Financial Health Management: 10 Tips for a Secure Future

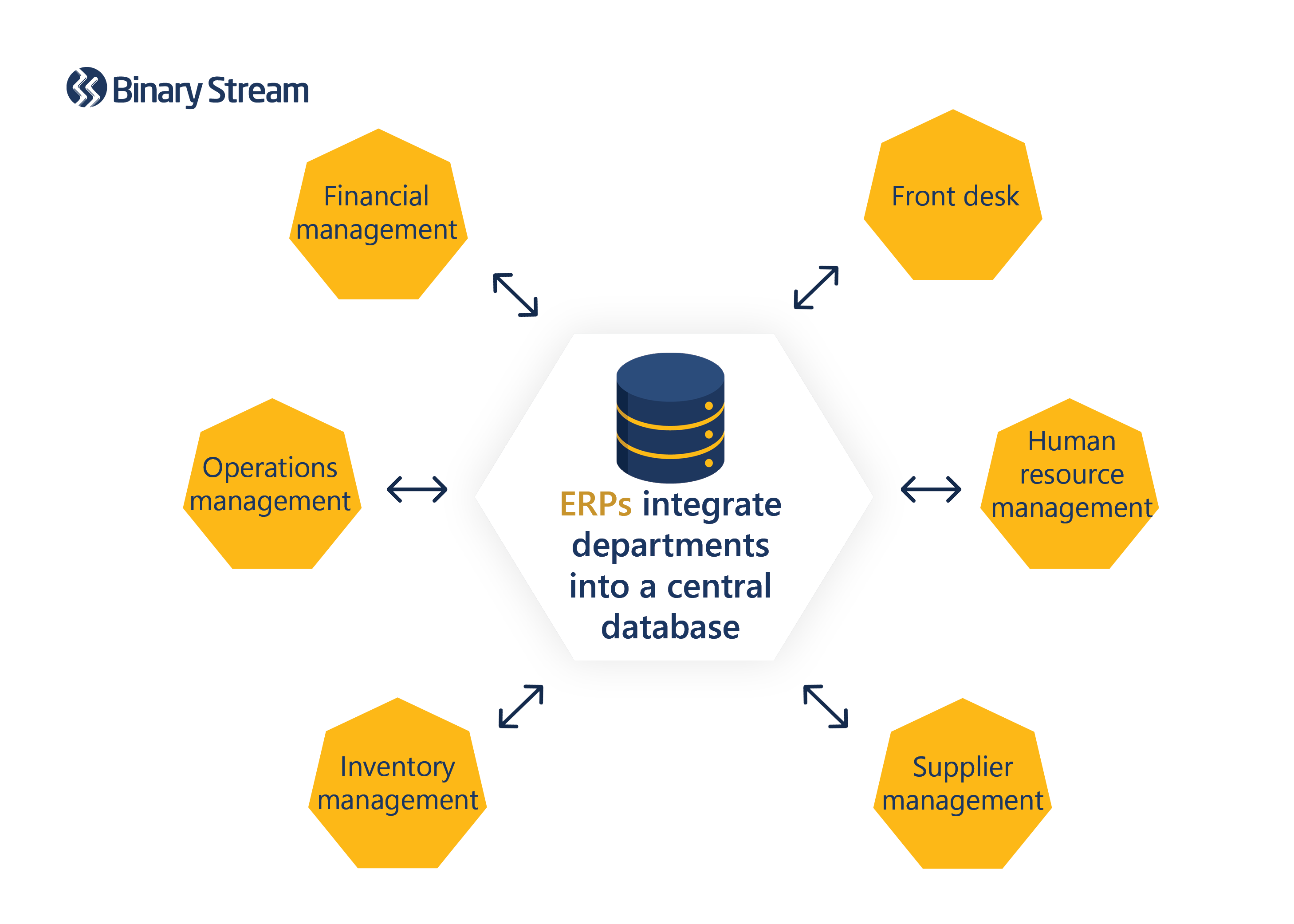

Financial health management is crucial for any business aiming for long-term success. It involves understanding and managing your business finances effectively.

Maintaining financial health means having the right tools and strategies to manage cash flow, investments, and expenses. One such tool that can help is the Revenued Business Card Visa® Commercial Card. This unique card offers revenue-based financing by purchasing future receivables, providing flexible access to working capital. Unlike traditional credit cards or loans, it adapts to your business’s performance and growth. With 24/7 access to funds and dedicated account support, it ensures your business has the financial stability it needs. For more information on how this card can benefit your business, visit the Revenued website.

Introduction To Financial Health Management

Financial health management is crucial for every individual and business. It involves managing finances to ensure stability and growth. This practice helps in making informed financial decisions, leading to a better financial future.

Understanding Financial Health

Financial health refers to the state of one’s personal or business finances. It includes various aspects like income, expenses, savings, investments, and liabilities. A good financial health means having a balanced budget, minimal debt, and adequate savings for emergencies and future goals.

To assess financial health, one must look at several indicators:

- Income vs. Expenses: Ensure your income covers all expenses with some amount left for savings.

- Debt Management: Keep debt levels manageable and ensure timely payments.

- Savings and Investments: Regularly save and invest to grow your wealth over time.

- Emergency Fund: Maintain a fund to cover unexpected expenses.

Why Financial Health Is Important

Maintaining good financial health is important for several reasons:

- Security: Good financial health provides a safety net during tough times.

- Opportunities: It enables you to seize financial opportunities and make investments.

- Stress Reduction: Reduces financial stress and improves overall well-being.

- Future Planning: Helps in planning for retirement and other long-term goals.

Businesses also benefit from good financial health. It allows them to access funding, invest in growth, and navigate economic challenges effectively.

About Revenued Business Card Visa® Commercial Card

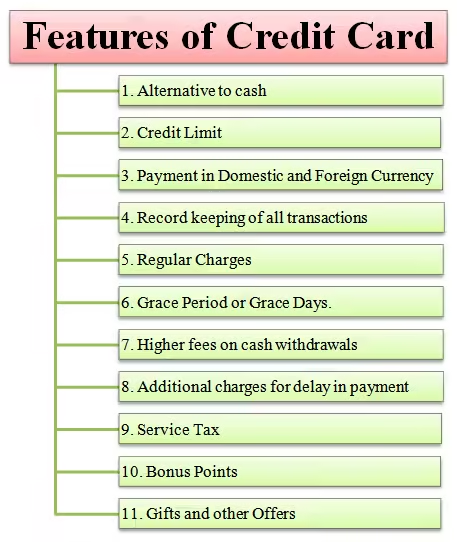

The Revenued Business Card Visa® Commercial Card offers unique revenue-based financing. This card is not a traditional credit card or loan, making it a flexible option for businesses.

Here are some main features:

- Flex Line: Provides immediate and mobile access to working capital.

- Revenue-Based Financing: Funds are provided by purchasing future receivables.

- 24/7 Access: Available through a mobile app and Visa business card.

- Spending Limits: Adjusts based on business performance and revenue growth.

- Dedicated Support: A dedicated Account Manager is provided upon approval.

Benefits of using Revenued Business Card Visa® Commercial Card include:

- Immediate Access to Working Capital

- Flexible Usage

- Growth-Oriented Financing

- User Control: Easy transaction and payment history management via an app.

- High Approval Likelihood: More likely to receive funding compared to traditional banks.

For more details or to apply, visit the Revenued website.

Tip 1: Create A Budget

Managing your financial health starts with creating a budget. A well-planned budget gives you control over your money. It helps you track spending, save for goals, and avoid debt. Let’s explore the steps to create an effective budget and the tools to help you stay on track.

Steps To Creating An Effective Budget

- List All Income: Include all sources of revenue. This could be your salary, business income, or any side gigs.

- Track Your Expenses: Break down your spending into categories. Essential expenses include rent, groceries, and utilities. Non-essential expenses are dining out, entertainment, and hobbies.

- Set Financial Goals: Define short-term and long-term goals. Short-term goals might be saving for a vacation. Long-term goals could include building an emergency fund or retirement savings.

- Allocate Funds: Assign specific amounts to each expense category. Ensure your income covers all necessary expenses first.

- Monitor and Adjust: Regularly review your budget. Adjust categories as needed based on actual spending.

Tools To Help You Budget

Several tools can simplify budgeting. Here are a few recommendations:

- Spreadsheets: Use Excel or Google Sheets. Customize templates to fit your budget needs.

- Budgeting Apps: Consider apps like Mint, YNAB (You Need A Budget), or PocketGuard. These apps automatically track expenses and provide insights.

- Financial Software: Software like Quicken offers comprehensive financial management tools. Track spending, investments, and plan for the future.

Remember, the key to successful budgeting is consistency. Regularly update and review your budget to stay on top of your financial health.

Tip 2: Build An Emergency Fund

Creating an emergency fund is crucial for financial health management. It acts as a safety net during unexpected financial crises. Let’s explore its importance and how much you should save.

Importance Of An Emergency Fund

An emergency fund ensures you have money set aside for unplanned expenses. These could be medical bills, car repairs, or sudden job loss. Without it, you might rely on high-interest loans or credit cards, leading to debt.

Having an emergency fund reduces stress and provides peace of mind. Knowing you have a financial cushion helps you focus on long-term financial goals. It also prevents disruption to your daily life and business operations.

How Much Should You Save?

The amount to save varies based on individual circumstances. Experts generally recommend setting aside 3 to 6 months’ worth of living expenses. This range provides a buffer to cover essential costs during emergencies.

To calculate the exact amount:

- List monthly essential expenses (rent, utilities, groceries).

- Multiply the total by the number of months you want to cover.

For example, if your monthly expenses are $2,000, aim for $6,000 to $12,000 in your emergency fund. Adjust this amount based on your comfort level and financial situation.

Consider using the Revenued Business Card Visa® Commercial Card to manage your business finances. It provides flexible, revenue-based financing, which can support your emergency fund. Learn more about it on the Revenued website.

| Expense Type | Amount |

|---|---|

| Rent/Mortgage | $1,200 |

| Utilities | $300 |

| Groceries | $500 |

By following these steps, you will build a robust emergency fund. This will strengthen your overall financial health.

Tip 3: Manage And Reduce Debt

Managing and reducing debt is crucial for maintaining healthy finances. By taking control of your debt, you can improve your financial stability and pave the way for future growth. Here are some effective strategies to help you manage and reduce your debt.

Strategies For Managing Debt

To effectively manage your debt, start by creating a detailed list of all your debts. Include the amounts owed, interest rates, and minimum payments. This will give you a clear picture of your financial obligations.

- Prioritize High-Interest Debt: Focus on paying off debts with the highest interest rates first. This strategy helps reduce the amount you pay in interest over time.

- Debt Consolidation: Consider consolidating multiple debts into a single loan. This can simplify your payments and may offer a lower interest rate.

- Budgeting: Create a strict budget to control your spending. Allocate a portion of your income specifically for debt repayment.

- Automate Payments: Set up automatic payments to ensure you never miss a due date. This helps avoid late fees and keeps your credit score intact.

Benefits Of Reducing Debt

Reducing debt offers numerous benefits that can enhance your financial well-being. Here are some key advantages:

- Improved Credit Score: Lowering your debt levels can boost your credit score. A higher credit score opens doors to better interest rates and financial opportunities.

- Increased Savings: With less money going towards debt payments, you can save more. This allows you to build an emergency fund or invest in your future.

- Reduced Stress: Carrying a heavy debt load can be stressful. Reducing your debt can alleviate financial pressure and improve your overall mental health.

- Financial Freedom: Being debt-free provides more financial flexibility. You can make choices based on your goals rather than debt obligations.

Managing and reducing debt is a vital step towards achieving financial health. By implementing these strategies and understanding the benefits, you can take control of your finances and secure a brighter future.

Tip 4: Save For Retirement

Saving for retirement is crucial for financial health. It ensures you have funds for a comfortable life when you stop working. Planning and saving early can help you achieve your retirement goals.

Retirement Savings Options

There are several options for saving for retirement. Here are some popular ones:

- 401(k): Offered by many employers. Contributions are pre-tax, and some employers match contributions.

- IRA: Individual Retirement Accounts. These come in two types: Traditional and Roth.

- Pension Plans: Provided by some employers, particularly in public sector jobs. Pensions provide a fixed monthly income after retirement.

- Annuities: Insurance products that provide a steady income stream in retirement.

How Much To Save For Retirement

Determining how much to save depends on several factors. Consider the following:

| Factor | Description |

|---|---|

| Current Age | The younger you start, the less you need to save monthly. |

| Retirement Age | Decide when you plan to retire. This affects how long you need to save. |

| Expected Expenses | Estimate your monthly expenses in retirement. Include housing, healthcare, and leisure. |

| Income Sources | Consider other income sources like Social Security, pensions, or rental income. |

A general rule of thumb is to save at least 15% of your income. Adjust based on your specific situation.

Tip 5: Invest Wisely

Investing is a key aspect of financial health management. Wise investment choices can grow your wealth, ensure financial security, and help achieve long-term goals. Let’s explore some essential aspects of wise investing.

Types Of Investments

Understanding different types of investments helps in making informed decisions. Here are some common investment options:

- Stocks: Buying shares in companies. Higher risk, potential for high returns.

- Bonds: Lending money to a company or government. Lower risk, steady returns.

- Mutual Funds: Pooling money with other investors to buy a mix of stocks and bonds.

- Real Estate: Buying property to rent or sell. Requires more capital, can provide passive income.

- ETFs: Exchange-Traded Funds, similar to mutual funds but traded like stocks.

- Commodities: Investing in physical goods like gold, oil, or agricultural products.

Risk Management In Investing

Managing risk is crucial in investing. Here are some strategies to mitigate risk:

- Diversification: Spread investments across different asset classes to reduce risk.

- Research: Understand the market, the company, and the investment before committing funds.

- Long-Term Perspective: Invest for the long haul to ride out market volatility.

- Risk Tolerance: Assess your ability to withstand losses and invest accordingly.

- Rebalance Portfolio: Regularly review and adjust your investment mix to stay aligned with goals.

Consider utilizing tools like the Revenued Business Card Visa® Commercial Card to manage working capital. This card offers:

- Immediate Access to Working Capital: Funds when needed most.

- Flexible Usage: Pay for only what you use.

- Growth-Oriented Financing: Financing grows with your business performance.

For more details, visit the Revenued website.

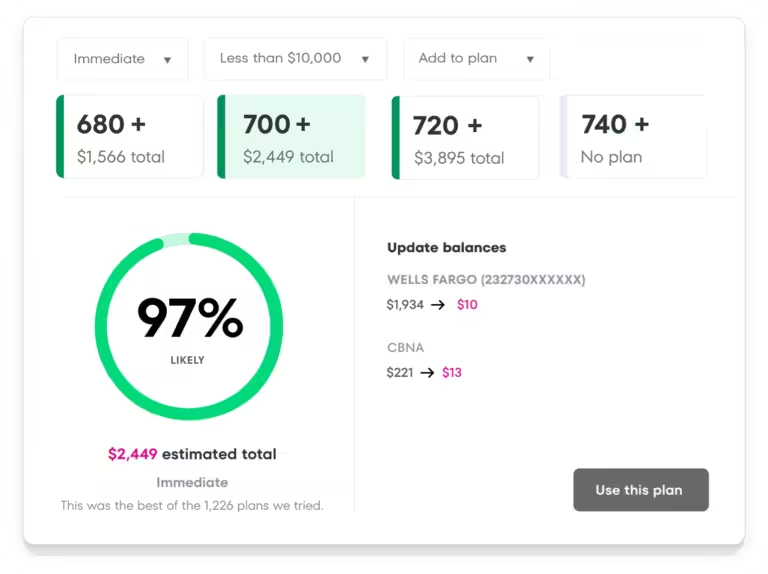

Tip 6: Monitor Your Credit Score

Maintaining a healthy credit score is crucial for your financial well-being. Monitoring your credit score helps you understand your financial status and make informed decisions. It can influence your ability to access credit and secure favorable terms.

Why Your Credit Score Matters

Your credit score reflects your creditworthiness. Lenders use it to decide if you qualify for a loan or credit card. A good score can lead to lower interest rates and better financial opportunities.

| Credit Score Range | Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Excellent |

A poor score might limit your access to credit and increase borrowing costs. Conversely, a high score enhances your financial credibility and opens doors to better financial products.

Tips For Improving Your Credit Score

- Pay your bills on time. Late payments can significantly impact your score.

- Keep your credit card balances low. High balances can negatively affect your score.

- Don’t close old credit cards. Long credit history can improve your score.

- Limit new credit applications. Too many can lower your score.

- Regularly check your credit report. Ensure there are no errors affecting your score.

Consider using financial tools like the Revenued Business Card Visa® Commercial Card to manage your business finances. It provides immediate access to working capital and adjusts spending limits based on your business performance.

By following these tips and monitoring your credit score, you can achieve better financial health and unlock more opportunities for growth.

Tip 7: Plan For Big Purchases

Planning for large purchases is crucial for maintaining your financial health. It helps you avoid debt, manage your finances effectively, and ensure you are prepared for significant expenses. Whether you are looking to buy a new car, home, or expensive equipment for your business, having a solid plan in place can make a big difference.

Setting Savings Goals

Start by setting clear savings goals. Identify the item you want to purchase and its cost. Break down the total amount into manageable monthly savings targets. This approach helps you stay focused and ensures you reach your goal without financial strain.

| Item | Cost | Monthly Savings Goal |

|---|---|---|

| Car | $20,000 | $500 |

| Home | $300,000 | $1,500 |

| Business Equipment | $10,000 | $300 |

Use tools like savings calculators and budgeting apps to track your progress. Adjust your spending habits if necessary to meet your savings targets. Consistency is key to achieving your savings goals.

Financing Options

Sometimes, saving alone might not be enough. Exploring financing options can help bridge the gap. Consider products like the Revenued Business Card Visa® Commercial Card. This card provides immediate access to working capital through a mobile app and Visa business card. It uses a revenue-based financing model, which adjusts spending limits based on your business performance and revenue growth.

- Flex Line: Access working capital instantly.

- Revenue-Based Financing: Funds are provided by purchasing future receivables.

- 24/7 Access: Manage your funds anytime, anywhere.

- Dedicated Support: Get help from a dedicated Account Manager.

The Revenued Business Card is beneficial for business owners who need quick access to funds without the constraints of traditional loans. With a high approval likelihood and a straightforward application process, it can be a valuable tool for managing significant purchases.

Planning for big purchases with a combination of disciplined saving and smart financing options can keep your financial health intact while helping you achieve your goals.

Tip 8: Protect Your Assets

Protecting your assets is essential for maintaining financial health. This involves ensuring that your investments, property, and other valuables are secure. Here are some ways to safeguard your assets.

Types Of Insurance To Consider

Insurance plays a crucial role in asset protection. Here are some types of insurance you should consider:

- Health Insurance: Covers medical expenses and protects against high costs of healthcare.

- Life Insurance: Provides financial support to your family in the event of your death.

- Homeowners Insurance: Protects your home from damage and theft.

- Auto Insurance: Covers vehicle damages and liabilities from accidents.

- Disability Insurance: Provides income if you are unable to work due to a disability.

- Business Insurance: Protects your business from various risks, including liability and property damage.

Importance Of Asset Protection

Asset protection is vital for several reasons. Here are some key points:

- Financial Security: Ensures you have funds available in case of emergencies.

- Peace of Mind: Knowing your assets are protected reduces stress and anxiety.

- Future Planning: Protecting assets helps in planning for future expenses and goals.

- Legal Safeguards: Shields your assets from potential lawsuits and claims.

One way to ensure financial security is by using a product like the Revenued Business Card Visa® Commercial Card. It provides immediate access to working capital, which can be vital for protecting your business assets.

| Feature | Description |

|---|---|

| Flex Line | Immediate access to working capital via mobile app. |

| Revenue-Based Financing | Funds provided by purchasing future receivables. |

| 24/7 Access | Funding available anytime through app and Visa card. |

| Spending Limits | Limits adjust based on business performance. |

| Dedicated Support | Account Manager available upon approval. |

In conclusion, protecting your assets is a critical part of financial health management. By considering the right insurance options and using tools like the Revenued Business Card, you can ensure your financial stability and peace of mind.

Tip 9: Stay Informed About Financial Trends

Keeping yourself updated with financial trends is essential for managing your financial health. It helps you make informed decisions, adjust strategies, and stay competitive. Understanding market shifts, new policies, and innovative financial products can significantly impact your business success.

Resources For Financial Education

To stay informed, utilize various resources. Here are some valuable ones:

- Financial News Websites: Websites like Bloomberg, Reuters, and CNBC provide the latest updates.

- Online Courses: Platforms such as Coursera and Udemy offer courses on financial management.

- Podcasts: Listen to financial experts on shows like The Dave Ramsey Show and Planet Money.

- Industry Reports: Read reports from organizations like the Federal Reserve and IMF.

- Social Media: Follow thought leaders and financial analysts on Twitter and LinkedIn.

How Staying Informed Can Help

Staying informed offers several benefits:

- Better Decision-Making: You can make timely and accurate financial decisions.

- Risk Management: Anticipate and mitigate potential financial risks effectively.

- Competitive Edge: Understand your market better and stay ahead of competitors.

- Innovative Solutions: Discover new tools like the Revenued Business Card Visa® Commercial Card for flexible financing options.

| Resource Type | Examples |

|---|---|

| News Websites | Bloomberg, Reuters, CNBC |

| Online Courses | Coursera, Udemy |

| Podcasts | The Dave Ramsey Show, Planet Money |

| Industry Reports | Federal Reserve, IMF |

| Social Media | Twitter, LinkedIn |

Tip 10: Seek Professional Advice

Managing your financial health can sometimes be overwhelming. It’s essential to understand when to seek professional advice. A financial advisor can provide you with personalized strategies and insights that cater to your unique financial situation.

When To Consult A Financial Advisor

- Major Life Changes: Significant events like marriage, divorce, or having a baby.

- Investment Decisions: When you need help with investing or saving for retirement.

- Complex Financial Situations: Handling large inheritances or managing multiple income sources.

- Debt Management: Assistance in creating a plan to pay off debts effectively.

Benefits Of Professional Financial Advice

| Benefit | Explanation |

|---|---|

| Personalized Financial Plan | Customized strategies tailored to your financial goals. |

| Expert Insights | Professional advisors offer advice based on experience and market knowledge. |

| Risk Management | Help in identifying and mitigating financial risks. |

| Informed Decisions | Access to expert opinions ensures informed financial choices. |

For businesses, seeking professional advice can also mean exploring financial products like the Revenued Business Card Visa® Commercial Card. It offers unique financing options based on revenue, providing immediate access to working capital without being a traditional loan or credit card.

With features like a Flex Line and adjustable spending limits, it is designed to grow with your business. This makes it a valuable tool for managing business finances effectively.

For more details about the Revenued Business Card Visa® Commercial Card, visit the Revenued website.

Frequently Asked Questions

What Is Financial Health Management?

Financial health management involves monitoring and improving your financial status. It includes budgeting, saving, investing, and managing debt. This helps achieve long-term financial goals.

How Can I Improve My Financial Health?

To improve financial health, create a budget, reduce expenses, and save regularly. Invest wisely and pay off debt promptly. Regularly review financial goals.

Why Is Budgeting Important For Financial Health?

Budgeting helps track income and expenses, ensuring you live within your means. It identifies areas to cut costs and save money, improving financial stability.

What Are The Benefits Of Managing Debt?

Managing debt reduces financial stress and improves credit scores. It frees up money for savings and investments, enhancing overall financial health.

Conclusion

Managing financial health is crucial for business success. Stay informed, plan wisely, and utilize effective tools. Consider the Revenued Business Card Visa® Commercial Card for flexible, revenue-based financing. It offers immediate access to capital, adapts to business growth, and provides dedicated support. By taking proactive steps, you can maintain financial stability and support your business goals. Remember, effective financial management is a continuous process that pays off in the long run.