Fast Cash Loans: Quick Solutions for Immediate Financial Needs

In need of quick cash? Fast cash loans might be your solution.

These loans offer a speedy way to get money when you need it most. Fast cash loans are designed for emergencies. They provide immediate financial relief, often with minimal application requirements. Whether you face unexpected medical bills or urgent home repairs, these loans can be a lifesaver. But it’s essential to understand how they work before diving in. With fast cash loans, you can avoid the stress of waiting for traditional loan approvals. Learn more about how these loans can help you manage financial crunches effectively. For a reliable option, consider Upstart Personal Loans. Click here to explore how Upstart can assist you in securing the funds you need swiftly and securely.

Introduction To Fast Cash Loans

Fast cash loans offer a quick financial solution during emergencies. They provide immediate funds to cover unexpected expenses. These loans are popular for their speed and convenience. Understanding their purpose and importance can help you make informed decisions.

What Are Fast Cash Loans?

Fast cash loans are short-term loans. They provide small amounts of money quickly. Typically, they are repaid within a few weeks or months. These loans are designed to meet urgent financial needs. Unlike traditional loans, they have a simpler application process.

Fast cash loans usually do not require a high credit score. This makes them accessible to more people. The loan approval process is quick. Often, funds are available within 24 hours. Lenders may offer these loans online, making them convenient to access from anywhere.

Purpose And Importance Of Fast Cash Loans

The main purpose of fast cash loans is to provide immediate financial relief. They are useful in situations like medical emergencies, car repairs, or urgent bills. These loans help you cover expenses without delay.

Fast cash loans are important because they offer a financial safety net. They provide a quick solution when you need money urgently. This can prevent further complications, such as late fees or service interruptions.

In summary, fast cash loans are a valuable financial tool. They are designed to provide immediate funds. Understanding their purpose and importance helps you use them wisely.

Key Features Of Fast Cash Loans

Fast cash loans are a popular option for people needing quick financial relief. These loans have several key features that make them an attractive choice. They offer rapid approval, minimal paperwork, flexible loan amounts, and do not require collateral.

Speed Of Approval And Disbursement

One of the most appealing features of fast cash loans is the speed of approval and disbursement. Many lenders process applications within a few hours. This means you can receive the funds on the same day you apply. This quick turnaround is crucial in emergencies. People prefer fast cash loans because of this feature.

Minimal Documentation Required

Another major benefit is the minimal documentation required. Unlike traditional loans, fast cash loans do not need extensive paperwork. You usually need to provide basic information, such as:

- Proof of income

- Identification

- Bank account details

This simplicity makes the application process smooth and stress-free. It is especially helpful for those who cannot gather numerous documents.

Flexibility In Loan Amounts

Fast cash loans offer flexibility in loan amounts. Borrowers can choose the amount they need, from a few hundred to several thousand dollars. This flexibility helps you borrow only what you need and can afford to repay. It makes fast cash loans suitable for various financial situations.

No Collateral Needed

A significant advantage is that there is no collateral needed. Fast cash loans are unsecured, meaning you do not need to pledge any assets. This feature makes it accessible to a broader audience, including those without valuable assets. It reduces the risk for the borrower and speeds up the approval process.

Pricing And Affordability Of Fast Cash Loans

Fast cash loans offer quick access to funds. Understanding pricing and affordability can help you make informed decisions. Below, we break down interest rates, fees, and compare fast cash loans to traditional loans. We will also look at repayment terms and conditions.

Interest Rates And Fees

Fast cash loans often come with higher interest rates compared to traditional loans. This is due to the quick approval process and minimal credit checks. Typically, the interest rates range from 10% to 35%.

Aside from interest rates, there are also various fees associated with fast cash loans:

- Origination Fees: This fee is charged for processing the loan application. It usually ranges from 1% to 5% of the loan amount.

- Late Payment Fees: If you miss a payment, you may be charged a late fee. This fee varies by lender but can be significant.

- Prepayment Penalties: Some lenders charge a fee if you repay the loan early. This compensates the lender for lost interest.

Comparison With Traditional Loans

Fast cash loans differ significantly from traditional loans in several key areas. Here’s a comparison:

| Feature | Fast Cash Loans | Traditional Loans |

|---|---|---|

| Approval Time | Within hours | Several days to weeks |

| Interest Rates | 10% – 35% | 5% – 15% |

| Credit Check | Minimal or none | Extensive |

| Loan Amount | $100 – $5,000 | $1,000 – $50,000+ |

Repayment Terms And Conditions

Repayment terms for fast cash loans are usually shorter than traditional loans. This often ranges from a few weeks to a few months. The exact terms depend on the lender and the loan amount.

Key conditions to be aware of include:

- Flexible Repayment Options: Some lenders offer flexibility in repayment schedules.

- Automatic Deductions: Payments may be automatically deducted from your bank account.

- Penalty for Late Payments: Missing a payment can result in penalties and increased interest rates.

Understanding these terms and conditions can help you manage your loan effectively. Always read the fine print before agreeing to a loan.

Pros And Cons Of Fast Cash Loans

Fast cash loans offer quick financial relief for those in urgent need of funds. They can be a lifesaver in emergencies but come with their own set of advantages and drawbacks.

Advantages Of Fast Cash Loans

- Quick Approval: Fast cash loans are approved within minutes or hours, providing immediate access to funds.

- Convenience: Applications are often completed online, eliminating the need for physical visits to a bank.

- Minimal Requirements: These loans typically require fewer documents and have less stringent credit checks.

- Flexibility: Borrowers can use the funds for various needs, from medical emergencies to unexpected bills.

Potential Drawbacks To Consider

- High Interest Rates: Fast cash loans often come with higher interest rates compared to traditional loans.

- Short Repayment Periods: Borrowers are usually required to repay the loan quickly, often within a few weeks.

- Potential for Debt Cycle: Due to high costs, borrowers may find themselves in a cycle of taking out new loans to repay old ones.

- Limited Loan Amounts: The amount you can borrow is typically lower than other types of loans.

Understanding the pros and cons of fast cash loans can help you make an informed decision. While they offer quick solutions, it’s important to be aware of their potential drawbacks.

Specific Recommendations For Ideal Users

Fast cash loans can be a lifesaver in urgent financial situations. They offer quick access to funds when you need it most. To make the best use of these loans, it’s important to understand who can benefit the most and the scenarios where they are most useful.

Who Can Benefit Most From Fast Cash Loans?

- Individuals with urgent financial needs: Those facing unexpected expenses, such as medical bills or car repairs, can benefit greatly from fast cash loans.

- People with limited access to traditional credit: If you have a low credit score or no credit history, fast cash loans can provide the funds you need without extensive credit checks.

- Short-term borrowers: These loans are ideal for those who need a small amount of money for a short period, typically a few weeks to a month.

Scenarios Where Fast Cash Loans Are Most Useful

Fast cash loans are particularly useful in several common scenarios:

| Scenario | Reason |

|---|---|

| Emergency Medical Expenses | Provides immediate funds to cover medical bills and prescriptions. |

| Car Repairs | Allows you to quickly fix your vehicle to maintain your daily routine. |

| Unexpected Travel | Covers last-minute travel expenses for urgent family matters. |

| Utility Bills | Ensures you can pay essential bills on time, avoiding service interruptions. |

In each of these scenarios, fast cash loans provide a quick and efficient solution to immediate financial needs. Understanding who benefits most and the ideal situations for their use can help you make informed decisions.

Frequently Asked Questions

What Are Fast Cash Loans?

Fast cash loans are short-term loans designed for quick financial assistance. They offer fast approval and disbursement, usually within 24 hours.

How Do Fast Cash Loans Work?

Fast cash loans work by providing quick funds. You apply online, get approved, and receive the money in your account within hours.

Are Fast Cash Loans Safe?

Fast cash loans are generally safe if you choose a reputable lender. Always read terms and conditions carefully before applying.

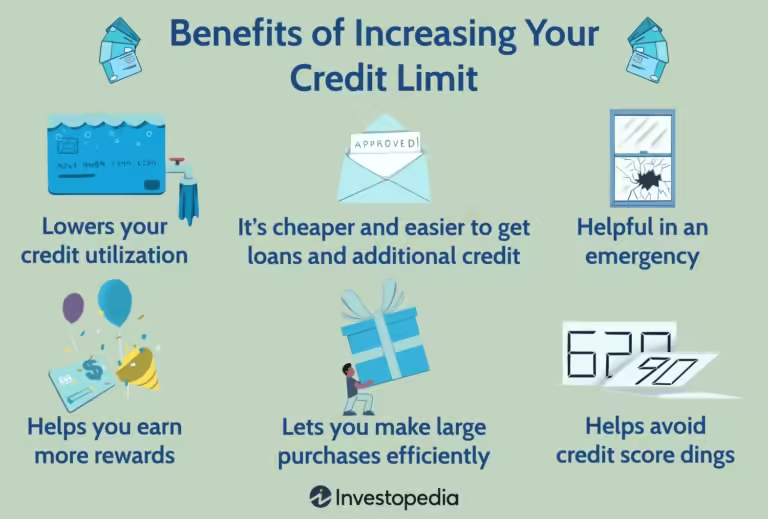

What Are The Benefits Of Fast Cash Loans?

Benefits include quick approval, minimal documentation, and fast disbursement. They are ideal for emergency expenses or unexpected bills.

Conclusion

Fast cash loans offer quick financial relief for urgent needs. They provide a simple and fast solution when money is tight. Consider all options before deciding on a loan. Upstart Personal Loans might be a good choice for you. They offer a secure and efficient platform for personal loans. Check out their services here. Always make sure to repay loans on time to avoid extra fees. Responsible borrowing helps maintain financial health. Take control of your finances with informed decisions.