Easy Credit Repair: Simple Steps to Boost Your Credit Score

Feeling overwhelmed by your credit issues? You are not alone.

Many people struggle with debt and credit problems. This blog post explores easy credit repair strategies to help you regain control of your finances. Credit repair can seem daunting, but it doesn’t have to be. With the right tools and guidance, you can take steps to improve your credit score and financial health. One such tool is SoloSuit, an automated software designed to help individuals navigate debt disputes. SoloSuit simplifies the process of responding to debt lawsuits and settling debts out of court, providing automated assistance and attorney reviews. Available in all 50 states, SoloSuit has protected $1.71 billion and helped 262,000 people. Ready to take control of your credit? Let’s dive into easy credit repair strategies that can make a difference. Learn more about SoloSuit here.

Introduction To Easy Credit Repair

Dealing with credit repair can be daunting. But with the right tools and knowledge, it becomes manageable. Easy credit repair is all about understanding your credit score and making informed decisions to improve it. Let’s dive into the essentials.

Understanding The Importance Of A Good Credit Score

A good credit score is crucial. It affects your ability to get loans, credit cards, and even employment. Here are some key benefits of a good credit score:

- Lower Interest Rates: You get better loan terms.

- Higher Credit Limits: You can borrow more money.

- Better Approval Chances: Easier to get loans and credit cards.

Maintaining a good credit score can save you money and open up financial opportunities. Regularly checking your score and understanding the factors that affect it are vital steps.

The Purpose Of Credit Repair

Credit repair aims to remove inaccurate or negative items from your credit report. This process can help improve your credit score over time. Here’s a breakdown:

| Action | Purpose |

|---|---|

| Dispute Errors | Remove incorrect information from your report. |

| Negotiate Settlements | Settle debts for less than the owed amount. |

| Monitor Credit | Keep track of changes and improvements. |

Using tools like SoloSuit can simplify this process. SoloSuit offers automated assistance to help you respond to debt lawsuits and settle debts outside of court. This tool helps you navigate debt disputes effectively.

SoloSuit’s main features include:

- Reply to a Debt Lawsuit: Compiling responses with attorney review and filing.

- Settle a Debt: Facilitates negotiations to settle debts for less.

With SoloSuit, you benefit from automated assistance, attorney review, and statewide coverage. It has a proven track record of protecting $1.71 billion and helping 262,000 people. Remember, SoloSuit is not a law firm but a self-help tool.

Key Features Of Credit Repair Strategies

Credit repair strategies can help improve your credit score and financial health. Focusing on key activities can make this process more effective. Below are essential features of successful credit repair strategies.

Reviewing Your Credit Report

Start by obtaining a copy of your credit report from major credit bureaus. Carefully review each entry for accuracy. Look for errors such as incorrect balances, outdated information, or accounts that do not belong to you. Highlighting these errors can guide your next steps in the credit repair process.

Disputing Inaccurate Information

If you find mistakes on your credit report, dispute them with the credit bureau. Send a dispute letter outlining the inaccuracies. Include any supporting documents that prove the errors. Follow up to ensure the bureau corrects or removes the disputed information.

Paying Down Existing Debt

High debt levels negatively impact your credit score. Focus on paying down existing debts. Create a budget to allocate funds towards debt repayment. Use methods like the debt snowball or avalanche to systematically reduce your debt. Consistent payments will show creditors your commitment to improving your financial situation.

Establishing Positive Credit History

Building a positive credit history is crucial. Open new lines of credit if needed, but use them responsibly. Make sure to pay all bills on time. This includes credit cards, loans, and utility bills. Positive payment history will gradually boost your credit score.

SoloSuit offers tools to help manage debt disputes effectively. With automated software, you can respond to debt lawsuits and settle debts out of court. SoloSuit’s services include attorney review and are available in all 50 states.

For more information about SoloSuit, visit their website.

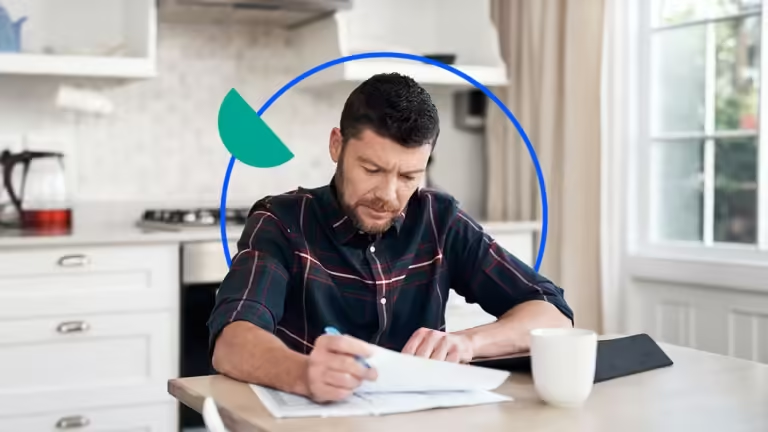

Step-by-step Process To Boost Your Credit Score

Improving your credit score can seem daunting, but breaking it down into simple steps can make it manageable. Follow this structured approach to boost your credit score efficiently and effectively.

Step 1: Obtain And Review Your Credit Report

First, obtain your credit report from major credit bureaus like Experian, TransUnion, and Equifax. Check for accuracy and ensure all information is correct. Look for errors such as incorrect personal details, duplicate accounts, or unauthorized transactions.

Use a table to compare information:

| Detail | Experian | TransUnion | Equifax |

|---|---|---|---|

| Personal Information | Correct/Incorrect | Correct/Incorrect | Correct/Incorrect |

| Account Status | Correct/Incorrect | Correct/Incorrect | Correct/Incorrect |

| Transaction History | Correct/Incorrect | Correct/Incorrect | Correct/Incorrect |

Step 2: Identify And Dispute Errors

Identify any errors in your credit report. Dispute inaccuracies by contacting the credit bureau. Provide supporting documents to validate your claim. This can be done online, by mail, or over the phone.

- Gather evidence like bank statements.

- Write a dispute letter.

- Send documents to the credit bureau.

Step 3: Create A Debt Repayment Plan

Develop a debt repayment plan to reduce outstanding balances. Prioritize high-interest debts first. Consider using tools like SoloSuit, which helps in negotiating and settling debts outside of court.

- List all debts with interest rates.

- Allocate funds to pay off high-interest debts.

- Use automated tools for easier management.

Step 4: Use Credit Cards Responsibly

Using credit cards responsibly can significantly impact your credit score. Keep your credit utilization ratio below 30%. Pay off your balance in full each month. Avoid maxing out your credit limits.

Tips for responsible credit card use:

- Monitor spending.

- Set up payment reminders.

- Use credit cards for essential purchases only.

Step 5: Avoid New Debt And Limit Hard Inquiries

Avoid accumulating new debt while working on credit repair. Limit hard inquiries on your credit report as they can lower your score. Each hard inquiry can reduce your score by a few points.

To avoid new debt:

- Stick to a budget.

- Focus on paying existing debts.

- Be cautious with new credit applications.

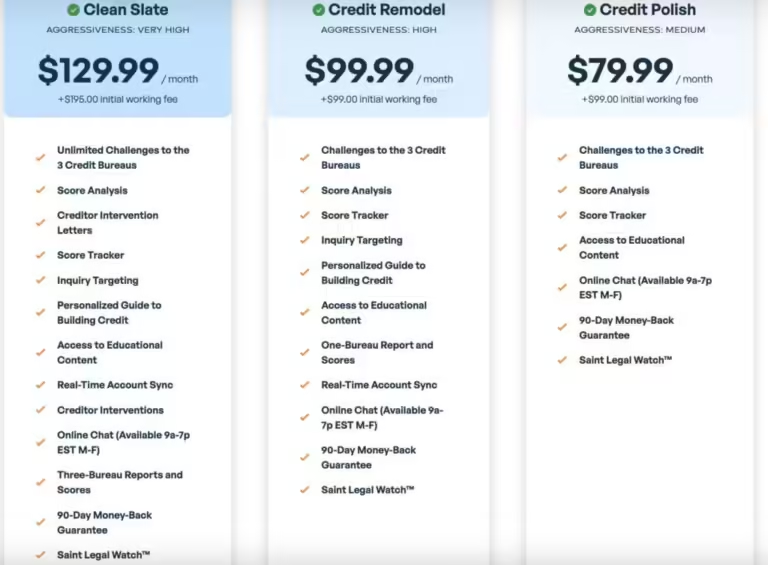

Pricing And Affordability Of Credit Repair Services

Understanding the cost of credit repair services is crucial for anyone wanting to improve their credit score. SoloSuit offers an innovative approach to managing debt disputes, providing automated software to simplify the process. Let’s delve into the aspects of pricing and affordability of these services.

Understanding Free Vs. Paid Credit Repair Services

There are both free and paid options available for credit repair. Free credit repair services often involve individuals taking steps on their own. This includes disputing errors on credit reports or negotiating with creditors.

Paid credit repair services typically offer more comprehensive support. These services might include professional assistance in disputing inaccuracies, negotiating settlements, and providing ongoing credit monitoring. SoloSuit, for example, provides automated tools to help respond to debt lawsuits and settle debts outside of court, with attorney reviews included.

While free services can save money, they might not offer the same level of expertise and support as paid options.

Evaluating The Cost-effectiveness Of Professional Help

When considering the cost-effectiveness of professional credit repair services, several factors come into play:

- Time Savings: Professional services can save significant time by handling complex tasks.

- Expertise: Services like SoloSuit offer attorney-reviewed responses, ensuring accuracy and compliance.

- Success Rates: Paid services often have proven track records. For instance, SoloSuit has protected $1.71 billion and helped 262,000 people.

- Statewide Coverage: SoloSuit is available in all 50 states, providing consistent service regardless of location.

While the pricing details of SoloSuit are not explicitly mentioned, the benefits of automated assistance and professional review can outweigh the costs. Users should weigh these benefits against any potential fees to determine the value for their specific situation.

In summary, understanding the differences between free and paid credit repair services, along with evaluating the cost-effectiveness of professional help, can guide individuals in making informed decisions. SoloSuit offers a blend of automated tools and attorney support, making it a valuable option for many.

Pros And Cons Of Different Credit Repair Approaches

Repairing credit can be done in various ways. Each method has its own advantages and disadvantages. Understanding these can help you choose the best approach to improve your credit score. Below are some common methods:

Diy Credit Repair

Pros:

- Cost-effective: It saves money since you do it yourself.

- Control: You have full control over the process.

- Learning: Gain knowledge about credit management.

Cons:

- Time-consuming: Requires significant time and effort.

- Complexity: Can be difficult to understand credit laws.

- Risk of Mistakes: Errors can worsen your credit.

Credit Repair Agencies

Pros:

- Expertise: Professionals handle the process.

- Convenience: Saves you time and effort.

- Resources: Access to tools and knowledge.

Cons:

- Cost: Services can be expensive.

- Scams: Risk of fraudulent agencies.

- Dependency: Less control over your credit repair process.

Debt Consolidation

Pros:

- Simplification: Combines multiple debts into one payment.

- Lower Rates: Potentially reduces interest rates.

- Improved Cash Flow: Frees up monthly cash.

Cons:

- Fees: May include service fees.

- Collateral Risk: May require collateral, risking assets.

- Longer Repayment: Can extend the debt period.

Specific Recommendations For Ideal Users

Repairing your credit can seem like a daunting task, but with the right strategies, it becomes manageable. Here are specific recommendations to help you, whether you have minor credit issues or significant debt. These tips will also assist you in maintaining a good credit score.

Best Practices For Individuals With Minor Credit Issues

If you have minor credit issues, focus on the following best practices:

- Check Your Credit Report: Regularly review your credit report for errors and dispute any inaccuracies.

- Pay Bills on Time: Ensure all your bills are paid on time. Late payments can significantly impact your credit score.

- Reduce Credit Card Balances: Aim to keep your credit card balances below 30% of your credit limit.

- Avoid New Debt: Refrain from taking on new debt unless absolutely necessary.

Strategies For Those With Significant Debt

For individuals with significant debt, consider these strategies:

- Use SoloSuit: Utilize SoloSuit to respond to debt lawsuits and negotiate settlements.

- Prioritize Debt Payments: Focus on paying off high-interest debts first. This will save you money in the long run.

- Create a Budget: Develop a budget to track your income and expenses. Stick to it to avoid unnecessary spending.

- Seek Professional Help: If overwhelmed, consider consulting a credit counselor for personalized advice.

Tips For Maintaining A Good Credit Score

Maintaining a good credit score requires consistent effort. Here are some tips:

- Monitor Your Credit Regularly: Keep an eye on your credit report to catch any errors or fraudulent activities.

- Keep Credit Utilization Low: Try to use less than 30% of your available credit.

- Pay Off Balances Monthly: If possible, pay off your credit card balances in full each month.

- Limit New Credit Applications: Applying for multiple credit cards in a short period can lower your score.

By following these recommendations, you can improve and maintain your credit score over time. Remember, consistency is key.

Frequently Asked Questions

What Is Credit Repair?

Credit repair involves correcting errors on your credit report to improve your credit score. It helps in achieving better loan terms.

How Can I Start Credit Repair?

Begin by obtaining your credit report from major credit bureaus. Identify errors, then dispute inaccuracies to improve your credit score.

How Long Does Credit Repair Take?

Credit repair duration varies. It usually takes three to six months to see significant improvements in your credit score.

Can I Repair My Credit Myself?

Yes, you can repair your credit yourself. Review your credit report, dispute errors, and adopt good financial habits.

Conclusion

Taking steps to repair your credit can be simple. Tools like SoloSuit offer automated help for debt disputes. They assist with debt lawsuits and settlements. This makes handling financial issues less stressful. Start today and take control of your credit. Remember, consistent effort leads to improvement. Use the right resources to navigate your financial journey.