Enhance Cash Flow: Proven Strategies for Business Success

Cash flow is crucial for any business. It ensures operational stability.

Want to enhance cash flow effectively? Managing finances can be complex, but there are tools designed to simplify the process. One such tool is the BILL Financial Operations Platform. This platform automates tasks like bill creation, payments, invoicing, and expense management, offering a seamless experience. By integrating with leading accounting software, BILL streamlines accounts payable and receivable, helping businesses save time and money. Whether you run a small business or a midsize company, optimizing your cash flow can significantly impact your financial health. Let’s explore how you can leverage tools like BILL to enhance your cash flow efficiently.

Introduction To Cash Flow Management

Managing cash flow is crucial for any business. It ensures that there is enough cash to meet obligations, invest in opportunities, and sustain operations. Effective cash flow management allows businesses to predict cash shortages and surpluses, making strategic decisions easier.

The Importance Of Cash Flow

Cash flow is the lifeblood of any business. It affects every aspect, from paying employees to purchasing inventory. Without proper cash flow management, a business may struggle to cover its expenses, leading to financial difficulties.

Here are some reasons why cash flow is important:

- Operational Needs: Ensures daily operations run smoothly.

- Debt Management: Helps in managing loans and credits.

- Investment Opportunities: Provides liquidity to invest in growth opportunities.

- Financial Stability: Reduces the risk of financial distress.

Understanding Cash Flow Basics

Understanding the basics of cash flow involves knowing how money moves in and out of your business. Cash flow is typically divided into three main categories:

- Operating Activities: Cash generated from core business operations.

- Investing Activities: Cash used or generated from investments.

- Financing Activities: Cash used to fund the business, such as loans or equity.

To manage cash flow effectively, businesses often use tools and platforms like the BILL Financial Operations Platform. This platform automates financial tasks, making it easier to track and manage cash flow.

Here are some features of the BILL Financial Operations Platform:

| Feature | Description |

|---|---|

| AP Automation | Streamlines the accounts payable process from bill creation to payments. |

| Spend & Expense Management | Provides budget setting and expense tracking with the BILL Divvy Card. |

| Financial Operations Platform | Manages AP, AR, spend, and expenses on a single platform. |

| Integrations | Compatible with QuickBooks, Sage Intacct, Oracle Netsuite, and more. |

| Mobile App | Allows access and management on-the-go. |

By using such tools, businesses can enhance their cash flow management, ensuring better control, visibility, and efficiency. This leads to increased efficiency, cost savings, and time savings, making it an essential part of business operations.

Key Strategies For Enhancing Cash Flow

Enhancing cash flow is crucial for maintaining a healthy financial position in any business. Implementing effective strategies can ensure your business operates smoothly and remains financially stable. Below are key strategies to enhance cash flow, focusing on improving accounts receivable, effective inventory management, optimizing accounts payable, and utilizing cash flow forecasting.

Managing accounts receivable efficiently is vital for cash flow enhancement. Here are some strategies:

- Issue invoices promptly to speed up payments.

- Offer discounts for early payments.

- Implement strict credit policies to minimize overdue payments.

- Use automated reminders for unpaid invoices.

The BILL Financial Operations Platform automates invoicing and payment reminders, streamlining the entire process.

Maintaining optimal inventory levels can significantly impact cash flow. Consider the following:

- Analyze sales trends to forecast demand accurately.

- Use just-in-time inventory management to reduce holding costs.

- Implement inventory tracking systems to prevent overstocking.

Effective inventory management helps free up cash tied in unsold stock, improving liquidity.

Managing accounts payable efficiently can improve your cash flow. Key tactics include:

- Negotiate better payment terms with suppliers.

- Schedule payments to take advantage of early payment discounts.

- Use automated systems to avoid late payment penalties.

The BILL Financial Operations Platform’s AP Automation feature streamlines the accounts payable process, from bill creation to approvals and payments, enhancing efficiency.

Accurate cash flow forecasting is essential for financial stability. Follow these steps:

- Review historical cash flow data to identify patterns.

- Regularly update forecasts based on current business conditions.

- Use forecasting tools to predict future cash flow needs.

Utilizing cash flow forecasting helps anticipate cash shortages and surpluses, allowing for better financial planning.

By leveraging these strategies and tools like the BILL Financial Operations Platform, businesses can enhance their cash flow, ensuring long-term financial health and stability.

Improving Accounts Receivable

Enhancing your cash flow begins with improving accounts receivable management. Efficiently managing accounts receivable ensures timely payments, reduces outstanding invoices, and improves overall financial health. Let’s explore some key strategies to achieve this.

Invoicing Best Practices

Implementing effective invoicing practices is crucial. Here are some tips:

- Clear and Accurate Invoices: Ensure invoices are easy to read and free of errors.

- Timely Invoicing: Send invoices immediately after delivering goods or services.

- Detailed Descriptions: Include a breakdown of charges to avoid disputes.

- Payment Terms: Clearly state payment terms and due dates.

- Automated Invoicing: Use tools like the BILL Financial Operations Platform to automate invoicing and reduce manual errors.

Implementing Early Payment Incentives

Encouraging clients to pay early can significantly improve cash flow. Consider these methods:

- Discounts for Early Payments: Offer a small discount for payments made before the due date.

- Flexible Payment Options: Provide multiple payment methods to make it easier for clients to pay promptly.

- Clear Communication: Inform clients about the benefits of early payment incentives.

| Incentive Type | Details |

|---|---|

| 2% Discount | For payments within 10 days |

| 1% Discount | For payments within 15 days |

Streamlining Collections Process

A streamlined collections process is essential for reducing outstanding receivables. Here are some strategies:

- Automated Reminders: Use automated reminders to notify clients of upcoming and overdue payments.

- Consistent Follow-up: Regular follow-up on overdue invoices ensures clients prioritize your payment.

- Dedicated Collections Team: Assign a team or individual responsible for managing collections.

- Use Technology: Utilize platforms like BILL to track and manage accounts receivable efficiently.

- Set up automated reminders in the BILL platform.

- Follow up consistently with clients on overdue invoices.

- Use reporting tools to monitor outstanding receivables.

By following these strategies, you can enhance your accounts receivable process, leading to better cash flow and financial stability.

Effective Inventory Management

Effective inventory management is essential for maintaining a healthy cash flow. It involves keeping track of stock levels, reducing excess inventory, and ensuring timely restocking. This process minimizes costs and maximizes profits. Here are some key strategies for effective inventory management.

Maintaining Optimal Inventory Levels

Maintaining optimal inventory levels is crucial for businesses. Too much inventory ties up capital and increases holding costs. Too little inventory can lead to stockouts and lost sales. Find a balance to ensure you have enough stock to meet demand while minimizing excess.

To maintain optimal levels:

- Track inventory turnover rates

- Analyze sales trends

- Implement just-in-time inventory practices

Using Inventory Management Software

Using inventory management software simplifies the process of tracking and managing stock. It automates tasks such as order processing, stock level monitoring, and reordering. This reduces human error and saves time.

Benefits of inventory management software:

- Real-time inventory tracking

- Automated reordering

- Integration with accounting systems

Consider integrating inventory management software with the BILL Financial Operations Platform. This platform offers seamless integration with leading accounting software, enhancing overall financial management.

Reducing Inventory Holding Costs

Reducing inventory holding costs involves minimizing the expenses associated with storing and managing inventory. These costs include warehousing, insurance, and depreciation.

Strategies to reduce holding costs:

- Negotiate better storage rates

- Implement drop shipping

- Use demand forecasting to avoid overstocking

By optimizing inventory levels and utilizing management software, businesses can effectively reduce holding costs. This enhances cash flow and improves financial health.

For more information on managing your finances, visit BILL.

Optimizing Accounts Payable

Effective accounts payable management is crucial for improving cash flow. By optimizing accounts payable processes, you can ensure timely payments, avoid late fees, and take advantage of early payment discounts. This section will focus on key strategies to enhance your accounts payable efficiency.

Negotiating Better Payment Terms

Negotiating better payment terms with suppliers can significantly impact your cash flow. Discuss extending payment periods to align with your cash flow cycles. Consider the following approaches:

- Extend Payment Periods: Request longer payment terms, like 60 or 90 days, to keep cash available longer.

- Flexible Terms: Negotiate flexible terms that adapt to your business needs.

- Volume Discounts: Use bulk buying power to negotiate better terms and discounts.

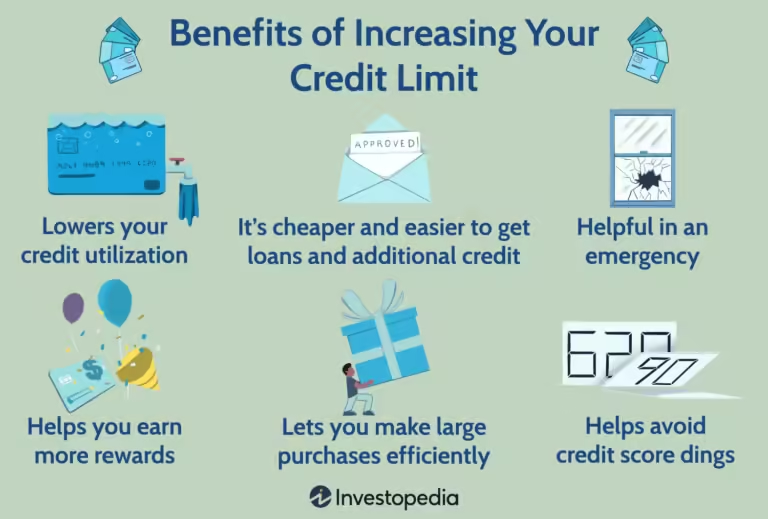

Taking Advantage Of Early Payment Discounts

Many suppliers offer early payment discounts, which can reduce expenses. These savings can add up over time. Implement these practices:

- Identify Discounts: Track which suppliers offer early payment discounts.

- Prioritize Payments: Pay invoices with early payment discounts first.

- Automate Tracking: Use software to monitor discount opportunities and deadlines.

Automating Payment Processes

Automation can streamline your accounts payable process, reducing errors and saving time. The BILL Financial Operations Platform offers comprehensive solutions:

- AP Automation: Automate bill creation, approvals, and payments.

- Expense Management: Manage expenses and set budgets with the BILL Divvy Card.

- Integration: Seamlessly integrate with QuickBooks, Sage Intacct, and other accounting software.

Using BILL can increase office efficiency by up to 20% and save users an average of 12 hours monthly. It provides a single platform to manage all financial operations, ensuring better control, visibility, and efficiency.

Utilizing Cash Flow Forecasting

Effective cash flow management is vital for any business. Utilizing cash flow forecasting can help businesses predict future financial positions, ensuring there are enough funds to cover upcoming expenses. This proactive approach can enhance decision-making and prevent liquidity issues. Let’s explore how to create and analyze cash flow forecasts, and how to adjust business strategies based on these insights.

Creating A Cash Flow Forecast

Creating a cash flow forecast involves estimating future cash inflows and outflows over a specific period. Start by listing all expected sources of income and all anticipated expenses. This could include:

- Income: Sales revenue, loan proceeds, investment returns, etc.

- Expenses: Rent, salaries, utility bills, loan repayments, etc.

To streamline this process, use tools like the BILL Financial Operations Platform. It integrates with leading accounting software, making it easier to track and forecast cash flow. BILL automates accounts payable (AP) and accounts receivable (AR) processes, providing a clearer financial picture.

Analyzing Cash Flow Trends

Once you have a cash flow forecast, analyze the trends it reveals. Look for patterns in income and expenses. Identify periods of surplus and potential shortfalls. Use this analysis to understand your business’s financial health. Key points to consider include:

- Seasonal Trends: Are there predictable fluctuations in cash flow?

- Expense Patterns: Are there recurring high-cost periods?

- Income Consistency: Is income steady or variable?

BILL’s integrated platform can help by providing detailed reports and insights. This visibility into your financial operations can highlight areas needing attention.

Adjusting Business Strategies Based On Forecasts

Use the insights from your cash flow forecast to adjust your business strategies. If forecasts show a potential shortfall, consider cost-cutting measures or exploring new revenue streams. If a surplus is expected, plan for investments or growth opportunities. Steps to consider include:

- Cost Management: Identify and reduce non-essential expenses.

- Income Diversification: Explore new markets or products.

- Investment Planning: Use surplus funds for strategic investments.

Leverage BILL’s financial operations platform to manage these adjustments seamlessly. Its features for spend and expense management can help keep your strategies aligned with your financial goals.

By utilizing cash flow forecasting, analyzing trends, and adjusting strategies, businesses can maintain healthy cash flow and ensure long-term success.

Pricing And Affordability Of Cash Flow Management Tools

Managing cash flow effectively is crucial for any business. Cash flow management tools help streamline financial operations. They offer features like expense tracking, invoicing, and budget control. Understanding the pricing and affordability of these tools is essential. It ensures businesses make informed decisions without straining their finances.

Cost Analysis Of Popular Tools

Several cash flow management tools are available in the market. Each tool comes with its unique features and pricing models. Let’s look at the cost analysis of some popular tools:

| Tool | Monthly Cost | Main Features |

|---|---|---|

| BILL Financial Operations Platform | Contact Sales | AP Automation, Spend & Expense Management, Integrations |

| QuickBooks | $25 – $150 | Accounting, Invoicing, Expense Tracking |

| Zoho Books | $20 – $70 | Accounting, Invoicing, Inventory Management |

Budget-friendly Options For Small Businesses

Small businesses often operate on tight budgets. They need cost-effective solutions without compromising on essential features. Here are some budget-friendly options:

- Zoho Books: Starting at $20 per month, it offers comprehensive accounting features.

- Wave: Free accounting software with basic invoicing and expense tracking.

- FreshBooks: Plans start at $15 per month, ideal for freelancers and small businesses.

Return On Investment Considerations

Investing in cash flow management tools should offer a substantial return. Here are some key considerations:

- Time Savings: Tools like BILL save users an average of 12 hours monthly.

- Cost Savings: BILL users report average monthly savings of over $10K.

- Increased Efficiency: Automation features increase office efficiency by up to 20%.

Evaluating these factors ensures the tool you choose provides value. It aligns with your business goals and financial capacity.

For detailed pricing and demos, visit the BILL website.

Pros And Cons Of Different Cash Flow Strategies

Managing cash flow effectively is crucial for any business. Implementing various strategies can help improve financial health. Each approach has its own advantages and potential challenges. In this section, we will explore the pros and cons of different cash flow strategies.

Advantages Of Improved Cash Flow

Improved cash flow offers numerous benefits. Here are some key advantages:

- Increased Efficiency: Utilizing platforms like BILL can streamline financial tasks. Automated processes save time and reduce errors.

- Cost Savings: Businesses can save an average of $10K monthly. This can be reinvested into other areas of the business.

- Time Savings: On average, users save 12 hours monthly. This allows more focus on strategic initiatives.

- Better Control: A comprehensive platform like BILL provides visibility and control over financial operations. It ensures better management of AP, AR, and expenses.

- Scalability: Solutions like BILL are suitable for various business sizes. They cater to small businesses and midsize companies alike.

Potential Challenges And Risks

While improved cash flow offers many benefits, there are potential challenges:

- Implementation Costs: Initial setup and integration costs can be high. It may require investment in training and software.

- Technical Issues: Relying on digital platforms may lead to technical glitches. This can disrupt financial operations.

- Data Security: Handling sensitive financial data requires robust security measures. Breaches can lead to significant financial losses.

- Compliance: Adhering to various legal and compliance standards is critical. Non-compliance can result in penalties.

Balancing Immediate And Long-term Benefits

Businesses must balance short-term gains and long-term growth:

| Immediate Benefits | Long-Term Benefits |

|---|---|

| Quick access to funds | Improved financial stability |

| Reduced operational costs | Scalability and growth |

| Enhanced efficiency | Better financial control |

| Time savings | Increased profitability |

Using a solution like BILL can help achieve this balance. It integrates with leading accounting software and offers a comprehensive management platform. By leveraging such tools, businesses can enhance both immediate cash flow and long-term financial health.

Specific Recommendations For Business Types

Enhancing cash flow is crucial for every business, but strategies vary based on the type of business. Tailoring approaches to meet specific needs can help manage finances better and ensure sustainable growth. Here are specific recommendations for startups, established businesses, and seasonal businesses.

Strategies For Startups

Startups often face unique challenges with cash flow. Here are some strategies:

- Leverage Technology: Use tools like the BILL Financial Operations Platform to automate AP and AR processes. This saves time and reduces errors.

- Expense Management: Utilize the BILL Divvy Card for streamlined expense tracking. Set budgets and monitor spending in real-time.

- Integrate Systems: Ensure seamless integration with accounting software like QuickBooks or Xero. This provides better visibility and control over finances.

Approaches For Established Businesses

Established businesses need robust systems to manage more complex financial operations. Consider these approaches:

- Automate Processes: Implement BILL’s AP Automation to handle bill creation, approvals, and payments efficiently.

- Comprehensive Management: Use a single platform for all financial operations, including AP, AR, and expense management. This increases efficiency and control.

- Partner Programs: Take advantage of BILL’s Accountant Partner Program to automate bookkeeping tasks and manage client bill pay services.

Tactics For Seasonal Businesses

Seasonal businesses experience fluctuating cash flows. Here are some tactics to manage this:

- Plan Ahead: Use BILL to set budgets and track expenses, ensuring better preparation for off-peak seasons.

- Credit Lines: Access credit lines through the BILL Divvy Card to maintain liquidity during low-revenue periods.

- Monitor Spending: Keep a close eye on expenses with real-time tracking. Adjust budgets as needed to maintain a healthy cash flow.

Frequently Asked Questions

How Can I Improve My Business Cash Flow?

Improving cash flow involves better invoicing practices, reducing expenses, and optimizing inventory management. Regularly monitor your cash flow statements.

What Are Effective Cash Flow Strategies?

Effective strategies include timely invoicing, negotiating better payment terms, and managing inventory efficiently. Consider short-term financing options if necessary.

Why Is Cash Flow Important For Businesses?

Cash flow is crucial for meeting daily operational expenses. It ensures business stability and helps in planning future investments.

How Can Small Businesses Manage Cash Flow?

Small businesses can manage cash flow by budgeting, tracking expenses, and maintaining an emergency fund. Use accounting software for accuracy.

Conclusion

Enhancing cash flow is essential for business growth. Effective financial management can help. Platforms like Bill simplify financial tasks. This saves time and reduces costs. Streamlining accounts payable and expense management boosts efficiency. Better cash flow leads to more stability. Invest in tools that optimize your financial operations. This ensures a healthier financial future.