Financial Freedom Tips: Unlock Your Path to Wealth Today

Achieving financial freedom is a dream for many. It means having the ability to live comfortably without worrying about money.

But how can you get there? Financial freedom is not just for the wealthy. It’s attainable for anyone willing to take control of their finances. From managing debt to smart investments, there are practical steps you can follow to reach your financial goals. Understanding and improving your credit score is a crucial part of this journey. Tools like Credit Sesame can help. They provide free daily credit scores and personalized tips to improve your financial health. Check your credit score and get personalized recommendations here. Let’s explore how you can take charge of your finances and move closer to financial freedom.

Introduction To Financial Freedom

Achieving financial freedom is a goal for many. It means having enough money to cover your needs without relying on a paycheck. This freedom allows you to live life on your terms, pursue your passions, and plan for the future confidently. Let’s dive deeper into what financial freedom is and why it’s essential.

What Is Financial Freedom?

Financial freedom means having control over your finances. It involves saving, investing, and managing money wisely. You are not tied to a job solely for the paycheck. You can cover your expenses and emergencies without stress. It allows you to make choices that align with your values and goals.

Why Is Financial Freedom Important?

Financial freedom provides peace of mind. It reduces stress related to money. You can handle unexpected expenses without worry. It also allows you to retire comfortably and pursue hobbies and interests. Furthermore, it offers opportunities to help others and contribute to causes you care about.

Overview Of Financial Freedom Tips

- Create a Budget: Track your income and expenses to manage money effectively.

- Save Regularly: Build an emergency fund and save for long-term goals.

- Invest Wisely: Grow your money through smart investments.

- Manage Debt: Pay off high-interest debt and avoid unnecessary loans.

- Improve Credit Score: Use tools like Credit Sesame to monitor and improve your credit score.

- Plan for Retirement: Contribute to retirement accounts and plan for the future.

By following these tips, you can work towards achieving financial freedom. Each step brings you closer to a secure and independent financial future.

Setting Clear Financial Goals

Setting clear financial goals is crucial for achieving financial freedom. Without a defined path, it is easy to get off track. Clear goals help you prioritize your efforts, make informed decisions, and measure your progress. Here are some tips to help you set and track your financial goals.

The Importance Of Goal Setting

Financial goals give you a sense of direction and purpose. They help you focus on what is truly important. With clear goals, you can allocate your resources more effectively. This can prevent unnecessary spending and boost your savings.

- Motivation: Clear goals can motivate you to stay disciplined.

- Focus: Helps you concentrate on achieving specific targets.

- Measurable Progress: Allows you to track and measure your progress.

How To Set Smart Financial Goals

Setting goals using the SMART criteria ensures they are clear and achievable. SMART stands for:

| Criteria | Description |

|---|---|

| Specific | Clearly define what you want to achieve. |

| Measurable | Ensure you can track your progress. |

| Achievable | Set realistic goals within your reach. |

| Relevant | Align your goals with your broader financial objectives. |

| Time-bound | Set a deadline for achieving your goals. |

Tracking Your Progress

Once you have set your goals, it is important to track your progress. Regular tracking helps you stay on course and make adjustments as needed. You can use tools like Credit Sesame to monitor your credit score and get personalized recommendations.

Here are some tips for tracking your progress:

- Check your credit score regularly to ensure you are on track.

- Use a budgeting app to monitor your spending and savings.

- Review your goals monthly and adjust if necessary.

With the right tools and a clear plan, achieving financial freedom is within your reach. Stay disciplined and keep your eyes on your goals.

Creating A Budget And Sticking To It

Financial freedom begins with creating a budget and sticking to it. A budget helps you track your income and expenses, ensuring you spend less than you earn. This section will guide you through the importance of budgeting, how to create an effective budget, and tips for maintaining it.

Why Budgeting Is Crucial

Budgeting is crucial for several reasons:

- Control over Finances: A budget gives you control over your money.

- Avoid Debt: It helps you avoid unnecessary debt by keeping track of your spending.

- Financial Goals: A budget helps you save for financial goals like buying a home or retirement.

- Emergency Fund: It ensures you have an emergency fund for unexpected expenses.

Steps To Create An Effective Budget

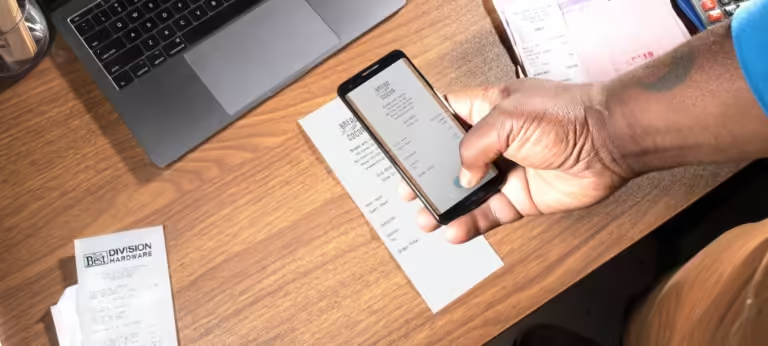

- Track Income: Start by recording all sources of income.

- List Expenses: Write down all your monthly expenses, including rent, utilities, groceries, and entertainment.

- Categorize Expenses: Divide expenses into fixed (rent, utilities) and variable (entertainment, dining out) categories.

- Set Limits: Set spending limits for each category based on your income.

- Allocate Savings: Allocate a portion of your income towards savings and emergency funds.

- Review Regularly: Review your budget regularly and adjust as needed.

Tips For Maintaining Your Budget

- Use Budgeting Tools: Use apps like Credit Sesame to monitor your expenses and credit score.

- Stay Disciplined: Stick to your budget by avoiding impulsive purchases.

- Review Monthly: Review your budget at the end of each month to track progress.

- Adjust as Necessary: Make adjustments if you notice any overspending in certain categories.

- Set Goals: Set short-term and long-term financial goals to stay motivated.

Creating and maintaining a budget is essential for achieving financial freedom. By following these steps and tips, you can take control of your finances and work towards your financial goals.

Managing Debt Effectively

Managing debt effectively is crucial for achieving financial freedom. It involves understanding different types of debt, strategies for paying off debt, and tips to avoid accumulating more debt. Let’s dive into these areas to help you manage your debt more efficiently.

Understanding Different Types Of Debt

Debt can be categorized into two main types: good debt and bad debt. Good debt includes mortgages, student loans, and business loans. These debts often have low interest rates and can increase your net worth. Bad debt includes high-interest credit card debt and personal loans used for non-essential items. Recognizing these types can help you prioritize which debts to tackle first.

| Type of Debt | Examples |

|---|---|

| Good Debt | Mortgages, Student Loans, Business Loans |

| Bad Debt | Credit Card Debt, Personal Loans for Non-Essentials |

Strategies For Paying Off Debt

Effective debt management involves using strategic methods to pay off what you owe. Here are a few strategies:

- Debt Snowball Method: Pay off the smallest debt first, then move to the next smallest.

- Debt Avalanche Method: Focus on paying off the debt with the highest interest rate first.

- Balance Transfer: Transfer high-interest debt to a lower-interest credit card.

- Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate.

Choosing the right strategy depends on your financial situation and personal preference. Assess your debts and decide which method aligns best with your goals.

Tips To Avoid Accumulating More Debt

Avoiding more debt is as important as paying off existing debt. Here are some tips to help you stay debt-free:

- Create a Budget: Track your income and expenses to see where your money goes.

- Build an Emergency Fund: Save 3-6 months’ worth of expenses to cover unexpected costs.

- Use Credit Wisely: Only charge what you can pay off in full each month.

- Monitor Your Credit: Use services like Credit Sesame to keep an eye on your credit score and report.

Implementing these tips can prevent you from falling into the debt trap and help you maintain financial stability.

Building Multiple Streams Of Income

Achieving financial freedom requires more than just saving money. One effective strategy is building multiple streams of income. This approach ensures you are not reliant on a single source of income, providing stability and growth opportunities.

Why Diversifying Income Is Important

Diversifying your income is crucial for financial security. Relying on one income source is risky. If that source fails, your financial stability is at risk. Multiple income streams can protect you from unexpected financial issues.

Additionally, having different sources of income can help you achieve your financial goals faster. It provides extra funds for investments, savings, or paying off debts. Diversification also allows you to explore new interests and skills, potentially leading to new career opportunities.

Ideas For Additional Income Streams

- Freelancing: Offer your skills online. Writing, graphic design, and programming are popular choices.

- Investing: Invest in stocks, bonds, or real estate. These can provide passive income over time.

- Online Businesses: Start a blog, YouTube channel, or e-commerce store. These can generate advertising and affiliate revenue.

- Gig Economy: Take up part-time jobs or gigs. Ride-sharing, food delivery, and pet sitting are examples.

- Rental Income: Rent out a spare room or property. Platforms like Airbnb can help find tenants.

How To Manage Multiple Income Sources

Managing multiple income sources requires organization and discipline. Here are some tips:

- Track Your Income: Use apps or spreadsheets to monitor your earnings. Ensure you know where each dollar comes from.

- Set Goals: Define clear financial goals. This helps you stay focused and measure your progress.

- Automate Savings: Set up automatic transfers to your savings or investment accounts. This ensures you save consistently.

- Use Tools: Utilize financial management tools like Credit Sesame. It helps monitor your credit score and find personalized credit offers.

- Evaluate Regularly: Review your income sources periodically. Identify what works and what needs improvement.

Building and managing multiple income streams can significantly boost your financial security and help you achieve financial freedom.

Investing For The Future

Investing is a key step toward achieving financial freedom. By making smart investments, you can grow your wealth over time and secure a stable financial future. Understanding the basics and developing a solid investment strategy can set you on the path to success.

Basics Of Investing

Before diving into investments, it’s crucial to understand the basics. Investing involves putting your money into assets that can generate returns over time. These assets might include stocks, bonds, real estate, or mutual funds. Each type of investment carries different levels of risk and return.

Here are some fundamental concepts:

- Risk and Return: Higher potential returns often come with higher risks.

- Diversification: Spreading investments across different assets to reduce risk.

- Time Horizon: The period you plan to hold an investment before cashing out.

Different Types Of Investments

There are various types of investments, each with its own advantages and disadvantages. Understanding these can help you make informed decisions.

| Type of Investment | Description | Risk Level |

|---|---|---|

| Stocks | Ownership in a company. Can provide high returns but also high risk. | High |

| Bonds | Loans to companies or governments. Generally safer with lower returns. | Low to Medium |

| Real Estate | Property investments. Can provide steady income and value appreciation. | Medium |

| Mutual Funds | Pooled funds managed by professionals. Diversified and less risky. | Varies |

How To Develop An Investment Strategy

Developing an investment strategy is crucial for achieving your financial goals. Here are steps to consider:

- Set Clear Goals: Define what you aim to achieve with your investments.

- Assess Your Risk Tolerance: Understand how much risk you can handle.

- Choose the Right Mix: Select a combination of investments that align with your goals and risk tolerance.

- Monitor and Adjust: Regularly review your portfolio and make adjustments as needed.

Remember, investing is a long-term commitment. Stay informed and make decisions based on research and your financial objectives. By following these steps, you can create a strong investment strategy and move closer to financial freedom.

Saving And Emergency Funds

Achieving financial freedom starts with smart saving and having a solid emergency fund. These fundamental steps can help you handle unexpected expenses and reduce financial stress. Let’s dive into the importance of saving, how to build an emergency fund, and tips for growing your savings.

The Importance Of Saving

Saving money is crucial for financial stability. It helps you prepare for unforeseen expenses and allows you to invest in your future. Here are some key reasons why saving is important:

- Financial Security: Savings act as a financial cushion during emergencies.

- Goal Achievement: Helps you reach financial goals like buying a house or car.

- Peace of Mind: Reduces stress knowing you have a financial backup.

How To Build An Emergency Fund

An emergency fund is essential for unexpected expenses such as medical bills or car repairs. Here’s how you can build one:

- Set a Goal: Determine how much you need. Aim for 3-6 months of living expenses.

- Start Small: Begin with a small amount each month and gradually increase it.

- Automate Savings: Set up automatic transfers to your emergency fund.

- Use a Separate Account: Keep your emergency fund in a separate, easily accessible account.

Tips For Growing Your Savings

Growing your savings requires discipline and strategic planning. Here are some effective tips:

- Budgeting: Create a budget and stick to it. Track your expenses and identify areas to cut back.

- Reduce Debt: Pay off high-interest debts to free up more money for saving.

- Save Windfalls: Put any unexpected money, like bonuses or tax refunds, into your savings.

- Use Financial Tools: Utilize financial services like Credit Sesame to monitor and improve your credit score, which can help you get better financial offers.

Minimizing Expenses And Maximizing Savings

Achieving financial freedom requires careful planning and disciplined habits. One of the most effective strategies is to minimize expenses while maximizing savings. This section will explore actionable tips to help you identify unnecessary costs, adopt frugal living practices, and boost your savings.

Identifying And Reducing Unnecessary Expenses

Start by examining your monthly expenses. Identify areas where you can cut back without affecting your quality of life. Use the table below as a guide:

| Expense Category | Potential Savings |

|---|---|

| Subscription Services | Cancel unused subscriptions. |

| Dining Out | Cook at home more often. |

| Utilities | Implement energy-saving habits. |

| Transportation | Use public transport or carpool. |

Review your bank and credit card statements to spot recurring charges. Use a service like Credit Sesame to get an overview of your spending habits.

Frugal Living Tips

Adopting a frugal lifestyle can significantly reduce your expenses. Here are some tips:

- Shop with a list to avoid impulse purchases.

- Buy generic brands instead of name brands.

- Use coupons and take advantage of sales.

- Grow your own vegetables and herbs.

- DIY repairs and maintenance tasks.

- Borrow books from the library instead of buying new ones.

These small changes can add up to substantial savings over time.

Ways To Maximize Your Savings

Once you’ve minimized your expenses, focus on maximizing your savings. Here are some strategies:

- Set up automatic transfers to a savings account.

- Use high-interest savings accounts or CDs.

- Invest in low-risk options like bonds.

- Take advantage of employer-sponsored retirement plans.

- Use cashback apps for everyday purchases.

Utilize tools like Credit Sesame to track your financial progress and find personalized credit offers to improve your financial health.

Educating Yourself Financially

Achieving financial freedom starts with understanding your finances. Educating yourself financially empowers you to make informed decisions about your money. It helps you identify and seize opportunities while avoiding common pitfalls. Below, we’ll explore why financial education is key, resources for learning about finance, and the importance of continuing financial education.

Why Financial Education Is Key

Financial education is crucial for several reasons:

- Informed Decisions: It allows you to make better financial choices.

- Budgeting: Helps you create and stick to a budget.

- Debt Management: Teaches you how to manage and reduce debt.

- Investment Knowledge: Provides insights into smart investment strategies.

- Financial Goals: Assists in setting and achieving financial goals.

Resources For Learning About Finance

There are many resources available to help you learn about finance:

| Resource | Description |

|---|---|

| Books | Many books cover personal finance, investing, and budgeting. |

| Online Courses | Platforms like Coursera and Udemy offer finance courses. |

| Websites | Sites like Credit Sesame provide credit scores and financial tips. |

| Podcasts | Listen to finance experts discuss trends and tips. |

| Workshops | Attend local or online workshops on financial topics. |

Continuing Financial Education

Financial education doesn’t stop. It’s essential to keep learning:

- Stay Updated: Follow financial news and trends.

- Advanced Courses: Enroll in advanced finance courses as your knowledge grows.

- Networking: Join finance-related groups to exchange knowledge.

- Review Finances: Regularly review and adjust your financial plans.

By continually educating yourself, you’ll be better prepared to handle financial challenges and achieve your financial goals.

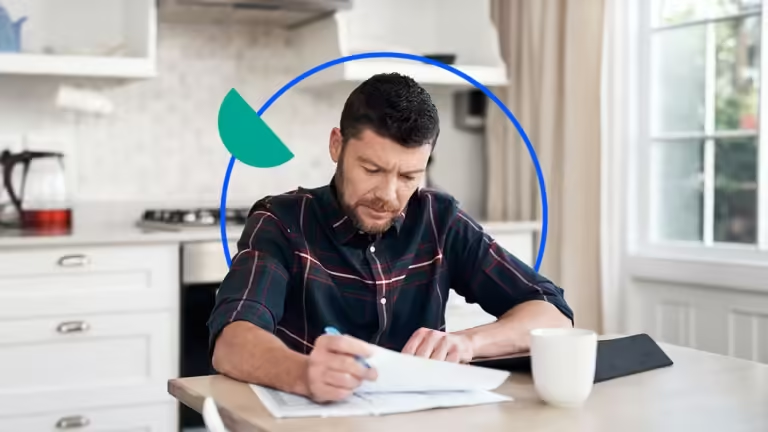

The Role Of Mindset In Achieving Financial Freedom

Achieving financial freedom is more than just numbers and investments. It starts with the right mindset. Your beliefs, attitudes, and thoughts about money can either propel you towards financial success or hold you back. Let’s explore how your mindset plays a crucial role in your journey to financial freedom.

Developing A Wealth Mindset

Developing a wealth mindset involves shifting your focus from scarcity to abundance. Believe that you can achieve financial success. Here are some steps to help you:

- Educate Yourself: Learn about personal finance. Read books, take courses, and stay informed.

- Set Clear Goals: Define what financial freedom means to you. Set specific, measurable, and realistic goals.

- Visualize Success: Imagine yourself achieving your financial goals. Visualization can boost your motivation.

- Surround Yourself with Positivity: Engage with people who support your financial goals. Avoid negativity and naysayers.

Overcoming Financial Fear And Anxiety

Financial fear and anxiety can be paralyzing. To overcome these emotions, consider the following strategies:

- Identify Your Fears: Write down your financial fears. Understanding them is the first step to overcoming them.

- Seek Professional Help: A financial advisor can provide guidance and help you create a solid plan.

- Practice Mindfulness: Techniques like meditation can reduce anxiety and help you stay focused.

- Build an Emergency Fund: Having a financial cushion can alleviate anxiety about unexpected expenses.

Cultivating Financial Discipline And Patience

Financial discipline and patience are key to achieving long-term financial freedom. Here’s how to cultivate these qualities:

| Strategy | Description |

|---|---|

| Create a Budget | Track your income and expenses. Stick to your budget to avoid overspending. |

| Automate Savings | Set up automatic transfers to your savings account. This ensures consistent saving. |

| Invest Wisely | Invest in assets that align with your financial goals. Be patient and avoid impulsive decisions. |

| Review Regularly | Regularly review your financial plan. Adjust as needed to stay on track. |

To start your journey towards financial freedom, tools like Credit Sesame can be invaluable. Credit Sesame offers daily credit scores and personalized recommendations to help you achieve your financial goals. It’s free to use and provides quick access to your credit score and report summary. With Credit Sesame’s personalized actions, you can take control of your financial future.

Conclusion: Your Path To Financial Freedom

Achieving financial freedom is a journey. It requires dedication, smart planning, and consistent effort. By following key tips and taking decisive actions today, you can pave the way to a secure financial future.

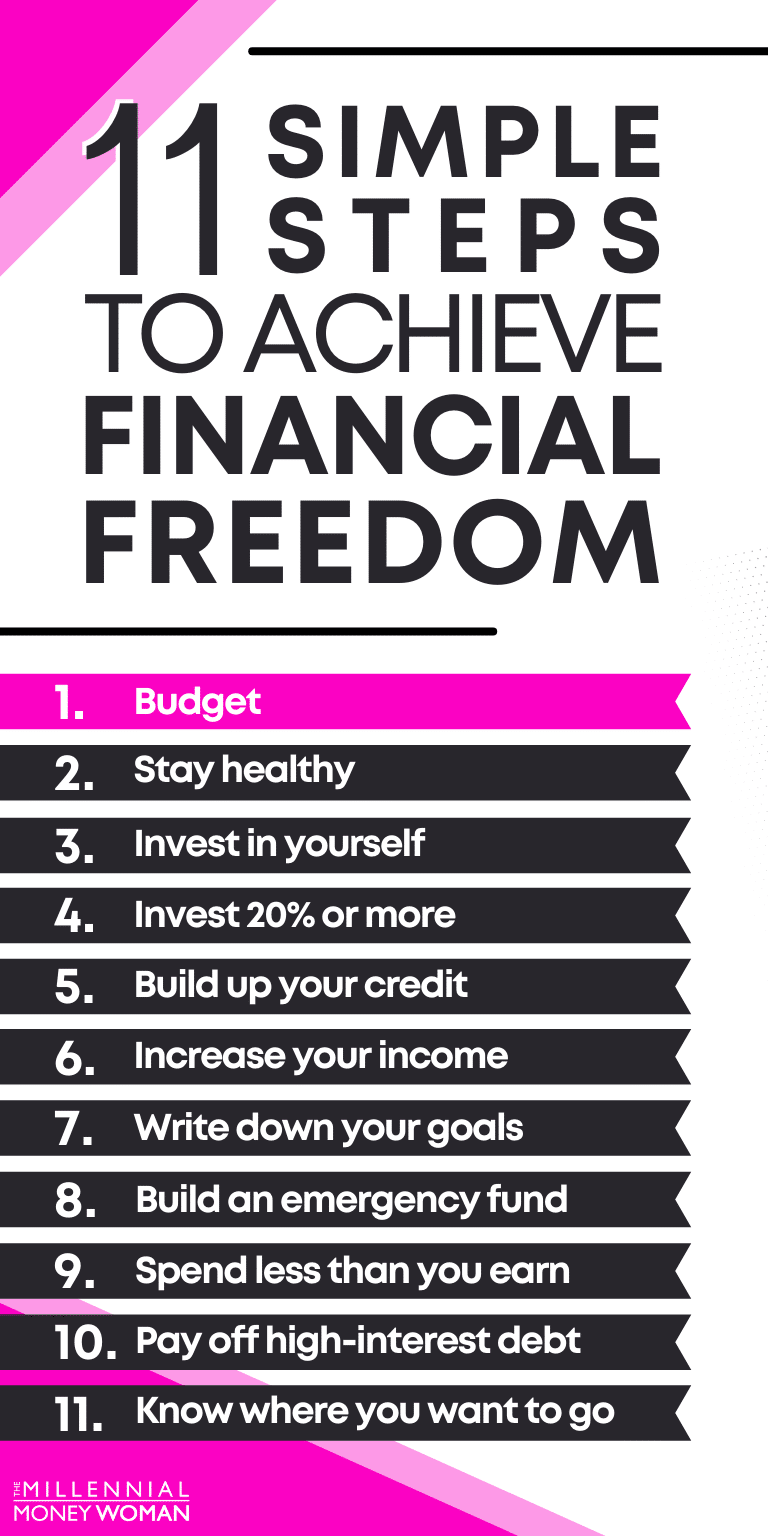

Recap Of Key Tips

Let’s revisit the essential tips for achieving financial freedom:

- Budget Wisely: Track your income and expenses to understand your financial habits.

- Save Regularly: Set aside a portion of your income each month.

- Invest Smartly: Diversify your investments to grow your wealth.

- Reduce Debt: Pay off high-interest debts to reduce financial strain.

- Build an Emergency Fund: Save for unexpected expenses to avoid financial setbacks.

Taking Action Today

Procrastination is the enemy of financial freedom. Start taking action today:

- Create a Budget: Use tools or apps to track your spending.

- Open a Savings Account: Automate transfers to your savings account.

- Invest in Your Future: Consider low-cost index funds or retirement accounts.

- Use Credit Sesame: Monitor your credit score and find personalized recommendations.

Staying Committed To Your Financial Goals

Consistency is key to achieving financial freedom. Here’s how to stay committed:

- Set Realistic Goals: Break down your goals into achievable milestones.

- Review Regularly: Assess your progress and adjust your plans as needed.

- Seek Support: Surround yourself with a supportive community or financial advisor.

- Stay Educated: Keep learning about personal finance through books, blogs, or courses.

By following these strategies and making informed decisions, you can achieve financial freedom and secure a prosperous future.

Frequently Asked Questions

What Is Financial Freedom?

Financial freedom means having enough savings, investments, and cash to support your desired lifestyle. It involves less financial stress and more choices.

How Can I Achieve Financial Freedom?

Start by budgeting, saving, and investing wisely. Reduce debt and increase income streams. Consistently review and adjust your financial plan.

Why Is Budgeting Important For Financial Freedom?

Budgeting helps track expenses, manage money effectively, and avoid unnecessary debt. It ensures you live within your means.

What Are The Best Investments For Financial Freedom?

Consider diversified portfolios, including stocks, bonds, real estate, and mutual funds. Research and seek professional advice to maximize returns.

Conclusion

Achieving financial freedom requires planning and discipline. Use the tips shared to guide your journey. Small, consistent actions make a big impact over time. Remember to monitor your credit score regularly. Tools like Credit Sesame can help. Stay committed, and you’ll see progress. Your financial goals are within reach. Keep learning and adjusting your strategy as needed. Financial freedom is a marathon, not a sprint. Stay focused and patient for long-term success.