Emergency Credit Cards: Your Lifeline in Financial Crises

Emergency credit cards are a lifesaver in unexpected situations. They provide quick access to funds when you need them most.

In moments of financial stress, having an emergency credit card can make all the difference. Whether it’s an unforeseen medical expense, a sudden car repair, or an urgent home fix, these cards offer a safety net. But not all credit cards are created equal. It’s crucial to understand their features, benefits, and how they can be a vital part of your financial toolkit. In this post, we will explore what makes emergency credit cards essential, the key aspects to consider, and how to choose the best one for your needs. Get ready to learn how to be prepared for any financial curveballs life throws your way. For additional ways to manage finances and earn extra money, check out Freecash, an online platform rewarding users for testing apps, playing games, and completing surveys. Start earning today by visiting Freecash.

Introduction To Emergency Credit Cards

Emergencies happen unexpectedly, and having a financial safety net is crucial. Emergency credit cards can be your lifeline in such situations. They provide a quick solution to manage unforeseen expenses without draining your savings. Understanding these cards is essential for financial preparedness.

What Are Emergency Credit Cards?

Emergency credit cards are financial tools designed for urgent, unexpected expenses. These cards offer quick access to funds during crises. They often come with features that prioritize ease of use and fast approval.

Key characteristics include:

- High Credit Limits: To cover significant expenses.

- Low-Interest Rates: Lower rates to minimize financial strain.

- Flexible Repayment Options: Allowing manageable repayment plans.

Purpose And Importance In Financial Crises

Emergency credit cards serve a critical purpose in managing financial emergencies. They provide immediate access to funds, ensuring you can handle unexpected costs without delay. This can be vital during medical emergencies, car repairs, or sudden travel needs.

The importance of emergency credit cards during financial crises includes:

- Immediate Financial Relief: Access funds quickly without extensive approval processes.

- Protection of Savings: Avoid dipping into savings meant for long-term goals.

- Credit Building: Responsible use can help improve your credit score.

Having an emergency credit card like Freecash can be a smart move. Freecash offers a variety of tasks to earn money, which can be a supplementary way to manage finances. With options like instant cashouts and high payouts, Freecash enhances your financial flexibility.

| Feature | Description |

|---|---|

| Task Variety | Choose from 193 different offers including apps, games, and surveys. |

| Earning Potential | Earn up to $50.99 per offer. |

| Instant Cashouts | Withdraw earnings almost instantly starting at $2.00. |

| Daily Bonuses | Extra rewards by climbing the daily bonus ladder, reaching the leaderboard, or starting a streak. |

| High Payouts | Higher payouts compared to other similar platforms. |

Explore Freecash’s offerings to enhance your financial emergency preparedness. Visit Freecash for more details and to start earning today.

Key Features Of Emergency Credit Cards

Emergency credit cards can be a lifeline during unexpected financial situations. These cards offer several key features that make them an essential tool for managing sudden expenses effectively. In this section, we will explore the primary features of emergency credit cards.

Instant Approval And Quick Access To Funds

One of the most significant advantages of emergency credit cards is instant approval. Many providers offer immediate decisions, allowing you to access funds quickly. This feature is crucial during emergencies when time is of the essence. You can start using your card almost immediately after approval, ensuring you have the necessary financial support.

High Credit Limit For Significant Emergencies

Emergency credit cards often come with a high credit limit. This allows you to cover substantial expenses without worrying about hitting your limit. Whether it’s medical bills, car repairs, or other significant costs, a high credit limit ensures you have adequate funds available.

Low Or No Annual Fees For Affordability

Many emergency credit cards have low or no annual fees. This makes them an affordable option for those who need a financial safety net. Avoiding high annual fees means you can maintain the card without a significant cost burden, making it easier to manage your finances.

Flexible Repayment Options To Ease Financial Stress

Flexible repayment options are a critical feature of emergency credit cards. These cards often offer various repayment plans to suit your financial situation. You can choose from multiple options, such as minimum payments or full balance payments, to ease financial stress.

24/7 Customer Support For Immediate Assistance

Emergency credit cards typically provide 24/7 customer support. This ensures you can get help whenever you need it, day or night. Whether you have questions about your account or need assistance during an emergency, customer support is always available.

| Feature | Description |

|---|---|

| Instant Approval | Quick decisions and access to funds. |

| High Credit Limit | Adequate funds for significant expenses. |

| Low/No Annual Fees | Affordable maintenance of the card. |

| Flexible Repayment | Various options to suit your situation. |

| 24/7 Customer Support | Assistance available any time. |

Pricing And Affordability Breakdown

Understanding the pricing and affordability of emergency credit cards is crucial. Let’s break down the costs associated with these cards.

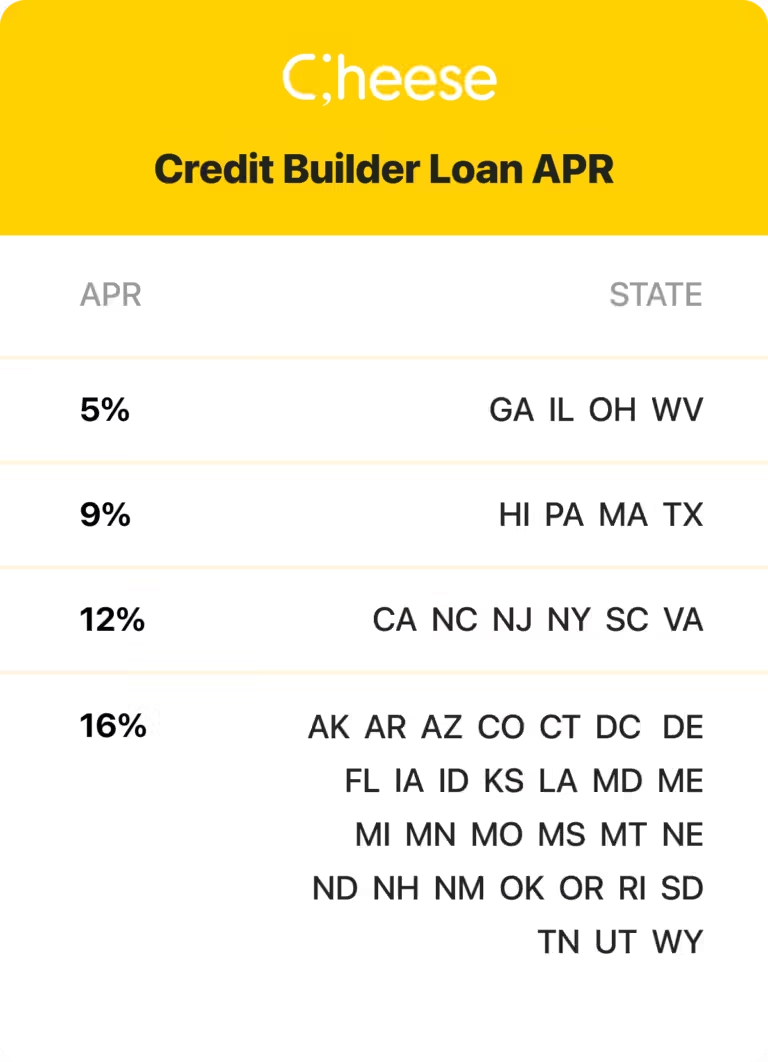

Interest Rates And Apr Comparison

Interest rates vary significantly between different emergency credit cards. Compare the Annual Percentage Rates (APR) before deciding.

| Credit Card | APR (Annual Percentage Rate) |

|---|---|

| Card A | 15.99% – 25.99% |

| Card B | 14.49% – 23.49% |

| Card C | 16.24% – 26.24% |

Annual Fees And Hidden Costs

Some cards have annual fees while others do not. Always check for hidden costs.

- Annual Fees: Some cards charge up to $95 per year.

- Hidden Costs: Look out for late payment fees and foreign transaction fees.

Balance Transfer Fees And Cash Advance Fees

Balance transfer fees and cash advance fees can add up quickly. Understand these costs before using these features.

- Balance Transfer Fees: Typically 3% – 5% of the amount transferred.

- Cash Advance Fees: Usually 5% of the cash advance amount or $10, whichever is greater.

By understanding these fees, you can make informed decisions about which emergency credit card is right for you.

Pros And Cons Based On Real-world Usage

Emergency credit cards, like any financial tool, have their advantages and disadvantages. Understanding these can help users make informed decisions. Below, we explore the pros and cons based on real-world usage.

Advantages: Quick Access, High Limits, Flexibility

Quick Access: Emergency credit cards provide instant financial support. This is crucial during unexpected situations. Unlike traditional loans, which can take days or weeks to process, credit cards offer immediate funds. This quick access can help cover sudden expenses like medical bills or urgent repairs.

High Limits: Many emergency credit cards come with high credit limits. These higher limits enable users to manage substantial expenses without delay. For instance, a card with a $10,000 limit can cover significant emergency costs, reducing the financial burden.

Flexibility: Emergency credit cards offer flexibility in spending. Users can use them for various needs, from booking last-minute flights to paying for essential services. Additionally, many cards offer rewards and cashback, providing added value for every dollar spent.

Disadvantages: High-interest Rates, Potential For Debt Accumulation

High-Interest Rates: One major drawback of emergency credit cards is the high-interest rates. These rates can quickly accumulate, especially if the balance is not paid off promptly. For example, a card with a 20% APR can significantly increase the total amount owed.

Potential for Debt Accumulation: The convenience of emergency credit cards can lead to debt accumulation. If not managed carefully, users may find themselves in a cycle of debt. Regularly monitoring spending and making timely payments is essential to avoid this pitfall.

| Advantage | Details |

|---|---|

| Quick Access | Immediate financial support during emergencies |

| High Limits | Manage substantial expenses without delay |

| Flexibility | Use for various needs, earn rewards |

| Disadvantage | Details |

|---|---|

| High-Interest Rates | Significant increase in total amount owed |

| Debt Accumulation | Risk of falling into a cycle of debt |

Emergency credit cards can be a double-edged sword. Understanding their pros and cons is crucial for effective management.

Specific Recommendations For Ideal Users

Emergency credit cards can be lifesavers in various financial crises. Choosing the right card for your needs is crucial. Different cards cater to specific situations, making them ideal for certain users. Below are tailored recommendations for various types of users based on their unique needs.

Best For Individuals With Unstable Income

For those with unpredictable income, having an emergency credit card provides a financial cushion. These cards offer flexible repayment options and low-interest rates.

- Low-Interest Rates: Keep your monthly payments manageable during income fluctuations.

- No Annual Fees: Avoid additional financial burdens.

- Flexible Repayment Options: Adjust payments based on your current financial situation.

| Feature | Benefit |

|---|---|

| Low-Interest Rates | Keep payments manageable |

| No Annual Fees | Avoid extra costs |

| Flexible Repayment | Adjust payments as needed |

Ideal For Unplanned Medical Emergencies

Medical emergencies can be financially draining. An emergency credit card can help cover these unexpected costs. Look for cards that offer:

- High Credit Limits: Ensure you have enough funds for significant medical expenses.

- Zero Percent APR for Introductory Period: Pay off the balance without accruing interest initially.

- Cash Back on Medical Expenses: Earn rewards while managing your health costs.

Perfect For Travel-related Financial Crises

Travel can be unpredictable, and having an emergency credit card can save the day. For travel-related financial crises, the ideal card offers:

- Travel Insurance: Get coverage for trip cancellations and interruptions.

- No Foreign Transaction Fees: Avoid extra charges on international purchases.

- Emergency Assistance Services: Access help in case of travel emergencies.

| Feature | Benefit |

|---|---|

| Travel Insurance | Coverage for trip issues |

| No Foreign Transaction Fees | Save on international purchases |

| Emergency Assistance | Get help during travel crises |

Frequently Asked Questions

What Are Emergency Credit Cards?

Emergency credit cards are used in urgent situations. They provide quick access to funds. Ideal for unexpected expenses.

How To Get An Emergency Credit Card?

Apply online or at a bank. Approval depends on credit score. Some cards offer instant approval.

Can I Use Emergency Credit Cards For Medical Bills?

Yes, you can. Emergency credit cards can cover urgent medical expenses. Always check your card’s terms.

Are There Fees For Emergency Credit Cards?

Yes, there can be. Fees vary by card and issuer. Always read the fine print.

Conclusion

Emergency credit cards can be lifesavers in urgent situations. They offer quick access to funds when needed most. Always use them wisely to avoid high interest rates. Remember to check for fees and terms before applying. For flexible and easy earning options, consider using Freecash. It rewards users for completing tasks and offers. To learn more, visit Freecash and start earning today. Stay financially prepared and secure with the right tools.