Financial Literacy Programs: Empowering Your Financial Future

Financial literacy programs are essential in today’s complex financial world. They equip individuals with the knowledge to make informed decisions.

Understanding finances can be daunting. Many struggle with budgeting, saving, or managing debt. Financial literacy programs provide practical tools and education. These programs can significantly impact one’s financial health. They teach budgeting, saving, investing, and credit management. Developing these skills can lead to better financial stability and security. For those looking to build credit, consider using services like Perpay. Perpay offers a unique way to shop, build credit, and manage payments seamlessly. Investing time in financial literacy is a wise decision that pays off in the long run.

Introduction To Financial Literacy Programs

Financial literacy programs are crucial for understanding and managing personal finances. These programs offer essential knowledge to help individuals make informed decisions about budgeting, saving, investing, and credit management. In today’s complex financial landscape, such education is more important than ever.

What Are Financial Literacy Programs?

Financial literacy programs provide educational resources and training on key financial topics. These programs cover areas such as budgeting, saving, investing, credit management, and retirement planning. They aim to equip individuals with the skills needed to manage their money effectively.

Perpay, for example, offers a unique financial service that helps users shop for everyday items, build credit, and pay over time through automatic paycheck deductions. This service is part of a broader effort to enhance financial literacy and improve credit scores.

The Importance Of Financial Literacy In Today’s World

Understanding personal finance is more vital now than ever. With the rise of credit cards, loans, and digital banking, having a strong grasp of financial literacy can prevent debt and financial hardship. Programs like Perpay help individuals manage their finances by offering interest-free payments and credit improvement.

Financial literacy also helps individuals plan for the future. Whether it’s saving for a major purchase, investing for retirement, or managing credit, these skills are essential. Perpay’s automatic paycheck deductions and credit-building features simplify financial management and help improve credit scores, with users seeing an average increase of 36 points within the first three months.

| Feature | Details |

|---|---|

| Perpay Marketplace | Access to $1,000 credit for shopping top brands |

| Perpay Credit Card | Use anywhere Mastercard is accepted and earn 2% rewards |

| Credit Building | Automatic payments from your paycheck to build credit |

| Interest-Free Payments | Pay over time with no interest or fees |

Overall, financial literacy programs like Perpay are essential tools for managing personal finances. They provide valuable education and resources to help individuals make informed financial decisions, improve their credit scores, and achieve long-term financial stability.

Key Features Of Effective Financial Literacy Programs

Financial literacy programs empower individuals to manage their finances wisely. Effective programs share common features that enhance learning and application.

Comprehensive Curriculum Covering Essential Financial Topics

A comprehensive curriculum is crucial. It covers a range of topics like budgeting, saving, investing, and credit management. Each topic is vital to building a solid financial foundation.

Here is a list of essential financial topics:

- Budgeting: Creating and maintaining a budget.

- Saving: Importance of emergency funds and saving strategies.

- Investing: Basics of stocks, bonds, and mutual funds.

- Credit Management: Understanding credit scores and managing debt.

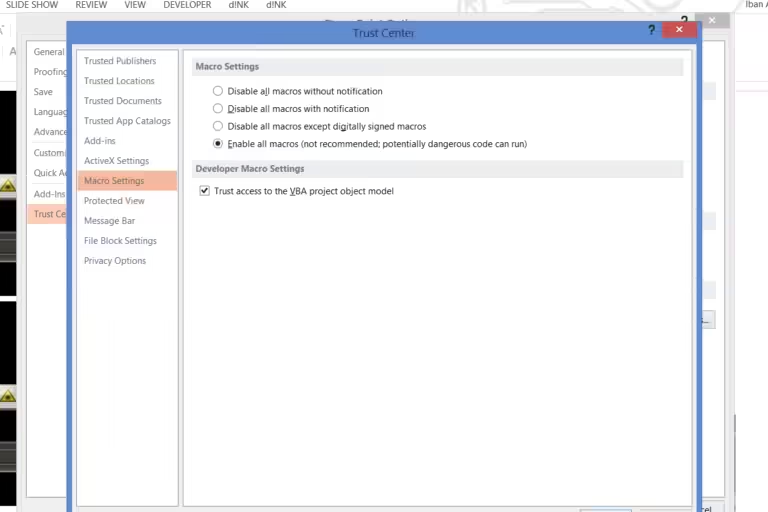

Interactive Learning Tools And Resources

Interactive tools make learning engaging and practical. These resources help users apply knowledge in real-life scenarios. Effective programs include:

- Simulations: Real-world financial simulations and games.

- Workshops: Hands-on workshops for practical learning.

- Online Resources: Access to articles, videos, and webinars.

Personalized Financial Planning And Advice

Personalized advice ensures that financial plans are tailored to individual needs. This approach considers personal goals, income, and expenses. Features include:

- One-on-One Counseling: Personal sessions with financial advisors.

- Customized Plans: Tailored budgeting and saving plans.

- Progress Tracking: Tools to track financial progress and milestones.

Support From Financial Experts And Mentors

Expert support provides guidance and mentorship. Experienced professionals offer valuable insights and advice. This support includes:

- Mentorship Programs: Pairing with experienced financial mentors.

- Expert Webinars: Sessions with financial experts for advanced learning.

- Q&A Sessions: Opportunities to ask experts specific questions.

Programs like Perpay integrate these features, helping users manage their finances better. Perpay offers a marketplace, credit card, and credit-building services. Their interest-free payments and rewards program are additional benefits. Visit Perpay for more details.

How Financial Literacy Programs Benefit Different Audiences

Financial literacy programs play a crucial role in enhancing the financial well-being of various audiences. These programs provide essential knowledge and skills to manage finances effectively. Understanding how these programs benefit different groups can highlight their importance and encourage participation.

Empowering Young Adults With Financial Knowledge

Financial literacy programs equip young adults with crucial financial skills. These skills include budgeting, saving, and understanding credit. Young adults learn the importance of building and maintaining good credit. They also gain knowledge on how to avoid debt and make informed financial decisions. Programs like Perpay offer young adults tools to shop, build credit, and manage payments seamlessly.

Helping Families Achieve Financial Stability

Families benefit significantly from financial literacy programs. These programs teach budgeting and saving for future needs. Families learn to manage expenses, avoid debt, and plan for emergencies. They also discover the advantages of using financial services like Perpay. Perpay helps families shop for essential items with interest-free payments and build credit through automatic paycheck deductions.

Guiding Entrepreneurs In Managing Business Finances

Entrepreneurs need sound financial knowledge to manage their business finances effectively. Financial literacy programs provide guidance on budgeting, cash flow management, and investment strategies. Entrepreneurs learn to differentiate between personal and business expenses. Programs like Perpay offer tools to manage business purchases and improve credit, supporting business growth and financial stability.

Supporting Seniors In Retirement Planning

Seniors benefit from financial literacy programs by learning to manage their retirement funds. These programs offer insights into social security, pensions, and investment options. Seniors can plan for healthcare costs and living expenses post-retirement. Using services like Perpay, seniors can manage their purchases and payments without incurring interest or fees, ensuring financial security.

For more details, visit Perpay’s official website.

Pricing And Affordability Of Financial Literacy Programs

Understanding the pricing and affordability of financial literacy programs is crucial. These programs vary in cost, offering options for every budget. Below, we explore free and low-cost programs, comprehensive paid programs, and available scholarships and financial aid.

Free And Low-cost Program Options

Many organizations offer free or low-cost financial literacy programs. These are ideal for those on a tight budget. Here are some options:

- Non-Profit Organizations: Many non-profits provide free workshops and seminars.

- Online Resources: Websites and apps offer free courses and tools.

- Community Programs: Local libraries and community centers often host free classes.

These programs are excellent starting points. They provide essential knowledge without financial strain.

Investment In Comprehensive Paid Programs

For more in-depth learning, consider investing in comprehensive paid programs. These usually offer:

- Extensive Curriculum: Detailed modules covering a wide range of topics.

- Expert Instructors: Access to professionals with real-world experience.

- Interactive Learning: Tools, quizzes, and interactive sessions for better engagement.

While these programs require a financial commitment, they offer significant value. They provide thorough education that can have long-term benefits.

Scholarships And Financial Aid Availability

Scholarships and financial aid can make these programs more accessible. Here are some options:

- Educational Grants: Many institutions offer grants for financial literacy education.

- Non-Profit Scholarships: Some non-profits provide scholarships for low-income individuals.

- Employer Sponsorships: Check if your employer offers sponsorships or reimbursements for such programs.

Exploring these options can reduce costs significantly, making quality education attainable.

Pros And Cons Of Financial Literacy Programs

Financial literacy programs are designed to educate individuals on managing money, budgeting, saving, and investing. These programs can have significant impacts on financial well-being. Below, we will explore the advantages and limitations of such programs, as well as some real-world success stories.

Advantages Of Structured Financial Education

Structured financial education offers several benefits that help individuals and communities:

- Improved Financial Management: Learners understand budgeting and saving better.

- Reduced Debt: Participants often reduce their debt levels significantly.

- Increased Savings: Savings rates tend to increase with financial education.

- Enhanced Credit Scores: Programs like Perpay help build and improve credit scores.

- Better Financial Decisions: Informed individuals make smarter investment choices.

For example, the Perpay Credit Card allows users to shop with a $1,000 credit limit, pay over time, and improve their credit scores without interest or fees. Such features highlight the practical benefits of financial education tools.

Potential Limitations And Challenges

Despite their benefits, financial literacy programs can face several challenges:

| Challenge | Description |

|---|---|

| Accessibility: | Not everyone has access to these programs due to location or cost. |

| Engagement: | Keeping participants engaged over time can be difficult. |

| Implementation: | Applying learned concepts in real life can be challenging. |

| Resource Limitation: | Programs may lack sufficient resources or qualified instructors. |

For instance, despite Perpay’s positive reviews for fast shipping and excellent customer service, it may not be available in all states, limiting its accessibility.

Real-world Success Stories

Real-world examples illustrate the impact of financial literacy programs:

- Perpay: Many users report an average credit score increase of 36 points within the first 3 months of using Perpay.

- User Testimonials: Positive feedback highlights improved credit scores and simplified payment processes.

- Convenient Payments: Automatic paycheck deductions have helped users manage their finances better.

These success stories showcase how structured financial education and tools like Perpay can lead to significant financial improvements.

Recommendations For Choosing The Right Financial Literacy Program

Finding the right financial literacy program can make a significant difference in your financial journey. Below are some key recommendations to help you make an informed decision.

Identifying Your Financial Goals And Needs

First, outline your financial goals and needs. Are you looking to build a positive credit history, manage debt, or simply learn how to budget effectively? Identifying these objectives will help you narrow down programs that align with your goals.

- Short-term goals: Budgeting, savings

- Long-term goals: Retirement planning, investing

- Credit-related goals: Improving credit score, managing credit cards

Evaluating Program Content And Quality

Not all programs are created equal. Evaluate the content and quality of the program by examining the curriculum, teaching methods, and resources available.

| Aspect | What to Look For |

|---|---|

| Curriculum | Comprehensive coverage of financial topics |

| Teaching Methods | Interactive, engaging, and easy-to-follow lessons |

| Resources | Workbooks, online tools, and real-life case studies |

Considering Program Format And Accessibility

Consider the program format and accessibility. Do you prefer online courses, in-person workshops, or a hybrid model? Ensure the program fits your schedule and learning style.

- Online: Flexible, self-paced

- In-person: Structured, interactive

- Hybrid: A mix of both

Reading Reviews And Testimonials

Finally, read reviews and testimonials to gauge the program’s effectiveness. Look for feedback on user experience, success stories, and overall satisfaction.

Positive reviews often highlight:

- Improved credit scores

- Effective budgeting strategies

- Enhanced financial knowledge

For example, Perpay has received positive reviews for its fast shipping, improved credit scores, and excellent customer service.

Conclusion: Taking The First Step Towards Financial Empowerment

Financial literacy programs are crucial in providing individuals with the knowledge and skills needed to make informed financial decisions. These programs empower people to take control of their financial future, leading to stability and growth. Let’s explore some key aspects of starting this journey.

Setting Realistic Financial Goals

Setting realistic financial goals is the foundation of financial empowerment. Start by assessing your current financial situation. Identify your income, expenses, and savings. This will help you understand where you stand financially.

Next, define your financial goals. These could include saving for emergencies, paying off debt, or planning for retirement. Be specific and set achievable targets. For instance, aim to save a certain amount each month or reduce credit card debt by a specific percentage.

Creating a budget is essential. It helps you allocate funds towards your goals and track your progress. Use tools or apps to simplify this process. Remember, small steps today lead to significant financial security tomorrow.

Continuing Education And Lifelong Learning

Financial literacy is not a one-time achievement. It’s a continuous journey. Stay informed about financial trends and updates. Subscribe to financial newsletters, attend workshops, or join online courses. Websites like Perpay offer valuable resources and tools to help you stay educated.

Engage with financial communities. Share experiences and learn from others. This collective knowledge can provide insights into various financial strategies. Regularly reviewing your financial plan ensures it remains relevant and effective.

Invest in self-education. Read books, listen to podcasts, or watch webinars on financial management. The more you learn, the better equipped you’ll be to make sound financial decisions.

Encouraging A Culture Of Financial Literacy

Promote financial literacy within your community. Share your knowledge with family and friends. Encourage discussions about money management. This helps break the stigma around financial conversations.

Support local financial education programs. Volunteer or donate to organizations that provide financial literacy resources. Creating a financially literate community benefits everyone.

Implement financial literacy in schools. Advocate for integrating financial education into the curriculum. Early exposure to financial concepts prepares the younger generation for future financial responsibilities.

Use social media platforms to spread awareness. Share articles, tips, and success stories. Engaging in online discussions can inspire others to take control of their finances.

By fostering a culture of financial literacy, we collectively move towards a more financially secure and empowered society.

:max_bytes(150000):strip_icc()/FinancialLiteracy_Final_4196456-74c34377122d43748ed63ef46a285116.jpg)

Frequently Asked Questions

What Are Financial Literacy Programs?

Financial literacy programs educate individuals on managing personal finances. They cover budgeting, saving, investing, and understanding financial products. These programs aim to improve financial decision-making skills.

Why Are Financial Literacy Programs Important?

Financial literacy programs are important because they empower people to make informed financial decisions. They help individuals avoid debt, plan for the future, and achieve financial stability.

Who Can Benefit From Financial Literacy Programs?

Anyone can benefit from financial literacy programs. They are useful for students, young professionals, families, and retirees. These programs provide valuable financial knowledge for every stage of life.

What Topics Do Financial Literacy Programs Cover?

Financial literacy programs cover various topics, including budgeting, saving, investing, credit management, and retirement planning. They provide comprehensive financial education.

Conclusion

Financial literacy programs empower individuals to manage their finances better. They provide essential knowledge and skills. Such programs lead to improved financial decisions. They also reduce financial stress and enhance economic stability. For those looking to improve their credit score, Perpay offers a unique solution. Perpay allows users to shop, build credit, and pay over time. By participating in these programs, individuals can achieve financial freedom. Start your journey toward financial literacy today.