Effective Credit Repair Methods: Boost Your Score Fast

Credit repair can seem daunting. But effective methods make it manageable.

Understanding credit repair is crucial for financial health. Many struggle with poor credit scores due to debt or other issues. Fortunately, there are practical steps you can take to repair your credit. This blog will guide you through proven methods to improve your credit score. By following these tips, you can achieve better financial stability. Stay with us as we explore these effective credit repair methods. For more comprehensive guidance, consider checking out resources like SubTo. They offer valuable insights into creative financing and real estate investing, helping both novice and experienced investors reach their goals. Improving your credit is possible. Let’s get started!

Introduction To Credit Repair

Credit repair involves improving your credit score by addressing negative items on your credit report. This process is crucial for anyone looking to enhance their financial health.

Understanding Credit Scores

A credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850. The higher your score, the better your credit profile.

Credit scores are calculated based on various factors:

- Payment History: Accounts for 35% of your score.

- Amounts Owed: Makes up 30% of your score.

- Length of Credit History: Comprises 15% of your score.

- New Credit: Contributes 10% to your score.

- Types of Credit Used: Represents the remaining 10%.

The Importance Of A Good Credit Score

A good credit score opens doors to better financial opportunities. It helps secure loans with lower interest rates.

Here are some benefits of having a good credit score:

| Benefit | Description |

|---|---|

| Lower Interest Rates | Save money on loans and credit cards. |

| Higher Loan Approval | Greater chance of getting loan applications approved. |

| Better Credit Card Offers | Access to cards with better rewards and perks. |

| More Housing Options | Easier to rent or buy a home. |

Maintaining a good credit score is essential. It impacts many aspects of your financial life.

Key Features Of Effective Credit Repair Methods

Effective credit repair methods help improve your credit score and financial health. Understanding these key features can make the process simpler and more effective. Here are some essential aspects to focus on.

Identifying And Disputing Errors On Your Credit Report

Errors on credit reports can harm your credit score. It is crucial to identify and dispute these errors. Request your credit report from major credit bureaus, and review it for inaccuracies. Common errors include incorrect personal information, duplicate accounts, and unauthorized transactions.

Once you identify errors, file a dispute with the credit bureau. Provide documentation to support your claim. The bureau will investigate and correct any verified errors, potentially boosting your credit score.

Paying Down High-interest Debts

High-interest debts can be a significant burden on your finances. Prioritize paying down these debts to reduce your overall debt load. Start by listing all your debts and their interest rates.

Focus on paying off the debts with the highest interest rates first. This method, known as the avalanche method, can save you money on interest payments and help you become debt-free faster.

Establishing A Positive Payment History

A positive payment history is crucial for a good credit score. Ensure you make all payments on time, including credit cards, loans, and utility bills. Late or missed payments can negatively impact your credit score.

Set up automatic payments or reminders to help you stay on track. Consistently making on-time payments can significantly improve your credit score over time.

Utilizing Credit Counseling Services

Credit counseling services offer professional help for managing your debts and improving your credit score. These services provide personalized advice and support to help you create a debt management plan.

Credit counselors can negotiate with creditors on your behalf, potentially reducing interest rates or creating more manageable payment plans. Utilizing these services can be an effective way to regain control of your finances and improve your credit score.

Step-by-step Guide To Boosting Your Credit Score

Repairing your credit score can feel overwhelming, but breaking it down into manageable steps makes the process easier. This guide outlines effective strategies to help you improve your credit score, one step at a time.

Step 1: Obtain Your Credit Report

Start by getting a copy of your credit report from all three major credit bureaus: Equifax, Experian, and TransUnion. You are entitled to one free report from each bureau every year, available at annualcreditreport.com. Reviewing your report helps you understand your current credit standing.

Step 2: Identify And Dispute Errors

Examine your credit report for any errors, such as incorrect personal information, accounts that do not belong to you, or inaccurate account statuses. If you find mistakes, dispute them with the credit bureau. Provide documentation to support your claim and follow up until the errors are corrected.

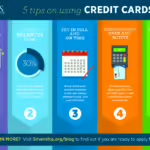

Step 3: Pay Down Balances Strategically

High credit card balances can negatively impact your credit score. Focus on paying down balances, especially on cards that are close to their limits. Aim to keep your credit utilization below 30%. This shows lenders you can manage your credit responsibly.

Step 4: Avoid New Debt

While working to improve your credit score, avoid taking on new debt. New credit inquiries can lower your score temporarily. Instead, focus on managing your existing credit accounts wisely.

Step 5: Build Positive Credit Habits

Developing good credit habits is crucial for long-term credit health. Pay your bills on time, avoid maxing out your credit cards, and monitor your credit regularly. Consistency and discipline will help you maintain a high credit score.

Pros And Cons Of Diy Credit Repair

DIY credit repair can be a rewarding journey, but it has its challenges. Let’s explore the pros and cons of fixing your credit on your own. This will help you decide if it’s the right path for you.

Pros: Cost-effective And Educational

One of the biggest advantages of DIY credit repair is that it is cost-effective. You save money by not hiring a credit repair company. Instead, you invest your own time and effort.

DIY credit repair is also highly educational. You learn about your credit report and score. This knowledge can help you make better financial decisions in the future.

Here are some benefits:

- Save money on credit repair services.

- Gain valuable financial knowledge.

- Control over the credit repair process.

Cons: Time-consuming And Complex

Despite the benefits, DIY credit repair can be time-consuming. You need to review your credit report, identify errors, and dispute them. This process can take several months.

Another downside is that it can be complex. Understanding credit laws and regulations requires research. Mistakes in the process can delay your progress.

Consider these challenges:

- Requires significant time commitment.

- Complex legal and financial knowledge needed.

- Risk of errors that can worsen your credit.

Pros And Cons Of Professional Credit Repair Services

Thinking of using professional credit repair services? It’s essential to know the advantages and disadvantages. This section will help you make an informed decision.

Pros: Expertise And Time-saving

Professional credit repair services offer expert knowledge. They understand credit laws and can find errors quickly. This expertise can lead to faster results in improving your credit score.

Time-saving is another significant benefit. Fixing credit issues on your own takes time. Professionals handle the process efficiently, allowing you to focus on other tasks.

Cons: Cost And Potential Scams

One major drawback is the cost. Professional services can be expensive. You might spend hundreds of dollars, which is a lot for many people.

Another concern is potential scams. Some companies promise results they can’t deliver. Research thoroughly to avoid falling victim to scams. Look for reputable services with positive reviews.

Pricing And Affordability Of Credit Repair Options

Understanding the costs associated with credit repair is crucial. Both DIY methods and professional services have their own pricing structures. Knowing these can help you make an informed decision based on your budget and needs.

Cost Of Diy Methods

DIY credit repair methods are typically the most affordable. These methods require you to take action independently. Here are some potential costs:

- Credit Reports: Free annual credit reports from each of the three major credit bureaus.

- Dispute Letters: Minimal costs for postage if sending physical letters.

- Time Investment: Significant time required to research, prepare, and follow up on disputes.

In general, the main investment in DIY credit repair is your time and effort. This makes it a cost-effective option for those willing to put in the work.

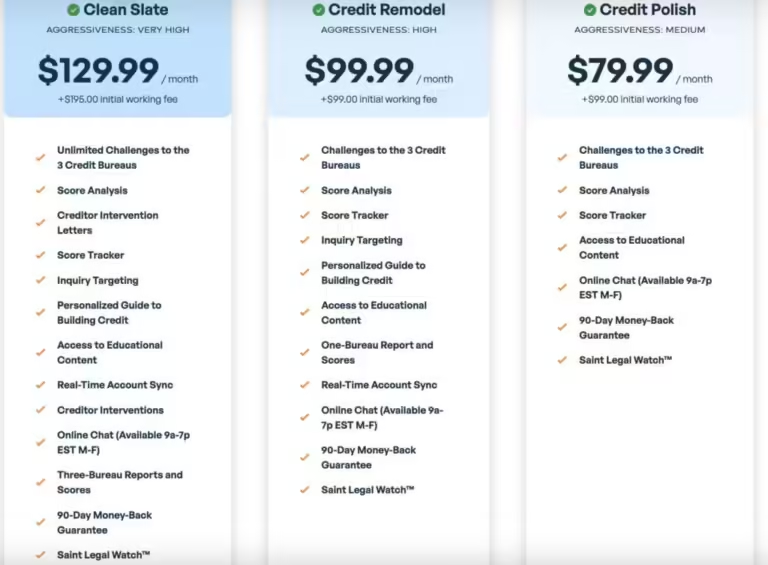

Cost Of Professional Services

Professional credit repair services come at a higher cost but offer convenience and expertise. Here are common pricing models:

| Service Type | Typical Cost |

|---|---|

| Monthly Subscription | $50 – $150 per month |

| One-Time Fee | $300 – $1,000 |

These services handle all aspects of the credit repair process, from pulling credit reports to disputing errors on your behalf. This can save you time and potentially yield faster results.

Weighing The Costs Vs. Benefits

Deciding between DIY methods and professional services involves weighing costs against benefits:

- Budget: Consider your financial situation. DIY methods are cheaper but require more effort.

- Time: Professional services save time but are more expensive. If time is limited, this option may be worth the cost.

- Expertise: Professionals have experience and may achieve better results. If your credit issues are complex, their expertise can be valuable.

Ultimately, your choice will depend on your specific needs, budget, and the complexity of your credit situation.

Ideal Scenarios And Recommendations For Credit Repair

Effective credit repair methods can significantly improve your financial health. Understanding when to use DIY methods or professional services is crucial. Here are some ideal scenarios and recommendations for credit repair.

When To Choose Diy Credit Repair

DIY credit repair is suitable for those with minor credit issues. If you have a few late payments or a single collection account, DIY can be effective.

- Minor Inaccuracies: Dispute small errors on your credit report.

- Limited Debt: Manageable debts that are not overwhelming.

- Financial Discipline: Ability to follow a budget and pay bills on time.

By using free online resources and credit report dispute tools, you can address these issues without professional help.

When To Opt For Professional Services

Professional credit repair services are ideal for more complex situations. Consider this option if you face:

- Severe Credit Damage: Multiple collections, charge-offs, or bankruptcies.

- Time Constraints: Lack of time to manage credit repair yourself.

- Legal Issues: Need for legal advice or assistance.

Professionals have the expertise to handle intricate cases and negotiate with creditors on your behalf.

Combining Methods For Best Results

Combining DIY and professional services can offer the best results. Start by addressing minor issues yourself. For more complex problems, consult a professional.

- Initial Steps: Dispute simple inaccuracies and pay down small debts.

- Consult Experts: Seek professional advice for severe issues.

- Ongoing Maintenance: Regularly monitor your credit report and maintain good financial habits.

Using a combination of methods ensures a comprehensive approach to credit repair, leading to better financial stability.

Conclusion: Achieving Financial Health Through Credit Repair

Effective credit repair methods can pave the way to achieving financial health. By understanding and implementing key strategies, you can improve your credit score and enjoy greater financial stability. Below, we summarize the main points and offer final tips for maintaining a good credit score.

Summary Of Key Points

- Regularly Monitor Credit Reports: Check for errors and dispute inaccuracies.

- Pay Bills on Time: Late payments negatively impact your credit score.

- Reduce Debt: Aim to lower your credit card balances.

- Limit New Credit Inquiries: Too many inquiries can harm your score.

- Use Credit Wisely: Maintain a low credit utilization ratio.

Final Tips For Maintaining A Good Credit Score

- Stay Organized: Keep track of payment deadlines and due dates.

- Build an Emergency Fund: This helps avoid missing payments during unexpected expenses.

- Review Financial Goals: Regularly assess and adjust your financial plans.

- Educate Yourself: Continue learning about financial management and credit repair methods.

- Seek Professional Help: Consider consulting a credit counselor for expert advice.

By following these strategies and tips, you can achieve and maintain a healthy credit score, leading to better financial opportunities and peace of mind.

Frequently Asked Questions

What Are Effective Credit Repair Methods?

Effective credit repair methods include disputing errors on your credit report, paying down debt, and maintaining timely payments.

How Long Does Credit Repair Take?

Credit repair can take a few months to a year, depending on your situation and the methods used.

Can Paying Off Debt Improve Credit Score?

Yes, paying off debt can significantly improve your credit score by reducing your credit utilization ratio.

Do Credit Repair Companies Work?

Credit repair companies can help, but you can also repair your credit yourself by following proper methods.

Conclusion

Effective credit repair methods can improve your financial health. With patience and persistence, you can see positive results. Always monitor your credit report for errors. Take proactive steps to address issues. Need help with real estate investments? Check out SubTo for expert guidance and community support. Visit SubTo for more information. Start your journey towards better credit today. Stay committed, and success will follow.