Financial Empowerment Tools: Boost Your Financial Confidence

In today’s fast-paced world, financial empowerment is crucial for small business success. With the right tools, businesses can navigate financial challenges and thrive.

Financial empowerment tools offer a lifeline for small business owners. They provide essential insights into financial health and growth strategies. One such tool is the Hello Alice Business Health Score™ Assessment. This tool evaluates your business’s financial health and offers personalized growth plans. It helps small businesses understand how stakeholders view their financial standing. By using these tools, businesses can become financially fit, opening doors to new opportunities. Hello Alice also rewards businesses for achieving growth milestones, making it a valuable resource for any small business owner. Start your journey towards financial empowerment today.

Introduction To Financial Empowerment Tools

Financial empowerment tools are essential for individuals and businesses seeking to improve their financial health. These tools provide valuable insights, strategies, and resources that can help you achieve financial stability and confidence. One such powerful tool is the Hello Alice Business Health Score™ Assessment. This tool is designed to evaluate the financial health of small businesses and offer personalized growth plans. Below, we will explore what financial empowerment tools are and why financial confidence is important.

What Are Financial Empowerment Tools?

Financial empowerment tools are resources that help individuals and businesses understand and improve their financial situation. They offer assessments, personalized plans, and strategic insights to guide financial decisions.

For example, the Hello Alice Business Health Score™ Assessment measures how banks, creditors, investors, and other stakeholders view your business’s financial health. It provides a detailed evaluation and custom growth plans.

| Feature | Description |

|---|---|

| Measure Business Health | Assess financial health from stakeholders’ perspective |

| Personalized Growth Plans | Receive step-by-step frameworks to improve your score |

| Rewards for Growth | Unlock grants, discounts, and opportunities |

Why Financial Confidence Is Important

Financial confidence is crucial for making informed decisions and achieving stability. When you understand your financial health, you can plan better and take strategic actions.

The Hello Alice Business Health Score™ Assessment helps businesses become financially fit. It offers insights that allow you to optimize your financial health and access new opportunities. Joining a community of 1.4 million businesses focused on growth can provide additional support.

- Financial Fitness: Open doors to new opportunities

- Strategic Insights: Optimize your financial health

- Community Support: Connect with other growth-focused businesses

With these tools, you can take control of your financial future and achieve your business goals.

Key Features Of Financial Empowerment Tools

Financial empowerment tools are essential for small business owners aiming to enhance their financial health. These tools offer various features that help manage finances efficiently. Below are the key features that you can benefit from:

Effective budgeting and expense tracking are crucial for maintaining financial stability. These tools help you monitor your income and expenses, ensuring you stay within your budget.

You can categorize expenses, track spending patterns, and identify areas where you can cut costs. This feature is particularly useful for small businesses trying to manage their cash flow.

Investment and portfolio management tools assist in making informed investment decisions. They offer insights into market trends and help you diversify your investment portfolio.

You can track the performance of your investments and adjust your strategy to maximize returns. These tools are beneficial for small businesses looking to grow their capital.

Managing debt is vital for financial health. Debt management solutions help you keep track of loans, credit card debts, and other liabilities.

These tools offer strategies to pay off debt faster, reduce interest costs, and improve your creditworthiness. For small businesses, effective debt management ensures better cash flow and financial stability.

Your credit score impacts your ability to secure loans and favorable terms. Credit score monitoring tools provide real-time updates on your credit status.

They alert you to any changes in your score and offer tips to improve it. For small businesses, maintaining a good credit score is essential for obtaining financing and business growth.

Continuous learning is key to financial success. Financial education and resources provide valuable information and training materials.

These resources include articles, webinars, and community forums where you can learn from experts and peers. For example, the Hello Alice platform offers a comprehensive tool to assess financial health and provide personalized growth plans.

By utilizing these resources, small business owners can make informed decisions and enhance their financial literacy.

Budgeting And Expense Tracking

Managing finances can feel overwhelming, but budgeting and expense tracking make it easier. These tools help you understand where your money goes, identify areas to save, and set realistic financial goals. Let’s explore how budgeting tools can help you save money, track your expenses, and achieve your financial goals.

How Budgeting Tools Help You Save Money

Budgeting tools are designed to help you manage your money effectively. They allow you to create a budget that aligns with your income and expenses. By using these tools, you can:

- Set spending limits for different categories like food, entertainment, and bills.

- Monitor your spending in real-time to avoid overspending.

- Automatically categorize transactions to see where your money goes.

Using a budgeting tool can lead to significant savings. You become more aware of your spending habits and can make informed decisions. Tools like Hello Alice Business Health Score™ Assessment offer insights into your financial health, helping you make better financial choices.

Tracking Expenses To Identify Spending Patterns

Expense tracking is crucial for understanding your spending patterns. By tracking your expenses, you can:

- Identify areas where you spend the most money.

- Find opportunities to cut costs and save more.

- Recognize patterns that may lead to wasteful spending.

Tools that track expenses provide detailed reports, showing you exactly where your money goes. This information is valuable for making adjustments to your budget and improving your financial health.

Setting Financial Goals And Sticking To Them

Setting financial goals is important for achieving long-term financial success. With budgeting and expense tracking tools, you can:

- Set realistic financial goals based on your current financial situation.

- Track your progress towards these goals and make necessary adjustments.

- Stay motivated by seeing your progress and celebrating milestones.

Using a tool like Hello Alice Business Health Score™ Assessment helps you set and achieve your financial goals. It provides personalized growth plans to improve your financial health, making it easier to stick to your goals and achieve financial fitness.

Investment And Portfolio Management

Investment and portfolio management are crucial for achieving financial empowerment. Effective investment strategies can help you grow your wealth. Proper portfolio management ensures that your investments align with your financial goals and risk tolerance. Below are some essential aspects of managing investments and portfolios.

Simplifying Investment Decisions

Making investment decisions can be complex. The Hello Alice Business Health Score™ Assessment simplifies this process. It assesses your business’s financial health, providing insights that guide investment choices. With personalized growth plans, you can make informed decisions to improve your financial status.

Diversifying Your Portfolio

Diversification reduces risk by spreading investments across various assets. The Hello Alice platform offers strategic insights to optimize your portfolio. By understanding how banks, creditors, and investors view your business, you can choose a mix of assets that balance risk and reward.

Real-time Monitoring Of Investment Performance

Keeping track of your investments is vital for financial success. Real-time monitoring tools help you evaluate performance and make necessary adjustments. With the Hello Alice Business Health Score™ Assessment, you receive continuous updates on your financial health, allowing you to stay on top of your investment performance.

Debt Management Solutions

Managing debt effectively is crucial for maintaining financial health. Debt management solutions offer practical strategies to help you reduce, consolidate, and monitor your debts. This ensures smoother financial operations and overall business success.

Strategies To Reduce Debt

Effective debt reduction strategies are essential for long-term financial stability. Here are some actionable steps:

- Create a Budget: Track your income and expenses to identify areas where you can cut costs.

- Prioritize Debts: Focus on paying off high-interest debts first to reduce overall interest costs.

- Increase Payments: Whenever possible, make larger payments to reduce the principal faster.

- Seek Professional Advice: A financial advisor can offer personalized strategies to manage and reduce debt.

Consolidation Options

Debt consolidation combines multiple debts into a single payment. This can simplify your financial obligations and potentially reduce interest rates. Common consolidation options include:

- Personal Loans: Consolidate multiple debts into one loan with a fixed interest rate.

- Balance Transfer Credit Cards: Transfer balances from high-interest credit cards to one with a lower rate.

- Home Equity Loans: Use the equity in your home to secure a loan for debt consolidation.

- Debt Management Plans: Offered by credit counseling agencies, these plans consolidate debts and negotiate lower interest rates on your behalf.

Monitoring And Managing Payment Schedules

Staying on top of your payment schedules is essential to avoid late fees and maintain good credit. Here are some tips:

- Set Up Reminders: Use calendar alerts or mobile apps to remind you of upcoming payments.

- Automate Payments: Enroll in automatic payments to ensure timely payments each month.

- Review Statements Regularly: Check your statements for accuracy and monitor your progress in reducing debt.

- Adjust as Needed: If your financial situation changes, adjust your payment plan to stay on track.

By implementing these debt management solutions, you can improve your financial health and work towards a more stable future.

Credit Score Monitoring

Credit score monitoring is a vital tool for financial empowerment. By understanding and tracking your credit score, you can make informed decisions that impact your financial health. This section delves into the importance of maintaining a good credit score, the tools available to monitor and improve it, and how to understand credit reports.

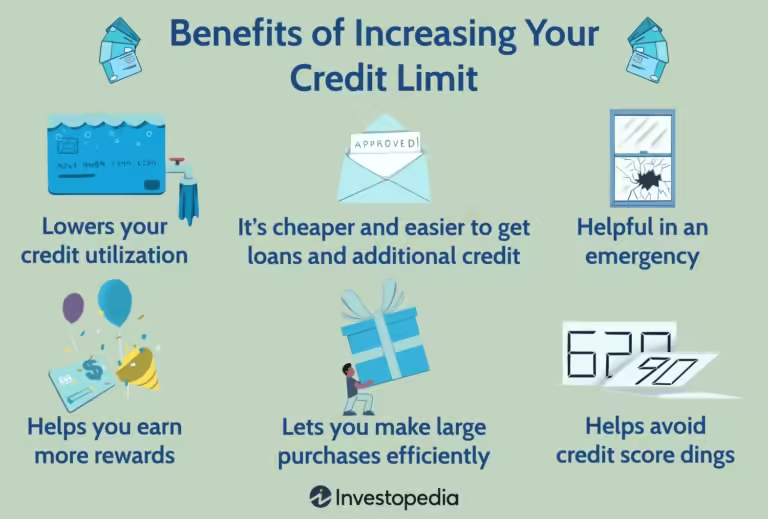

Importance Of A Good Credit Score

A good credit score opens doors to better financial opportunities. It can help you secure lower interest rates on loans, qualify for premium credit cards, and even rent apartments. Here are some key reasons:

- Lower Interest Rates: Lenders offer better rates to those with high credit scores.

- Higher Credit Limits: A good score increases your borrowing capacity.

- Better Loan Approval Chances: Lenders trust borrowers with good scores.

- Favorable Insurance Premiums: Some insurers offer lower rates to high-score clients.

Tools To Track And Improve Your Credit Score

Several tools can help you monitor and improve your credit score:

- Hello Alice Business Health Score™ Assessment: This tool assesses your business’s financial health and offers personalized growth plans.

- Credit Monitoring Services: Services like Experian and TransUnion provide regular updates on your credit score.

- Credit Report Websites: Websites like AnnualCreditReport.com offer free credit reports.

- Financial Apps: Apps like Credit Karma and Mint track your score and suggest improvements.

Using these tools can help you stay informed and take proactive steps to enhance your credit score.

Understanding Credit Reports

Credit reports contain detailed information about your credit history. Here’s what you need to know:

| Section | Details |

|---|---|

| Personal Information | Includes your name, address, and social security number. |

| Credit Accounts | Details of your credit cards, loans, and payment history. |

| Credit Inquiries | Records of who has checked your credit report. |

| Public Records | Information about bankruptcies and other financial issues. |

Reviewing your credit report regularly ensures accuracy and helps you spot any errors or fraud early.

Financial Education And Resources

Understanding how to manage finances is crucial for business success. Financial education and resources provide the knowledge and tools needed to make informed decisions. Explore various programs, reading materials, and community support options to enhance financial literacy.

Access To Financial Literacy Programs

Many organizations offer financial literacy programs that teach vital skills. These programs cover budgeting, saving, investing, and managing debt. One such program is the Hello Alice Business Health Score™ Assessment. It helps small businesses evaluate their financial health. Participants receive personalized growth plans to improve their scores.

| Program | Description | Benefits |

|---|---|---|

| Hello Alice Business Health Score™ Assessment | A tool to measure and improve business financial health | Personalized growth plans, rewards for milestones |

Reading Materials And Online Courses

Reading materials and online courses are excellent resources for financial education. They offer in-depth knowledge on various financial topics. Many platforms provide free and paid courses covering business finance, personal finance, and investment strategies.

- Books: Numerous books cover financial management and investment strategies.

- Online Courses: Websites like Coursera and Udemy offer courses on financial literacy.

- Blogs: Financial blogs provide up-to-date information and tips.

Community Support And Forums

Joining a community of like-minded individuals can be very beneficial. Community support and forums provide a space for sharing experiences and advice. Members can ask questions, share insights, and support each other.

The Hello Alice community includes 1.4 million businesses focused on growth and financial health. By participating, you can gain valuable insights and support. Engaging with a community helps you stay motivated and informed about the latest financial trends.

- Access to a network of thriving businesses.

- Opportunities to share and receive advice.

- Support from peers and experts.

Pricing And Affordability

Choosing the right financial empowerment tools involves considering their cost and value. Understanding pricing and affordability helps businesses make informed decisions. Let’s explore the different aspects of financial tools, focusing on their costs and benefits.

Free Vs Paid Financial Tools

Financial tools come in both free and paid versions. Free tools like the Hello Alice Business Health Score™ Assessment offer valuable features at no cost. These tools are great for startups and small businesses on a tight budget.

Paid tools, on the other hand, provide more advanced features. They may offer deeper insights, more detailed reports, or enhanced customer support. While they require an investment, the return can be significant for growing businesses.

Cost-benefit Analysis

Conducting a cost-benefit analysis helps determine the value of financial tools. Consider the following factors:

- Features: What features are essential for your business?

- Cost: How much does the tool cost, and what are the payment terms?

- Benefits: What benefits will the tool bring to your business?

For instance, the Hello Alice Business Health Score™ Assessment is free and offers personalized growth plans and community support. These benefits can enhance your business’s financial health without any cost.

Affordable Options For Different Budgets

There are financial tools available for every budget. Here are some options:

| Budget | Tool | Features |

|---|---|---|

| Free | Hello Alice Business Health Score™ Assessment | Measure business health, personalized growth plans, community support |

| Low Cost | Basic accounting software | Expense tracking, invoicing, financial reports |

| Medium Cost | Advanced financial management tools | Budgeting, forecasting, comprehensive financial analysis |

| High Cost | Enterprise-level financial solutions | Custom integrations, extensive support, advanced analytics |

Choosing the right tool depends on your business needs and budget. Free tools like Hello Alice are excellent for getting started. More advanced tools can be considered as your business grows.

Pros And Cons Of Financial Empowerment Tools

Understanding the pros and cons of financial empowerment tools is crucial for making informed decisions. These tools offer numerous benefits, but they also have limitations. This section explores the advantages and potential drawbacks, helping you balance technology with personal financial advice.

Advantages Of Using Financial Tools

Financial empowerment tools like the Hello Alice Business Health Score™ Assessment provide significant advantages:

- Measure Business Health: These tools assess how banks, creditors, and investors view your business’s financial health.

- Personalized Growth Plans: Receive customized frameworks to improve your financial health score.

- Rewards for Growth: Unlock grants, discounts, and opportunities as you achieve growth milestones.

- Financial Fitness: Helps businesses become financially fit and open doors to new opportunities.

- Strategic Insights: Provides insights to optimize financial health.

- Community Support: Join a community of 1.4 million businesses focused on growth and financial health.

Potential Drawbacks And Limitations

While financial tools offer many benefits, they have potential drawbacks:

- Over-Reliance on Technology: Dependence on tools may limit personal financial understanding.

- Privacy Concerns: Sharing financial data with online tools raises privacy issues.

- Technical Issues: Tools may face technical problems, affecting their reliability.

- Cost: Some financial tools may have hidden costs or fees.

Balancing Technology With Personal Financial Advice

It’s essential to balance the use of technology with personal financial advice:

- Consult Financial Advisors: Even with tools, seek advice from professional advisors.

- Use Tools Wisely: Leverage tools for insights but make decisions based on comprehensive advice.

- Stay Informed: Keep up with financial knowledge to complement tool-based insights.

By understanding the pros and cons, and balancing technology with personal advice, businesses can make the most of financial empowerment tools.

Recommendations For Ideal Users

Choosing the right financial empowerment tools is crucial. It helps you achieve your financial goals effectively. Different users have different needs. Here are recommendations for ideal users.

Best Tools For Beginners

Beginners need simple and user-friendly tools. Here are some excellent options:

- Mint: Track expenses and create budgets easily.

- YNAB (You Need A Budget): Learn budgeting basics and manage finances.

- Personal Capital: Start with basic investment tracking and financial planning.

For small business owners, the Hello Alice Business Health Score™ Assessment is perfect. It provides a comprehensive evaluation of your business’s financial health. It also offers personalized growth plans. This makes it easier for beginners to understand and improve their financial standing.

Advanced Tools For Experienced Users

Experienced users need tools that offer advanced features and deeper insights. Here are some top picks:

- Quicken: Comprehensive financial management with advanced features.

- QuickBooks: Ideal for detailed business accounting and financial analysis.

- Wealthfront: Automated investment management with advanced financial planning tools.

For seasoned business owners, Hello Alice continues to be valuable. It provides strategic insights and step-by-step growth plans. This helps optimize financial health and unlock new opportunities.

Tools For Specific Financial Goals

Different financial goals require specialized tools. Here are some recommendations:

| Financial Goal | Recommended Tool |

|---|---|

| Saving for Retirement | Betterment: Automated investing with retirement planning. |

| Paying Off Debt | Debt Payoff Planner: Create a personalized debt repayment plan. |

| Improving Business Health | Hello Alice Business Health Score™ Assessment: Evaluate and enhance business financial health. |

The Hello Alice Business Health Score™ Assessment stands out for business growth. It helps measure business health, provides personalized growth plans, and rewards milestones. This makes it a powerful tool for achieving specific business financial goals.

Frequently Asked Questions

What Are Financial Empowerment Tools?

Financial empowerment tools are resources and strategies that help individuals manage, grow, and protect their finances effectively.

Why Are Budgeting Apps Important?

Budgeting apps help track expenses, manage budgets, and save money. They provide insights into spending habits.

How Do Investment Platforms Benefit Users?

Investment platforms offer easy access to stocks, bonds, and other assets. They help grow wealth over time.

What Is The Role Of Financial Advisors?

Financial advisors provide expert advice on managing finances. They help with investments, retirement planning, and debt management.

Conclusion

Empowering your financial health is within reach. Tools like the Hello Alice Business Health Score™ Assessment can guide you. Assess your business health and get personalized growth plans. This tool helps small businesses thrive and achieve financial fitness. Start your journey towards a healthier business today. Learn more about Hello Alice here.