Credit Utilization Tips: Maximize Your Credit Score Today

Credit utilization is a key factor in managing your credit score. It’s the ratio of your credit card balances to credit limits.

Understanding how to keep this ratio low can help improve your credit health. In this blog post, we’ll explore some effective credit utilization tips. These tips will help you manage your credit cards wisely and maintain a healthy credit score. Whether you’re aiming to buy a house, get a loan, or simply improve your financial health, managing your credit utilization is crucial. We’ll share practical advice that you can easily apply to your daily life. So, let’s dive into these tips and learn how to take control of your credit utilization today. And remember, for daily updates on your credit score and personalized actions to improve your credit, check out Credit Sesame.

Introduction To Credit Utilization

Credit utilization is a key factor in managing credit health. It directly impacts your credit score. Understanding how it works can help you improve your financial standing.

Understanding Credit Utilization

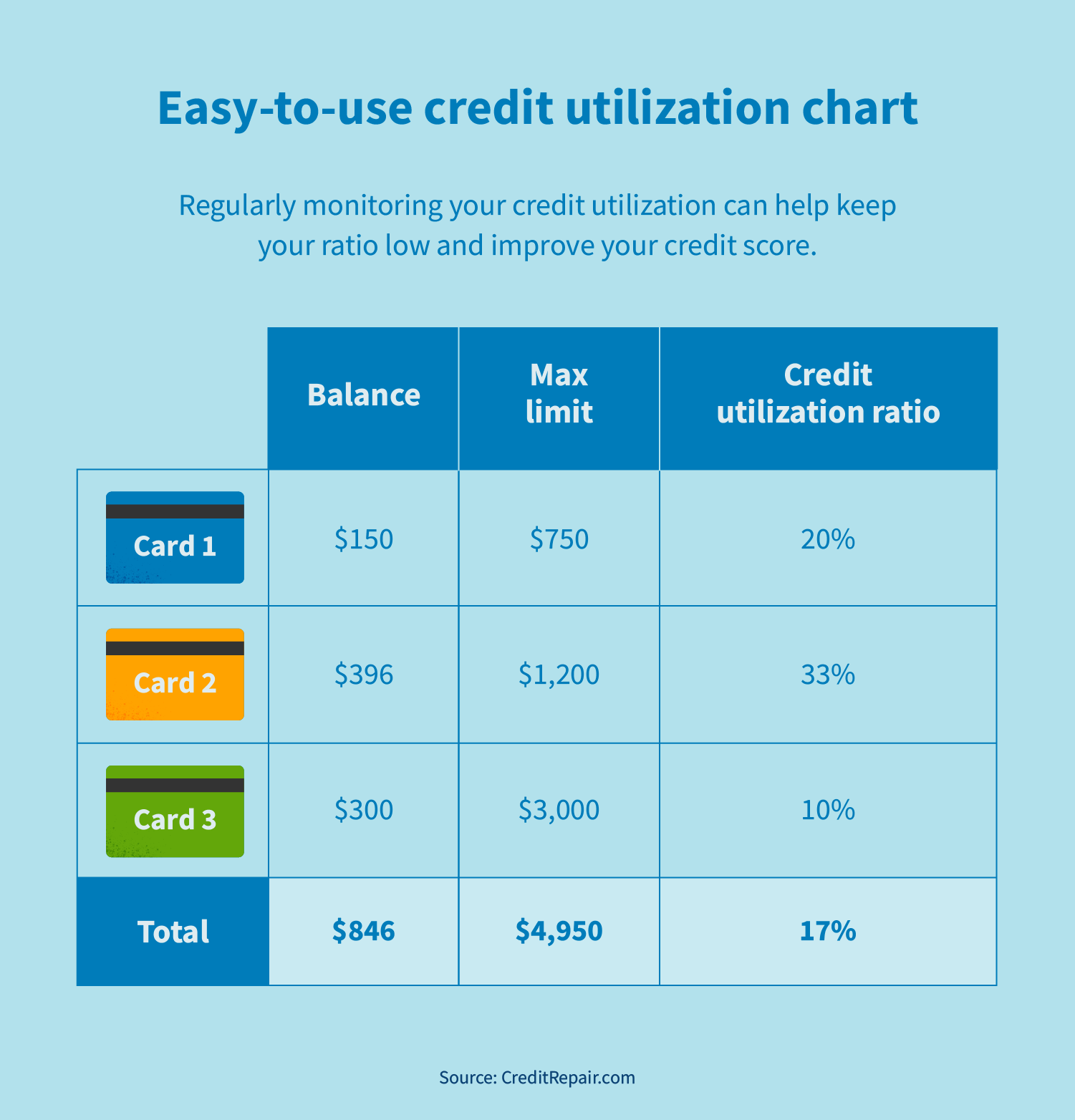

Credit utilization is the ratio of your credit card balances to your credit limits. It is usually expressed as a percentage. For instance, if you have a total credit limit of $10,000 and a balance of $2,000, your credit utilization is 20%.

Here is a simple formula to calculate it:

Credit Utilization = (Total Credit Card Balances / Total Credit Limits) 100Keeping this ratio low is crucial. Experts recommend maintaining a credit utilization rate below 30% to positively impact your credit score.

Importance Of Credit Utilization In Your Credit Score

Credit utilization accounts for about 30% of your credit score. It is one of the most significant factors in determining your creditworthiness. High utilization rates can signal financial distress to lenders.

Here’s why keeping a low utilization rate is beneficial:

- Improves Credit Score: A low utilization rate shows responsible credit use.

- Increases Approval Chances: Lenders are more likely to approve loans or new credit.

- Better Interest Rates: Good credit scores often lead to lower interest rates.

Using a service like Credit Sesame can help you monitor and manage your credit utilization effectively. Credit Sesame provides daily updates on your credit score and factors that impact it. Additionally, it offers personalized actions to improve your credit health.

With tools like Sesame Grade and personalized recommendations, you can stay on top of your credit utilization and ensure it remains at an optimal level.

| Feature | Benefit |

|---|---|

| Daily Credit Score Updates | Monitor changes in your credit score daily |

| Personalized Actions | Receive recommendations to improve your credit score |

| Sesame Grade | Understand the factors impacting your credit score |

Remember, managing credit utilization is essential for maintaining a healthy credit score and financial well-being. Regularly monitor your credit with tools like Credit Sesame to stay informed and proactive.

Key Tips To Maximize Your Credit Score Through Credit Utilization

Improving your credit score is essential for financial health. One effective method is managing credit utilization. Credit Sesame offers tools and insights to help users enhance their credit scores. Here are key tips to maximize your credit score through credit utilization.

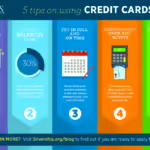

Maintain Low Credit Card Balances

Keeping your credit card balances low is crucial. Aim to use less than 30% of your credit limit. For example, if your limit is $1,000, try to keep the balance under $300. High balances negatively impact your credit score. Regularly monitor your spending and pay off balances to stay within the ideal range.

Pay Off Balances Strategically

Pay off your credit card balances before the statement date. This ensures lower utilization is reported to credit bureaus. Focus on paying off high-interest debt first. Use the Credit Sesame platform to get personalized recommendations. These actions can help you manage your debt effectively.

Increase Your Credit Limits

Requesting a higher credit limit can improve your credit utilization ratio. If you have a good payment history, your issuer may approve an increase. With a higher limit, your overall utilization decreases, even with the same balance. This positively impacts your credit score.

Diversify Your Credit Types

Having a mix of credit types can boost your credit score. This includes credit cards, installment loans, and retail accounts. Credit Sesame’s Sesame Grade can help you understand the impact of different credit types. A diversified credit profile shows lenders you can handle various credit forms.

Monitor Your Credit Reports Regularly

Regularly checking your credit reports helps you spot errors and potential fraud. Use Credit Sesame’s free daily credit score updates and credit report tools. If you find inaccuracies, dispute them immediately. Keeping your credit report accurate is essential for a healthy credit score.

These tips can help you manage your credit utilization and improve your credit score. Use the resources available on Credit Sesame to stay informed and proactive about your credit health.

Detailed Breakdown Of Each Tip

Understanding how to manage credit utilization can significantly impact your credit score. Here, we provide a detailed breakdown of each tip to help you better manage your credit utilization. These tips will guide you in maintaining a healthy credit profile.

How Maintaining Low Balances Helps

Keeping your credit card balances low is essential. High balances can negatively affect your credit score. Aim to keep balances below 30% of your credit limit. For example, if your limit is $1,000, try to keep your balance under $300. This shows lenders you are responsible with credit.

Strategic Payment Techniques

Paying your credit card bill on time is crucial. Late payments can hurt your credit score. Consider making multiple payments throughout the month. This can keep your balance low and reduce interest charges. Set up automatic payments to avoid missing due dates.

Benefits Of Increasing Credit Limits

Requesting a higher credit limit can lower your credit utilization ratio. If your limit increases, and your spending stays the same, your utilization ratio decreases. For instance, if your limit goes from $1,000 to $2,000, and your balance is $300, your utilization drops from 30% to 15%. This can boost your credit score.

The Role Of Credit Diversification

Having a mix of credit types, such as credit cards, auto loans, and mortgages, is beneficial. This shows lenders you can manage different forms of credit. Credit Sesame can help you find personalized credit offers suitable for your profile. A diversified credit portfolio can improve your overall credit health.

Importance Of Regular Credit Monitoring

Regularly monitoring your credit report helps you spot errors and potential fraud. Credit Sesame offers daily credit score updates, which keep you informed about changes in your credit profile. This proactive approach allows you to address issues promptly and maintain a healthy credit score.

By following these tips, you can effectively manage your credit utilization and improve your credit score. Remember, Credit Sesame provides various tools and resources to help you on your credit journey.

Pricing And Affordability Of Credit Improvement Tools

Managing and improving your credit score doesn’t have to break the bank. Various tools are available to assist in this journey, both free and paid. Understanding the pricing and benefits of these credit improvement tools can help you make an informed choice.

Free Credit Monitoring Tools

Free credit monitoring tools like Credit Sesame offer valuable services at no cost. These tools provide daily updates on your credit score and highlight factors affecting it. With Credit Sesame, users also receive personalized actions to improve their credit scores. The platform includes a feature called Sesame Grade, which provides a letter grade based on the five major factors impacting credit scores.

Benefits of Free Tools:

- Daily credit score updates

- Personalized actions for score improvement

- Curated credit offers based on your profile

- No cost and easy to use

Paid Services And Their Benefits

Paid services often come with additional features that can be very beneficial. For example, Sesame Cash is a service from Credit Sesame that includes a prepaid debit card to help build credit through everyday purchases. This service has a monthly fee of $9.99 and a $3 monthly inactivity fee, which can be waived under specific conditions.

Benefits of Paid Services:

- Enhanced credit building tools

- Potential fee waivers with account activity

- Comprehensive credit management features

Cost-effective Strategies For Credit Improvement

There are several cost-effective strategies you can employ to improve your credit. Here are a few:

- Regularly check your credit report for errors and dispute inaccuracies.

- Pay your bills on time to maintain a good payment history.

- Keep your credit utilization low by not maxing out your credit cards.

- Consider using tools like Credit Sesame for free credit monitoring and guidance.

By leveraging free tools and adopting these strategies, you can effectively manage and improve your credit without incurring significant costs.

| Tool | Cost | Key Features |

|---|---|---|

| Credit Sesame | Free | Daily credit score updates, personalized actions, Sesame Grade |

| Sesame Cash | $9.99/month | Prepaid debit card, credit building, fee waivers |

Pros And Cons Of Various Credit Utilization Strategies

Managing credit utilization effectively can significantly impact your credit score. Credit Sesame offers tools to help monitor and manage your credit utilization, but it’s essential to understand the pros and cons of different strategies. Let’s explore some of these strategies in detail.

Pros Of Maintaining Low Balances

Keeping low credit balances is crucial for maintaining a healthy credit score. Here are some benefits:

- Improved Credit Score: Low balances mean lower credit utilization, positively impacting your score.

- Financial Flexibility: You have more available credit for emergencies or unexpected expenses.

- Reduced Interest Payments: Paying less interest helps you save money in the long run.

Cons Of High Credit Utilization

High credit utilization can harm your credit profile. Consider these drawbacks:

- Lower Credit Score: High balances increase your credit utilization ratio, negatively affecting your score.

- Higher Interest Costs: Carrying high balances leads to more interest charges, increasing debt.

- Reduced Credit Approval Chances: High utilization signals risk to lenders, reducing your chances of credit approval.

Advantages And Disadvantages Of Increasing Credit Limits

Raising your credit limits can be a double-edged sword. Here are the pros and cons:

| Advantages | Disadvantages |

|---|---|

| Lower Utilization Ratio: Higher limits mean lower utilization, potentially boosting your credit score. | Risk of Overspending: Higher limits can tempt you to spend more, leading to more debt. |

| Increased Financial Flexibility: More available credit can help manage large or unexpected expenses. | Possible Higher Interest Costs: If overspending occurs, interest costs can increase. |

Pros And Cons Of Using Multiple Credit Types

Diversifying your credit types can impact your credit score in various ways. Let’s look at the pros and cons:

- Pros:

- Credit Mix: A variety of credit types can positively affect your credit score.

- Financial Management: Different credit types help in managing various financial needs.

- Cons:

- Complexity: Managing multiple credit types can be complicated and time-consuming.

- Potential Debt Increase: Multiple credit accounts can lead to higher overall debt if not managed properly.

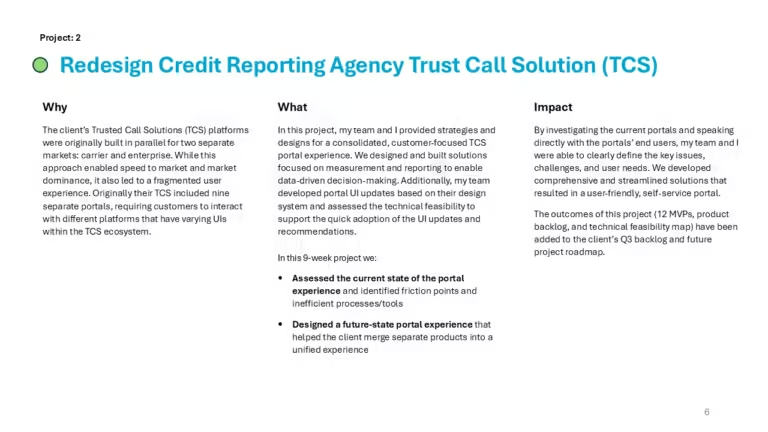

Specific Recommendations For Ideal Users

Credit Sesame offers tools and advice to help users manage their credit scores. Different users have unique needs based on their life stage and financial situation. Here are tailored recommendations for various groups to get the most out of Credit Sesame.

Best Strategies For Young Adults

Young adults often have limited credit history. Building a strong foundation early is crucial. Here are some tips:

- Monitor Your Credit Score: Use Credit Sesame’s daily updates to track changes and understand what impacts your score.

- Use Credit Builder Tools: The Sesame Cash prepaid debit card helps build credit with everyday purchases.

- Pay Bills on Time: Timely payments are essential for a good credit score.

- Keep Balances Low: Avoid maxing out credit cards. Aim for a credit utilization rate below 30%.

Tips For Families And Couples

Managing credit as a family or couple can be challenging. Here are some strategies:

- Joint Monitoring: Both partners should monitor their credit scores regularly.

- Shared Financial Goals: Set joint financial goals and work towards them together.

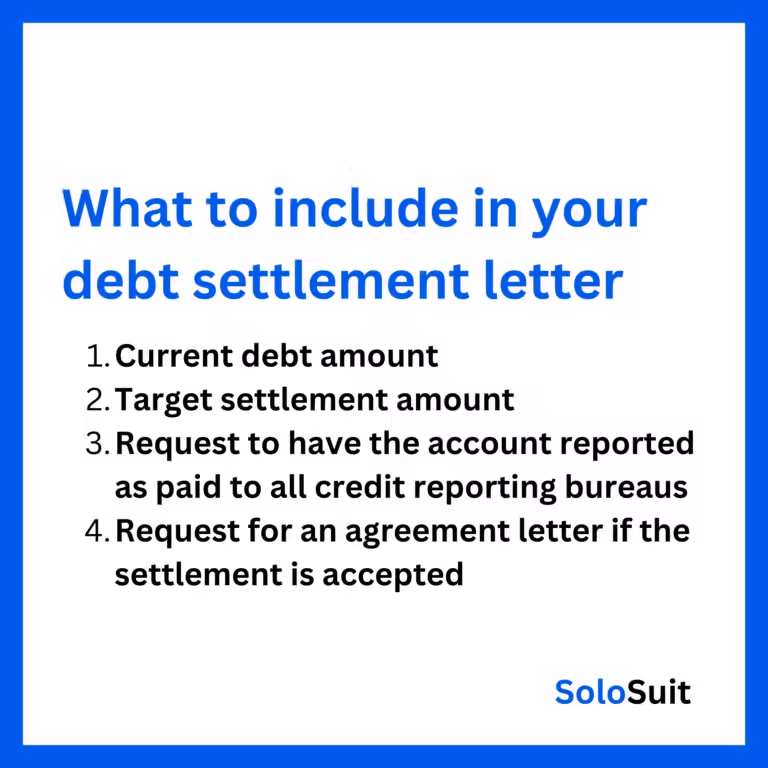

- Debt Management: Pay off high-interest debts first. Consider debt consolidation if necessary.

- Emergency Fund: Maintain an emergency fund to avoid relying on credit during tough times.

Advice For Individuals With High Debt

High debt can be overwhelming. Credit Sesame provides tools and tips to manage and reduce debt effectively:

- Debt Reduction Plan: Create a plan to pay off debts systematically. Focus on high-interest debts first.

- Credit Offers: Use Credit Sesame’s curated credit offers to find better interest rates and balance transfer options.

- Avoid New Debt: Limit new credit applications to avoid increasing your debt.

- Seek Professional Help: If needed, consult a credit counselor for personalized advice.

Recommendations For Business Owners

Business owners need to manage both personal and business credit. Here are some recommendations:

- Separate Finances: Keep personal and business finances separate to avoid complications.

- Monitor Both Credit Scores: Regularly check both personal and business credit scores.

- Business Credit Cards: Use business credit cards for company expenses to build business credit.

- Manage Cash Flow: Maintain a healthy cash flow to ensure timely payments on all debts.

Frequently Asked Questions

What Is Credit Utilization?

Credit utilization is the percentage of your available credit that you use. It impacts your credit score significantly. Keeping it low is advisable.

How To Lower Credit Utilization?

To lower credit utilization, pay off your balances regularly. Also, avoid maxing out your credit cards. Requesting a credit limit increase can help too.

Does High Credit Utilization Hurt Your Score?

Yes, high credit utilization can hurt your credit score. It indicates higher risk to lenders. Keeping it below 30% is recommended.

How Often Should I Check My Credit Utilization?

You should check your credit utilization monthly. This helps you stay on track. Monitoring ensures you maintain a healthy credit score.

Conclusion

Managing your credit utilization is essential for a healthy financial life. Practice these tips for better credit scores. Regularly monitor your credit score with Credit Sesame. It provides daily updates and personalized actions for improvement. Want to learn more? Visit Credit Sesame for details. Remember, maintaining low credit utilization helps your credit health. Stay informed and proactive with these strategies. Your future self will thank you.