Easy Payment Solutions: Simplify Your Transactions Today

In today’s fast-paced world, businesses need easy payment solutions. Efficient, secure, and versatile payment methods can make a significant difference.

Understanding the need for streamlined payments, Square offers a comprehensive platform that supports millions of businesses globally. Square’s suite of tools helps businesses manage operations, boost efficiency, and open new revenue streams. From secure hardware and POS systems to advanced reporting and team management, Square provides all the necessary resources for seamless business operations. Whether you run a restaurant, retail store, or beauty business, Square’s custom solutions are designed to meet your specific needs. Learn more about how Square can transform your business at Square.

Introduction To Easy Payment Solutions

In today’s fast-paced world, businesses need efficient and secure payment solutions. Square offers a platform designed to streamline business operations and simplify transactions. This section will explore the importance and benefits of using easy payment solutions like Square.

Overview Of Payment Solutions

Payment solutions come in various forms to meet different business needs. Square provides a comprehensive suite of software and hardware options. These include:

- Hardware and POS Systems: Enables businesses to sell securely anywhere.

- Payments: Supports secure payments, including online ordering and local delivery.

- Custom-Tailored Product Suites: Offers specialized solutions for restaurants, retail, and beauty businesses.

- Operations Management: Helps streamline operations across multiple locations.

- Cash Flow Management: Provides instant transfers for a fee or free next-business-day transfers.

- Team Management: Optimizes team shifts and ensures secure management.

- Customer Engagement: Centralizes customer data to increase loyalty.

- Advanced Reporting: Delivers powerful data for better decision-making.

- Revenue Diversification: Tracks profit margins and opens new revenue streams.

- Online Presence: Creates branded websites with inventory sync capabilities.

Purpose And Importance Of Simplifying Transactions

Simplifying transactions is crucial for modern businesses. Square helps businesses in several ways:

- Efficiency: Automates tasks, saving time and improving efficiency.

- Revenue Growth: Enhances customer loyalty and diversifies revenue streams.

- Data-Driven Decisions: Uses advanced reporting for confident business decisions.

- Custom Solutions: Provides tailored solutions for specific industries.

- Seamless Integration: Integrates with existing business software.

Overall, easy payment solutions like Square enhance business operations and customer satisfaction. They are essential for staying competitive in today’s market.

Key Features Of Easy Payment Solutions

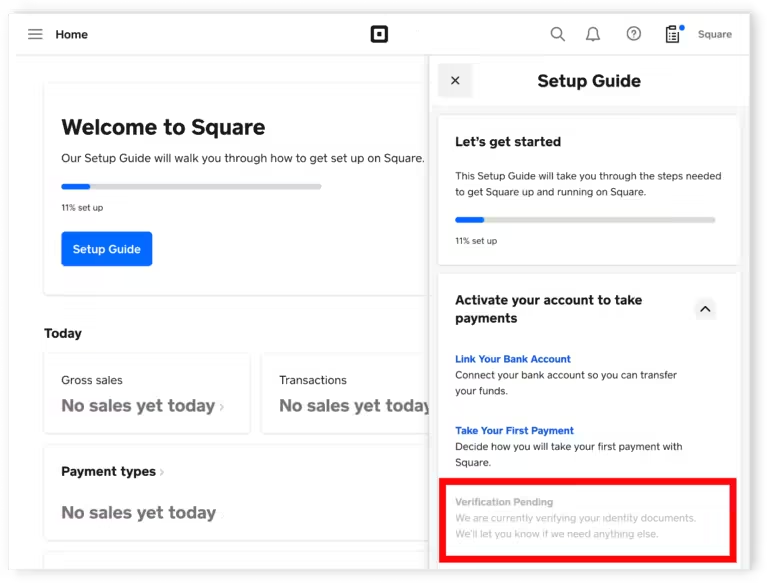

Easy payment solutions like Square provide many features to help businesses manage their operations smoothly. Here are the key features:

User-friendly Interface

Square offers a user-friendly interface that allows businesses to manage their payments and operations easily. The intuitive design ensures that users can navigate the system without any hassle. This helps in saving time and improving efficiency.

Multiple Payment Methods Integration

With Square, businesses can integrate multiple payment methods seamlessly. This includes credit cards, online ordering, local delivery, and more. The flexibility to accept different payment types helps in catering to a wider customer base.

High-level Security Measures

Square ensures that all transactions are secure with high-level security measures. This includes encryption and compliance with industry standards. By prioritizing security, Square helps protect both businesses and their customers from potential threats.

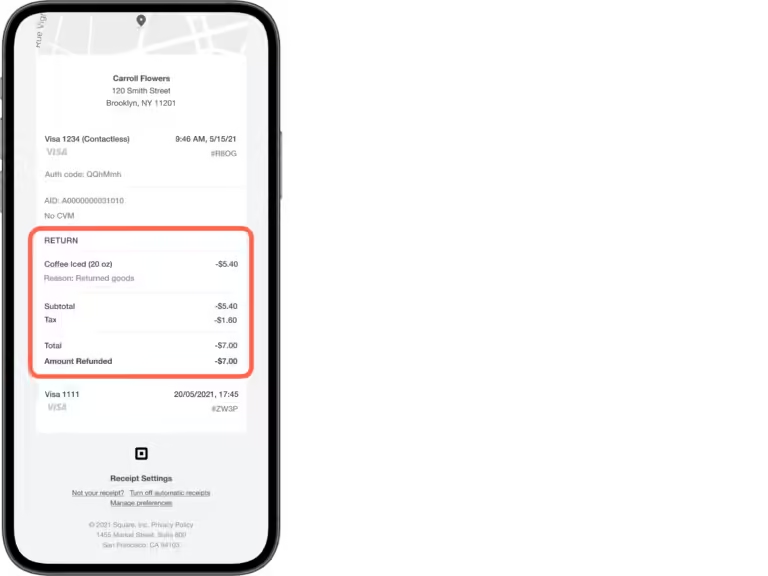

Instant Transaction Processing

One of the standout features of Square is its instant transaction processing. Businesses can opt for instant transfers for a small fee, with funds available within 20 minutes. Free next-business-day transfers are also available, providing flexibility in cash flow management.

| Feature | Description |

|---|---|

| User-Friendly Interface | Easy to navigate and manage operations without hassle. |

| Multiple Payment Methods | Accepts various payment types including credit cards and online orders. |

| High-Level Security | Ensures secure transactions with encryption and compliance. |

| Instant Transaction Processing | Offers instant transfers for a fee or free next-business-day transfers. |

Pricing And Affordability

Finding an affordable and reliable payment solution is crucial for any business. Square offers competitive pricing options that cater to various business needs. Let’s delve into the cost structure and see how Square stands out in terms of pricing and affordability.

Cost Structure Breakdown

Square provides a transparent pricing model with no hidden fees. Here’s a detailed breakdown:

| Service | Cost |

|---|---|

| Instant Transfers | Small fee |

| Next-Business-Day Transfers | Free |

| Custom Loan Offers | Based on Square sales |

Square’s pricing structure is designed to support businesses of all sizes, ensuring that you only pay for the services you use. This flexibility helps you manage costs effectively.

Comparison With Other Payment Solutions

How does Square compare with other payment solutions? Here’s a quick comparison:

- Transparency: Square offers clear pricing with no hidden fees.

- Flexibility: Customizable loan offers based on sales, unlike many competitors.

- Efficiency: Instant and next-business-day transfers to manage cash flow efficiently.

Square’s competitive edge lies in its comprehensive service offering and transparent pricing, making it a preferred choice for many businesses.

Value For Money

Square delivers great value for money through its array of features:

- Advanced Reporting: Gain insights to make informed business decisions.

- Customer Engagement: Build loyalty with centralized customer data and insights.

- Revenue Diversification: Open new revenue streams and track profit margins.

Investing in Square means more than just a payment solution. It equips your business with tools to enhance efficiency and drive growth.

Pros And Cons Of Easy Payment Solutions

Easy payment solutions, like Square, offer many benefits for businesses. But they also have challenges. Understanding both can help you make informed decisions.

Advantages Based On User Feedback

Square users have shared many advantages of using the platform:

- Efficiency: Automation saves time and boosts efficiency.

- Seamless Integration: Integrates with existing business software.

- Secure Payments: Accept payments securely, anywhere.

- Custom Solutions: Tailored for restaurants, retail, and beauty.

- Cash Flow Management: Instant transfers for a small fee.

- Advanced Reporting: Powerful data for confident decisions.

Challenges And Limitations

Despite many benefits, users have noted some limitations:

- Instant Transfer Fees: Small fees for instant transfers.

- Loan Eligibility: Not all customers qualify for loans.

- Transfer Limits: Daily transfer limit of £3,500.

- Repayment Terms: Loans must be repaid within 18 months.

| Feature | Pros | Cons |

|---|---|---|

| Efficiency | Automate tasks, save time | None reported |

| Cash Flow Management | Instant transfers | Fees for instant transfers |

| Loan Terms | Customized offers | Not all qualify, must repay in 18 months |

Understanding these pros and cons helps in evaluating Square for your business needs.

Recommendations For Ideal Users

Square offers easy payment solutions that cater to a wide range of businesses. Its features make it ideal for different users who need secure and seamless transactions. Below are specific recommendations for businesses that benefit the most, scenarios where Square excels, and specific use cases.

Businesses That Benefit The Most

Several businesses can maximize the benefits of Square’s offerings. Here are the key ones:

- Restaurants: Manage orders, tables, and payments seamlessly.

- Retail Stores: Track inventory and sales across multiple locations.

- Beauty Salons: Optimize appointments and payments efficiently.

- Small Businesses: Ideal for those needing secure, quick payment options.

Scenarios Where Easy Payment Solutions Excel

There are specific scenarios where Square’s payment solutions excel:

- Online Ordering: Perfect for businesses with online stores.

- Local Delivery: Manage payments for local deliveries effortlessly.

- In-Person Transactions: Use POS systems for secure payments.

- Multiple Locations: Streamline operations across various locations.

Specific Use Cases

| Use Case | Description |

|---|---|

| Instant Transfers | Small fee for instant access to funds. |

| Customer Loyalty | Use centralized data to improve customer retention. |

| Advanced Reporting | Data-driven insights for confident decision-making. |

| Custom Solutions | Tailored for restaurants, retail, and beauty businesses. |

Square’s easy payment solutions are versatile and adaptable, making them suitable for various types of businesses and scenarios. Whether you need to manage a single location or multiple ones, Square’s comprehensive suite of tools ensures efficiency and growth.

Frequently Asked Questions

What Are Easy Payment Solutions?

Easy payment solutions are convenient methods for customers to pay for goods or services. These can include credit cards, mobile payments, and online banking. They aim to streamline the payment process.

How Do Easy Payment Solutions Work?

Easy payment solutions work by simplifying the transaction process. They often use technology to securely process payments. This can include contactless payments, digital wallets, or online payment gateways.

Why Use Easy Payment Solutions?

Using easy payment solutions improves customer satisfaction and speeds up transactions. They also enhance security and reduce the risk of fraud. Businesses benefit from faster, more reliable payments.

Are Easy Payment Solutions Secure?

Yes, easy payment solutions are designed with security in mind. They use encryption and other technologies to protect sensitive information. This minimizes the risk of data breaches and fraud.

Conclusion

Choosing the right payment solution can transform your business operations. Square offers a comprehensive platform for secure, efficient transactions and streamlined operations. Whether you run a restaurant, retail store, or beauty business, Square has tailored solutions for you. Manage your cash flow, optimize team shifts, and engage customers effectively. Make confident decisions with advanced reporting. Ready to simplify your business operations and boost efficiency? Discover more about Square here.