Financial Planning: Essential Tips for Future Security

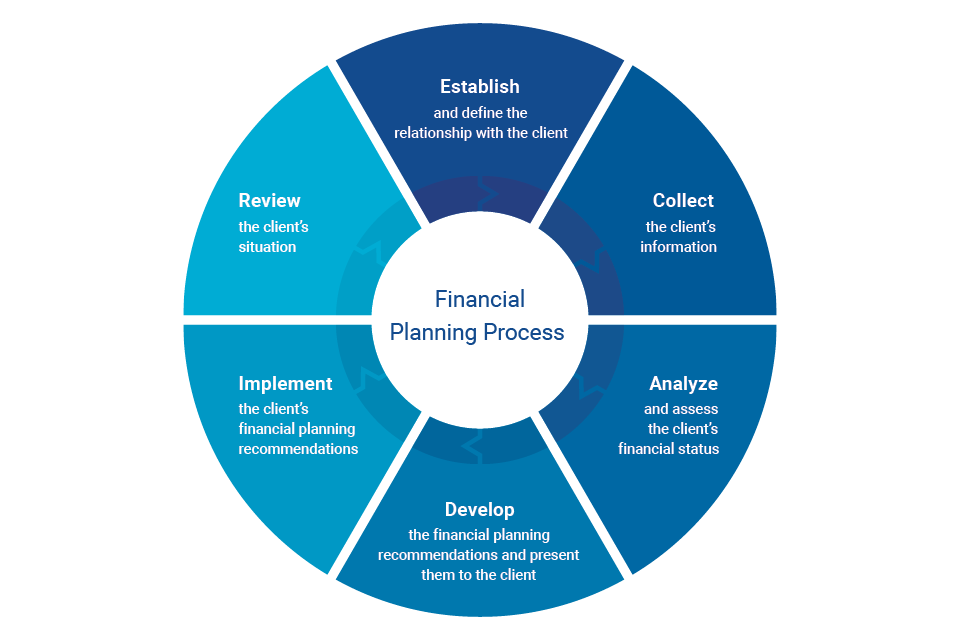

Financial planning is crucial for achieving financial stability and reaching your life goals. It involves creating a strategy to manage your income, expenses, savings, and investments effectively.

In today’s fast-paced world, understanding financial planning can make a significant difference in your quality of life. Whether you want to save for retirement, buy a home, or simply manage debt, a solid financial plan can help you navigate your financial journey. Personal Loans® is an excellent resource for those seeking financial assistance, offering loan amounts from $250 to $35,000. This service is free to use and provides quick access to a network of lenders, ensuring you get the help you need promptly. Explore more about how Personal Loans® can aid your financial planning today.

Introduction To Financial Planning

Financial planning is essential to managing your finances effectively. It helps in achieving short-term and long-term financial goals. This guide will introduce you to the fundamentals of financial planning, its importance, and how it can benefit you.

What Is Financial Planning?

Financial planning involves creating a strategy to manage your money. This includes budgeting, saving, investing, and planning for future expenses. It helps in making informed decisions about your finances.

Effective financial planning considers your income, expenses, and financial goals. It can also include planning for emergencies and unexpected events.

The Importance Of Financial Planning

Financial planning is crucial for several reasons:

- Goal Setting: Helps in defining and achieving financial goals.

- Budget Management: Assists in managing income and expenses.

- Investment Planning: Guides on where to invest your money.

- Risk Management: Prepares you for financial uncertainties.

Proper financial planning ensures you are well-prepared for the future. It helps in making smarter financial decisions and securing a stable financial future.

| Feature | Details |

|---|---|

| Loan Amount | $250 to $35,000 |

| No Hidden Fees | No upfront costs or obligations |

| Fast Funding | Funds received as soon as the next business day |

| Flexible Usage | Loans can be used for various purposes |

| Competitive Rates | Access to a wide variety of lenders |

| Security | Advanced data encryption technology |

For more information on personal loans, visit Personal Loans®.

Setting Financial Goals

Setting financial goals is essential for achieving financial stability and success. It helps you create a clear path to follow and allows you to measure your progress. Understanding the difference between short-term and long-term goals, as well as how to set SMART goals, will help you stay focused and motivated.

Short-term Vs Long-term Goals

Financial goals can be categorized into short-term and long-term goals. Short-term goals usually span a few months to a couple of years. Examples include building an emergency fund or paying off small debts. Long-term goals typically take several years to achieve. These might include saving for retirement or buying a house.

| Goal Type | Time Frame | Examples |

|---|---|---|

| Short-term Goals | Up to 2 years | Emergency fund, small debt repayment |

| Long-term Goals | 3 years or more | Retirement savings, buying a house |

Smart Goals For Financial Success

To achieve financial success, setting SMART goals is crucial. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound.

- Specific: Clearly define your goal. For example, saving $5,000 for an emergency fund.

- Measurable: Ensure you can track your progress. Break your goal into smaller milestones.

- Achievable: Set realistic goals based on your current financial situation.

- Relevant: Your goals should align with your long-term financial plans.

- Time-bound: Set a deadline for achieving your goal. This adds urgency and motivation.

Here’s an example of a SMART goal: “I will save $5,000 for an emergency fund by setting aside $200 from my monthly paycheck for the next 25 months.”

By adhering to these principles, you can ensure your financial goals are clear, realistic, and achievable.

Creating A Budget

Creating a budget is a crucial step in financial planning. It helps you manage your money, keep track of expenses, and save for future goals. By understanding where your money goes, you can make better financial decisions and achieve financial stability.

Why Budgeting Is Crucial

Budgeting is essential because it provides a clear picture of your financial health. It allows you to:

- Control spending: Track your expenses and avoid overspending.

- Save money: Allocate funds for savings and future goals.

- Reduce stress: Knowing your finances are in order reduces anxiety.

- Plan for emergencies: Set aside money for unexpected expenses.

- Improve financial habits: Develop better money management skills.

Steps To Create An Effective Budget

Follow these steps to create a budget that works for you:

- Determine your income: List all sources of income, including salary, bonuses, and side hustles.

- Track your expenses: Record all monthly expenses such as rent, utilities, groceries, and entertainment.

- Set financial goals: Identify short-term and long-term goals, such as paying off debt or saving for a vacation.

- Create a spending plan: Allocate your income to cover expenses and savings. Use categories like housing, food, transportation, and entertainment.

- Adjust as needed: Review and adjust your budget regularly to reflect changes in income or expenses.

| Income | Amount |

|---|---|

| Salary | $3,000 |

| Side Hustle | $500 |

| Expense | Amount |

|---|---|

| Rent | $1,000 |

| Utilities | $150 |

| Groceries | $300 |

| Transportation | $200 |

| Entertainment | $100 |

Creating a budget helps you control your finances and achieve your goals. It’s a powerful tool for anyone looking to improve their financial situation. Start budgeting today and see the difference it makes in your life.

Saving Strategies

Financial planning is essential for a secure future. One of the key components of financial planning is developing effective saving strategies. These strategies help you manage your finances, build a safety net, and achieve long-term goals. Below, we will explore the importance of an emergency fund, tips for building one, and long-term savings plans.

Emergency Fund Importance

An emergency fund is a crucial part of financial stability. It provides a safety net during unexpected situations. Such as sudden medical expenses, job loss, or urgent repairs. Without an emergency fund, you may need to rely on credit cards or loans, which can lead to debt. Having an emergency fund ensures you are prepared for life’s uncertainties.

Tips For Building An Emergency Fund

Building an emergency fund may seem daunting, but with the right approach, it becomes manageable. Here are some tips to help you get started:

- Set a Goal: Determine how much you need to save. Experts recommend saving 3 to 6 months of living expenses.

- Start Small: Begin with small, manageable amounts. Even $20 a week adds up over time.

- Automate Savings: Set up automatic transfers to your savings account. This ensures consistency.

- Cut Unnecessary Expenses: Identify areas where you can reduce spending. Redirect these savings to your emergency fund.

- Use Windfalls: Allocate any unexpected money, such as tax refunds or bonuses, to your emergency fund.

Long-term Savings Plans

Long-term savings plans are essential for achieving significant financial goals. Such as buying a home, funding education, or retiring comfortably. Here are some strategies to consider:

- Invest in Retirement Accounts: Utilize accounts like 401(k)s or IRAs. These offer tax advantages and compound interest.

- Set Up a College Fund: For your children, consider a 529 plan. It offers tax benefits and helps cover future education costs.

- Consider Diversified Investments: Diversify your portfolio with stocks, bonds, and mutual funds. This spreads risk and can increase returns.

- Regular Contributions: Make regular contributions to your savings and investment accounts. Consistency is key to growth.

- Review and Adjust: Periodically review your savings plans. Adjust contributions and strategies based on your financial goals and market conditions.

By implementing these saving strategies, you can build a solid financial foundation. This ensures you are prepared for emergencies and on track to achieve your long-term goals.

Investing Wisely

Investing wisely is essential for achieving financial stability and growth. By making informed decisions, you can increase your wealth over time. Let’s explore key aspects of investing wisely.

Understanding Different Investment Options

Investments come in various forms. Understanding them is crucial to making the right choices.

| Investment Type | Description |

|---|---|

| Stocks | Ownership shares in a company. Potential for high returns, but riskier. |

| Bonds | Loans to companies or governments. Generally safer but lower returns. |

| Mutual Funds | Pools of money managed by professionals. Diversified but may have fees. |

| Real Estate | Investing in property. Can provide steady income and potential appreciation. |

| Commodities | Physical goods like gold or oil. Often used as a hedge against inflation. |

Risk Management In Investments

Managing risk is vital to protect your investments. Here are some strategies:

- Know Your Risk Tolerance: Assess how much risk you can handle.

- Diversify Your Portfolio: Spread investments across different asset classes.

- Stay Informed: Keep up with market trends and news.

- Set Limits: Use stop-loss orders to prevent large losses.

- Regular Reviews: Review and adjust your portfolio periodically.

Diversification Strategies

Diversification helps reduce risk by spreading investments. Consider these strategies:

- Asset Allocation: Divide investments among stocks, bonds, and other assets.

- Geographical Diversification: Invest in different regions to mitigate local risks.

- Sector Diversification: Spread investments across various industries.

- Investment Styles: Combine growth and value investing for balance.

- Rebalance Regularly: Adjust your portfolio to maintain desired allocation.

Managing Debt

Managing debt is a crucial aspect of financial planning. It involves understanding the types of debt you have, creating strategies to reduce it, and avoiding common pitfalls. Effective debt management can help you achieve financial freedom and peace of mind.

Types Of Debt

Debt can be categorized into various types, each with unique characteristics. Here are some common types:

- Credit Card Debt: High-interest debt accumulated through credit card usage.

- Personal Loans: Loans for personal use, such as those offered by Personal Loans®.

- Student Loans: Debt incurred for educational purposes, typically with lower interest rates.

- Mortgage Loans: Loans used to purchase real estate, often with long repayment periods.

- Auto Loans: Debt for purchasing vehicles, usually with fixed monthly payments.

Strategies For Debt Reduction

Reducing debt requires a strategic approach. Here are some effective strategies:

- Create a Budget: Track income and expenses to identify areas to cut costs.

- Prioritize Payments: Focus on paying off high-interest debts first.

- Consolidate Debt: Combine multiple debts into one loan with a lower interest rate. Services like Personal Loans® can help.

- Use the Snowball Method: Pay off smaller debts first to build momentum.

- Negotiate with Creditors: Contact lenders to discuss possible payment plans or reduced interest rates.

Avoiding Common Debt Traps

Many people fall into common debt traps that can be avoided with awareness:

- Minimum Payments: Paying only the minimum amount increases the total interest paid over time.

- Impulse Spending: Avoid unplanned purchases that add unnecessary debt.

- Ignoring Bills: Late payments can lead to penalties and higher interest rates.

- Over-Borrowing: Only borrow what you can afford to repay. Evaluate terms and conditions before accepting a loan.

For example, with Personal Loans®, you can review loan offers without any obligation to accept them. This helps in making an informed decision.

Retirement Planning

Retirement planning is a critical aspect of financial planning. It ensures a secure and comfortable future. With the right strategy, you can enjoy your golden years stress-free. Let’s delve into the key areas of retirement planning.

Importance Of Early Planning

Starting early with your retirement planning can significantly benefit you. The sooner you begin, the more time your investments have to grow. This approach leverages the power of compound interest. For instance, saving just $100 a month at a 6% interest rate can grow to a substantial amount over 30 years.

Here are some key reasons why early planning is important:

- More Time to Save: Starting early gives you more time to save and invest.

- Compound Interest: Your investments grow faster due to compound interest.

- Financial Security: Early planning ensures financial security during retirement.

- Reduced Stress: Knowing you are prepared reduces financial stress.

Retirement Savings Options

There are various retirement savings options available. Choosing the right one depends on your financial goals and situation. Here are some popular options:

| Savings Option | Description |

|---|---|

| 401(k) | A retirement savings plan offered by employers with tax advantages. |

| IRA | Individual Retirement Account with tax benefits. |

| Roth IRA | Individual Retirement Account with tax-free withdrawals in retirement. |

| Pension Plans | Employer-provided plans that pay a fixed amount upon retirement. |

Maximizing Retirement Contributions

Maximizing your retirement contributions is crucial for a secure future. Here are some strategies:

- Employer Match: Contribute enough to get the full employer match in a 401(k).

- Catch-Up Contributions: If over 50, take advantage of catch-up contributions in IRAs and 401(k)s.

- Automate Savings: Set up automatic contributions to ensure consistent saving.

- Review and Adjust: Regularly review and adjust your contributions based on your goals.

By following these strategies, you can build a robust retirement fund. This will ensure a financially secure and stress-free retirement.

Insurance And Protection

Insurance is a vital part of financial planning. It acts as a safety net, protecting your finances from unexpected events. Having the right insurance coverage ensures you and your family remain financially secure.

Types Of Insurance To Consider

Understanding different types of insurance is essential. Here are some key types to consider:

- Health Insurance: Covers medical expenses and hospitalization costs.

- Life Insurance: Provides financial support to your family in case of your untimely death.

- Auto Insurance: Covers damages and liabilities from car accidents.

- Home Insurance: Protects your home and belongings from damages or theft.

- Disability Insurance: Provides income if you are unable to work due to a disability.

How Insurance Protects Your Finances

Insurance helps shield your finances in various ways:

- Risk Management: Transfers the financial risk from you to the insurance company.

- Peace of Mind: Knowing you are covered reduces stress and worry.

- Financial Stability: Prevents sudden financial burdens from unexpected events.

- Legal Compliance: Some insurances, like auto insurance, are legally required.

By investing in proper insurance, you ensure that unexpected costs do not derail your financial goals. It is an integral part of a robust financial plan.

Estate Planning

Estate planning is the process of organizing and managing your assets in the event of death or incapacitation. It ensures your wishes are honored, provides for your loved ones, and can minimize taxes and legal fees. Let’s explore what estate planning entails.

What Is Estate Planning?

Estate planning involves creating a strategy to manage your assets and distribute them according to your wishes. This includes property, investments, insurance, and personal belongings. It helps avoid disputes and ensures a smooth transition for your heirs.

Essential Estate Planning Documents

Several key documents are vital for a comprehensive estate plan:

- Will: Specifies how your assets will be distributed.

- Trust: Manages assets and provides instructions for distribution.

- Power of Attorney: Grants someone authority to make financial decisions if you are unable.

- Healthcare Directive: Details your wishes for medical care if you cannot communicate them.

- Beneficiary Designations: Ensures life insurance and retirement accounts go to the right people.

Benefits Of Estate Planning

Estate planning offers numerous benefits:

- Peace of Mind: Ensures your wishes are followed and your loved ones are cared for.

- Tax Efficiency: Reduces estate taxes and legal fees.

- Avoids Probate: Simplifies asset distribution and avoids lengthy legal processes.

- Protects Beneficiaries: Provides for minor children and ensures assets are managed wisely.

- Incapacity Planning: Prepares for potential incapacitation with clear instructions.

In conclusion, estate planning is essential for everyone. It protects your assets, ensures your wishes are honored, and provides for your loved ones. Start planning today for a secure future.

Review And Adjust Your Plan

Financial planning is not a one-time event. It’s an ongoing process that requires regular attention. As life changes, so do your financial needs. That’s why it’s essential to review and adjust your plan periodically. This ensures that your financial goals stay on track and adapt to new circumstances.

Regular Financial Check-ups

Regular financial check-ups help you stay informed about your financial health. Just like visiting a doctor for a routine health check, your finances also need regular review. You can start by setting specific times each year to examine your financial plan. During these check-ups, assess your income, expenses, savings, and investments.

- Review your budget and adjust for any changes in income or expenses.

- Check your investment portfolio to ensure it aligns with your risk tolerance and goals.

- Update your debt repayment plan if there are new loans or changes in interest rates.

Using tools and apps can make tracking your finances easier. These tools can provide insights and help you stay organized.

Adjusting Your Plan For Life Changes

Life changes can significantly impact your financial plan. Events like marriage, having a child, or changing jobs require adjustments to your plan. For example, a new job might come with a different salary, affecting your budget and savings goals. Similarly, marriage or having a child will introduce new expenses and financial responsibilities.

Consider these steps when adjusting your plan:

- Re-evaluate your budget to include new expenses.

- Update your savings goals to reflect new priorities, such as a child’s education fund.

- Review your insurance policies to ensure adequate coverage for new dependents.

Adapting your plan to life changes helps maintain financial stability and prepare for future needs.

Seeking Professional Advice

Sometimes, navigating financial changes can be challenging. Seeking professional advice can provide clarity and guidance. Financial advisors can offer insights tailored to your unique situation. They can help with investment strategies, retirement planning, and debt management.

Here are some benefits of consulting a professional:

| Benefit | Description |

|---|---|

| Expertise | Access to specialized knowledge and experience. |

| Personalized Advice | Customized strategies based on your goals and circumstances. |

| Objective Perspective | Unbiased recommendations that consider your best interests. |

For example, using services like Personal Loans® can connect you with lenders for various financial needs. This service offers loans ranging from $250 to $35,000 with no hidden fees and fast funding options.

Regularly reviewing and adjusting your financial plan ensures it remains relevant and effective. This proactive approach helps you stay on track towards achieving your financial goals.

Frequently Asked Questions

What Is Financial Planning?

Financial planning is the process of creating a roadmap for managing your finances. It involves setting financial goals, budgeting, and making informed investment decisions to achieve long-term stability.

Why Is Financial Planning Important?

Financial planning is crucial for ensuring financial security and achieving your financial goals. It helps you manage income, control expenses, and make informed investment decisions, ultimately leading to financial independence.

How Do I Start Financial Planning?

Begin financial planning by assessing your current financial situation. Set clear financial goals, create a budget, and identify investment opportunities. Seek professional advice if needed.

What Are The Benefits Of Financial Planning?

Financial planning offers numerous benefits, including improved financial security, better investment decisions, and reduced financial stress. It helps you achieve your financial goals and ensures long-term financial stability.

Conclusion

Financial planning is essential for a secure future. Start small, stay consistent, and adapt. Consider options like Personal Loans® for flexible financial solutions. This service connects you with lenders, offering fast and convenient loans. A good plan helps you manage expenses, save wisely, and invest smartly. Stay informed and make thoughtful financial decisions. Your future self will thank you.