Easy Credit Card Integration: Simplify Your Payment Process

Credit card integration can seem complex and daunting. But it doesn’t have to be.

Integrating credit card payments into your business is crucial in today’s digital age. With so many solutions available, finding a simple and efficient option is essential. Melio provides an easy way to handle credit card payments, streamlining the process for both businesses and their customers. This integration allows you to manage payments effectively, ensuring smooth transactions and satisfied clients. Keep reading to discover how Melio can simplify your credit card payment process.

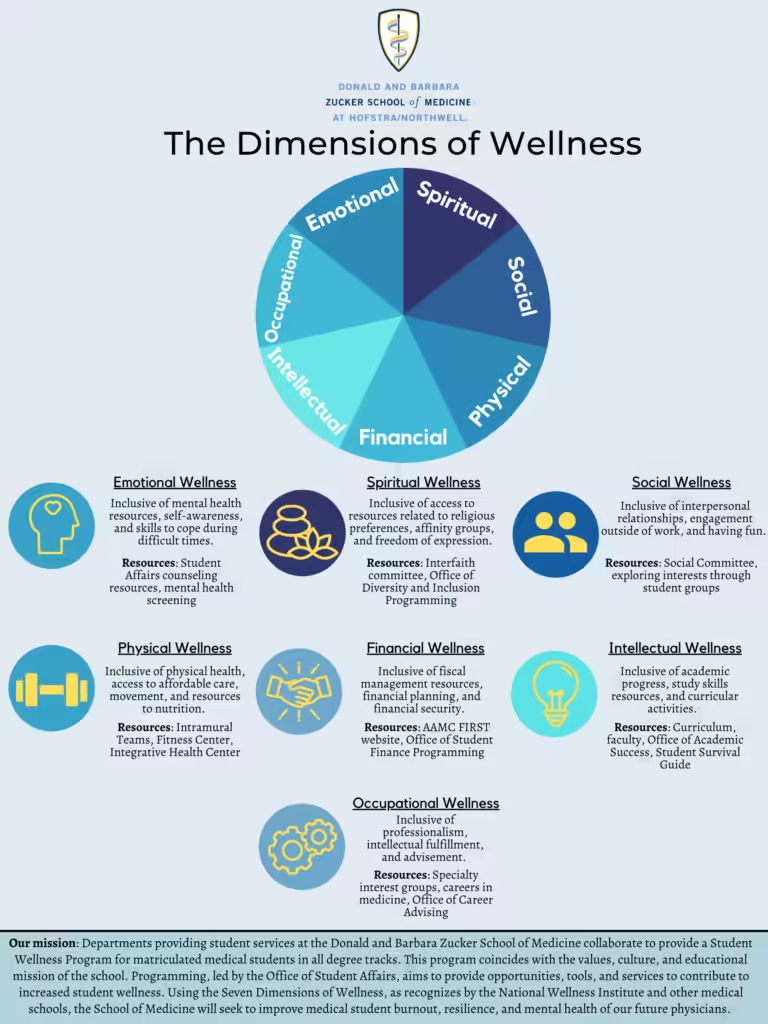

Introduction To Easy Credit Card Integration

In today’s fast-paced digital world, businesses need efficient payment solutions. Melio offers a user-friendly credit card integration for small and medium enterprises. This solution simplifies transactions and enhances customer experience.

Understanding The Need For Simplified Payment Processes

Businesses often face challenges with payment processing. Traditional methods can be time-consuming and prone to errors. Simplified payment processes are essential for improving cash flow and customer satisfaction.

Efficient payment solutions reduce administrative tasks. They also ensure timely payments and reduce human errors. This is where Melio comes in, providing a seamless credit card integration.

Overview Of Credit Card Integration Solutions

Credit card integration solutions connect business systems with payment gateways. This integration allows for smooth transactions and secure data handling. Melio’s integration solution is easy to implement and maintain.

Key features of Melio’s credit card integration include:

- User-friendly interface for quick setup

- Secure transactions with encrypted data

- Real-time payment tracking and notifications

- Flexible payment options for customers

Melio supports various payment gateways, ensuring compatibility with different business needs. This flexibility makes it a preferred choice for many small and medium enterprises.

Key Features Of Easy Credit Card Integration

Integrating credit card payments can be simple and efficient with Melio. Discover the key features that make this process seamless and secure for businesses.

Seamless Setup And Installation

Melio offers a quick and effortless setup process. The installation steps are straightforward, ensuring businesses can start accepting payments in no time. This user-friendly setup minimizes downtime and maximizes productivity.

Comprehensive Security Measures

Security is a top priority with Melio. The platform includes multiple layers of protection:

- Encryption of sensitive data

- Tokenization to safeguard credit card information

- Regular security audits and updates

These measures ensure that both businesses and their customers are protected from fraud and data breaches.

Multi-platform Compatibility

Melio is designed to work across various platforms, including:

- Web browsers

- Mobile devices

- POS systems

This compatibility ensures that businesses can accept payments from anywhere, providing flexibility and convenience.

Real-time Transaction Processing

Melio processes transactions in real-time. This means businesses can see payments and updates immediately. Real-time processing helps in better cash flow management and reduces waiting times for both merchants and customers.

User-friendly Interface

The interface of Melio is designed with simplicity in mind. It features:

- Intuitive navigation

- Clear and concise instructions

- Accessible support options

This user-friendly design ensures that even those with limited tech experience can use the platform effectively, making it an ideal choice for businesses of all sizes.

Benefits Of Easy Credit Card Integration

Integrating credit card payments into your business is essential. It offers a range of benefits that can streamline operations and improve customer satisfaction. Below, we’ll explore the key benefits of easy credit card integration for your business.

Enhanced Customer Experience

One of the primary benefits is an enhanced customer experience. Customers prefer quick and easy payment methods. Offering credit card payments can make transactions faster and more convenient.

- Quick and seamless transactions

- Reduced waiting times

- Increased customer satisfaction

When customers have a smooth payment experience, they are more likely to return. This can lead to higher customer retention rates and positive reviews.

Increased Sales And Revenue

Easy credit card integration can lead to increased sales and revenue. Customers are more likely to make purchases when they can pay with their preferred method.

- Higher conversion rates

- Impulse buying due to ease of payment

- Access to a broader customer base

Offering credit card payments can attract more customers. This can result in higher sales volumes and increased revenue for your business.

Reduced Transaction Errors

Manual payment processing can lead to errors. Easy credit card integration reduces these transaction errors.

- Automated payment processing

- Accurate transaction records

- Minimized human error

Fewer errors mean fewer disputes and refunds. This can save your business time and money.

Improved Cash Flow Management

Effective cash flow management is crucial for any business. Easy credit card integration can help with improved cash flow management.

| Benefit | Description |

|---|---|

| Faster Payment Processing | Payments are processed quickly and efficiently. |

| Better Financial Planning | Accurate transaction records help in financial forecasting. |

| Reduced Payment Delays | Immediate transaction updates reduce payment delays. |

With improved cash flow, businesses can better manage their finances. This ensures smooth operations and financial stability.

Pricing And Affordability

Understanding the cost of integrating credit card services is crucial for businesses. Melio offers straightforward pricing that ensures value without hidden fees. Let’s break down the costs and compare them with competitors.

Cost Breakdown Of Integration Services

Melio offers a transparent pricing structure. Here’s a detailed breakdown:

| Service | Cost |

|---|---|

| Setup Fee | Free |

| Monthly Subscription | $10 |

| Transaction Fee | 2.9% + $0.30 |

- Setup Fee: No initial cost for integration.

- Monthly Subscription: Affordable at $10 per month.

- Transaction Fee: Standard 2.9% + $0.30 per transaction.

Comparing Pricing With Competitors

How does Melio stack up against the competition? Here’s a comparison:

| Provider | Setup Fee | Monthly Subscription | Transaction Fee |

|---|---|---|---|

| Melio | Free | $10 | 2.9% + $0.30 |

| Provider A | $50 | $15 | 3.0% + $0.35 |

| Provider B | $30 | $12 | 2.7% + $0.25 |

Melio’s pricing is competitive, especially with no setup fee and low subscription costs.

Value For Money Analysis

What makes Melio a smart choice?

- No Setup Fee: Save on initial costs.

- Low Subscription: Only $10 per month.

- Standard Transaction Fee: 2.9% + $0.30 per transaction.

Melio offers excellent value for money. It combines affordability with robust features, making it ideal for small businesses.

Pros And Cons Based On Real-world Usage

Credit card integration can significantly impact business operations. Melio offers a solution that simplifies payments. Users have shared their experiences, highlighting both positives and negatives. This section will explore the real-world advantages and challenges of using Melio for credit card integration.

Advantages Experienced By Users

Melio users have reported several benefits:

- Simplicity: The platform is user-friendly, making it easy for anyone to use.

- Cost-Effective: There are no fees for bank transfers, saving businesses money.

- Flexibility: Users can pay vendors even if the vendors do not accept credit cards.

- Integration: Melio integrates well with accounting software, streamlining financial processes.

- Efficiency: Payments can be scheduled, ensuring timely transactions.

Common Challenges And Drawbacks

Despite the advantages, users have encountered some challenges:

- Processing Time: Some users have reported delays in processing payments.

- Transaction Limits: There are limits on the amount that can be transferred, which may be restrictive for larger businesses.

- Customer Support: Some users found customer support to be slow or unresponsive.

User Testimonials And Feedback

Real users have shared their feedback about Melio:

“Melio has streamlined our payment process. The integration with our accounting software is seamless.”

“We experienced some delays with payments, but overall, it has saved us money on fees.”

“Customer support could be better, but the platform itself is very easy to use.”

These testimonials provide a balanced view of Melio’s real-world performance.

Specific Recommendations For Ideal Users

Integrating credit cards into your business can boost efficiency. Melio offers a seamless way to do this. But, who benefits the most from this integration? This section provides specific recommendations for ideal users.

Best Use Cases For Small Businesses

Small businesses need quick and easy solutions. Melio is perfect for them. Here are some reasons:

- Simple setup process

- Low transaction fees

- Easy management of payments

These features help small businesses save time and money. They can focus more on growth.

Suitability For Large Enterprises

Large enterprises have complex needs. Melio addresses these with:

- Advanced security features

- High transaction limits

- Comprehensive reporting tools

These tools help large companies manage vast amounts of data. They ensure secure and efficient payment processes.

Recommendations For E-commerce Platforms

E-commerce platforms can greatly benefit from Melio. Here’s why:

| Feature | Benefit |

|---|---|

| Fast integration | Quickly start accepting payments |

| Multiple payment options | Attract more customers |

| Automated invoicing | Reduce manual effort |

These features make Melio an ideal choice for online stores. They can enhance user experience and increase sales.

Conclusion: Simplifying Your Payment Process

Integrating credit card payments into your business can seem daunting. With tools like Melio, the process becomes straightforward. This integration can save time and reduce errors.

Recap Of Key Points

- Ease of Use: Melio’s platform is user-friendly and requires no advanced technical skills.

- Secure Transactions: Melio ensures that all transactions are encrypted and secure.

- Cost-Effective: Using Melio can save money with its competitive fee structure.

- Time-Saving: Automating payments can free up valuable time for business owners.

Final Thoughts On Easy Credit Card Integration

Adopting Melio for credit card integration offers many benefits. It makes managing payments easier and more efficient. This can lead to smoother business operations.

Consider integrating Melio into your payment process. It provides a reliable and secure way to handle credit card payments. This can help you focus on growing your business.

Frequently Asked Questions

How To Integrate A Credit Card With My Website?

Integrating a credit card is straightforward. Use a reliable payment gateway like Stripe or PayPal. Follow their setup guide, add the necessary API keys, and test transactions.

What Is The Easiest Way For Credit Card Integration?

The easiest way is using a payment gateway’s ready-made plugins. Platforms like Shopify or WooCommerce offer simple integration steps.

Are There Any Fees For Credit Card Integration?

Yes, payment gateways charge transaction fees. These can vary between 1. 5% to 3% per transaction. Check with your provider for exact rates.

Can I Integrate Multiple Credit Cards?

Yes, most payment gateways support multiple card types. You can accept Visa, Mastercard, American Express, and others. Ensure your provider supports these options.

Conclusion

Integrating credit cards into your business can boost efficiency. Melio simplifies this process. No complicated steps. Seamless transactions save time and effort. Want to explore more? Check out Melio for easy credit card integration. Your business deserves smooth, hassle-free payments.