Expense Tracking Software: Simplify Your Financial Management

Managing finances can be a daunting task for freelancers and small business owners. Expense tracking software simplifies this process, allowing you to focus on growing your business.

Expense tracking software, like Found, offers an all-in-one solution for your financial needs. It integrates smart banking, bookkeeping, and tax tools specifically designed for freelancers, contractors, and small business owners. With Found, you can manage cash flow, organize expenses, and handle taxes effortlessly. Its user-friendly interface and automated features save time and reduce stress, making financial management easier and more efficient. No hidden fees, no account maintenance costs, and real-time tax calculations ensure you stay on top of your finances without any surprises. Discover more about how Found can transform your business financial management by visiting their website here.

Introduction To Expense Tracking Software

Expense tracking software like Found has revolutionized the way freelancers, contractors, and small business owners manage their finances. This powerful tool integrates banking, bookkeeping, and tax management in one easy-to-use platform. Let’s explore what expense tracking software is and why it is crucial for effective financial management.

What Is Expense Tracking Software?

Expense tracking software is a digital tool designed to help individuals and businesses monitor and manage their expenditures. It automates the process of recording expenses, categorizing them, and generating reports. Found offers automatic expense tracking for seamless, paper-free bookkeeping. This integration simplifies the financial management process and eliminates the need to toggle between different apps.

The Importance Of Financial Management

Effective financial management is essential for any business. It ensures that cash flow is monitored, budgets are adhered to, and tax obligations are met. Found provides smart tax tools that calculate estimated tax bills in real-time and auto-categorize expenses for easy write-offs. This helps businesses stay on top of their finances and avoid costly mistakes.

Here are some key benefits of using expense tracking software like Found:

- Simplifies tax management and financial tracking

- Saves time with automation and integrated tools

- Provides a user-friendly interface

- Offers secure banking with FDIC insurance up to $250,000

The combination of these features makes expense tracking software an invaluable asset for freelancers, contractors, and small business owners.

For more information, visit Found.

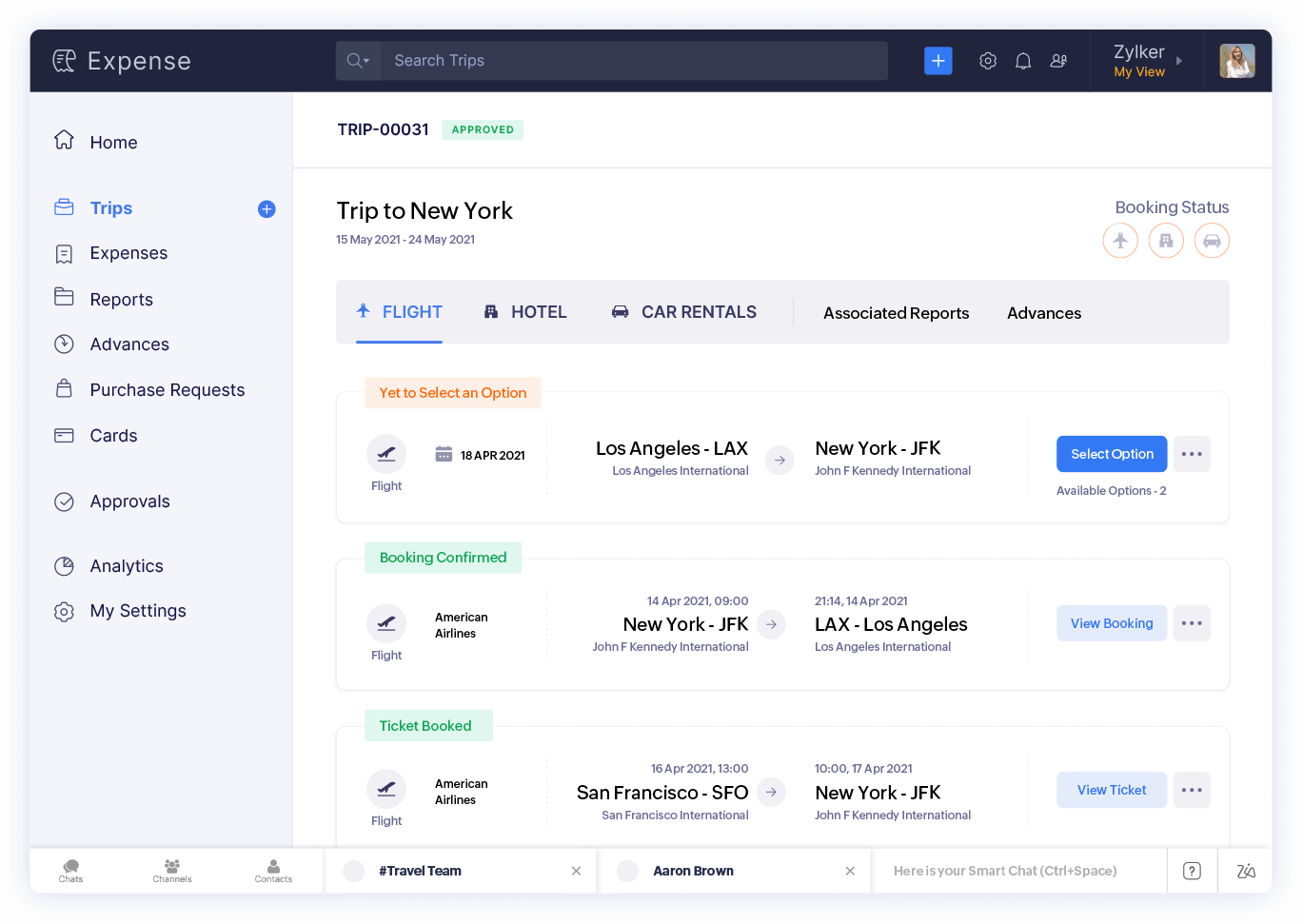

Key Features Of Expense Tracking Software

Expense tracking software is essential for freelancers, contractors, and small business owners. Found is a powerful solution that simplifies financial management. Here are the key features that make it stand out:

Automated Expense Recording

Found offers automatic expense tracking for seamless, paper-free bookkeeping. The software categorizes expenses automatically, making it easier to manage and track spending. This saves time and reduces the risk of manual entry errors.

Real-time Financial Reporting

Found provides real-time financial reporting. Users can access up-to-date information on their financial status. This feature helps in making informed business decisions promptly.

Budgeting And Forecasting Tools

Found includes budgeting and forecasting tools that assist in planning and financial projections. These tools help users set financial goals and track progress, ensuring better financial management.

Multi-device Synchronization

Found is accessible via iOS, Android, and desktop platforms. This multi-device synchronization ensures that users can manage their finances from anywhere, at any time. All data is updated in real-time across all devices.

Customizable Expense Categories

Found allows users to customize expense categories. This feature helps in organizing expenses according to specific business needs, making it easier to track and report expenses accurately.

| Feature | Description |

|---|---|

| Automated Expense Recording | Automatic tracking and categorization of expenses |

| Real-Time Financial Reporting | Access to up-to-date financial information |

| Budgeting and Forecasting Tools | Tools for financial planning and projections |

| Multi-Device Synchronization | Accessible on iOS, Android, and desktop platforms |

| Customizable Expense Categories | Organize expenses according to business needs |

Benefits Of Using Expense Tracking Software

Managing finances can be tough. Expense tracking software like Found can help. Let’s explore the key benefits of using such a tool.

Enhanced Financial Awareness

Expense tracking software provides a clear picture of your financial health. With Found, you get real-time updates on your cash flow. This helps in understanding your spending patterns. It also aids in identifying areas where you can save money.

Time-saving Automation

Manual bookkeeping is time-consuming. Found automates many tasks. It offers features like auto-categorization of expenses and automatic tax calculations. This saves time and reduces the workload. You can focus more on your business rather than paperwork.

Improved Budget Adherence

Sticking to a budget is easier with expense tracking software. Found provides tools to create and monitor budgets. You can set spending limits and get alerts when you are close to exceeding them. This ensures you stay within your financial goals.

Reduced Risk Of Human Error

Human errors are common in manual financial tracking. Found minimizes these risks. It automates data entry and calculations, ensuring accuracy. This reduces the chances of mistakes that can cost money.

Better Financial Decision Making

Good financial decisions come from accurate data. Found offers integrated financial tools. These tools provide insights into your financial status. With accurate information, you can make informed decisions for your business.

Here is a summary table of the key benefits:

| Benefit | Description |

|---|---|

| Enhanced Financial Awareness | Real-time updates on cash flow and spending patterns |

| Time-Saving Automation | Automates tasks like expense categorization and tax calculations |

| Improved Budget Adherence | Tools to create and monitor budgets with alerts |

| Reduced Risk of Human Error | Minimizes errors through automation |

| Better Financial Decision Making | Provides insights for informed financial decisions |

Found integrates smart banking, bookkeeping, and tax tools. It is ideal for freelancers, contractors, and small business owners. The software is free to use with no hidden fees. It is secure with FDIC insurance and data encryption. Experience seamless financial management with Found.

Pricing And Affordability

Choosing the right expense tracking software depends heavily on pricing and affordability. Found offers various features that cater to freelancers and small business owners. Understanding the cost implications is crucial for making an informed decision.

Free Vs. Paid Versions

Found provides a free business banking solution with no monthly account maintenance fees. This plan includes essential features such as:

- Smart online banking

- Virtual cards and custom pockets

- No hidden fees

- Easy sign-up process with no credit check

For those needing advanced features, Found Plus offers additional bookkeeping tools. This paid subscription includes:

- Advanced bookkeeping software

- Enhanced tax management tools

Subscription Plans And Features

Found’s subscription plans are designed to cater to different business needs. Here is a detailed look at their offerings:

| Plan | Features | Cost |

|---|---|---|

| Free Plan |

|

$0/month |

| Found Plus |

|

Subscription fee applies |

Cost-benefit Analysis

Evaluating the cost-benefit of Found’s expense tracking software is essential. Here are the key benefits:

- Simplifies tax management: Real-time tax calculations and auto-categorization for write-offs.

- Saves time: Integrated tools eliminate the need to toggle between apps.

- Secure banking: FDIC insurance, data encryption, and fraud monitoring ensure security.

Although Found’s free plan covers basic needs, the Found Plus subscription provides advanced tools that can significantly enhance financial management. The absence of hidden fees and the security provided make it a valuable investment for small business owners.

Pros And Cons Of Expense Tracking Software

Expense tracking software can significantly streamline your financial management. It offers numerous advantages, but it is not without its drawbacks. Below, we explore the pros and cons of using expense tracking software, so you can make an informed decision.

Pros: Efficiency And Convenience

Expense tracking software like Found enhances efficiency and convenience in several ways:

- Automatic expense tracking reduces the need for manual data entry.

- Integrated financial tools eliminate the need to toggle between apps.

- Real-time tax calculations simplify tax management.

- Virtual cards and custom pockets help organize money effortlessly.

With Found, you can manage your expenses seamlessly, saving valuable time.

Pros: Comprehensive Financial Insights

Using expense tracking software provides comprehensive financial insights:

- Auto-categorization for easy write-offs.

- Professional, trackable invoicing for better financial oversight.

- FDIC insurance up to $250k ensures your money is safe.

These features allow for better financial decision-making and planning.

Cons: Potential Privacy Concerns

Using expense tracking software may raise privacy concerns:

- Data encryption and secure infrastructure are essential but might still make some users wary.

- Comprehensive fraud monitoring is in place, yet concerns about data privacy persist.

It’s crucial to trust the software and the security measures it employs.

Cons: Learning Curve For New Users

New users may face a learning curve:

- Understanding the features and tools might take some time.

- Adapting to a new system can be initially overwhelming.

However, the user-friendly interface of Found is designed to ease this transition.

Who Can Benefit From Expense Tracking Software?

Expense tracking software is a valuable tool for anyone who manages finances. It simplifies the process of tracking, categorizing, and managing expenses. Let’s explore who can benefit from using expense tracking software like Found.

Individuals And Personal Use

Individuals can use expense tracking software to manage personal finances. It helps track spending habits, categorize expenses, and set budgets. This makes it easier to save money and plan for future goals.

- Track daily expenses

- Set and manage budgets

- Gain insights into spending habits

Small Business Owners

Small business owners need to monitor cash flow and manage expenses efficiently. Found offers features like smart online banking and virtual cards. These tools help in organizing money and managing business finances seamlessly.

- Monitor cash flow

- Organize money with custom pockets

- Track expenses automatically

Freelancers And Contractors

Freelancers and contractors often juggle multiple projects. Managing finances can be overwhelming. Found provides integrated tools for invoicing, bookkeeping, and tax management. This simplifies financial tracking and ensures timely payments.

- Send professional invoices

- Auto-categorize expenses

- Calculate estimated taxes in real-time

Corporate Finance Teams

Corporate finance teams handle large volumes of transactions. Accurate expense tracking is crucial. Expense tracking software streamlines the process, ensuring accurate financial reporting and compliance with regulations.

- Ensure accurate financial reporting

- Maintain compliance with regulations

- Handle large volumes of transactions

Frequently Asked Questions

What Is Expense Tracking Software?

Expense tracking software is a tool that helps you monitor and manage your expenses. It simplifies budgeting and financial planning by categorizing expenditures.

Why Use Expense Tracking Software?

Expense tracking software helps you stay on budget and avoid overspending. It provides detailed insights into your spending habits, aiding in better financial decisions.

How Does Expense Tracking Software Work?

Expense tracking software records your transactions and categorizes them. It generates reports and visual summaries to help you understand your spending patterns.

Can Expense Tracking Software Sync With Bank Accounts?

Yes, many expense tracking software options can sync with bank accounts. This feature automatically imports transactions, making tracking easier and more accurate.

Conclusion

Expense tracking software can greatly simplify your financial management. Tools like Found offer seamless integration of banking, bookkeeping, and tax solutions. You get smart banking features with no hidden fees and easy sign-up. The automatic expense tracking and tax tools save time and reduce stress. Found is user-friendly and secure, making it perfect for freelancers and small business owners. Interested in streamlining your finances? Check out Found for more details.