Fast Credit Repair Options: Boost Your Score Quickly

Struggling with poor credit can feel overwhelming. Thankfully, there are fast credit repair options available to help you regain financial stability.

Repairing your credit quickly is crucial, especially if you need to secure loans or credit cards soon. Fast credit repair options provide you with tools and strategies to boost your credit score efficiently. Whether you’re dealing with high debt, late payments, or other credit issues, these options can make a significant difference. From negotiating with creditors to utilizing specialized services, there are various ways to improve your credit health swiftly. Dive into these solutions and take control of your financial future today. For business owners, the Revenued Business Card Visa® Commercial Card is an excellent choice. It offers revenue-based financing, providing immediate access to working capital. Learn more about it here.

Introduction To Fast Credit Repair Options

Improving your credit score quickly can open doors to better financial opportunities. Whether you’re planning to secure a loan, get a new credit card, or improve your business’s financial health, finding fast credit repair options is crucial. Below, we explore some of the best solutions to repair your credit quickly and effectively.

Understanding The Need For Quick Credit Repair

Bad credit can hinder many aspects of your financial life. It can make it difficult to qualify for loans, rent an apartment, or even get a job. In business, poor credit can affect your ability to secure funding or make large purchases. Quick credit repair is essential to regain financial stability and access better financial products.

Overview Of The Best Fast Credit Repair Solutions

There are several methods to repair your credit swiftly. Here are some of the most effective options:

- Professional Credit Repair Services: These companies specialize in disputing errors on your credit report and negotiating with creditors.

- Debt Consolidation: Combining multiple debts into one can simplify payments and potentially lower interest rates.

- Secured Credit Cards: These cards require a deposit and can help rebuild credit by demonstrating responsible use.

- Revenue-Based Financing: Products like the Revenued Business Card Visa® Commercial Card provide access to working capital based on future receivables, which can help manage business finances effectively.

Each method has its own advantages and suitability depending on your specific situation. For businesses, the Revenued Business Card Visa® Commercial Card offers unique benefits.

| Feature | Description |

|---|---|

| Revenue-Based Financing | Provides funding by purchasing a portion of future receivables. |

| Flex Line | Mobile and immediate access to working capital. |

| Spending Limits | Adjusts based on business performance and revenue growth. |

| Mobile App | Allows for easy management of transactions and payment history. |

| Dedicated Account Manager | Personal support throughout the application and usage process. |

| Fast Application Process | Apply online and get a funding decision within an hour. |

| 24/7 Access to Funds | Instant access to business funding anytime, anywhere. |

With these features, the Revenued Business Card Visa® Commercial Card can be a valuable tool for businesses seeking quick access to capital.

Key Features Of Effective Credit Repair Services

Effective credit repair services offer a range of features to help improve your credit score. Understanding these features can make the process smoother and more efficient. Below are some key components of a successful credit repair service.

Professional Credit Counseling

Professional credit counseling provides expert advice to manage and improve your credit. Counselors offer strategies to reduce debt and build better financial habits. They assess your financial situation and create a personalized plan.

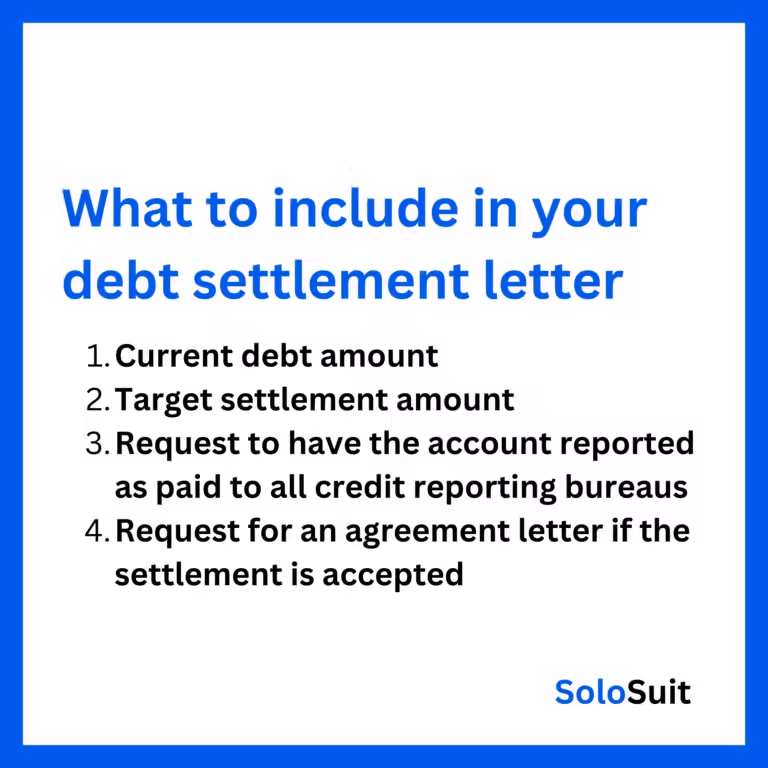

Credit Report Analysis And Dispute

Analyzing your credit report is a crucial step. Credit repair services meticulously review your credit report to find errors. These errors can negatively impact your credit score. They then file disputes to correct inaccuracies with credit bureaus.

| Step | Description |

|---|---|

| Review | Examine your credit report for errors. |

| Dispute | File disputes to correct inaccuracies. |

| Follow-up | Ensure corrections are made by credit bureaus. |

Debt Management Plans

A debt management plan (DMP) is a structured repayment plan. It is designed to reduce your debt and improve your credit score. These plans consolidate your debts into one monthly payment. They may also negotiate lower interest rates with your creditors.

- Consolidate multiple debts into one payment.

- Negotiate lower interest rates.

- Provide a clear timeline for debt repayment.

Credit Monitoring Services

Credit monitoring services track changes in your credit report. They provide alerts for any significant changes. This helps you stay informed and take immediate action if needed. Regular monitoring ensures that you are aware of your credit status at all times.

- Track changes in your credit report.

- Receive alerts for significant changes.

- Take immediate action if needed.

By leveraging these key features, credit repair services can effectively help you improve your credit score and achieve financial stability.

Pricing And Affordability Breakdown

Understanding the cost of credit repair is vital for making informed decisions. Below, we break down the pricing and affordability of various credit repair options.

Cost Of Professional Credit Repair Services

Professional credit repair services charge different fees based on the services provided. Here’s a look at common pricing structures:

| Service Type | Cost Range |

|---|---|

| Monthly Subscription | $79 – $129 per month |

| One-Time Setup Fee | $15 – $200 |

| Pay-Per-Deletion | $50 – $150 per item |

The total cost depends on the number of inaccuracies on your credit report and the duration of the service.

Free Vs. Paid Credit Repair Solutions

Comparing free and paid credit repair solutions can help determine the best choice for you.

- Free Solutions: These include DIY methods and non-profit credit counseling. They require time and effort but cost nothing.

- Paid Solutions: Professional services offer expertise and convenience. They may be worth the investment for faster results.

Evaluating Value For Money

It’s crucial to evaluate the value you get from paid credit repair services:

- Service Quality: Look for services with high customer ratings and success rates.

- Time Savings: Professional services can save you time compared to DIY methods.

- Long-Term Benefits: Improved credit can lead to better loan rates and financial opportunities.

Choose a service that balances cost with the quality and speed of results.

Pros And Cons Of Fast Credit Repair Options

Fast credit repair options can quickly improve your credit score. They might also involve high costs and temporary solutions. Weigh the benefits and drawbacks before deciding.

Fast credit repair can be a game-changer for those in urgent need of improving their credit scores. However, it’s essential to weigh the benefits and risks before diving in. Below, we explore the pros and cons of fast credit repair options.Benefits Of Rapid Credit Improvement

- Quick Results: Fast credit repair services can improve your credit score within weeks.

- Access to Better Rates: An improved credit score can qualify you for better interest rates on loans and credit cards.

- Increased Credit Limit: A higher credit score can lead to an increased credit limit, offering more financial flexibility.

- Enhanced Financial Opportunities: Better credit scores open doors to more financial products and services.

- Immediate Financial Relief: Rapid credit improvement can provide quick relief from financial stress.

Potential Drawbacks And Risks

- High Costs: Fast credit repair services can be expensive, with fees adding up quickly.

- Temporary Fixes: Some methods may offer only short-term improvements, not addressing underlying issues.

- Scams and Fraud: Beware of fraudulent companies promising guaranteed credit score boosts.

- Legal Risks: Certain credit repair tactics might skirt legal boundaries, putting you at risk.

- Negative Impact: Improper handling can inadvertently harm your credit score further.

Comparing Different Credit Repair Methods

| Method | Benefits | Drawbacks |

|---|---|---|

| Do-It-Yourself (DIY) |

|

|

| Credit Repair Services |

|

|

| Credit Counseling |

|

|

Specific Recommendations For Ideal Users

Choosing the right fast credit repair option depends on the severity of your credit issues and your unique financial situation. Here are tailored recommendations for different users.

Best Options For Individuals With Minor Credit Issues

If you have minor credit issues, consider these strategies:

- Credit Monitoring Services: These services help you track your credit score and report any inaccuracies.

- Secured Credit Cards: Use a secured card to build credit by making small, regular purchases and paying them off promptly.

- Dispute Inaccuracies: Regularly check your credit report for errors and dispute any inaccuracies with the credit bureaus.

Effective Solutions For Severe Credit Problems

For severe credit problems, more intensive solutions are needed:

- Credit Counseling: Work with a certified credit counselor to develop a personalized debt management plan.

- Debt Consolidation Loans: Combine multiple debts into a single loan with a lower interest rate and manageable payments.

- Bankruptcy: As a last resort, consider bankruptcy to discharge your debts and start rebuilding your credit.

Tailored Approaches For Different Financial Situations

Different financial situations require tailored approaches:

| Financial Situation | Recommended Approach |

|---|---|

| Freelancers | Use Revenued Business Card Visa® Commercial Card for flexible, revenue-based financing. |

| Small Business Owners | Consider a Flex Line from Revenued for immediate access to working capital. |

| Individuals with Irregular Income | Opt for financing that adjusts with your revenue growth, like the Revenued card. |

The Revenued Business Card Visa® Commercial Card offers fast access to funds, flexible usage, and excellent customer support. It’s an ideal solution for business owners needing quick and adaptable financing.

Frequently Asked Questions

What Are Fast Credit Repair Options?

Fast credit repair options include paying down debt, disputing errors, and negotiating with creditors. Using secured credit cards can also help.

How Long Does Credit Repair Take?

Credit repair can take a few months to a year. Timelines vary based on individual credit situations.

Can Paying Off Debt Improve Credit Score Quickly?

Yes, paying off debt can quickly improve your credit score. Reducing credit card balances is particularly effective.

Are Credit Repair Services Effective?

Credit repair services can be effective but results vary. Always research and choose a reputable company.

Conclusion

Finding the right credit repair option is crucial for financial health. Consider tools that fit your needs best. For businesses, the Revenued Business Card Visa® Commercial Card offers flexible financing. It adapts to your revenue growth and provides quick access to funds. Learn more about it here. Take control of your credit today. Better credit leads to better opportunities.