay your rent on time, save for emergencies, and work towards future goals.

- Budgeting: Helps track income and expenses.

- Savings: Provides a safety net for emergencies.

- Investing: Grows your wealth over time.

One useful tool for renters is the Bilt World Elite Mastercard®. This card allows you to earn points on rent payments with no transaction fees.

Common Financial Challenges Faced By Renters

Renters often face several financial challenges. These can include high rent costs, lack of savings, and limited access to credit.

| Challenge | Description |

|---|---|

| High Rent Costs | Rent can take up a large portion of your income. |

| Lack of Savings | Many renters struggle to save money each month. |

| Limited Access to Credit | Renters may have lower credit scores, limiting their options. |

Using a credit card like the Bilt World Elite Mastercard® can help. It offers rewards on rent payments without transaction fees. This can save you money and help you build credit.

To learn more about the Bilt World Elite Mastercard®, visit the Bilt Rewards website.

Setting Financial Goals

Financial planning is crucial for renters. Setting clear financial goals can help manage your money better. Here, we will explore short-term and long-term goals, and introduce the SMART Goals Framework for renters.

Short-term Vs Long-term Goals

Understanding the difference between short-term and long-term goals is essential. Short-term goals are immediate, usually achievable within one year. Examples include saving for a vacation or paying off a small debt. Long-term goals require more time, often spanning several years. These can include building an emergency fund, saving for a down payment on a house, or planning for retirement.

- Short-term goals: Vacations, minor debt payments.

- Long-term goals: Emergency fund, down payment on a house, retirement.

Smart Goals Framework For Renters

The SMART Goals Framework helps in setting achievable and realistic goals. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound.

| SMART Criteria | Description | Example |

|---|---|---|

| Specific | Define the goal clearly | Save $500 for a vacation |

| Measurable | Track progress easily | Save $50 monthly |

| Achievable | Set realistic goals | Based on your budget, save $50 monthly |

| Relevant | Align with your financial situation | Ensure it fits your budget |

| Time-bound | Set a deadline | Achieve this in 10 months |

Using the SMART framework can guide renters in setting and achieving their financial goals effectively. For instance, if you use the Bilt World Elite Mastercard® to pay rent, you can earn points with no transaction fees. These points can be redeemed for travel, fitness classes, and more, which aligns well with both short-term and long-term goals.

Benefits of using Bilt World Elite Mastercard®:

- Earn points on rent payments with no transaction fees.

- Redeem points for various rewards including travel and fitness.

- Access exclusive experiences and events.

- Benefit from travel insurance and purchase protection.

- No annual fee to worry about.

To learn more, visit the Bilt Rewards website.

Budgeting Strategies For Renters

Managing your finances as a renter can be challenging. Implementing effective budgeting strategies helps in achieving financial stability. Here are some key strategies to help renters budget wisely.

Creating A Realistic Budget

To create a realistic budget, start by listing all your income sources. Include your salary, side jobs, and any other income.

| Income Source | Monthly Amount |

|---|---|

| Salary | $3000 |

| Side Job | $500 |

Next, list all your expenses. Categorize them into fixed and variable expenses. Examples of fixed expenses include rent, utilities, and insurance. Variable expenses include groceries, entertainment, and dining out.

| Expense Type | Monthly Amount |

|---|---|

| Rent | $1200 |

| Utilities | $150 |

| Groceries | $300 |

| Entertainment | $100 |

Subtract your total expenses from your total income to see what is left. This amount can be allocated for savings or unexpected expenses. A realistic budget helps in avoiding overspending.

Tracking Expenses And Adjusting Budget

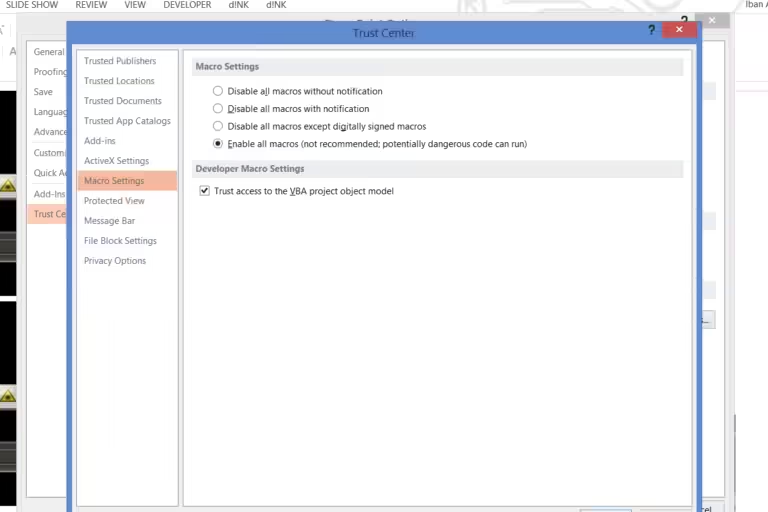

Tracking expenses is crucial for effective budgeting. Use apps or spreadsheets to record every expense. This practice ensures you stay within your budget.

Identify areas where you can cut back. For example, dining out less or reducing subscription services. Adjust your budget based on these observations.

Regularly review your budget. Make necessary adjustments to reflect changes in your income or expenses. This keeps your budget accurate and relevant.

Consider using the Bilt World Elite Mastercard® to earn rewards on rent payments. This card has no transaction fees for rent payments. Redeem points for travel, fitness classes, and more. Plus, there is no annual fee.

By following these budgeting strategies, renters can manage their finances effectively and achieve financial goals.

Saving And Emergency Funds

Financial planning is crucial for renters. One key aspect is saving and building an emergency fund. This ensures financial stability and security during unexpected situations.

Importance Of An Emergency Fund

An emergency fund is a financial safety net. It covers unforeseen expenses such as medical bills, car repairs, or job loss. Without it, renters might rely on high-interest credit cards or loans. This can lead to debt accumulation.

An emergency fund brings peace of mind. It reduces financial stress and allows you to handle emergencies without disrupting your daily life. Experts recommend saving three to six months’ worth of living expenses.

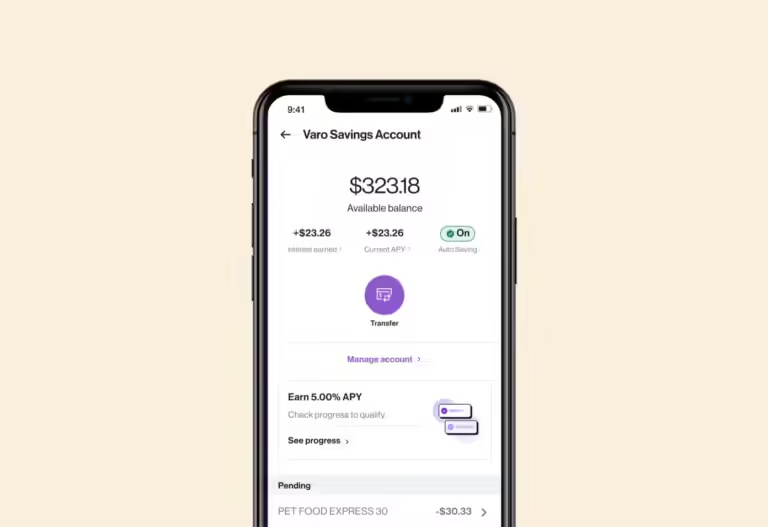

Strategies To Build And Maintain An Emergency Fund

Building an emergency fund requires discipline and strategic planning. Here are some strategies to help:

- Set a Savings Goal: Determine the amount you need in your emergency fund. Start with a small goal, then gradually increase it.

- Automate Savings: Set up automatic transfers from your checking account to a savings account. This ensures consistent savings without needing to remember.

- Reduce Unnecessary Expenses: Identify and cut down on non-essential expenses. Redirect these funds to your emergency savings.

- Use Windfalls Wisely: Allocate bonuses, tax refunds, or unexpected income to your emergency fund.

- Earn Rewards: Use credit cards like the Bilt World Elite Mastercard®. Earn points on rent payments with no transaction fees. Redeem points for various rewards, saving money in the process.

Maintaining your emergency fund is equally important. Avoid dipping into it for non-emergencies. Regularly review and adjust your contributions to keep up with inflation and lifestyle changes.

By following these strategies, renters can build and maintain a robust emergency fund. This ensures financial security and peace of mind.

Debt Management And Reduction

Renting a home comes with unique financial responsibilities. Managing and reducing debt is crucial for renters striving for financial stability. Focusing on debt management can help you free up more funds for savings and other essential expenses.

Identifying And Prioritizing Debts

Effective debt management starts with identifying and prioritizing your debts. Begin by creating a list of all your debts. Include credit card balances, student loans, and any other outstanding amounts.

| Type of Debt | Amount Owed | Interest Rate |

|---|---|---|

| Credit Card | $2,500 | 18% |

| Student Loan | $15,000 | 5% |

| Personal Loan | $5,000 | 10% |

Once you have a clear picture, prioritize your debts based on the interest rate and amount owed. High-interest debts should be addressed first as they can grow quickly.

Effective Debt Repayment Strategies

Choosing the right repayment strategy can make a significant difference. Consider these two popular methods:

- Avalanche Method: Focus on paying off the debt with the highest interest rate first. Make minimum payments on other debts. This method saves money on interest in the long run.

- Snowball Method: Pay off the smallest debt first. Once it’s cleared, move to the next smallest. This method provides quick wins and can boost motivation.

Both methods have their advantages. Select the one that aligns with your financial goals and preferences.

Using a tool like the Bilt World Elite Mastercard® can help manage debts efficiently. It offers no transaction fees on rent payments, which can free up extra funds for debt repayment.

Maintain consistency in your repayment efforts. Regular payments help reduce debt over time, bringing you closer to financial freedom.

Investment Strategies For Renters

Renters often feel they have fewer investment options compared to homeowners. However, there are smart strategies that can help renters grow their wealth. By understanding basic investment options and balancing risk and reward, renters can make informed decisions to secure their financial future.

Introduction To Basic Investment Options

Understanding the basics of investing is crucial for renters. Here are some common investment options:

- Stocks: Buying shares of a company to gain profits from its growth.

- Bonds: Lending money to a company or government in exchange for interest payments.

- Mutual Funds: Pooling money with other investors to buy a diversified portfolio of stocks and bonds.

- ETFs: Similar to mutual funds, but traded on stock exchanges like individual stocks.

- Real Estate Investment Trusts (REITs): Investing in real estate properties without owning them directly.

Renters can choose these options based on their financial goals and risk tolerance.

Balancing Risk And Reward

Balancing risk and reward is key to successful investing. Each investment option carries its own level of risk and potential reward.

| Investment Option | Risk Level | Potential Reward |

|---|---|---|

| Stocks | High | High |

| Bonds | Low | Low to Moderate |

| Mutual Funds | Moderate | Moderate |

| ETFs | Moderate | Moderate |

| REITs | High | High |

Consider your financial goals and risk tolerance before investing. Diversifying your investments can also help manage risk. For instance, a mix of stocks, bonds, and mutual funds can provide a balanced portfolio.

Using a rewards credit card like the Bilt World Elite Mastercard® can also complement your investment strategy. It allows you to earn points on rent payments with no transaction fees. These points can be redeemed for travel, fitness classes, and more. This way, you save money while investing in experiences and rewards.

Remember, no investment is without risk. Do thorough research or consult a financial advisor to make informed decisions.

Maximizing Income And Side Hustles

Financial planning for renters involves more than just budgeting. Maximizing your income through side hustles can make a significant difference. It can help cover rent and build savings. Let’s explore how to boost your income effectively.

Exploring Additional Income Sources

There are many ways to earn extra income. Freelancing, part-time jobs, and online gigs are popular options. Consider using platforms like Upwork or Fiverr for freelance work. These platforms offer opportunities in writing, graphic design, and programming.

Online surveys and market research are other options. Websites like Swagbucks and Survey Junkie pay for completing surveys. It’s a simple way to make some extra cash in your spare time.

Don’t forget about gig economy jobs. Driving for Uber or delivering for DoorDash can be profitable. These jobs offer flexibility and allow you to work on your schedule.

Balancing Multiple Income Streams

Managing multiple income streams requires organization. Time management is crucial. Use tools like Google Calendar to schedule your tasks and deadlines.

Prioritizing your tasks helps maintain balance. Focus on high-paying gigs first. Track your income from each source. Use a simple spreadsheet or apps like Mint or YNAB.

Consider using the Bilt World Elite Mastercard® to manage your finances. This card helps you earn points on rent payments without transaction fees. These points can be redeemed for travel, fitness classes, and more. Plus, there’s no annual fee.

Here’s a quick table summarizing the main features of the Bilt World Elite Mastercard®:

| Feature | Details |

|---|---|

| Points on Rent Payments | Earn points with no transaction fees |

| Rewards | Redeem for travel, fitness, and more |

| Exclusive Experiences | Access to special events and experiences |

| Annual Fee | None |

| World Elite Benefits | Travel insurance and purchase protection |

Using the right tools and strategies can help you maximize your income. This way, you can manage your rent and build a secure financial future.

Retirement Planning For Renters

Planning for retirement is crucial for everyone, including renters. While homeowners can rely on home equity, renters need to adopt different strategies. With the right approach, renters can effectively prepare for retirement. This section will cover key areas like understanding retirement accounts and setting and achieving retirement goals.

Understanding Retirement Accounts

Retirement accounts are essential tools for saving for the future. There are several types of retirement accounts available:

- 401(k): Offered by many employers, these accounts allow you to save pre-tax dollars.

- IRA: Individual Retirement Accounts can be opened independently and offer tax advantages.

- Roth IRA: Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

Each type of account has its own benefits and limitations. Understanding these can help renters choose the best options for their needs.

Setting And Achieving Retirement Goals

Setting clear retirement goals is vital. Start by determining how much money you will need in retirement. Consider factors like:

- Living expenses

- Healthcare costs

- Leisure activities

Once you have an estimate, create a plan to reach your goals:

- Calculate how much you need to save monthly or annually.

- Choose the right retirement accounts to maximize your savings.

- Regularly review and adjust your plan as needed.

For renters, using a rewards program like Bilt Rewards can be beneficial. The Bilt World Elite Mastercard® allows you to earn points on rent payments without any transaction fees. These points can be redeemed for travel, fitness classes, and more, helping you save money and enhance your lifestyle.

By understanding retirement accounts and setting achievable goals, renters can secure a comfortable future. Plan early, stay disciplined, and use available tools to make your retirement dreams a reality.

Insurance And Protection

Financial planning for renters involves more than just budgeting for monthly rent. Having the right insurance and protection is crucial. This ensures your belongings and financial well-being are safeguarded against unexpected events. Here, we will explore the types of insurance renters should consider and how to evaluate coverage needs and options.

Types Of Insurance Renters Should Consider

As a renter, having the right insurance can provide peace of mind. Below are the key types of insurance you should consider:

- Renter’s Insurance: Protects personal belongings from theft, fire, or damage.

- Liability Insurance: Covers costs if someone gets injured in your rental property.

- Flood Insurance: Essential if you live in areas prone to flooding.

- Pet Insurance: Covers veterinary expenses if you have pets.

Each insurance type serves a specific purpose. Choose the ones that fit your lifestyle and risk factors.

Evaluating Coverage Needs And Options

Identifying the right amount of coverage involves careful evaluation. Here are some steps to help you:

- Assess Your Belongings: Make a list of your valuable items. Estimate their total value.

- Research Insurance Providers: Compare options and read reviews. Look for policies that match your needs.

- Check Policy Limits: Ensure the coverage limits are sufficient for your belongings.

- Understand Deductibles: Know how much you will pay out-of-pocket before insurance kicks in.

- Consider Additional Coverage: If you have high-value items, add riders to your policy.

Additionally, consider using a credit card like the Bilt World Elite Mastercard®. This card offers travel insurance and purchase protection among its many benefits. Earn points on rent payments with no transaction fees. Redeem points for travel, fitness, and more.

Choosing the right insurance and understanding your coverage needs will help you stay financially protected as a renter.

Utilizing Financial Tools And Resources

Managing finances as a renter can be challenging. Fortunately, various tools and resources can help. From budgeting apps to financial planning services, renters have many options to improve their financial health. This section explores some of the best tools and resources available.

Budgeting And Savings Apps

Budgeting and savings apps are essential for renters. They help track expenses, set savings goals, and monitor spending habits. Here are some popular apps:

- Mint: Tracks spending, creates budgets, and offers financial advice.

- YNAB (You Need A Budget): Helps allocate every dollar and avoid overspending.

- PocketGuard: Shows how much disposable income is left after bills and savings.

These apps make it easier to manage finances and save money. They provide insights into spending patterns and help renters stay on track with their financial goals.

Financial Planning Services

Financial planning services offer personalized advice and strategies. They can help renters with various financial goals, such as saving for a house or retirement. Some popular services include:

- Betterment: Offers robo-advisor services and personalized financial advice.

- Personal Capital: Provides wealth management and retirement planning tools.

- Wealthfront: Delivers automated investment management and financial planning.

These services provide expert guidance to help renters make informed financial decisions. They offer tools to plan for the future and achieve financial stability.

Additionally, renters can benefit from using the Bilt World Elite Mastercard® by Bilt Rewards. This card allows renters to earn points on rent payments without transaction fees. Points can be redeemed for travel, fitness classes, and more. The card also offers exclusive experiences and events, travel insurance, and purchase protection, with no annual fee. For more information, visit the Bilt Rewards website.

Common Mistakes To Avoid

Financial planning is crucial for renters. Mistakes can lead to unnecessary stress. Learn about common pitfalls and how to avoid them.

Overspending On Rent

Many renters make the mistake of overspending on rent. This often leaves little room for other expenses. A good rule is to keep rent at 30% of your income. Use a budget to track expenses and stay within limits.

Tips to avoid overspending:

- Set a realistic rent budget.

- Consider utilities and other housing costs.

- Look for rental deals or negotiate with landlords.

Neglecting Long-term Financial Goals

Renters often neglect long-term financial goals. This can affect future stability. It’s important to save for emergencies and retirement.

Here are some steps to stay on track:

- Set up an emergency fund.

- Contribute to a retirement account.

- Invest in low-risk options.

Using tools like the Bilt World Elite Mastercard® can help. Earn points on rent payments with no transaction fees. Redeem points for travel, fitness, and more.

Main features include:

| Feature | Details |

|---|---|

| Earn points on rent | No transaction fees |

| Redeem points | Travel, fitness classes, and more |

| Exclusive experiences | Access to special events |

| No annual fee | Save more money |

Plan wisely and avoid these common mistakes. Secure your financial future as a renter.

Conclusion And Final Recommendations

Financial planning is crucial for renters to secure their financial future. By implementing smart strategies, renters can manage their finances effectively and achieve their goals. Below are the key strategies and recommendations to help you get started on your financial planning journey.

Recap Of Key Strategies

- Create a Budget: Track your income and expenses to understand your financial situation. Use apps or spreadsheets to manage your budget.

- Build an Emergency Fund: Save at least three to six months’ worth of expenses. This fund will help you during unexpected situations.

- Reduce Debt: Prioritize paying off high-interest debts. Consider consolidating loans or using balance transfer options for lower interest rates.

- Save for Retirement: Contribute to retirement accounts like 401(k) or IRA. Start early to take advantage of compound interest.

- Use Reward Programs: Utilize credit cards like the Bilt World Elite Mastercard® to earn points on rent payments with no transaction fees.

Encouragement To Start Financial Planning Today

Don’t wait to start your financial planning. The sooner you begin, the more secure your future will be. Here are some steps to take right now:

- Analyze your current financial situation and identify areas for improvement.

- Set realistic financial goals for the short-term and long-term.

- Explore financial tools and resources that can assist you in managing your finances.

- Consider using the Bilt World Elite Mastercard® to maximize your rent payments and earn valuable rewards.

Starting your financial planning journey today can lead to a more stable and prosperous future. Take control of your finances and achieve your goals with confidence.

Frequently Asked Questions

What Is Financial Planning For Renters?

Financial planning for renters involves budgeting, saving, and managing expenses. It ensures renters can meet financial goals and emergencies.

How Can Renters Save Money Effectively?

Renters can save money by budgeting, cutting unnecessary expenses, and setting up automatic savings. Prioritize needs over wants.

Why Is Renter’s Insurance Important?

Renter’s insurance protects personal belongings and provides liability coverage. It’s essential for financial security and peace of mind.

How To Create A Budget As A Renter?

To create a budget, list income and expenses. Track spending, set financial goals, and adjust accordingly. Use budgeting apps.

Conclusion

Effective financial planning can make life easier for renters. Prioritize budgeting and saving. This helps manage unexpected expenses. Use resources like the Bilt World Elite Mastercard® to earn rewards on rent payments. Learn more about the card here. This card offers points without transaction fees. Redeem points for travel, fitness, and more. No annual fee means you save money. Stay proactive with your finances and enjoy peace of mind.