Financial Health: Essential Tips for a Prosperous Future

Financial health is crucial for achieving personal and business goals. It involves managing income, expenses, savings, and investments effectively.

In today’s fast-paced world, understanding financial health is more important than ever. It goes beyond just having enough money. Financial health means having a stable income, manageable debts, and a safety net for emergencies. It also involves planning for the future, like retirement and major life events. Good financial health can reduce stress and improve quality of life. This blog will explore essential aspects of financial health and provide tips to enhance your financial well-being. Whether you are an individual or a business owner, maintaining good financial health is key to long-term success. Discover how tools like Firstbase can simplify financial management and help you achieve your goals.

Introduction To Financial Health

Maintaining good financial health is crucial for a stable and prosperous life. It involves managing your finances effectively, ensuring that your expenses don’t exceed your income, and saving for future needs. In this section, we’ll delve into the concept of financial health and why it is essential for everyone.

Understanding Financial Health

Financial health refers to the state of one’s personal financial situation. It includes the ability to meet financial obligations, manage debt, and save for the future. Here are some key aspects of financial health:

- Income vs. Expenses: Ensure your income covers your expenses.

- Debt Management: Keep your debt at manageable levels.

- Savings: Regularly save for emergencies and future goals.

- Investments: Grow your wealth through wise investments.

By focusing on these areas, you can improve your financial health and achieve financial stability.

The Importance Of Financial Health For A Prosperous Future

Good financial health is essential for a prosperous future. Here are some reasons why:

- Stress Reduction: Financial stability reduces stress and anxiety.

- Emergency Preparedness: Savings help you handle unexpected expenses.

- Better Opportunities: A strong financial position opens doors to better opportunities.

- Retirement Security: Ensuring you save enough for a comfortable retirement.

Maintaining financial health allows you to enjoy life without constant financial worries. It gives you the freedom to pursue your goals and dreams.

For entrepreneurs, tools like Firstbase One can be incredibly beneficial. Firstbase One simplifies business operations, ensuring you stay compliant, manage taxes, and keep accurate financial records. This, in turn, contributes to better financial health for your business.

With features like incorporation, mailroom services, and accounting, Firstbase One provides an all-in-one platform to streamline your business needs. By automating these processes, you save time and resources, allowing you to focus on growing your business.

Investing in tools that enhance your financial health is an investment in your future. Use these tools to build a strong financial foundation for yourself and your business.

Assessing Your Current Financial Situation

Understanding your financial health starts with a comprehensive assessment of your current situation. This involves evaluating various aspects of your finances to ensure you have a clear picture of where you stand. Below, we break down the key areas you need to focus on.

Evaluating Income And Expenses

Begin by examining your income. This includes your salary, business profits, rental income, and any other sources of revenue. Create a list or a table to make it easier to track.

| Income Source | Amount ($) |

|---|---|

| Salary | 3000 |

| Business Profits | 1500 |

| Rental Income | 800 |

Next, list your expenses. These include rent, utilities, groceries, transportation, and other costs. Tracking these will help you understand where your money goes.

| Expense Type | Amount ($) |

|---|---|

| Rent | 1000 |

| Utilities | 200 |

| Groceries | 400 |

| Transportation | 150 |

Understanding Your Net Worth

To understand your net worth, calculate the difference between your assets and liabilities. Assets include cash, investments, and property. Liabilities are debts like loans and credit card balances.

Use the formula: Net Worth = Total Assets – Total Liabilities

- Assets

- Cash: $5000

- Investments: $12000

- Property: $150000

- Liabilities

- Loans: $20000

- Credit Card Debt: $3000

Your net worth helps you understand your overall financial standing.

Identifying Financial Strengths And Weaknesses

Analyze your income, expenses, assets, and liabilities to identify your financial strengths and weaknesses. Are you saving enough? Do you have high debt?

- Strengths:

- Consistent income

- Strong savings

- Investment growth

- Weaknesses:

- High debt

- Overspending on non-essentials

- Lack of emergency fund

By identifying these areas, you can create a plan to improve your financial health.

Creating A Comprehensive Budget

Maintaining strong financial health starts with creating a comprehensive budget. A budget helps you manage your income and expenses, ensuring you meet your financial goals. It can also reduce stress and improve your financial well-being.

Steps To Create An Effective Budget

Follow these steps to create an effective budget:

- Identify Your Income: List all sources of income, including salary, side gigs, and investments.

- List Your Expenses: Break down expenses into categories like housing, groceries, transportation, and entertainment.

- Set Financial Goals: Define short-term and long-term goals, such as saving for a vacation or building an emergency fund.

- Allocate Funds: Assign a specific amount of money to each expense category, prioritizing essential expenses and savings.

- Monitor and Adjust: Regularly review your budget and make adjustments as needed to stay on track.

Tracking And Adjusting Your Budget

Consistently tracking your spending is crucial to maintaining an effective budget. Here are some tips:

- Keep Receipts: Save receipts from all purchases to track your spending.

- Review Statements: Check your bank and credit card statements to ensure all transactions are accounted for.

- Compare to Budget: Compare your actual spending to your budgeted amounts monthly.

- Adjust as Needed: If you overspend in one category, adjust other categories to balance your budget.

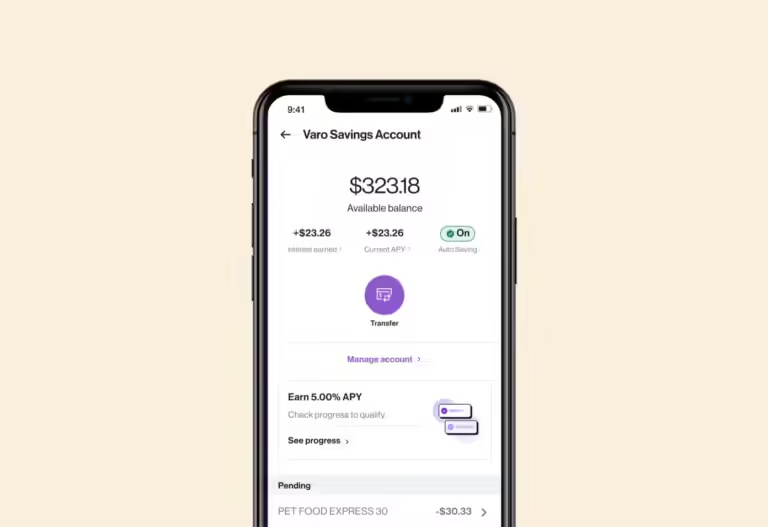

Tools And Apps For Budget Management

Using tools and apps can simplify budget management. Here are some popular options:

| Tool/App | Description |

|---|---|

| Mint | A free app that tracks expenses, sets budgets, and provides financial insights. |

| YNAB (You Need A Budget) | Helps you plan your spending and build better financial habits. |

| Firstbase One | An all-in-one startup operating system that includes accounting and bookkeeping features. |

These tools can help you stay organized and manage your budget more effectively.

Building An Emergency Fund

Creating an emergency fund is essential for financial stability. It acts as a safety net during unforeseen circumstances. This section will guide you on why it’s crucial, how much to save, and strategies for building it effectively.

Why An Emergency Fund Is Crucial

An emergency fund ensures financial security. It helps cover unexpected expenses without relying on credit cards or loans. Key reasons include:

- Unexpected Medical Bills: Covers unforeseen medical expenses.

- Job Loss: Provides a cushion during unemployment.

- Home or Car Repairs: Manages sudden repair costs.

How Much Should You Save?

Determining how much to save can vary. A general rule is:

| Monthly Expenses | Recommended Savings |

|---|---|

| 3 months | Minimum emergency fund |

| 6 months | Ideal emergency fund |

| 12 months | Optimal emergency fund |

Strategies For Building An Emergency Fund

Here are some effective strategies to build your emergency fund:

- Set a Goal: Determine the amount you need.

- Automate Savings: Set up automatic transfers to your savings account.

- Cut Unnecessary Expenses: Review and reduce non-essential spending.

- Increase Income: Consider side jobs or freelance work to boost savings.

- Monitor Progress: Regularly check your savings to stay on track.

Building an emergency fund takes time and discipline, but it is a crucial step towards financial health.

Managing Debt Effectively

Managing debt effectively is crucial for maintaining good financial health. It involves understanding the types of debt, implementing strategies to pay off debt, and avoiding common debt traps. By mastering these areas, you can achieve greater financial stability and peace of mind.

Understanding Different Types Of Debt

Not all debts are created equal. Understanding the different types of debt can help you manage them better.

| Type of Debt | Description |

|---|---|

| Credit Card Debt | High-interest debt that accumulates quickly if not paid off monthly. |

| Student Loans | Loans taken to pay for education, often with lower interest rates. |

| Mortgage | Long-term loan to purchase a home, usually with a fixed interest rate. |

| Personal Loans | Unsecured loans for various personal expenses, interest rates vary. |

Strategies For Paying Off Debt

Paying off debt requires a strategic approach. Here are some effective strategies:

- Debt Snowball Method: Pay off small debts first to build momentum.

- Debt Avalanche Method: Focus on paying off debts with the highest interest rates first.

- Consolidation: Combine multiple debts into one with a lower interest rate.

- Refinancing: Replace high-interest debt with a new loan at a lower rate.

Avoiding Debt Traps

Avoiding debt traps is essential to maintain financial health. Here are some tips:

- Create a Budget: Track your income and expenses to avoid overspending.

- Emergency Fund: Save at least three to six months of expenses to cover unexpected costs.

- Smart Borrowing: Only borrow what you can afford to pay back.

- Monitor Credit: Regularly check your credit report for errors and signs of fraud.

By understanding debt types, using effective pay-off strategies, and avoiding common traps, you can manage your debt more effectively and improve your financial health.

Saving And Investing For The Future

Maintaining your financial health involves prudent saving and smart investing. This ensures you have a secure financial future and can handle unexpected expenses. Let’s explore the importance of saving early, various investment options, and strategies to balance risk and reward.

The Importance Of Saving Early

Starting to save early is crucial for accumulating wealth over time. The power of compound interest means your savings grow faster the earlier you start. For example, saving $100 a month at an interest rate of 5% can grow significantly over 20-30 years.

Consider this table showing the growth of $100 monthly savings over different periods:

| Years of Saving | Total Savings |

|---|---|

| 10 | $15,528 |

| 20 | $41,610 |

| 30 | $79,073 |

Early savings also provide a financial cushion for emergencies, reducing the need for high-interest loans.

Investment Options And Strategies

Investing is essential for growing your wealth beyond what savings alone can achieve. There are several investment options available:

- Stocks: Buying shares in companies for potential high returns.

- Bonds: Lending money to entities in exchange for periodic interest payments.

- Mutual Funds: Pooling money with other investors to invest in a diversified portfolio.

- Real Estate: Investing in property for rental income or appreciation.

Each option has its benefits and risks. Diversification, or spreading investments across different assets, helps mitigate risks.

Balancing Risk And Reward In Investments

Balancing risk and reward is key to a successful investment strategy. Higher-risk investments like stocks can offer higher returns but also greater potential losses. Lower-risk investments like bonds provide stability but generally lower returns.

Consider these strategies to balance risk and reward:

- Asset Allocation: Divide investments among different asset categories to spread risk.

- Rebalancing: Periodically adjust your portfolio to maintain your desired risk level.

- Risk Tolerance: Understand your risk appetite and invest accordingly.

Investing involves a trade-off between risk and potential reward. Assess your financial goals and risk tolerance to make informed decisions.

Planning For Retirement

Planning for retirement is essential to ensure a secure and comfortable future. By setting clear goals, choosing the right savings plans, and maximizing benefits, you can achieve financial health in your golden years.

Setting Retirement Goals

Start by setting clear retirement goals. Consider factors like your desired lifestyle, travel plans, and healthcare needs. Ask yourself:

- When do you plan to retire?

- What will your monthly expenses be?

- How much will you need for healthcare?

Use a retirement calculator to estimate your needs. Setting specific goals helps you stay on track and measure your progress.

Retirement Savings Plans

Choosing the right retirement savings plan is crucial. Here are some options:

| Plan | Description | Benefits |

|---|---|---|

| 401(k) | Employer-sponsored plan with tax advantages. | Employer match, tax-deferred growth. |

| IRA | Individual Retirement Account for tax-deferred savings. | Flexibility, tax benefits. |

| Roth IRA | Tax-free growth and withdrawals. | Tax-free income in retirement. |

Evaluate each plan’s benefits to find the best fit for your situation.

Maximizing Social Security Benefits

To maximize your Social Security benefits, consider:

- Delaying benefits: Waiting until age 70 increases your monthly benefits.

- Working longer: More working years can boost your benefit amount.

- Coordinating with your spouse: Strategize to maximize combined benefits.

Understand the rules and how your decisions impact your benefits. This ensures you get the most out of your Social Security.

Protecting Your Financial Health

Maintaining financial health requires more than just saving money. It involves taking proactive steps to protect your finances from unforeseen risks. Let’s explore some key areas to focus on.

The Role Of Insurance

Insurance plays a critical role in protecting your financial health. It acts as a safety net during unexpected events.

- Health Insurance: Covers medical expenses and protects against high healthcare costs.

- Life Insurance: Provides financial support to your loved ones in case of your untimely death.

- Home Insurance: Protects your home and belongings against damages or theft.

- Auto Insurance: Covers vehicle repairs and liabilities in accidents.

Having the right insurance can prevent financial setbacks and give peace of mind.

Safeguarding Against Fraud And Scams

Fraud and scams can significantly damage your financial health. Here are ways to protect yourself:

- Monitor Accounts Regularly: Check bank and credit card statements for unusual activities.

- Use Strong Passwords: Create complex passwords and update them regularly.

- Be Cautious Online: Avoid sharing personal information on unsecured websites.

- Stay Informed: Educate yourself about common fraud schemes and scams.

Taking these precautions helps to safeguard your finances from potential threats.

Regular Financial Check-ups

Just like health check-ups, regular financial check-ups are essential. Here’s what you should do:

- Review Your Budget: Ensure your spending aligns with your financial goals.

- Check Your Credit Score: Monitor your credit score for any discrepancies.

- Analyze Investments: Evaluate the performance of your investments periodically.

- Update Financial Plans: Adjust your financial plans based on life changes.

Regular financial check-ups keep your financial health in top shape.

Conclusion: Steps Towards A Prosperous Financial Future

To achieve a prosperous financial future, you need to take specific steps. These steps involve understanding essential financial tips and the importance of continuous learning and adaptation. By following these guidelines, you can secure and enhance your financial health.

Recap Of Essential Tips

Here are some critical tips for maintaining and improving your financial health:

- Create a Budget: Track your income and expenses to manage your finances better.

- Save Regularly: Set aside a portion of your income for savings to build an emergency fund.

- Reduce Debt: Pay off high-interest debts first to minimize interest payments.

- Invest Wisely: Diversify your investments to spread risk and maximize returns.

- Plan for Retirement: Start saving for retirement early to take advantage of compound interest.

The Importance Of Continuous Learning And Adaptation

Financial landscapes change constantly. Therefore, staying updated and adaptable is crucial. Here’s how you can do it:

- Educate Yourself: Read financial books, attend seminars, and follow reputable financial blogs.

- Monitor Market Trends: Keep an eye on market changes to adjust your investment strategies.

- Seek Professional Advice: Consult financial advisors for personalized advice and guidance.

- Review Your Financial Plan: Regularly reassess your financial goals and strategies to ensure they align with your current situation.

By following these steps, you can confidently move towards a prosperous financial future. Remember, the key lies in staying informed and being proactive in managing your finances.

Frequently Asked Questions

What Is Financial Health?

Financial health refers to the state of your personal financial situation. It includes savings, investments, and income.

How Can I Improve Financial Health?

To improve financial health, create a budget, reduce debt, and save regularly. Also, invest wisely for the future.

Why Is Financial Health Important?

Financial health is important because it ensures stability and security. It helps you manage unexpected expenses and plan for retirement.

What Are Signs Of Good Financial Health?

Good financial health includes having an emergency fund, minimal debt, and a diverse investment portfolio. It also means consistent income.

Conclusion

Achieving financial health involves smart planning and regular monitoring. It’s vital to manage finances effectively. Tools like Firstbase can simplify this. They offer all-in-one solutions for business needs. Incorporation, bookkeeping, and tax filing become seamless. Take charge of your financial future. Use reliable tools and stay informed. Your financial health is within reach. Keep learning and stay proactive.