Credit Utilization Strategies: Boost Your Credit Score Now

Managing your credit utilization is crucial for maintaining a healthy credit score. Credit utilization refers to the percentage of your available credit that you are currently using.

It plays a significant role in determining your creditworthiness. Understanding effective credit utilization strategies can help you improve your financial health and increase your credit score. This blog will delve into various methods to manage your credit utilization efficiently. By implementing these strategies, you can ensure a balanced credit profile and avoid potential pitfalls. Whether you’re a seasoned entrepreneur or just starting out, these tips will guide you in making informed decisions about your credit. Let’s explore how to optimize your credit utilization for better financial stability. For a comprehensive business management solution, consider Firstbase. This platform integrates incorporation, compliance, bookkeeping, and tax services, making it easier to handle your business finances.

Introduction To Credit Utilization Strategies

Managing credit utilization is key to improving credit scores. This guide will break down credit utilization strategies and explain their importance.

What Is Credit Utilization?

Credit utilization refers to the ratio of your credit card balances to your credit limits. It is expressed as a percentage.

For example, if your credit limit is $10,000 and your balance is $2,000, your credit utilization rate is 20%. This ratio helps creditors assess how well you manage credit.

Importance Of Credit Utilization In Credit Scores

Credit utilization significantly impacts your credit score. It accounts for 30% of your FICO score. Keeping a low utilization rate shows responsible credit management.

| Credit Utilization Rate | Impact on Credit Score |

|---|---|

| 0-30% | Positive |

| 30-50% | Neutral |

| 50% and above | Negative |

Maintaining a credit utilization rate below 30% is ideal. It signals to lenders that you are a low-risk borrower.

Here are some strategies to manage and reduce credit utilization:

- Pay down balances frequently.

- Request higher credit limits.

- Keep old credit accounts open.

- Monitor your credit report regularly.

Effective management of credit utilization can lead to a healthier financial profile. This is crucial for securing loans and favorable interest rates.

Understanding Credit Utilization

Credit utilization is a key factor in determining your credit score. It measures how much of your available credit you are using. A lower credit utilization ratio indicates responsible credit management, which can positively impact your credit score. Understanding how credit utilization works can help you make informed financial decisions.

How Credit Utilization Is Calculated

Your credit utilization ratio is calculated by dividing your total credit card balances by your total credit limits. The result is then multiplied by 100 to get a percentage. For example, if you have a total credit limit of $10,000 and your current balance is $2,500, your credit utilization ratio is 25%.

| Total Credit Limit | Current Balance | Credit Utilization Ratio |

|---|---|---|

| $10,000 | $2,500 | 25% |

Ideal Credit Utilization Percentage

The ideal credit utilization percentage is typically below 30%. Keeping your credit utilization below this threshold indicates that you are managing your credit well. Lower utilization can improve your credit score and demonstrate financial responsibility. Aim to pay down balances to maintain a low credit utilization ratio.

- Below 10%: Excellent

- 10% – 29%: Good

- 30% – 49%: Fair

- 50% and above: Poor

Monitoring your credit utilization regularly can help you stay within the ideal range. Consider setting up alerts to track your balances and ensure you do not exceed the recommended percentage.

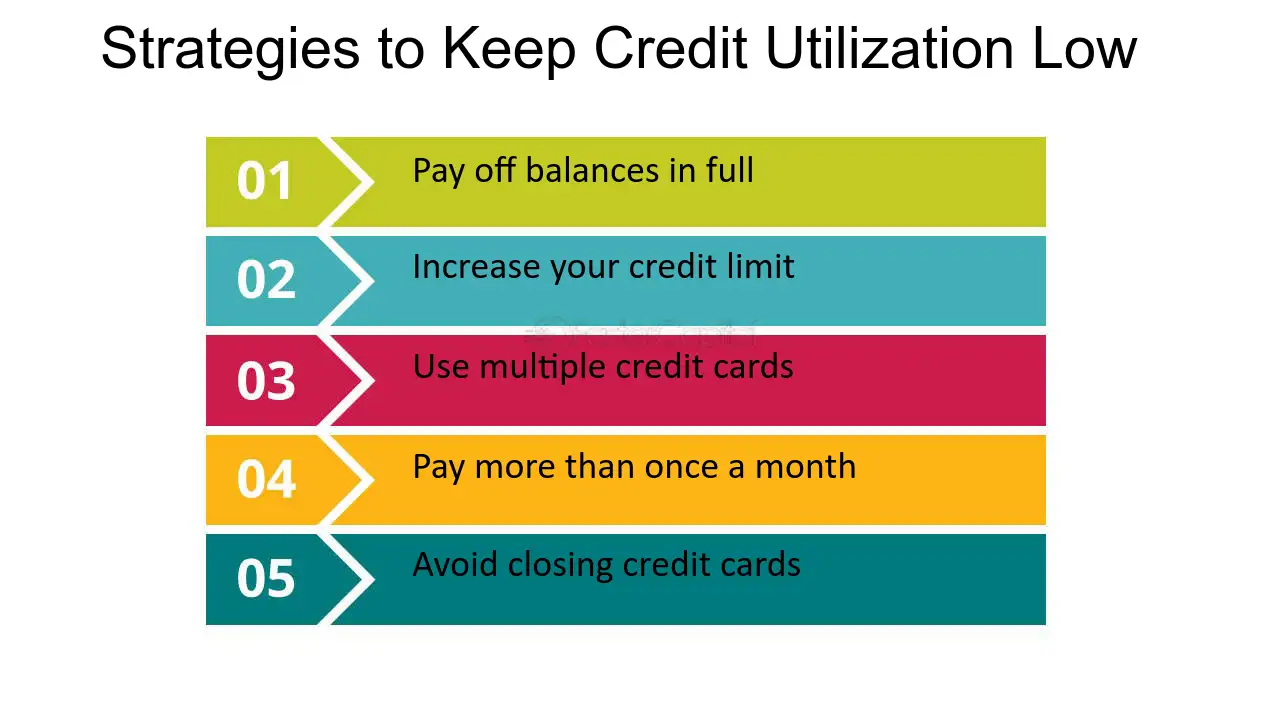

Strategies To Lower Credit Utilization

Maintaining a low credit utilization rate is crucial for a healthy credit score. It shows lenders you manage credit responsibly. Here are some effective strategies to lower your credit utilization and boost your credit score.

Pay Down Balances Strategically

Paying down your credit card balances is one of the most direct ways to lower your credit utilization. Focus on cards with the highest interest rates first. This method can save money on interest while reducing your overall debt.

Consider using the debt avalanche method, which targets high-interest debt first. Alternatively, the debt snowball method focuses on paying off smaller balances first, providing quick wins and motivation.

Another strategy is to make multiple payments throughout the month. This ensures your balances are lower when reported to credit bureaus.

Increase Your Credit Limits

Requesting a credit limit increase from your credit card issuer can effectively lower your credit utilization ratio. Before requesting an increase, ensure your credit history is strong, and your income can support higher credit limits.

Contact your card issuer and ask for an increase. Be prepared to provide updated income information and explain why you need the increase. A higher limit with the same balance results in a lower credit utilization rate.

Be cautious not to increase spending with a higher credit limit. The goal is to lower your utilization rate, not to accumulate more debt.

Diversify Your Credit Accounts

Diversifying your credit accounts can also help lower your credit utilization. Having a mix of credit types, such as credit cards, installment loans, and retail accounts, can positively impact your credit score.

Consider opening a new credit account only if it makes financial sense. For instance, a personal loan to consolidate credit card debt can lower your utilization rate by converting revolving debt to installment debt.

Monitor your credit report regularly to ensure new accounts are reported correctly and your utilization rate is accurately reflected.

Benefits Of Managing Credit Utilization

Managing your credit utilization effectively can bring several significant benefits. It helps improve your financial health, enhances your credit score, and opens doors to better financial opportunities. Let’s dive into the specific advantages of managing your credit utilization.

Improving Your Credit Score

One of the primary benefits of managing credit utilization is improving your credit score. Credit utilization, the ratio of your credit card balances to your credit limits, is a major factor in calculating your credit score. Keeping this ratio below 30% can positively impact your score.

- Lower credit utilization indicates responsible credit management.

- A higher credit score can result from maintaining a low utilization ratio.

Regularly monitoring and managing your credit utilization helps maintain a good credit score, which is crucial for financial stability.

Better Loan And Credit Card Approval Rates

Maintaining a low credit utilization ratio can lead to better loan and credit card approval rates. Lenders view low utilization as a sign of low risk. They are more likely to approve applications from individuals with low credit utilization.

- Increased chances of approval for new credit cards.

- Higher likelihood of getting approved for personal and business loans.

This increased approval rate can provide more financial flexibility and opportunities for growth, especially for business owners.

Lower Interest Rates

Managing your credit utilization can also result in lower interest rates. Lenders often offer better interest rates to individuals with lower credit utilization ratios. This can save you money over time.

- Lower interest rates on credit cards.

- Reduced interest rates on loans.

By keeping your credit utilization low, you can benefit from more favorable loan terms and lower overall borrowing costs.

Common Mistakes To Avoid

Understanding how to manage credit utilization is crucial for maintaining a healthy credit score. Many people make common mistakes that can negatively impact their credit. Here are some of the most frequent errors and how to avoid them.

Maxing Out Credit Cards

Maxing out credit cards is a major mistake. It significantly affects your credit utilization ratio. This ratio is the percentage of your credit limit that you are using. Ideally, you should use less than 30% of your available credit.

For example, if you have a credit limit of $10,000, aim to keep your balance below $3,000. High balances can lower your credit score and signal to lenders that you may be overextended.

Closing Old Credit Accounts

Closing old credit accounts can harm your credit score. Even if you no longer use a card, it contributes to your overall credit limit. Closing an account reduces your available credit, which can increase your credit utilization ratio.

Additionally, the age of your credit accounts is a factor in your credit score. Older accounts show a longer credit history, which is beneficial. Keeping old accounts open, even with minimal or no use, can help maintain a lower credit utilization ratio and a longer credit history.

Ignoring Credit Reports

Ignoring credit reports is a critical mistake. Regularly reviewing your credit reports helps you identify errors or fraudulent activity. Mistakes on your credit report can lower your credit score, making it harder to get loans or credit.

Check your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. You are entitled to a free report from each bureau once a year. Look for inaccuracies and dispute any errors you find. This proactive approach helps maintain a healthy credit score.

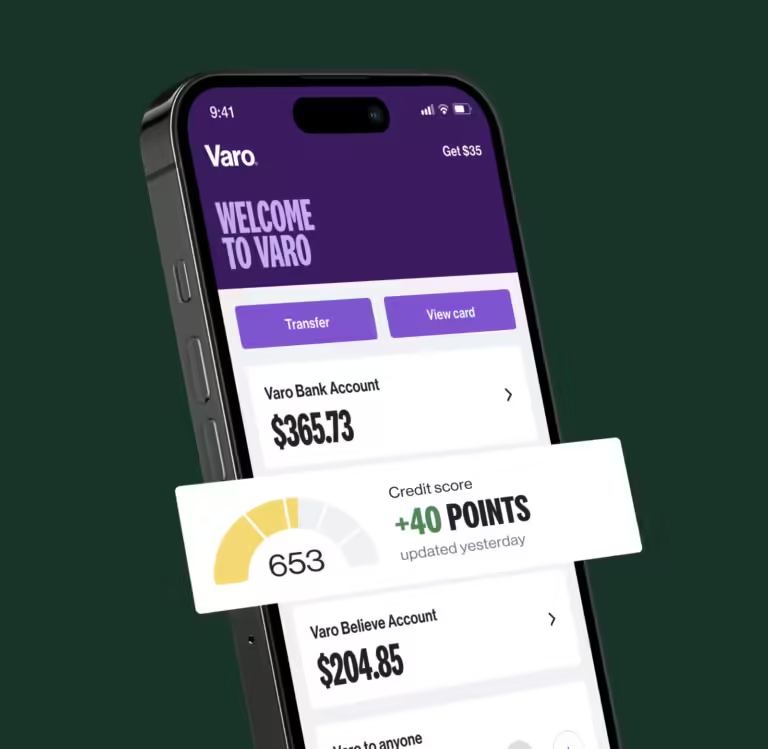

Tools And Resources For Monitoring Credit Utilization

Managing your credit utilization is crucial for maintaining a healthy credit score. Utilizing effective tools and resources can help you keep track of your credit usage. Here, we explore some of the best options available.

Credit Monitoring Services

Credit monitoring services are essential for keeping an eye on your credit utilization. These services provide regular updates and alerts regarding your credit activities. Some popular credit monitoring services include:

- Experian: Offers real-time alerts and monthly credit score updates.

- Equifax: Provides detailed credit reports and identity theft protection.

- TransUnion: Features credit score tracking and debt analysis tools.

These services often provide comprehensive reports that show your credit utilization ratio. This helps you understand how much of your available credit you are using.

Financial Apps And Tools

Various financial apps and tools can assist in monitoring your credit utilization. These apps offer features like budget tracking, expense monitoring, and credit score updates. Here are some recommended options:

| App/Tool | Features |

|---|---|

| Mint | Budget tracking, bill reminders, and credit score monitoring. |

| Credit Karma | Free credit score updates and credit report analysis. |

| Personal Capital | Investment tracking and financial planning tools. |

Using these tools allows you to stay on top of your spending and credit usage. They provide insights into your financial habits and help you manage your finances more effectively.

Pros And Cons Of Different Credit Utilization Strategies

Choosing the right credit utilization strategy can significantly impact your financial health. Each strategy has its own set of advantages and disadvantages. Here, we explore the pros and cons of three popular methods: balance transfer options, personal loans to pay off credit cards, and using savings to pay down debt.

Balance Transfer Options

A balance transfer involves moving your existing credit card debt to a new card with a lower interest rate. This can be a smart way to save on interest and pay off debt faster.

| Pros | Cons |

|---|---|

|

|

Personal Loans To Pay Off Credit Cards

Using a personal loan to pay off credit card debt can help you manage your payments more effectively. This option allows you to convert high-interest debt into a single, fixed monthly payment.

| Pros | Cons |

|---|---|

|

|

Using Savings To Pay Down Debt

Paying down debt with your savings can be a straightforward approach. This method involves using available cash reserves to reduce or eliminate your credit card balances.

| Pros | Cons |

|---|---|

|

|

Recommendations For Different Financial Situations

Credit utilization strategies vary based on individual financial situations. Tailoring your approach can help you manage your credit effectively. Here are some recommendations for different scenarios:

For Young Adults

Young adults often start with limited credit history. Building a strong foundation is crucial. Here are some tips:

- Keep Balances Low: Aim to use less than 30% of your credit limit.

- Pay Bills on Time: Timely payments build a positive credit history.

- Use Credit Wisely: Avoid maxing out your credit cards.

Consider starting with a secured credit card. This can help you build credit without the risk of overspending.

For Families

Families often face varying expenses. Managing credit utilization helps in balancing these costs. Here’s how:

- Create a Budget: Track all expenses to avoid overspending.

- Use Multiple Cards: Spread expenses across several credit cards to keep utilization low.

- Emergency Fund: Maintain a fund for unexpected expenses, reducing the need for credit.

Also, consider using a rewards credit card. This can provide benefits like cash back or travel points.

For Individuals With High Debt

High debt can be overwhelming. Effective strategies can help manage and reduce it. Follow these steps:

| Strategy | Description |

|---|---|

| Debt Avalanche | Pay off high-interest debts first to save on interest. |

| Debt Snowball | Start with smaller debts to build momentum. |

| Balance Transfers | Transfer high-interest balances to a lower-interest card. |

Consider seeking professional advice to create a personalized debt repayment plan.

Using credit responsibly can improve your financial health, no matter your situation. Tailor these recommendations to fit your needs and goals.

Conclusion: Achieving Financial Health Through Smart Credit Utilization

Smart credit utilization is a key factor in achieving financial health. Managing your credit wisely can improve your credit score, reduce debt, and increase your financial stability. Let’s recap the main points and provide some final tips for maintaining low credit utilization.

Recap Of Key Points

- Understand Credit Utilization: It’s the ratio of your credit card balances to your credit limits.

- Keep Balances Low: Aim to use less than 30% of your available credit.

- Pay Off Debt: Regularly pay off your balances to maintain a low utilization rate.

- Monitor Your Credit: Regularly check your credit reports to stay on top of your credit utilization.

- Limit New Credit Applications: Too many new accounts can negatively impact your credit score.

Final Tips For Maintaining Low Credit Utilization

- Set Up Automatic Payments: This ensures your bills are always paid on time.

- Increase Credit Limits: Requesting a higher credit limit can help lower your utilization ratio.

- Use Multiple Cards: Spread your expenses across different cards to keep individual balances low.

- Pay Twice a Month: Making payments more frequently can help maintain low balances.

- Avoid Closing Old Accounts: Keeping old accounts open can benefit your credit history and utilization.

Smart credit utilization plays a crucial role in achieving financial health. By maintaining low balances and managing credit wisely, you can improve your credit score and financial stability.

Frequently Asked Questions

What Is Credit Utilization?

Credit utilization is the ratio of your credit card balance to your credit limit. It’s expressed as a percentage. Maintaining a low credit utilization ratio can positively impact your credit score.

How Does Credit Utilization Affect My Credit Score?

A high credit utilization ratio can lower your credit score. Keeping your credit utilization below 30% can help improve your score. It shows lenders you manage credit responsibly.

What Is A Good Credit Utilization Ratio?

A good credit utilization ratio is typically below 30%. Lower ratios are better. Aim to keep your utilization as low as possible to maintain a healthy credit score.

How Can I Lower My Credit Utilization?

You can lower your credit utilization by paying down your balances. Increasing your credit limits and spreading out your spending across multiple cards can also help.

Conclusion

Effective credit utilization is crucial for financial health. Implement these strategies to maintain a low credit utilization ratio. This helps improve your credit score and financial standing. For business owners, consider using tools like Firstbase. Firstbase simplifies incorporation, compliance, and accounting. This all-in-one platform saves time and reduces costs. Make smart financial moves today and watch your credit grow stronger.