Credit Score Requirements: Essential Guide to Boost Your Score

Understanding credit score requirements is crucial for securing loans or credit. A good credit score can open doors, while a bad one can limit options.

Credit scores are a numerical reflection of your creditworthiness, impacting your ability to borrow money. Whether you’re looking for a mortgage, a car loan, or a personal loan, lenders will check your credit score. They use it to determine the risk of lending to you. It’s essential to know what score you need for different types of credit. This knowledge helps you plan and improve your financial health. In this blog post, we’ll explore the various credit score requirements for different types of loans and how to achieve the best score possible. Let’s dive in and understand how you can improve your chances of getting approved for a loan. Upstart Personal Loans can be a great option if you need a personal loan and want to learn more.

Introduction To Credit Scores

Understanding credit scores is crucial for managing your finances effectively. A credit score influences loan approvals, interest rates, and even job opportunities. Let’s dive into the basics of credit scores.

What Is A Credit Score?

A credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850, with higher scores indicating better credit. Credit bureaus calculate this score based on your credit history, payment behavior, and debt levels.

Your credit score is essential for lenders to assess the risk of lending you money. The score helps them decide whether to approve your credit application and what interest rate to offer.

Importance Of A Good Credit Score

Maintaining a good credit score offers several benefits:

- Lower interest rates on loans and credit cards.

- Higher chances of loan approval.

- Better terms on mortgage and car loans.

- Increased opportunities for rental applications.

- Potential employment advantages.

Good credit scores demonstrate financial responsibility. They indicate that you pay your bills on time and manage your debts well.

To improve your credit score, consider paying bills promptly, reducing debt, and monitoring your credit report regularly. Regular checks help you catch errors and prevent identity theft.

Understanding Credit Score Requirements

Credit scores play a crucial role in personal finance. They impact loan approvals, interest rates, and even rental agreements. Understanding credit score requirements can help manage your finances better and improve your chances of securing loans.

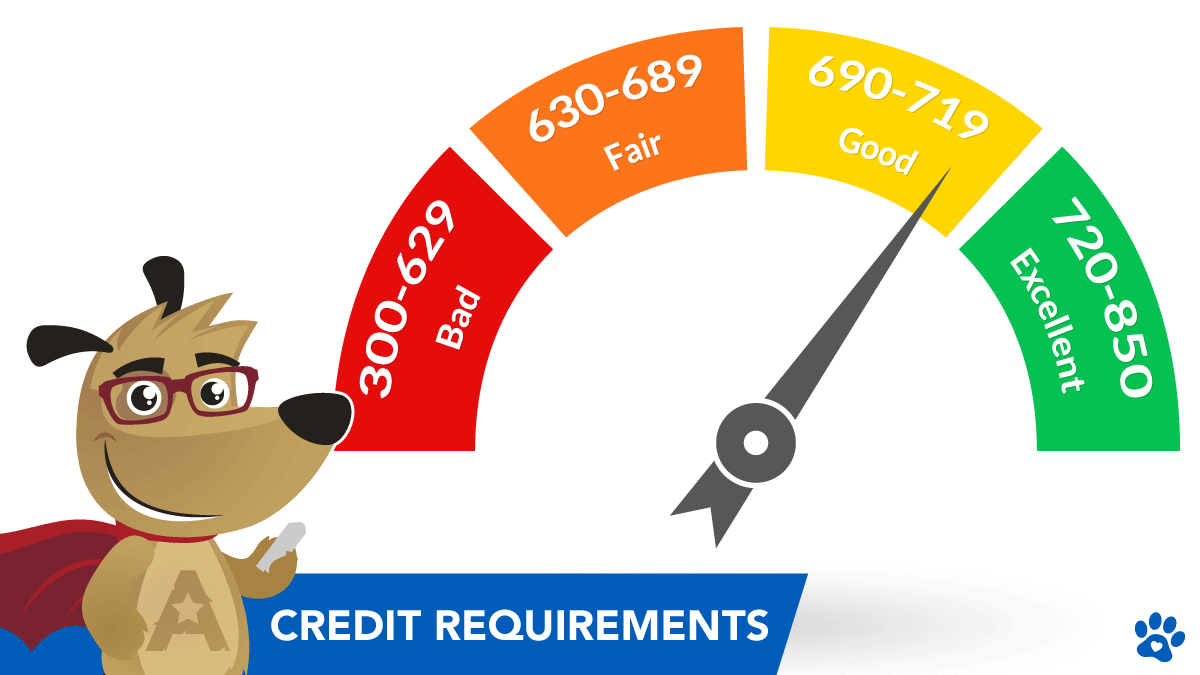

Credit Score Ranges Explained

Credit scores usually range from 300 to 850. Here’s a breakdown:

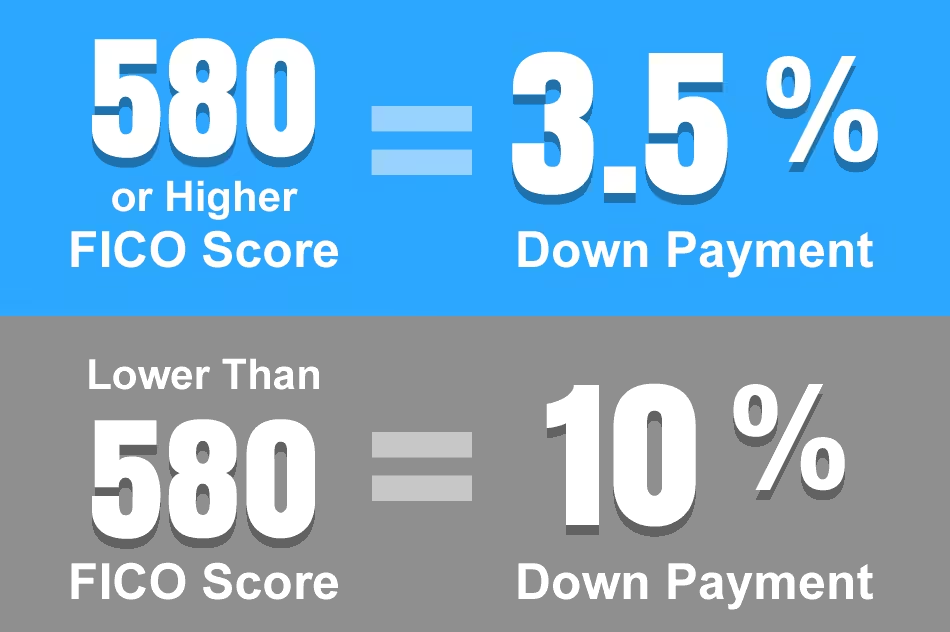

- 300-579: Poor. Difficult to get loans.

- 580-669: Fair. Higher interest rates.

- 670-739: Good. Qualifies for most loans.

- 740-799: Very Good. Lower interest rates.

- 800-850: Excellent. Best terms and rates.

How Lenders Use Credit Scores

Lenders use credit scores to assess your creditworthiness. A higher score indicates lower risk.

They evaluate:

- Payment History: Timely payments boost your score.

- Credit Utilization: Low balance-to-limit ratio is favorable.

- Credit History Length: Longer history is better.

- New Credit: Too many new accounts can hurt your score.

- Credit Mix: Diverse credit types improve your score.

Using these criteria, lenders decide whether to approve loans. They also determine interest rates based on your score.

Explore Upstart Personal Loans for more information on securing loans with various credit scores.

Key Factors Affecting Your Credit Score

Your credit score determines your financial health. Understanding the key factors can help you maintain or improve your score. Here are the main elements that influence it:

Payment History

Your payment history is the most crucial factor. It shows how consistently you pay your bills on time. Lenders prefer borrowers who pay on time.

- Late payments can lower your score.

- Consistent on-time payments improve your score.

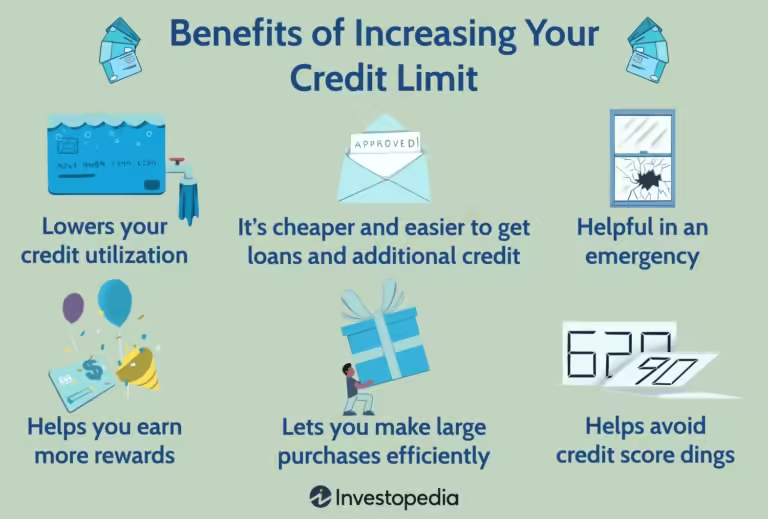

Credit Utilization Ratio

The credit utilization ratio is the percentage of available credit you use. Lower ratios are better.

- Try to keep your ratio below 30%.

- High utilization can indicate financial stress.

Length Of Credit History

The length of credit history considers how long your accounts have been open. Longer histories are more favorable.

- Older accounts add more weight to your score.

- New accounts lower the average age of your credit.

Types Of Credit Accounts

The types of credit accounts you have also matter. A mix of different types is beneficial.

- Credit cards, mortgages, and personal loans show diverse credit use.

- Having only one type may not be as favorable.

Recent Credit Inquiries

Recent credit inquiries refer to how many times lenders have checked your credit. Too many inquiries can be a red flag.

- Hard inquiries affect your score.

- Soft inquiries do not impact your score.

Understanding these factors can help you manage your credit score effectively. For more information on personal loans, visit Upstart Personal Loans.

Tips And Strategies To Boost Your Credit Score

Improving your credit score is essential for better financial health. A higher score can open doors to better loan terms and interest rates. Here are some effective tips and strategies to boost your credit score.

Pay Your Bills On Time

Paying your bills on time is crucial. Late payments can significantly impact your credit score. Set reminders or automate payments to ensure you never miss a due date. Consistent, timely payments build a positive credit history.

Reduce Outstanding Debts

High levels of debt can lower your credit score. Focus on paying down outstanding debts. Create a budget and allocate extra funds towards debt repayment. Prioritize high-interest debts first to reduce the total amount of interest paid.

Avoid New Credit Inquiries

Frequent credit inquiries can negatively affect your credit score. Each inquiry can lower your score by a few points. Apply for new credit only when necessary. Multiple inquiries in a short period can signal financial instability.

Keep Old Accounts Open

Closing old credit accounts can hurt your credit score. Length of credit history is a key factor in your score. Keep old accounts open and active to maintain a longer credit history. Use them occasionally to keep them active.

Regularly Check Your Credit Report

Regularly checking your credit report helps you identify errors. Mistakes can lower your score unfairly. Obtain a free credit report annually from each of the three major credit bureaus. Dispute any inaccuracies you find to correct them.

By following these tips and strategies, you can improve your credit score over time. Remember, consistency and patience are key to building a strong credit profile.

Common Credit Score Myths Debunked

Credit scores are often misunderstood. Many myths surround credit scores, leading to misinformation. Here, we debunk some of the most common myths.

Checking Your Own Credit Lowers Your Score

Many believe that checking your own credit report lowers your score. This is false. A soft inquiry, like checking your own credit, does not impact your score. Only hard inquiries, from lenders, might affect your score.

Closing Old Accounts Improves Your Score

Another myth is that closing old accounts can improve your credit score. In reality, closing old accounts can hurt your score. Old accounts contribute to your credit history length. A longer history generally helps your score.

You Have One Credit Score

Some think they have only one credit score. This is not true. You have multiple credit scores. Different credit bureaus and scoring models calculate these scores. Each may use slightly different data or methods.

Tools And Resources To Monitor And Improve Your Credit Score

Monitoring and improving your credit score is crucial for financial health. Using the right tools and resources can make this task easier. Below are some effective ways to keep an eye on your credit and improve it over time.

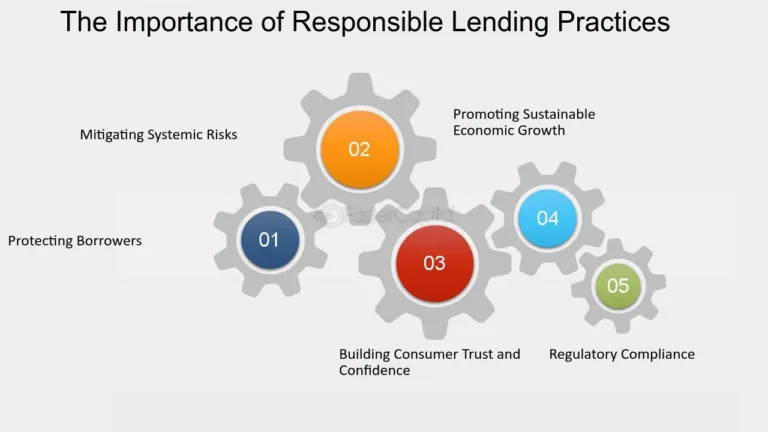

Credit Monitoring Services

Credit monitoring services offer tools to track your credit activity. These services alert you to any significant changes, such as new accounts or inquiries. Some popular credit monitoring services include:

- Experian

- TransUnion

- Equifax

Using these services, you can detect fraudulent activities early and take action to protect your credit score. Many services provide reports and scores from multiple credit bureaus, giving you a comprehensive view of your credit health.

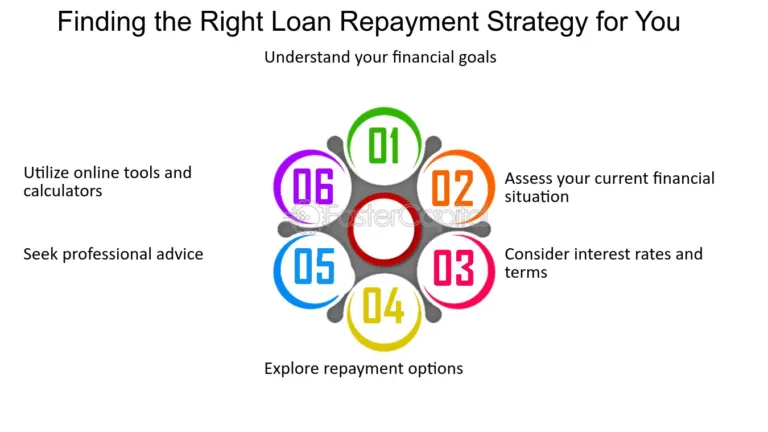

Credit Score Simulators

Credit score simulators allow you to predict how different financial actions might impact your credit score. These tools help you make informed decisions. For example, you can simulate the effect of:

- Paying off a loan

- Opening a new credit card

- Missing a payment

By using a credit score simulator, you can plan your financial moves strategically. This helps you avoid actions that might harm your credit score.

Financial Counseling And Advising

Financial counseling and advising services provide personalized advice. Professionals in this field can help you understand your credit report and develop a plan to improve your score. Services include:

- Debt management plans

- Credit report reviews

- Budgeting assistance

Talking to a financial counselor can offer insights that are specific to your situation. They can guide you through complex financial decisions and help you achieve a better credit score.

Conclusion And Final Recommendations

Understanding and maintaining a healthy credit score is crucial for financial stability. This section will summarize the key points discussed and offer final tips for keeping your credit score in good shape.

Recap Of Key Points

- Credit Score Basics: Credit scores range from 300 to 850. Higher scores indicate better creditworthiness.

- Factors Affecting Credit Score: Payment history, credit utilization, length of credit history, new credit, and credit mix.

- Importance of a Good Credit Score: Better loan terms, lower interest rates, and easier approval for credit.

- Improving Your Credit Score: Pay bills on time, reduce debt, avoid opening many new accounts at once, and monitor your credit report.

Final Tips For Maintaining A Healthy Credit Score

To maintain a healthy credit score, follow these tips:

- Pay On Time: Always pay your bills on time. Late payments can negatively impact your score.

- Keep Balances Low: Maintain low balances on credit cards and other revolving credit.

- Avoid New Debt: Avoid opening new credit accounts unnecessarily.

- Regularly Check Credit Report: Monitor your credit report regularly for errors and dispute any inaccuracies.

- Use Credit Wisely: Use credit responsibly and don’t max out your credit cards.

By following these recommendations, you can maintain a strong credit score, ensuring financial opportunities and stability. For more personalized advice and tools, consider exploring platforms like Upstart Personal Loans to help manage your financial needs effectively.

Frequently Asked Questions

What Is A Good Credit Score?

A good credit score typically ranges from 670 to 739. It indicates a reliable borrower.

How To Improve My Credit Score?

Pay bills on time, reduce debt, and avoid new credit inquiries. Regularly check your credit report for errors.

Why Is My Credit Score Important?

Your credit score impacts loan approvals, interest rates, and rental applications. It reflects your financial responsibility.

Can I Get A Loan With Bad Credit?

Yes, but expect higher interest rates. Consider secured loans or improving your credit first.

Conclusion

Understanding credit score requirements is crucial for financial health. Maintaining a good credit score opens doors to better financial opportunities. Always pay bills on time and manage debts wisely. Regularly check your credit report for errors. For those seeking personal loans, consider Upstart Personal Loans. They offer flexible options, making borrowing easier. Good credit management ensures financial stability and future opportunities. Stay informed and proactive.