Emergency Credit Options: Quick Solutions for Financial Relief

Emergencies often hit without warning, leaving us scrambling for quick financial solutions. Emergency credit options can be a lifesaver in such situations, providing the necessary funds to tackle unexpected expenses.

In this blog post, we will explore various emergency credit options available to help you navigate financial crises. From credit cards to personal loans, understanding these options can ease stress during tough times. We will also introduce a comprehensive solution for business founders, Firstbase. This all-in-one startup operating system streamlines incorporation, bookkeeping, and tax filing, among other essential services. Whether for personal or business emergencies, knowing your credit options is key. Stay tuned to learn more about how to secure funds when you need them the most.

Introduction To Emergency Credit Options

Emergency credit options provide immediate financial relief during unexpected situations. These can include medical emergencies, sudden job loss, or urgent home repairs. Understanding these options can help you make informed decisions during a crisis.

Understanding Emergency Credit

Emergency credit is designed to offer quick access to funds in critical times. It differs from regular credit due to its rapid approval process. Common forms of emergency credit include:

- Credit Cards: Many credit cards offer cash advances.

- Personal Loans: Lenders can approve personal loans quickly.

- Payday Loans: Small, short-term loans meant for immediate needs.

Each option has its pros and cons. Credit cards may have high-interest rates. Personal loans might require a good credit score. Payday loans can be very expensive. Consider all factors before choosing.

Importance Of Quick Financial Relief

Quick financial relief is crucial in emergencies. It helps cover unexpected expenses without disrupting your budget. It can prevent further financial stress. For example, a sudden medical bill can be paid using emergency credit, ensuring you receive timely treatment.

Fast access to funds can also save you from penalties. If your car needs urgent repairs, emergency credit can cover the costs. This can prevent missed work days and additional expenses.

Lastly, having emergency credit options gives peace of mind. Knowing you have a safety net during unforeseen events reduces anxiety. It allows you to focus on resolving the emergency rather than worrying about finances.

Types Of Emergency Credit Options

Emergencies can happen at any time, and having access to quick credit is crucial. Understanding the different types of emergency credit options can help you make informed decisions during stressful times. Here, we explore several options available for immediate financial relief.

Personal Loans

Personal loans are a common choice for emergency credit. These loans are offered by banks, credit unions, and online lenders. They typically have lower interest rates compared to credit cards. Personal loans can be used for various purposes, including medical bills, car repairs, or unexpected expenses.

| Features | Details |

|---|---|

| Interest Rates | Lower than credit cards |

| Repayment Term | Flexible, often 1-5 years |

| Approval Time | Varies, usually within a few days |

Credit Card Cash Advances

Credit card cash advances provide quick access to cash. You can withdraw money from your credit card’s available credit limit. This option is convenient but comes with higher interest rates and fees compared to other credit options.

- Immediate access to cash

- High interest rates and fees

- Repayment terms similar to credit card purchases

Payday Loans

Payday loans are short-term loans designed to cover expenses until your next paycheck. They are easy to obtain but come with very high interest rates. These loans should be used as a last resort due to their high cost.

- Quick and easy approval

- High interest rates

- Short repayment period

Peer-to-peer Lending

Peer-to-peer lending platforms connect borrowers with individual lenders. This option can offer competitive interest rates and flexible terms. It’s an alternative to traditional bank loans and can be accessed online.

- Competitive interest rates

- Flexible repayment terms

- Online application process

Emergency Assistance Programs

Emergency assistance programs are offered by various organizations, including government agencies and non-profits. These programs provide financial aid to individuals in crisis situations. The aid can cover basic needs such as food, housing, and medical expenses.

| Provider | Services |

|---|---|

| Government Agencies | Financial aid for basic needs |

| Non-Profit Organizations | Support for housing, food, and medical expenses |

Key Features Of Personal Loans

Personal loans offer a range of benefits that make them a popular choice for emergency credit options. They provide financial flexibility and convenience, helping you manage unexpected expenses effectively.

Flexible Repayment Terms

One of the significant advantages of personal loans is the flexible repayment terms. Borrowers can choose repayment periods that best suit their financial situation. This flexibility ensures that you can manage your loan repayments without straining your budget.

| Repayment Term | Benefit |

|---|---|

| Short-term (1-3 years) | Faster payoff, less interest paid |

| Medium-term (3-5 years) | Balanced approach, moderate interest |

| Long-term (5+ years) | Lower monthly payments, more time to repay |

Lower Interest Rates Compared To Other Options

Personal loans generally come with lower interest rates compared to credit cards and payday loans. This makes them a cost-effective solution for managing debt or funding urgent needs. Lower interest rates help in reducing the overall repayment amount, making personal loans an attractive option.

- Typical personal loan interest rates: 5% – 15%

- Credit card interest rates: 15% – 25%

- Payday loan interest rates: 300% – 500%

Higher Loan Amounts Available

Another key feature of personal loans is the availability of higher loan amounts. Borrowers can access substantial funds, which are often not available through other emergency credit options. This makes personal loans suitable for large expenses such as medical bills, home repairs, or debt consolidation.

- Personal loans: Up to $100,000

- Credit cards: Up to $50,000

- Payday loans: Up to $1,000

In summary, personal loans provide flexible repayment terms, lower interest rates, and higher loan amounts. These features make them a reliable option for managing financial emergencies.

Key Features Of Credit Card Cash Advances

Credit card cash advances provide quick funds during emergencies. Ideal for unexpected expenses, they offer immediate cash access. Easy to use at ATMs or banks, these advances can be a lifeline in urgent situations.

Credit card cash advances offer a quick way to get funds. They come with specific features. Understanding these helps make informed decisions.Immediate Access To Funds

One of the primary benefits of credit card cash advances is immediate access to funds. This feature is crucial during emergencies. Funds are available right away. No lengthy approval process. Just visit an ATM or bank, and withdraw the needed amount. This convenience can be a lifesaver in urgent situations.Convenient And Easy To Obtain

Credit card cash advances are convenient and easy to obtain. You don’t need to fill out additional forms or undergo credit checks. Simply use your existing credit card. Most banks and ATMs support cash advances. This makes the process straightforward.Higher Interest Rates

A key point to consider is the higher interest rates. Cash advances typically have a higher APR compared to regular purchases. This means you will pay more in interest if the balance is not paid off quickly. Be mindful of this cost when deciding to use a cash advance. “`Key Features Of Payday Loans

Payday loans offer a quick solution for short-term financial needs. These loans are designed for emergencies and provide immediate access to funds. Understanding the key features of payday loans can help you decide if they are the right choice for your financial situation.

Quick Approval Process

One of the most attractive features of payday loans is the quick approval process. Unlike traditional loans, payday loans often require minimal documentation. You can apply online or in-person and receive a decision within minutes. This makes payday loans an ideal option for those who need cash urgently.

Short-term Financial Solution

Payday loans are a short-term financial solution. These loans are typically due on your next payday, which is usually within two weeks. This short repayment period can help you manage temporary cash flow problems without committing to long-term debt.

High Interest Rates And Fees

While payday loans provide quick access to cash, they come with high interest rates and fees. Borrowers should be aware that the cost of borrowing can be significantly higher compared to traditional loans. It’s important to understand the terms and conditions to avoid falling into a cycle of debt.

| Feature | Description |

|---|---|

| Quick Approval Process | Minimal documentation, decision within minutes. |

| Short-Term Financial Solution | Repayment is typically due by the next payday. |

| High Interest Rates and Fees | Higher costs compared to traditional loans. |

Key Features Of Peer-to-peer Lending

Peer-to-peer (P2P) lending offers a unique way to access emergency credit options. It’s a method where individuals lend money to each other without the need for a traditional financial institution. This approach brings several benefits, making it an attractive choice for many borrowers.

Lower Interest Rates

One of the most significant advantages of P2P lending is the lower interest rates. Traditional banks often have high overhead costs, which they pass on to borrowers through higher interest rates. In contrast, P2P platforms have fewer operational costs, allowing them to offer more competitive rates. This can result in significant savings over the life of the loan.

| Feature | Traditional Banks | P2P Lending |

|---|---|---|

| Interest Rates | Higher | Lower |

| Overhead Costs | High | Low |

Flexible Loan Amounts

P2P lending platforms offer flexible loan amounts to meet various needs. Borrowers can request small amounts for minor expenses or larger sums for significant financial needs. This flexibility is crucial, as it allows borrowers to tailor their loans to their specific situations.

- Small loans for minor expenses

- Larger loans for significant financial needs

- Customizable loan terms

Community-based Support

P2P lending builds on the idea of community-based support. Borrowers and lenders are often part of the same community. This connection can create a sense of trust and responsibility. Lenders feel good about helping someone in their community, while borrowers appreciate the personalized support.

This community aspect makes P2P lending more than just a financial transaction. It fosters a sense of belonging and mutual assistance. Borrowers are more likely to repay their loans on time, knowing they are accountable to someone they may know.

Key Features Of Emergency Assistance Programs

Emergency assistance programs offer critical support during financial crises. These programs provide essential aid to those in urgent need. Understanding the key features can help you navigate and benefit from these resources.

Government And Non-profit Support

Government and non-profit organizations play a crucial role in emergency assistance. These entities often provide grants, loans, and other forms of financial aid. The aim is to help individuals and families recover quickly. Programs may include housing assistance, food aid, and healthcare support.

- Grants: These are typically non-repayable funds provided by the government.

- Loans: Some loans come with favorable terms to ease the repayment process.

- Food Aid: Non-profits often provide free meals or groceries.

Low Or No Interest Rates

Emergency loans often feature low or no interest rates. This helps reduce the financial burden during tough times. These loans are designed to be more manageable compared to traditional loans. Lower interest rates mean smaller monthly payments, which can be a significant relief.

| Loan Type | Interest Rate |

|---|---|

| Government Loans | 0% – 3% |

| Non-Profit Loans | 0% – 5% |

Eligibility Requirements

Eligibility criteria vary by program. Most programs require proof of financial hardship. Some may also look at income levels, family size, and other factors. Understanding these requirements helps ensure you qualify for the aid you need.

- Proof of Income: Documentation of your current income level.

- Financial Hardship: Evidence of financial difficulties, such as job loss or medical expenses.

- Residency: Proof of residence in the area where the program operates.

Meeting these criteria is essential for accessing emergency support. Always check specific requirements for each program.

Pricing And Affordability Breakdown

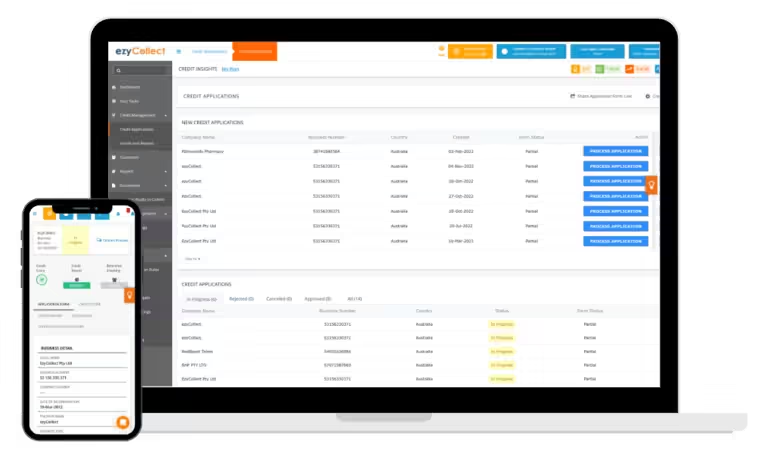

Understanding the pricing and affordability of emergency credit options is essential. It helps make informed financial decisions. Firstbase One offers various features that provide significant cost savings and benefits. Let’s dive into the details.

Comparing Interest Rates

Interest rates play a crucial role in determining the overall cost of emergency credit. Firstbase One provides competitive rates, making it an attractive option for startups. Here’s a comparison of typical interest rates:

| Credit Option | Interest Rate |

|---|---|

| Traditional Bank Loan | 5-10% |

| Credit Card | 15-25% |

| Firstbase One | 5-7% |

Fees And Additional Costs

Additional costs can significantly impact the affordability of credit options. Firstbase One offers transparency in its fee structure:

- Incorporation: No additional fees for forming an LLC or C-Corp.

- Mailroom: Included in the package, ensuring privacy and organization.

- Agent Services: Covers compliance in every state.

- Accounting: Full-service accrual bookkeeping is included.

- Tax Filing: Simplifies both corporate and personal tax returns.

- Payroll Tax Registration: No extra charges for state and city-level registrations.

- Banking and Payments: Waives Stripe processing fees for the first $20,000 in transactions.

- Equity Management: Free creation of a cap table in Carta and timely filing of 83(B).

Long-term Financial Impact

Considering the long-term financial impact is crucial. Firstbase One provides significant cost savings and benefits:

- Cost Savings: The package saves users $1,950 through bundled services.

- Perks: Access to $350,000 in perks from partners.

- Reduced Fees: No Stripe processing fees for the first $20,000 in transactions.

- Legal Credits: Up to $6,000 in credits from law firms.

- Efficiency: Combines multiple tools into a single platform, saving time and reducing costs.

Firstbase One supports over 30,000 companies and has helped raise $3 billion in funding. These benefits offer long-term financial stability and growth for startups.

Pros And Cons Of Each Credit Option

When facing financial emergencies, various credit options are available. Each option has its unique advantages and disadvantages. Understanding these can help you choose the best solution for your situation.

Personal Loans: Pros And Cons

Pros:

- Fixed interest rates and predictable monthly payments.

- Can be used for various purposes.

- Higher borrowing limits compared to other credit options.

- Lower interest rates than credit cards and payday loans.

Cons:

- Requires good credit for favorable terms.

- Longer approval process compared to other options.

- May have origination fees and prepayment penalties.

Credit Card Cash Advances: Pros And Cons

Pros:

- Quick access to cash.

- No application process; use existing credit line.

Cons:

- High interest rates compared to regular credit card purchases.

- Additional fees for cash advances.

- Interest starts accruing immediately.

Payday Loans: Pros And Cons

Pros:

- Fast approval and funding.

- Available for those with poor credit.

Cons:

- Extremely high interest rates and fees.

- Short repayment periods.

- Can lead to a cycle of debt.

Peer-to-peer Lending: Pros And Cons

Pros:

- Potentially lower interest rates than traditional loans.

- Flexible terms and conditions.

- Accessible to those with varying credit scores.

Cons:

- Longer approval process compared to other options.

- May require detailed financial information.

- Risk of default for lenders.

Emergency Assistance Programs: Pros And Cons

Pros:

- May offer grants or zero-interest loans.

- Designed to help those in dire need.

- Can provide immediate relief without long-term debt.

Cons:

- Eligibility requirements may be strict.

- Limited funding and availability.

- May require proof of hardship.

Choosing the right credit option requires careful consideration of these pros and cons. Assess your financial situation and needs before making a decision.

Recommendations For Ideal Users

Understanding the best emergency credit options tailored to your specific needs is crucial. Whether you have good credit, poor credit, or immediate financial requirements, we have you covered. Below are the recommended options for different user profiles.

Best Options For Individuals With Good Credit

If you have a strong credit score, you can access several favorable emergency credit options. Here are some benefits:

- Lower Interest Rates: Enjoy reduced interest rates, making repayment easier.

- Higher Credit Limits: Access to higher credit limits offers more financial flexibility.

- Better Rewards: Benefit from rewards programs that provide cash back, points, or travel miles.

Consider looking into personal loans from reputable banks or credit unions. Credit cards with low APR and generous rewards can also be beneficial.

Best Options For Individuals With Poor Credit

For those with poor credit, options might be more limited but still accessible. Here are some alternatives:

- Secured Credit Cards: These require a deposit but can help rebuild your credit.

- Credit Builder Loans: Small loans designed to improve your credit score.

- Payday Alternative Loans (PALs): Offered by some credit unions, these loans have lower fees and interest rates.

While these options might come with higher interest rates, they provide a way to manage your finances and improve your credit score over time.

Best Options For Immediate Financial Needs

In an emergency, speed is of the essence. Here are some options to consider:

- Personal Loans: Many lenders offer quick approval and funding.

- Credit Cards: Use existing credit cards if you have available credit.

- Payday Loans: These can be risky due to high interest, but they provide fast cash.

Personal loans from online lenders often have the quickest approval times. Make sure to compare different lenders to find the best terms.

Frequently Asked Questions

What Are Emergency Credit Options?

Emergency credit options include personal loans, credit cards, and payday loans. They provide quick access to funds during financial crises.

How Do Emergency Loans Work?

Emergency loans offer fast cash for urgent needs. They often have higher interest rates and short repayment periods.

Can I Get Emergency Credit With Bad Credit?

Yes, some lenders offer emergency credit to individuals with bad credit. Terms may vary and interest rates may be higher.

What Is The Fastest Way To Get Emergency Credit?

The fastest way is usually through online lenders or credit cards. Approval and funds can be instant.

Conclusion

Exploring emergency credit options ensures financial security during unexpected times. Consider reliable sources for quick access to funds. Evaluate options and choose wisely. Need comprehensive startup support? Check out Firstbase One for all-in-one business solutions. Stay prepared and make informed decisions for financial stability.