Financial Literacy: Unlock Your Path to Financial Freedom

Financial literacy is more important now than ever before. It empowers individuals to make informed financial decisions.

Understanding how to manage money, credit, and debt can be challenging, especially for those new to personal finance. This blog post aims to demystify financial literacy by offering practical advice and tools to help you take control of your financial future. Whether you want to improve your credit score, budget better, or make smarter investments, learning the basics of financial literacy is the first step. One tool that can support you on this journey is Credit Sesame. With its free daily credit score access and personalized recommendations, Credit Sesame can help you achieve your financial goals. Learn more about Credit Sesame here.

Introduction To Financial Literacy

Understanding financial literacy is key to managing money effectively. It involves knowledge and skills that help individuals make informed financial decisions. Below, we explore what financial literacy is and why it is crucial.

What Is Financial Literacy?

Financial literacy refers to the ability to understand and use various financial skills. These include personal financial management, budgeting, and investing. It also involves knowing how to utilize financial services and products like Credit Sesame.

Being financially literate means you can read and understand financial reports, credit scores, and other financial documents. You can also make decisions that improve your financial well-being.

Why Financial Literacy Is Important

Financial literacy is essential for several reasons. Firstly, it helps individuals manage their money more efficiently. By understanding how to budget, save, and invest, people can achieve their financial goals.

Secondly, it helps in improving credit scores. Tools like Credit Sesame offer free access to credit scores and personalized actions to improve them. A good credit score is crucial for securing loans and getting favorable interest rates.

Moreover, financial literacy promotes security. Knowing how to protect personal data and understanding the terms and conditions of financial products minimizes the risk of fraud. Services like Credit Sesame use 256-bit encryption to ensure data protection.

Lastly, financial literacy saves time and money. For instance, Credit Sesame helps users find credit offers with high approval odds, saving them the hassle of multiple applications.

Product Summary: Credit Sesame

Credit Sesame is a free service designed to help users understand and improve their credit scores. It offers daily credit score access, personalized actions, and high-approval credit offers.

| Main Features | Benefits |

|---|---|

|

|

Improving financial literacy can lead to better financial stability and success. Using tools like Credit Sesame can help on this journey.

Key Concepts Of Financial Literacy

Understanding the key concepts of financial literacy is essential for managing your money effectively. The core concepts include budgeting and saving, understanding credit and loans, investing basics, and retirement planning. Mastering these areas can help you achieve financial stability and reach your financial goals.

Budgeting And Saving

Creating a budget involves tracking your income and expenses to ensure you live within your means. Start by listing all your sources of income, then categorize your expenses into needs and wants. Allocate a portion of your income towards savings. Use the 50/30/20 rule as a guideline: 50% for needs, 30% for wants, and 20% for savings.

| Category | Percentage |

|---|---|

| Needs | 50% |

| Wants | 30% |

| Savings | 20% |

Saving money regularly helps build an emergency fund and prepares you for unexpected expenses. Aim to save at least three to six months’ worth of living expenses.

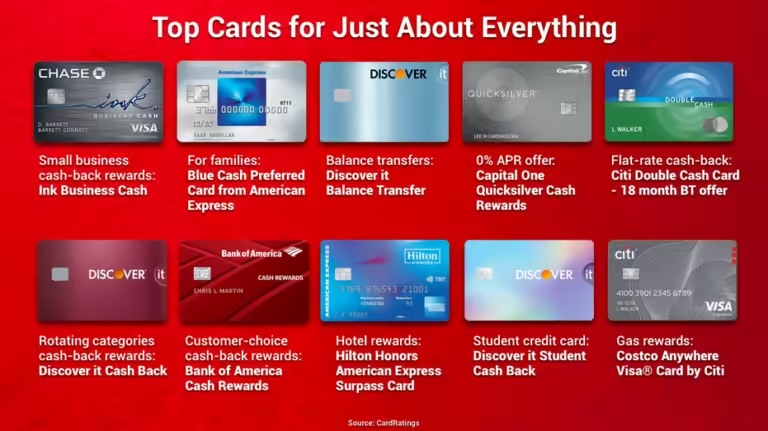

Understanding Credit And Loans

Credit and loans are essential tools for financing large purchases and building credit history. A good credit score can help you secure better loan terms and interest rates.

Credit Sesame offers a free service to check your credit score daily and understand the factors impacting it. The service provides personalized actions to improve your credit score and high-approval credit offers based on your profile. Sign up for Credit Sesame to monitor your credit score and find the best credit offers.

- Daily Credit Score Access: Monitor your score and changes.

- Personalized Actions: Receive tailored recommendations to improve your score.

- High-Approval Offers: Find credit offers with high chances of approval.

Investing Basics

Investing involves putting your money into assets like stocks, bonds, or real estate to grow your wealth over time. Start by understanding the different types of investments and their risks. Diversify your portfolio to spread risk and increase potential returns.

Consider these investment strategies:

- Stocks: Ownership in a company, potential for high returns.

- Bonds: Loans to governments or corporations, lower risk and returns.

- Real Estate: Property investment, potential for rental income and appreciation.

Start investing early to take advantage of compound interest, which can significantly grow your investments over time.

Retirement Planning

Planning for retirement involves saving and investing to ensure you have enough money to support yourself in your later years. Start by setting retirement goals and estimating how much you need to save.

Consider these retirement savings options:

- 401(k): Employer-sponsored plan with potential matching contributions.

- IRA: Individual Retirement Account with tax advantages.

- Roth IRA: Contributions are made with after-tax dollars, withdrawals are tax-free.

Contribute regularly to your retirement accounts and increase contributions as your income grows. Review your retirement plan periodically to ensure you are on track to meet your goals.

Tools And Resources For Improving Financial Literacy

Improving financial literacy is a crucial step towards achieving financial stability and independence. There are various tools and resources available that can help individuals understand and manage their finances better. In this section, we will explore some of the most effective tools and resources that can aid in improving financial literacy.

Financial Education Courses

Enrolling in financial education courses is a great way to build a strong foundation in personal finance. Many institutions and online platforms offer courses that cover topics like budgeting, investing, and debt management. These courses are designed to provide comprehensive knowledge and practical skills for managing money effectively.

- Coursera: Offers courses from top universities and institutions.

- Udemy: Provides a wide range of affordable courses on personal finance.

- Khan Academy: Free courses on finance and economics.

Books And Online Resources

Reading books and exploring online resources can greatly enhance financial literacy. Books by renowned authors provide in-depth insights and practical advice on various financial topics.

- Rich Dad Poor Dad by Robert Kiyosaki: A classic on financial education.

- The Total Money Makeover by Dave Ramsey: Focuses on budgeting and debt reduction.

- Investopedia: Comprehensive online resource for financial terms and concepts.

Financial Advisors And Coaches

Seeking advice from financial advisors and coaches can provide personalized guidance tailored to individual financial situations. These professionals can help with planning, investing, and managing finances effectively.

- Certified Financial Planners (CFP): Professionals certified to provide financial planning advice.

- Financial Coaches: Offer guidance on budgeting, saving, and debt management.

- Credit Sesame: Provides personalized actions to improve credit scores.

Apps And Software For Financial Management

Utilizing apps and software for financial management can simplify tracking and managing finances. These tools offer features like budgeting, expense tracking, and financial goal setting.

- Mint: Free budgeting app that tracks expenses and savings.

- YNAB (You Need A Budget): Helps users gain control of their money with proactive budgeting.

- Credit Sesame: Monitors credit scores and provides personalized recommendations.

Improving financial literacy is a continuous journey, and leveraging these tools and resources can make the process more manageable and effective.

Benefits Of Financial Literacy

Financial literacy is crucial for managing personal finances effectively. Understanding financial principles can significantly impact your financial well-being. Here are the key benefits of financial literacy:

Achieving Financial Independence

Financial literacy helps you achieve financial independence. Knowing how to manage money allows you to save and invest wisely. This knowledge reduces reliance on loans and credit. Over time, it leads to financial freedom.

Reducing Financial Stress

Understanding personal finance reduces financial stress. Knowing where your money goes helps you budget better. You can avoid unnecessary debt and create an emergency fund. This financial cushion offers peace of mind during unexpected events.

Improving Decision Making

Financial literacy improves decision-making skills. You learn to evaluate investment options and understand risks. This knowledge helps you make informed choices. Your decisions align with your long-term goals, leading to better financial outcomes.

Building Wealth Over Time

With financial literacy, you can build wealth over time. Knowing how to invest and save properly grows your assets. Understanding compound interest and market trends maximizes your wealth. Over years, these strategies create substantial financial growth.

Credit Sesame is a great tool for improving financial literacy. It offers:

- Daily Credit Score Access: Check your credit score daily and monitor changes.

- Personalized Actions: Receive tailored recommendations to improve your credit score.

- High-Approval Offers: Find credit offers with the highest chances of approval.

- Credit Builder: Build credit using everyday purchases with Sesame Cash.

Visit Credit Sesame to learn more and start your journey towards financial literacy today.

Common Challenges In Gaining Financial Literacy

Understanding finances can be tough. Many face common challenges on their journey to financial literacy. These challenges can range from dealing with incorrect information to managing past financial mistakes. Staying motivated and disciplined is another hurdle. Overcoming these obstacles is crucial for improving your financial health.

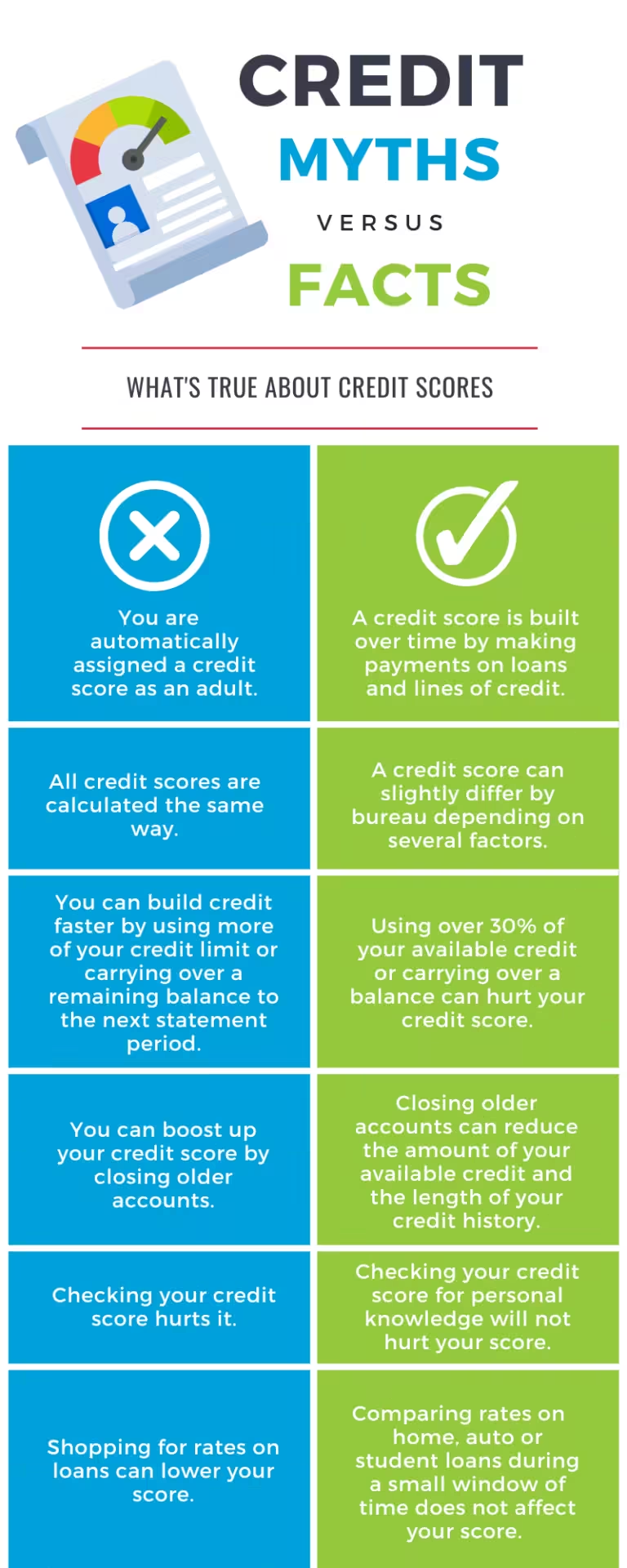

Overcoming Misinformation

Misinformation is a major barrier to financial literacy. Many people receive incorrect advice from unreliable sources. This can lead to poor financial decisions. Using trusted resources like Credit Sesame can help combat misinformation. Credit Sesame provides accurate and up-to-date financial information. It offers daily access to your credit score and report summary. This allows you to make informed decisions.

Dealing With Financial Mistakes

Everyone makes financial mistakes. It’s part of learning. The key is to learn from these mistakes and not repeat them. Credit Sesame offers personalized actions to help you improve your credit score. It also provides high-approval offers based on your credit profile. These features can guide you in making better financial choices.

Staying Motivated And Disciplined

Maintaining motivation and discipline is crucial for financial literacy. It’s easy to get discouraged. Regularly monitoring your credit score can help you stay focused. Credit Sesame provides daily credit score access. This can keep you motivated as you see your progress. Additionally, the Sesame Grade helps you understand the factors impacting your credit score. This clear grading system can make it easier to track improvements.

Using tools like the Sesame Cash prepaid debit card can also encourage discipline. This card helps you build credit with everyday purchases. It’s a practical way to improve your financial habits without a credit check or security deposit.

Practical Steps To Enhance Your Financial Literacy

Improving financial literacy can transform your financial health. Understanding how to manage money, set goals, and make informed decisions is essential. Here are practical steps to enhance your financial literacy:

Setting Clear Financial Goals

Start by setting clear financial goals. Define what you want to achieve. Whether it’s saving for a home, paying off debt, or building an emergency fund, having specific goals gives you direction.

Write down your goals and break them into smaller, achievable milestones. Use tools like Credit Sesame to monitor your progress and receive personalized actions to improve your credit score.

| Short-term Goals | Long-term Goals |

|---|---|

| Save $500 in 3 months | Buy a house in 5 years |

| Pay off $1,000 credit card debt | Build $50,000 retirement fund |

Creating And Sticking To A Budget

Creating and sticking to a budget is crucial. Track your income and expenses. Categorize your spending to identify areas where you can cut back.

- List all sources of income.

- Track daily expenses.

- Separate needs from wants.

Use the Sesame Cash prepaid debit card to manage everyday purchases. It helps you build credit without overspending. Remember, a budget is a living document; adjust it as your financial situation changes.

Regularly Reviewing And Adjusting Financial Plans

Regularly review your financial plans. Set aside time each month to assess your budget and goals. Check if you are on track and make adjustments as needed.

For example, if you notice an increase in your spending, identify the cause and find ways to cut back. Use tools like Credit Sesame to get personalized recommendations and high-approval offers that can help you stay on track.

Continuously Educating Yourself

Financial literacy is a continuous journey. Take advantage of educational resources available online. Read blogs, watch videos, and attend webinars on financial topics.

Credit Sesame offers a variety of educational resources to help you understand credit scores, credit reports, and how to improve your financial health. Keep learning and stay informed about best practices in personal finance.

Tip: Knowledge is power. The more you learn, the better decisions you can make.

Real-life Success Stories

Financial literacy can transform lives. Many individuals have achieved financial freedom by understanding how to manage money, credit scores, and debt. These real-life success stories highlight the journeys of people who turned their finances around.

Individuals Who Achieved Financial Freedom

Financial freedom is a common goal, but achieving it requires dedication and knowledge. Here are some inspiring examples:

- John Doe: John improved his credit score using Credit Sesame’s personalized actions. His score increased from 580 to 720 in just one year. This improvement allowed him to buy his first home.

- Jane Smith: Jane used the Sesame Cash prepaid debit card to build credit. She started with no credit history and now enjoys a score of 750. She can now access better loan rates and credit offers.

- Mike Johnson: Mike found high-approval credit offers through Credit Sesame. These offers helped him consolidate debt and reduce interest rates. He is now debt-free and saving for retirement.

Lessons Learned From Their Journeys

These success stories offer valuable lessons for anyone looking to improve their financial literacy:

- Consistency is Key: Regularly monitoring your credit score can help you spot errors and track progress. Credit Sesame’s daily credit score access is a helpful tool.

- Understand Your Credit: Knowing the factors that impact your credit score is crucial. The Sesame Grade provides a clear understanding with a letter grade system.

- Take Personalized Actions: Tailored recommendations can guide you in improving your credit score. Credit Sesame offers personalized actions based on your credit profile.

- Use Credit Wisely: Building credit with everyday purchases is possible. The Sesame Cash prepaid debit card and virtual secured credit card make it easy without requiring a credit check.

- Secure Your Data: Protecting your information is vital. Credit Sesame uses 256-bit encryption and does not sell personal info to third parties.

These real-life success stories demonstrate that financial literacy can lead to financial freedom. With tools like Credit Sesame, anyone can improve their financial health and achieve their goals.

Frequently Asked Questions

What Is Financial Literacy?

Financial literacy is understanding financial concepts, such as budgeting, saving, and investing. It helps individuals make informed financial decisions.

Why Is Financial Literacy Important?

Financial literacy is crucial for managing personal finances effectively. It reduces financial stress and helps achieve long-term financial goals.

How Can I Improve My Financial Literacy?

You can improve financial literacy by reading books, taking courses, and using financial planning tools. Practice regularly to build skills.

What Are The Basics Of Financial Literacy?

The basics include budgeting, saving, investing, and understanding credit. These fundamentals help manage money wisely and plan for the future.

Conclusion

Improving financial literacy takes time and effort but brings great rewards. Understanding your credit score is a key part of this journey. Credit Sesame offers free daily access to your credit score and personalized advice. Start monitoring your credit today with Credit Sesame. Boosting your financial knowledge can lead to better financial decisions. Stay committed, stay informed, and take control of your financial future. It’s a step-by-step process that pays off in the long run. Keep learning and growing every day.