Debt Reduction Strategies: Proven Tips for Financial Freedom

Managing debt can be challenging, but effective strategies can make it easier. Debt reduction strategies help you regain control over your finances.

They offer a structured plan to reduce or eliminate debt, paving the way to financial freedom. Debt can feel overwhelming, but with the right approach, you can tackle it head-on. Understanding various debt reduction strategies is the first step toward achieving a healthier financial future. Whether you’re dealing with credit card debt, student loans, or personal loans, adopting the right strategies can make a significant difference. From budgeting and consolidating debts to negotiating with creditors, there are numerous ways to address your financial obligations. Tools like Credit Sesame can also assist in managing and improving your credit, making the debt reduction journey smoother. Learn more about how you can start taking control of your debt today here.

Introduction To Debt Reduction Strategies

Managing debt can be overwhelming. But with the right strategies, it becomes manageable. This section introduces effective debt reduction strategies to help you regain control of your finances.

Understanding The Importance Of Debt Reduction

Debt reduction is crucial for financial stability. Reducing debt decreases financial stress and improves your credit score. It also frees up funds for savings and investments.

Debt can impact your ability to qualify for loans or credit cards. High debt levels can lead to higher interest rates. By reducing debt, you can enhance your financial health and future opportunities.

Overview Of Common Debt Types

| Debt Type | Description | Example |

|---|---|---|

| Credit Card Debt | Unsecured debt with high interest rates | Purchases made with a credit card |

| Student Loans | Loans taken to pay for education | Federal or private student loans |

| Mortgage | Secured debt for purchasing a home | Home loans |

| Auto Loans | Secured debt for purchasing a vehicle | Car loans |

| Personal Loans | Unsecured loans for various purposes | Consolidation loans, medical bills |

Understanding the different types of debt is the first step. This knowledge helps you prioritize and manage your debt reduction plan more effectively.

Credit Sesame can be a valuable tool in this journey. It offers features like daily credit scores, personalized actions, and credit monitoring. These tools can guide you in making informed decisions about your debt.

Creating A Debt Reduction Plan

Reducing debt can feel overwhelming. But with a solid plan, you can take control of your finances. Let’s explore how to create an effective debt reduction plan.

Assessing Your Current Financial Situation

Before you start, you need to understand your current financial situation. This means listing all your debts. Include credit cards, loans, and any other liabilities. Note the interest rates, minimum payments, and total amounts due. Use a spreadsheet to keep everything organized.

| Debt Type | Amount Owed | Interest Rate | Minimum Payment |

|---|---|---|---|

| Credit Card 1 | $5,000 | 20% | $100 |

| Auto Loan | $10,000 | 5% | $200 |

| Personal Loan | $7,500 | 10% | $150 |

Setting Realistic Financial Goals

Set realistic financial goals to stay motivated. Start with short-term goals like paying off a small debt. Then, aim for long-term goals such as being debt-free in five years. Make sure your goals are specific, measurable, achievable, relevant, and time-bound (SMART).

For example:

- Short-term goal: Pay off $500 on Credit Card 1 in three months.

- Long-term goal: Become debt-free in five years.

Creating A Budget

A budget is essential for managing your money effectively. Start by tracking your income and expenses. Identify areas where you can cut costs. Allocate extra funds towards paying off your debt.

Here’s a simple budget outline:

Income: $3,000 - Rent: $1,000 - Utilities: $200 - Groceries: $300 - Transportation: $200 - Debt Payments: $600 - Savings: $200 - Miscellaneous: $500

Adjust your budget as needed to ensure you’re putting as much as possible towards debt reduction.

Using tools like Credit Sesame can help you monitor your credit score and receive personalized recommendations. This can be a valuable resource as you work to improve your financial situation.

Debt Snowball Method

The Debt Snowball Method is a popular strategy for reducing debt. It focuses on paying off smaller debts first, gaining momentum as each debt is eliminated. This method is designed to give you quick wins and boost your motivation.

How The Debt Snowball Method Works

In the Debt Snowball Method, you list all your debts from smallest to largest. You make minimum payments on all debts except the smallest one. For the smallest debt, you pay as much as you can. Once the smallest debt is paid off, you move to the next smallest, adding the previous payment amount to the next debt. This creates a snowball effect.

Benefits Of The Debt Snowball Method

- Quick Wins: Paying off smaller debts first gives you quick wins and boosts motivation.

- Increased Momentum: As each debt is paid off, you can allocate more funds to the next debt.

- Simple and Easy to Follow: The method is straightforward, making it easy to stick to.

- Psychological Boost: Seeing progress can help you stay committed to your debt reduction goals.

Step-by-step Guide To Implementing

- List Your Debts: Write down all your debts from smallest to largest, including the amounts and interest rates.

- Make Minimum Payments: Ensure you make minimum payments on all debts to avoid penalties.

- Focus on the Smallest Debt: Allocate as much money as possible to the smallest debt until it’s paid off.

- Move to the Next Debt: Once the smallest debt is cleared, move to the next smallest debt. Add the previous payment to this debt.

- Repeat the Process: Continue this process until all debts are paid off.

Using the Debt Snowball Method can significantly improve your financial health. For further assistance, consider using tools like Credit Sesame to monitor and manage your credit score.

Debt Avalanche Method

The Debt Avalanche Method is a popular strategy for reducing debt. It focuses on paying off debts with the highest interest rates first. This can save you money on interest and help you become debt-free faster. Below, we will explore how this method works, its benefits, and a step-by-step guide to implementing it.

How The Debt Avalanche Method Works

The Debt Avalanche Method involves paying off your debts in order of highest to lowest interest rate. Here’s a breakdown of how it works:

- List all your debts from highest to lowest interest rate.

- Make the minimum payment on all debts except the one with the highest interest rate.

- Put any extra money towards paying off the debt with the highest interest rate.

- Once the highest-interest debt is paid off, move to the next highest-interest debt.

- Repeat this process until all your debts are paid off.

Benefits Of The Debt Avalanche Method

The Debt Avalanche Method offers several key benefits:

- Interest Savings: By targeting high-interest debts first, you save money on interest over time.

- Faster Debt Reduction: Paying off high-interest debts quickly reduces the total repayment period.

- Psychological Boost: Seeing your debts decrease rapidly can motivate you to stay committed.

Step-by-step Guide To Implementing

Follow these steps to implement the Debt Avalanche Method:

- Gather Information: List all your debts along with their interest rates and balances.

- Rank Your Debts: Order them from highest to lowest interest rate.

- Budget for Extra Payments: Identify areas in your budget where you can allocate extra money towards debt repayment.

- Make Minimum Payments: Ensure you make the minimum payments on all debts to avoid penalties.

- Focus on High-Interest Debt: Direct any extra funds towards the debt with the highest interest rate.

- Monitor Progress: Regularly review your progress and adjust your strategy if needed.

- Stay Committed: Continue the process until all debts are paid off.

Using tools like Credit Sesame can help you monitor your credit score and manage your debts effectively. Credit Sesame offers features like daily credit score updates, personalized actions, and tailored credit product offers to help you stay on track with your debt reduction goals.

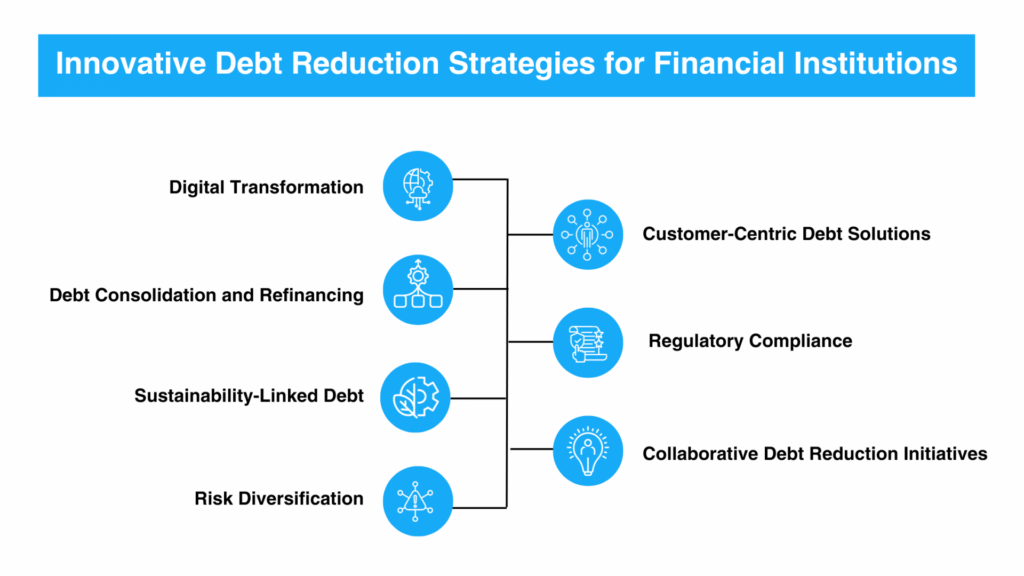

Debt Consolidation

Debt consolidation can simplify your finances. It combines multiple debts into one payment. This strategy helps manage your debt more effectively.

What Is Debt Consolidation?

Debt consolidation merges multiple debts into a single loan. It often involves a lower interest rate. This can make monthly payments more manageable.

Types Of Debt Consolidation

There are several ways to consolidate debt:

- Balance Transfer Credit Cards: Transfer balances from multiple cards to one with a lower rate.

- Personal Loans: Take out a loan to pay off various debts.

- Home Equity Loans: Use your home’s equity to get a loan for debt repayment.

- Debt Management Plans: Work with a credit counseling agency to consolidate your debt.

Pros And Cons Of Debt Consolidation

| Pros | Cons |

|---|---|

| Single monthly payment | Potential fees and costs |

| Lower interest rates | Longer repayment period |

| Improved credit score | Risk of losing collateral (home equity loans) |

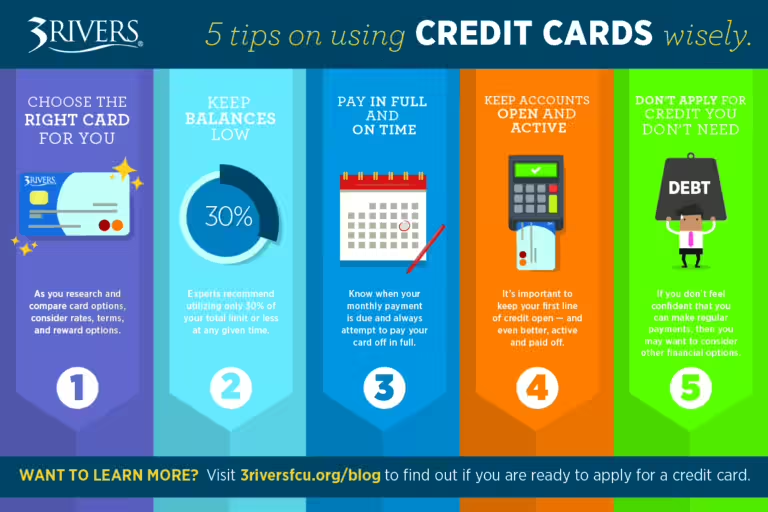

Balance Transfer Credit Cards

Balance transfer credit cards can be a powerful tool for debt reduction. They allow you to transfer high-interest debt to a new card with a low or zero percent introductory APR. This strategy can save you money on interest and help you pay off your debt faster.

How Balance Transfer Credit Cards Work

A balance transfer involves moving debt from one credit card to another. The new card usually offers a low or 0% APR for a set period, often 12 to 18 months. This can significantly reduce the amount of interest you pay.

To initiate a balance transfer, you apply for a new credit card and request the transfer. If approved, the new card issuer pays off your old debt, and you start making payments on the new card. Be aware of transfer fees, which are usually around 3% to 5% of the transferred amount.

Choosing The Right Balance Transfer Card

Choosing the right balance transfer card is crucial. Look for cards with a long 0% APR period and low transfer fees. Consider the ongoing APR after the introductory period ends. It’s also important to check your credit score, as better offers are available to those with higher scores.

Using a service like Credit Sesame can help. Credit Sesame offers personalized credit product recommendations and tailored credit card offers with high approval chances. Their free service provides daily credit scores and personalized actions to improve your credit.

Pros And Cons Of Balance Transfer Credit Cards

| Pros | Cons |

|---|---|

|

|

Negotiating With Creditors

Negotiating with creditors can be a useful strategy for reducing debt. It involves directly communicating with your creditors to discuss possible adjustments to your debt terms. This can include lowering interest rates, waiving fees, or setting up a more manageable payment plan. Effective negotiation can make a significant impact on your ability to pay down debt faster and with less financial strain.

How To Negotiate Lower Interest Rates

Negotiating lower interest rates with creditors requires preparation and confidence. Here are some steps to help you:

- Review Your Credit Report: Before contacting creditors, check your credit report for accuracy. You can use services like Credit Sesame to monitor your credit score and get personalized recommendations.

- Understand Your Financial Situation: Know your current debt, income, and expenses. This will help you present a clear picture to your creditors.

- Research Current Interest Rates: Be aware of the average interest rates for your type of debt. This information can be used as leverage during negotiations.

- Contact Your Creditor: Call your creditor and explain your situation. Be polite but firm in your request for a lower interest rate.

Tips For Successful Negotiation

Successful negotiation requires a strategic approach. Here are some tips to enhance your chances:

- Stay Calm and Professional: Maintain a respectful tone during the conversation. Anger or frustration can hinder your progress.

- Highlight Your Payment History: If you have a good track record of payments, emphasize this to show your commitment to resolving the debt.

- Be Honest: Clearly explain why you need a lower rate. Honesty builds trust with the creditor.

- Negotiate Other Terms: If a lower interest rate isn’t possible, ask for other concessions like fee waivers or extended payment terms.

When To Seek Professional Help

Sometimes, negotiating with creditors can be challenging. In such cases, seeking professional help might be necessary:

| Situation | Recommendation |

|---|---|

| Overwhelming Debt | Consider consulting a credit counseling agency for personalized advice. |

| Complex Financial Situation | Hire a debt settlement company to negotiate on your behalf. |

| Legal Issues | Seek advice from a financial attorney to understand your rights and options. |

Services like Credit Sesame offer tools and advice to help you manage and improve your credit. Utilizing these resources can make the process of negotiating with creditors more manageable and effective.

Increasing Your Income

Reducing debt often requires a multi-faceted approach. While cutting expenses is crucial, increasing your income can accelerate debt repayment. Explore various methods to boost your earnings and achieve financial freedom faster.

Side Hustles And Part-time Jobs

Finding a side hustle or part-time job can significantly supplement your income. Consider options like:

- Freelancing: Offer your skills on platforms like Upwork or Fiverr.

- Gig Economy Jobs: Drive for Uber, deliver with DoorDash, or rent out a room on Airbnb.

- Retail or Food Service: Work evenings or weekends at local businesses.

- Tutoring: Provide academic assistance in subjects you excel in.

Evaluate your skills and interests to find side jobs that fit your schedule and pay well.

Leveraging Skills For Additional Income

Utilize your existing skills to generate extra income. Here are some ideas:

- Consulting: Offer expert advice in your field.

- Teaching: Create online courses or workshops.

- Writing: Write articles, blogs, or eBooks.

- Crafting: Sell handmade items on Etsy or at local markets.

Platforms like LinkedIn and social media can help you market your services and reach potential clients.

Passive Income Opportunities

Passive income streams can provide ongoing earnings with minimal effort. Consider these options:

- Investments: Invest in stocks, bonds, or real estate.

- Rental Income: Rent out property or a spare room.

- Affiliate Marketing: Promote products and earn commissions.

- Digital Products: Sell eBooks, online courses, or printables.

Building passive income takes time but can significantly contribute to debt reduction in the long run.

| Method | Description | Potential Income |

|---|---|---|

| Freelancing | Offer skills like writing, graphic design, or coding. | $20-$100/hour |

| Consulting | Provide expert advice in your industry. | $50-$200/hour |

| Investments | Earn returns from stocks, bonds, or real estate. | Varies |

| Affiliate Marketing | Promote products and earn commissions. | 5%-30% per sale |

Explore these strategies to increase your income and accelerate your debt reduction journey.

Cutting Expenses

Reducing debt starts with controlling spending. Cutting expenses is essential for financial stability. By identifying non-essential expenses and minimizing monthly bills, you can save more money each month. Embracing a frugal lifestyle can further help in managing your finances efficiently.

Identifying Non-essential Expenses

The first step in reducing debt is to identify non-essential expenses. These are costs that are not necessary for your basic needs. Examples include dining out, subscription services, and impulse purchases. Reviewing your bank statements can help pinpoint these expenses. Create a list and prioritize them by importance.

- Dining Out: Prepare meals at home instead of eating out.

- Subscription Services: Cancel or pause services you rarely use.

- Impulse Purchases: Avoid buying items on a whim.

Tips For Reducing Monthly Bills

Lowering your monthly bills can free up cash for debt repayment. Here are some tips to consider:

- Negotiate with Service Providers: Call your utility, phone, and internet providers to ask for better rates.

- Switch to Energy-Efficient Appliances: Reduce electricity usage with energy-saving devices.

- Bundle Services: Combine phone, internet, and cable services to get discounts.

- Eliminate Unnecessary Services: Cancel any services you don’t need, such as premium cable channels.

Living A Frugal Lifestyle

Embracing a frugal lifestyle can significantly impact your savings. Here are some ways to live more frugally:

- Shop with a List: Stick to a shopping list to avoid buying unnecessary items.

- Buy Generic Brands: Choose store brands over name brands to save money.

- DIY Projects: Do-it-yourself projects can save money on home repairs and improvements.

- Reduce Entertainment Costs: Opt for free or low-cost entertainment options like visiting parks or attending community events.

By implementing these strategies, you can cut expenses and reduce debt more effectively. Remember, every little bit saved adds up over time.

Seeking Professional Help

Dealing with debt can be overwhelming. Sometimes, the best way to navigate through it is by seeking professional help. Experts can provide you with the tools and strategies needed to manage your debt effectively. Here, we explore when to consult a financial advisor, debt management programs, and credit counseling services.

When To Consult A Financial Advisor

Consulting a financial advisor can be beneficial when your debt feels unmanageable. Advisors can help you create a personalized plan to reduce your debt. They offer expert advice and can provide you with different strategies to ensure you stay on track. A financial advisor is especially useful if you have multiple sources of debt or if your debt has high-interest rates. They can help you prioritize which debts to pay off first and how to allocate your income effectively.

Debt Management Programs

Debt management programs (DMPs) are structured plans to help you pay off your debt. These programs are often provided by credit counseling agencies. They negotiate with your creditors to lower interest rates and monthly payments. This makes it easier for you to manage your debt. A DMP consolidates your payments into one monthly payment, simplifying the process. This program typically lasts between three to five years, depending on the amount of debt and the agreement with your creditors.

| Feature | Benefit |

|---|---|

| Negotiated Interest Rates | Lower monthly payments |

| Consolidated Payments | Simplified debt management |

| Structured Plan | Clear debt reduction timeline |

Credit Counseling Services

Credit counseling services offer guidance and support for managing your debt. These services provide advice on budgeting, debt repayment, and financial management. Credit counselors can help you understand your credit report and create a plan to improve your credit score. They also assist you in enrolling in a DMP, if necessary. Credit Sesame, for example, offers tools to monitor and improve your credit score, making it easier to manage your debt.

- Daily Credit Score

- Sesame Grade

- Personalized Actions

- Credit Offers

- Credit Builder

Credit counseling services are usually free or low-cost. They can provide you with valuable resources and support to help you regain control of your finances.

Staying Motivated On Your Debt-free Journey

Embarking on a debt-free journey can be challenging. Keeping up your motivation is crucial for success. Here are some effective strategies to help you stay on track.

Tracking Progress And Celebrating Milestones

Tracking your progress is essential. It helps you see how far you’ve come. Use tools like Credit Sesame to monitor your credit score daily. Seeing improvements can boost your morale.

Celebrate small victories. Every milestone matters. When you pay off a debt, reward yourself. It doesn’t have to be big. A small treat can keep you motivated.

- Set mini-goals

- Track your progress

- Celebrate each milestone

Staying Disciplined And Avoiding New Debt

Discipline is key to becoming debt-free. Avoid taking on new debt. Use the Sesame Grade feature to understand your credit health. Follow personalized actions to improve your credit score without adding new debt.

Create a budget and stick to it. Allocate funds for necessities and savings. Cut unnecessary expenses. Use a prepaid debit card like Credit Builder for everyday purchases. It helps you build credit without overspending.

| Strategy | Description |

|---|---|

| Budgeting | Create and follow a strict budget |

| Use Credit Builder | Build credit with everyday purchases |

| Avoid New Debt | Say no to new loans or credit cards |

The Psychological Benefits Of Financial Freedom

Financial freedom offers immense psychological benefits. Reduced stress is one of the most significant benefits. When you are debt-free, your mind is at ease.

Improved mental health is another benefit. You can focus on other aspects of your life. You will feel more in control and confident. Use Credit Sesame to keep track and stay motivated. It makes the journey easier.

- Reduced Stress

- Improved Mental Health

- Increased Confidence

Your debt-free journey may be long, but the benefits are worth it. Stay motivated and use tools like Credit Sesame to support your efforts.

Frequently Asked Questions

What Is Debt Reduction?

Debt reduction involves strategies to lower or eliminate your outstanding debts. It helps improve your financial stability and credit score.

How Can I Reduce My Debt Quickly?

To reduce debt quickly, prioritize high-interest debts, create a budget, and cut unnecessary expenses. Consider debt consolidation or negotiating with creditors.

Are Debt Consolidation Loans Effective?

Yes, debt consolidation loans can simplify payments by combining multiple debts into one. They often offer lower interest rates, saving you money.

What Is A Debt Snowball Method?

The debt snowball method involves paying off the smallest debts first. This strategy builds momentum and motivation as you eliminate smaller balances.

Conclusion

Effective debt reduction strategies can transform your financial future. Implement these tips consistently. Stay focused and disciplined in your debt repayment journey. Every step counts towards financial freedom. For additional credit management help, consider using Credit Sesame. This tool offers daily credit scores, personalized advice, and credit monitoring. Start reducing debt today. The journey may be tough, but the result is worth it. Stay committed and watch your debt decrease over time.