Financial Freedom: Unlock Your Path to Wealth and Independence

Financial freedom is a goal many aspire to achieve. It means having the financial stability to live life on your terms.

Achieving this goal requires careful planning, smart decisions, and sometimes the right tools. Imagine a life without the constant worry of debt. This is what financial freedom offers. It’s about having control over your finances, making choices that align with your values, and securing a stable future.

For those struggling with debt, achieving financial freedom may seem like a distant dream. But with tools like SoloSuit, it becomes a more attainable reality. SoloSuit provides essential help in managing and settling debts, ensuring you can respond to debt lawsuits and negotiate settlements effectively. By leveraging these resources, you can take significant steps toward financial stability and peace of mind.

Introduction To Financial Freedom

Financial freedom is a goal many aspire to achieve. It means having enough savings, investments, and cash to afford the lifestyle you desire. It also means growing a nest egg that allows you to retire or pursue any career you want without being driven by earning a set salary each year.

What Is Financial Freedom?

Financial freedom is the state of having sufficient personal wealth to live without needing to work actively for basic necessities. Individuals with financial freedom have assets that generate income equal to or greater than their expenses.

Financial freedom involves building a significant amount of savings and investments. It also means being debt-free and having multiple streams of passive income.

The Importance Of Achieving Financial Independence

Achieving financial independence provides security and peace of mind. It reduces stress related to financial uncertainties. Financial independence also offers the freedom to make life choices without being constrained by financial limitations.

Here are some key benefits of financial independence:

- Reduced Stress: Financial stability lowers anxiety about meeting everyday expenses and emergencies.

- Freedom to Retire Early: With financial independence, you can choose to retire early and enjoy life.

- More Career Choices: Financial freedom allows you to pursue careers or entrepreneurial ventures without the pressure of a paycheck.

SoloSuit can be a valuable tool in your journey towards financial freedom. This automated software helps individuals navigate debt disputes, respond to debt lawsuits, and settle debts outside of court. By using SoloSuit, you can potentially reduce the amount owed and protect your financial assets.

| Main Features | Benefits |

|---|---|

| Reply to a Debt Lawsuit | Assistance in compiling a response to a debt lawsuit, with attorney review and filing included. |

| Settle a Debt | Helps users negotiate with collectors to settle debts outside of court, often for less than the face value of the debt. |

SoloSuit is accessible in all 50 states and has helped protect $1.71 billion in assets for 262 thousand people. Although Solo is not a law firm and does not provide legal advice, it is a valuable self-help tool for managing debt.

For more information, visit SoloSuit.

Setting Financial Goals

Setting financial goals is essential for achieving financial freedom. Clear objectives guide your financial journey, keeping you motivated and focused. Here, we will explore how to define your goals, differentiate between short-term and long-term goals, and prioritize your financial objectives.

Defining Your Financial Goals

Start by assessing your current financial situation. Understand your income, expenses, and debt obligations. Clear goals require a solid understanding of where you stand financially.

Ask yourself what you want to achieve. Do you want to pay off debt, save for a home, or build an emergency fund? Specific goals are easier to plan for and achieve.

Write down your goals. This makes them tangible and helps track your progress. SoloSuit can help you manage debt and set clear financial targets.

Short-term Vs. Long-term Goals

Identify the timeframe for your goals. Short-term goals are usually achievable within a year. Examples include paying off a credit card or saving for a vacation.

Long-term goals take more time to achieve, often several years or decades. These include saving for retirement or paying off a mortgage.

| Short-term Goals | Long-term Goals |

|---|---|

| Pay off a credit card | Save for retirement |

| Build an emergency fund | Pay off a mortgage |

| Save for a vacation | Invest in a child’s education |

Both types of goals are crucial for financial stability. SoloSuit can assist in managing debt, helping you focus on your goals.

How To Prioritize Financial Objectives

List all your financial goals. Prioritize them based on urgency and importance. Immediate needs should come first, like paying off high-interest debt.

- Pay off high-interest debt

- Build an emergency fund

- Save for short-term needs

- Invest for long-term goals

Consider the impact of each goal on your financial health. Goals that reduce financial stress should take precedence. SoloSuit provides tools to manage debt effectively, allowing you to focus on other financial objectives.

Regularly review and adjust your priorities as your financial situation changes. Stay flexible and adapt to new circumstances.

By defining, differentiating, and prioritizing your financial goals, you can achieve financial freedom. Use tools like SoloSuit to manage debt and stay on track.

Creating A Budget And Sticking To It

Achieving financial freedom starts with creating a budget and sticking to it. A budget helps you manage your money effectively, ensuring your expenses do not exceed your income. Let’s explore the importance of budgeting, steps to create an effective budget, and tips for maintaining your budget.

The Importance Of Budgeting

Budgeting is crucial for financial stability. It helps you track your income and expenses, allowing you to identify areas where you can cut costs. With a budget, you can save more, reduce debt, and work towards your financial goals.

- Track Spending: Know where your money goes each month.

- Control Finances: Prevent overspending and manage debt better.

- Achieve Goals: Save for emergencies, retirement, or big purchases.

Steps To Create An Effective Budget

Creating an effective budget involves several key steps. Follow these steps to ensure your budget works for you:

- Calculate Your Income: Include all sources of income, such as salary, freelance work, and investments.

- List Your Expenses: Divide your expenses into fixed (rent, utilities) and variable (groceries, entertainment).

- Set Financial Goals: Define short-term and long-term goals, like saving for a vacation or paying off debt.

- Create a Plan: Allocate funds to each expense category and ensure your total expenses do not exceed your income.

- Track Your Spending: Use tools or apps to monitor your spending and adjust as needed.

Tips For Maintaining Your Budget

Sticking to your budget requires discipline and regular monitoring. Here are some tips to help you maintain your budget:

- Review Monthly: Regularly review your budget to ensure it aligns with your financial goals.

- Be Flexible: Adjust your budget as your income or expenses change.

- Avoid Impulse Purchases: Plan your purchases and avoid buying on a whim.

- Use Cash: For discretionary spending, use cash to prevent overspending.

- Seek Help: Tools like SoloSuit can help manage debt and respond to debt lawsuits, ensuring you stay on track.

| Step | Description |

|---|---|

| 1 | Calculate your income |

| 2 | List your expenses |

| 3 | Set financial goals |

| 4 | Create a plan |

| 5 | Track your spending |

Creating a budget and sticking to it is a powerful tool for achieving financial freedom. By understanding the importance of budgeting, following effective steps, and implementing practical tips, you can take control of your finances and work towards a stable financial future.

Building An Emergency Fund

Achieving financial freedom starts with building a solid emergency fund. This safety net is crucial for handling unexpected expenses without falling into debt. Let’s dive into the importance of an emergency fund and how to build one effectively.

Why You Need An Emergency Fund

An emergency fund serves as a financial cushion during unforeseen events. This fund can cover unexpected expenses such as medical bills, car repairs, or sudden job loss. Without it, you may need to rely on credit cards, leading to more debt.

Having an emergency fund provides peace of mind. It ensures you can manage emergencies without disrupting your financial goals. This security is essential for maintaining financial stability.

How Much Should You Save?

The amount to save depends on your personal circumstances. A common recommendation is to save three to six months’ worth of living expenses. This range offers a balance between being prepared and not over-saving.

| Monthly Expenses | Emergency Fund Goal |

|---|---|

| $2,000 | $6,000 – $12,000 |

| $3,000 | $9,000 – $18,000 |

| $4,000 | $12,000 – $24,000 |

Evaluate your expenses to determine the right amount. Consider factors like job stability, health, and dependents. Adjust your savings goal accordingly.

Strategies For Building Your Emergency Fund

Building an emergency fund requires consistent effort. Here are some strategies to help you:

- Set a Monthly Goal: Determine a fixed amount to save each month. Automate this process to ensure consistency.

- Cut Unnecessary Expenses: Review your budget and identify non-essential expenses. Redirect these funds to your emergency savings.

- Boost Your Income: Consider side gigs or freelance work to increase your income. Use the extra earnings to build your fund faster.

- Save Windfalls: Allocate bonuses, tax refunds, or monetary gifts to your emergency fund. These can significantly boost your savings.

Consistency is key. Stick to your plan, and your emergency fund will grow over time. A well-funded emergency account is a critical step towards financial freedom.

Managing And Reducing Debt

Achieving financial freedom often begins with managing and reducing debt. Debt can be a significant barrier to reaching financial goals. By understanding debt types, implementing reduction strategies, and appreciating the benefits of being debt-free, you can take control of your finances.

Types Of Debt And Their Impact

Debt comes in various forms, each with its own impact:

| Type of Debt | Impact |

|---|---|

| Credit Card Debt | High-interest rates can lead to long-term financial strain. |

| Student Loans | Can delay milestones like buying a home or saving for retirement. |

| Mortgages | Generally considered good debt but requires long-term commitment. |

| Personal Loans | Useful for emergencies but can have high-interest rates. |

Debt Reduction Strategies

Reducing debt requires a strategic approach. Here are some effective strategies:

- Debt Snowball Method: Pay off smaller debts first to build momentum.

- Debt Avalanche Method: Focus on paying off high-interest debts first.

- Consolidation: Combine multiple debts into a single payment with a lower interest rate.

- Negotiate Settlements: Use services like SoloSuit to negotiate and settle debts for less than the amount owed.

- Budgeting: Create a budget to track expenses and allocate extra funds towards debt repayment.

Benefits Of Being Debt-free

Being debt-free brings numerous benefits:

- Financial Security: More money available for savings and investments.

- Reduced Stress: Less financial anxiety and worry.

- Improved Credit Score: Better credit score opens up more financial opportunities.

- Increased Flexibility: Freedom to make life choices without financial constraints.

Using tools like SoloSuit can assist in managing and reducing debt effectively. SoloSuit helps in responding to debt lawsuits and negotiating settlements, which can be crucial steps in becoming debt-free.

Investing For The Future

Financial freedom requires planning, discipline, and wise investments. By investing for the future, you can grow your wealth and secure your financial stability. Understanding different investment options and how to start can be your first step towards financial independence.

Introduction To Investing

Investing involves allocating money with the expectation of generating income or profit. It is a way to build wealth over time by putting your money to work. Instead of letting savings sit idle, investing allows your money to grow.

Different Types Of Investments

There are several types of investments to consider. Each has its own risk level and potential return. Here are some common options:

- Stocks: Buying shares of a company to earn dividends and capital gains.

- Bonds: Lending money to an entity in exchange for interest payments over time.

- Mutual Funds: Pooling money with other investors to buy a diversified portfolio of stocks, bonds, or other assets.

- Real Estate: Purchasing property to earn rental income or to sell at a higher value.

- Cryptocurrencies: Investing in digital currencies like Bitcoin and Ethereum.

How To Start Investing

Starting to invest can seem daunting, but it doesn’t have to be. Follow these steps to begin your investment journey:

- Set Clear Goals: Determine what you want to achieve with your investments. Examples include saving for retirement, buying a house, or funding education.

- Create a Budget: Assess your finances and decide how much money you can invest. Ensure you have an emergency fund in place before investing.

- Choose an Investment Platform: Select a brokerage or investment app that suits your needs. Look for platforms with low fees and user-friendly interfaces.

- Diversify Your Portfolio: Spread your investments across different assets to reduce risk. Do not put all your money in one type of investment.

- Start Small: Begin with a small amount and gradually increase your investments as you become more comfortable.

- Stay Informed: Keep up with market trends and read financial news. This helps you make informed decisions.

By following these steps, you can start building your financial future with confidence. Investing is a powerful tool to achieve financial freedom.

Saving For Retirement

Saving for retirement is a key step towards achieving financial freedom. It ensures a stable and comfortable future. With careful planning and the right strategies, you can secure your golden years.

Why Retirement Planning Is Crucial

Retirement planning is crucial for several reasons:

- Financial Security: It ensures you have enough money to live comfortably.

- Inflation Protection: Helps combat the rising cost of living.

- Healthcare Costs: Addresses potential medical expenses in old age.

Without proper planning, you might face financial difficulties later in life. Start early and stay committed to your retirement goals.

Retirement Savings Options

There are various retirement savings options available:

| Option | Description |

|---|---|

| 401(k) | Employer-sponsored plan with tax advantages. |

| IRA | Individual Retirement Account, offering tax benefits. |

| Roth IRA | Tax-free growth and tax-free withdrawals. |

| Pension Plans | Employer-provided fixed payments post-retirement. |

Maximizing Your Retirement Contributions

Maximizing your retirement contributions is vital for a secure future. Here are some tips:

- Contribute Early: Start saving as soon as possible.

- Employer Match: Take full advantage of employer matching contributions.

- Annual Limits: Be aware of and contribute up to the annual limits.

- Automatic Contributions: Set up automatic contributions to ensure consistency.

By following these tips, you can significantly boost your retirement savings over time.

Increasing Your Income

Achieving financial freedom often involves increasing your income. This strategy helps you pay off debt, save more, and invest. Here are some ways to boost your earnings.

Exploring Side Hustles

Side hustles offer a way to earn extra money outside your main job. Consider your skills and interests when choosing one. Popular options include:

- Freelancing: Offer services like writing, graphic design, or web development.

- Online Tutoring: Teach subjects you are knowledgeable in.

- Gig Economy Jobs: Drive for ride-sharing services or deliver food.

- Selling Products Online: Use platforms like Etsy or eBay.

Side hustles can provide a significant boost to your income. They also offer flexibility and the potential to turn into full-time work.

Negotiating A Raise

Negotiating a raise at your current job is another effective way to increase your income. Follow these steps to prepare:

- Research Salary Trends: Know the average salary for your position and experience level.

- Document Your Achievements: Keep a record of your contributions and successes.

- Practice Your Pitch: Be ready to explain why you deserve a raise.

- Choose the Right Time: Find a moment when your boss is likely to be receptive.

Approaching your employer with confidence and evidence of your value can lead to a higher salary.

Investing In Yourself For Career Growth

Investing in your career can lead to higher earnings over time. Consider these strategies:

| Strategy | Description |

|---|---|

| Continuing Education | Take courses or earn certifications in your field. |

| Networking | Build connections with industry professionals. |

| Mentoring | Seek guidance from experienced colleagues. |

| Personal Development | Work on soft skills like communication and leadership. |

These investments can make you more valuable to employers and open up new opportunities.

Living Below Your Means

Achieving financial freedom starts with spending less than you earn. This concept is known as living below your means. It involves making conscious choices about your spending habits, prioritizing savings, and avoiding unnecessary debt. By adopting this approach, you can build a solid financial foundation and achieve long-term stability.

Benefits Of A Frugal Lifestyle

Living frugally offers numerous benefits:

- Increased Savings: By cutting unnecessary expenses, you can save more money each month.

- Reduced Stress: Less debt means less financial stress and more peace of mind.

- Financial Flexibility: You have more control over your finances and can handle emergencies better.

- Early Retirement: Save and invest wisely, and you may retire earlier than expected.

Tips For Cutting Expenses

Here are practical tips to help you reduce your spending:

- Create a Budget: Track your income and expenses to identify areas to cut back.

- Limit Dining Out: Cook at home more often to save on food costs.

- Use Public Transportation: Save on gas and maintenance by using buses or trains.

- Cancel Unused Subscriptions: Review your subscriptions and cancel those you no longer need.

- Shop Sales: Take advantage of discounts and sales for necessary purchases.

How To Avoid Lifestyle Inflation

Lifestyle inflation occurs when your spending increases as your income grows. Here’s how to avoid it:

- Set Financial Goals: Prioritize saving and investing over spending.

- Automate Savings: Set up automatic transfers to your savings account.

- Maintain a Budget: Stick to your budget, regardless of income increases.

- Avoid Impulse Purchases: Wait 24 hours before making any non-essential purchases.

By living below your means, you create a solid foundation for financial freedom. Stay disciplined, make smart choices, and watch your savings grow.

Monitoring And Adjusting Your Financial Plan

Achieving financial freedom is a journey that requires consistent oversight and flexibility. Regularly monitoring and adjusting your financial plan ensures you stay on track to meet your goals. Below, we delve into the key practices for maintaining and refining your financial strategy.

Regular Financial Check-ups

Performing regular financial check-ups is essential. Set aside time every month to review your budget, expenses, and savings. This helps you identify areas where you can cut costs or allocate more funds toward your goals.

Use a simple checklist to guide your monthly review:

- Assess your income and expenses.

- Track progress toward savings goals.

- Review and adjust your budget.

Adapting To Life Changes

Life is unpredictable. Adapting to life changes is crucial for maintaining financial stability. Events such as a new job, marriage, or unexpected expenses require adjustments to your financial plan.

Consider the following steps to adapt effectively:

- Re-evaluate your financial goals.

- Adjust your budget to reflect new circumstances.

- Seek professional advice if needed.

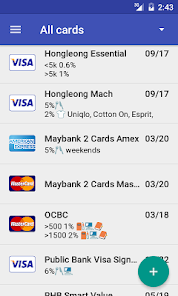

Using Financial Tools And Apps

In today’s digital age, leveraging financial tools and apps can simplify managing your finances. These tools help you keep track of spending, savings, and investments seamlessly.

Here is a table of popular financial tools and their key features:

| Tool/App | Key Features |

|---|---|

| Mint | Budget tracking, bill reminders, free credit score |

| YNAB (You Need A Budget) | Budgeting, expense tracking, goal setting |

| Personal Capital | Investment tracking, retirement planning, net worth calculation |

Incorporating these tools into your financial routine can enhance your ability to stay on top of your finances and adjust plans as needed.

The Psychological Aspect Of Financial Freedom

Achieving financial freedom is more than just accumulating wealth. It also involves understanding and managing the psychological aspects of money. By developing the right mindset and habits, you can reduce financial stress and build a more secure future.

Building A Wealth Mindset

Building a wealth mindset is crucial for financial freedom. This mindset involves adopting positive beliefs about money and your ability to manage it effectively. Here are some strategies to develop a wealth mindset:

- Set clear financial goals.

- Educate yourself about personal finance.

- Practice gratitude for what you have.

- Surround yourself with financially savvy people.

Overcoming Financial Anxiety

Financial anxiety can be a major barrier to achieving financial freedom. It is important to address this anxiety to make better financial decisions. Consider these tips to overcome financial anxiety:

- Create a budget to track your income and expenses.

- Build an emergency fund for unexpected expenses.

- Seek professional advice if needed.

- Practice mindfulness and stress-reduction techniques.

The Role Of Discipline And Patience

Discipline and patience play a significant role in financial freedom. Consistent and disciplined financial habits lead to long-term success. Here are some ways to cultivate discipline and patience:

| Habit | Action |

|---|---|

| Budgeting | Stick to a monthly budget to control spending. |

| Saving | Automate savings to build wealth over time. |

| Investing | Invest regularly and avoid impulsive decisions. |

| Debt Management | Pay down debts systematically and avoid new debts. |

By focusing on the psychological aspects of financial freedom, you can create a more balanced and secure financial future. Remember, financial freedom is not just about money, but also about peace of mind.

Conclusion: Your Journey To Financial Freedom

Embarking on the journey to financial freedom can seem daunting. However, with the right tools and mindset, achieving financial independence is within reach. This section will recap key points, offer encouragement, and provide final thoughts to guide you on your way.

Recap Of Key Points

- Understanding Debt: Recognize the impact of debt on your financial health.

- Managing Finances: Create a budget and stick to it.

- Investing Wisely: Diversify your investments to grow your wealth.

- Emergency Fund: Maintain a safety net to cover unexpected expenses.

Using tools like SoloSuit can assist in managing and reducing debt. SoloSuit helps you respond to debt lawsuits and settle debts outside of court, which can be a significant step towards financial freedom.

Encouragement For The Journey Ahead

Financial freedom is not an overnight achievement. It requires patience, discipline, and perseverance. Celebrate small victories along the way. Each step forward brings you closer to your goal.

Remember, you are not alone. Utilize resources and tools available, such as SoloSuit, to navigate financial challenges effectively. Keep your focus and stay committed to your financial goals.

Final Thoughts On Achieving Financial Independence

Achieving financial independence means having the freedom to live life on your terms. It involves eliminating debt, building savings, and investing wisely. By following the steps outlined, you can move towards a stable and secure financial future.

SoloSuit offers a valuable resource in managing debt, providing tools to respond to debt lawsuits and negotiate settlements. This support can play a crucial role in your journey to financial freedom.

Stay dedicated, be proactive, and use the resources at your disposal. Your journey to financial freedom is a marathon, not a sprint. Take it one step at a time, and you will reach your destination.

Frequently Asked Questions

What Is Financial Freedom?

Financial freedom means having enough savings, investments, and cash to afford the lifestyle you desire. It means growing your wealth and being free from financial worries.

How Can I Achieve Financial Freedom?

Achieving financial freedom involves smart budgeting, saving, investing, and reducing debt. It’s about planning, setting financial goals, and consistently working towards them.

Why Is Financial Freedom Important?

Financial freedom provides peace of mind and security. It allows you to pursue your passions, retire early, and enjoy life without financial stress.

How Long Does It Take To Gain Financial Freedom?

The time to achieve financial freedom varies. It depends on your income, savings rate, investments, and financial goals. Consistency and discipline are key.

Conclusion

Achieving financial freedom is within reach with the right steps. Managing debts effectively can be a game-changer. Tools like SoloSuit can assist in handling debt disputes. SoloSuit helps users respond to debt lawsuits and settle debts efficiently. For more details, check SoloSuit. Start your journey towards financial stability today. Control your finances and embrace a debt-free future.