Credit Score Myths: Debunking Common Misconceptions

Understanding credit scores can be confusing. Myths about them add to this confusion.

Credit scores are crucial for financial health, but many misconceptions can lead people astray. Believing these myths can harm your credit score and financial standing. In this blog, we will debunk common credit score myths and provide clear, accurate information. Understanding the truth behind these myths will help you make informed decisions about your credit. Whether you want to improve your score or just learn more, this guide will offer valuable insights. Let’s dive in and set the record straight on credit scores. For a reliable way to monitor and improve your credit score, check out Credit Sesame. They offer free credit score checks and personalized advice to help you achieve your financial goals.

Introduction To Credit Score Myths

Credit scores often seem like a mystery. Many people believe incorrect information about how they work. These credit score myths can harm your financial health. Let’s clear up the confusion.

Understanding The Importance Of Credit Scores

Your credit score impacts many areas of life. It affects loan approvals, interest rates, and even job opportunities. A higher score can save you money and open doors to better credit products.

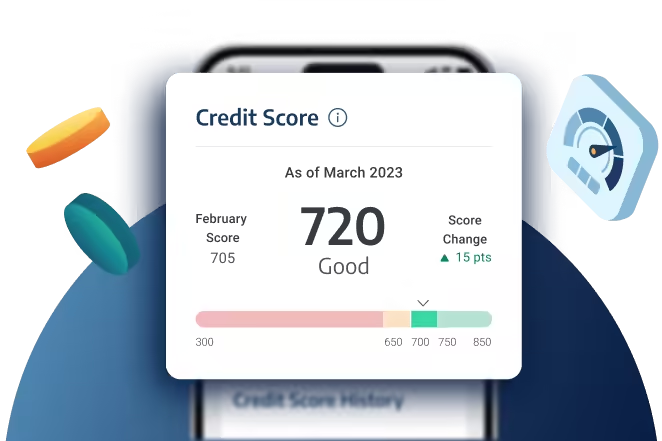

Credit Sesame provides tools to help you understand and improve your credit score. You can check your score daily and see the factors affecting it. Knowing your score is the first step to improving it.

| Feature | Description |

|---|---|

| Daily Credit Score Check | Monitor changes to your credit score every day. |

| Sesame Grade | See a letter grade based on five major credit factors. |

| Personalized Actions | Get recommendations to improve your credit score. |

Why Myths About Credit Scores Persist

Myths about credit scores persist for several reasons. Misinformation spreads easily, especially online. People may share outdated or incorrect advice without knowing it.

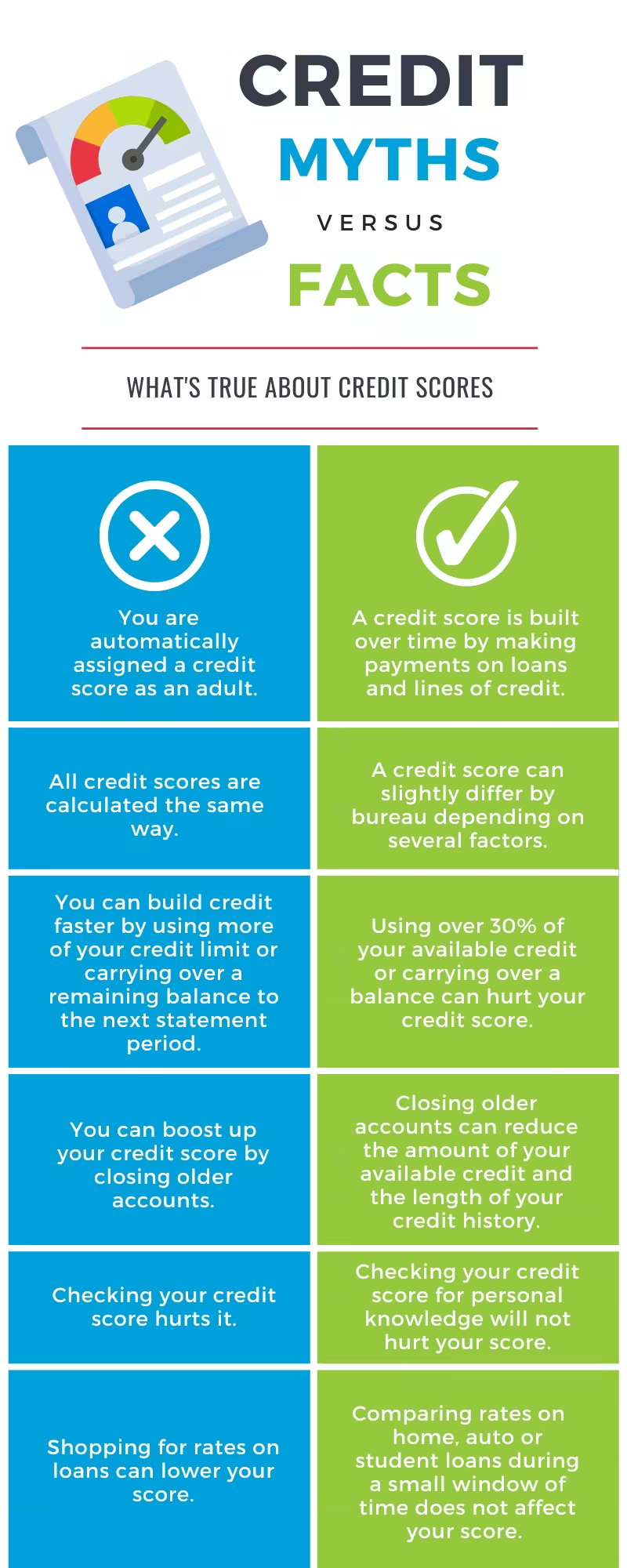

Here are common myths that Credit Sesame can help debunk:

- Checking your credit score will lower it.

- Closing a credit card improves your credit score.

- Having no debt means you have a good credit score.

Understanding the truth is essential. Credit Sesame provides accurate information and tools. It helps you make informed decisions about your credit.

For more details, visit Credit Sesame.

Common Credit Score Myths

Understanding credit scores can be challenging, and many misconceptions surround them. Knowing the truth behind these myths can help you manage your credit score more effectively. Let’s debunk some common credit score myths.

Many people believe that checking their credit score will lower it. This is not true. Checking your own credit score is considered a “soft inquiry” and does not affect your score. You can use platforms like Credit Sesame to check your score daily without any impact.

Some think that closing old accounts will improve their credit score. Closing old accounts can actually harm your credit score. It reduces your total available credit and can affect your credit history length. Keeping old accounts open, even if unused, can be beneficial.

Another common myth is that paying off a debt will remove it from your credit report. Paying off debt does not erase it from your report immediately. It will stay on your credit report for up to seven years, but it will be marked as paid. This can positively impact your credit score over time.

| Myth | Truth |

|---|---|

| Checking Your Credit Score Hurts It | Soft inquiries from checking your own score do not affect it. |

| Closing Old Accounts Improves Your Score | Closing accounts can reduce available credit and affect history length. |

| Paying Off a Debt Removes It from Your Credit Report | Paid debts stay on your report for up to seven years. |

Understanding these myths can help you manage your credit better. Using tools like Credit Sesame provides actionable insights and helps you track your credit score without any negative impact.

Myth 1: Checking Your Credit Score Hurts It

Many people fear that checking their credit score will lower it. This myth causes unnecessary worry. In reality, checking your own credit score does not harm it. Understanding the difference between types of credit inquiries can help you feel more confident.

The Difference Between Hard And Soft Inquiries

Credit inquiries come in two forms: hard inquiries and soft inquiries.

- Hard Inquiries: These occur when a lender checks your credit for a loan or credit card application. They can slightly lower your score.

- Soft Inquiries: These happen when you check your own credit score or when a lender checks your score for pre-approval offers. They do not affect your credit score.

Understanding these differences is crucial. Checking your own score is always a soft inquiry, which means it has no impact on your credit health.

How Checking Your Own Credit Score Can Actually Help

Regularly checking your credit score can be beneficial. Here’s how:

- Monitor Changes: Keep track of your credit score changes. Credit Sesame offers daily credit score checks for free.

- Identify Errors: Spot and correct any errors in your credit report. Incorrect information can hurt your score.

- Improve Understanding: Learn what impacts your score with Credit Sesame’s Sesame Grade. This feature provides a clear letter grade based on the five major factors affecting your credit.

- Personalized Actions: Get tailored recommendations to help improve your score. Credit Sesame suggests actions to reach your financial goals.

Regularly checking your credit score ensures you stay informed and proactive about your credit health. With Credit Sesame, you can do this without any negative impact on your score.

Myth 2: Closing Old Accounts Improves Your Score

Many people believe that closing old credit accounts will boost their credit score. This is a common misconception. In reality, closing old accounts can often harm your credit score.

Impact Of Account Age On Credit Scores

The age of your credit accounts plays a significant role in determining your credit score. Older accounts contribute to your credit history length, which is a key factor in your credit score calculation.

Credit scoring models, like FICO, consider the average age of your accounts. Closing an old account can reduce the average age of your accounts, negatively impacting your score.

A longer credit history demonstrates financial stability and responsible credit management, which lenders prefer.

Why Keeping Old Accounts Open Can Be Beneficial

Keeping old accounts open offers several benefits:

- Maintains Credit History: A long credit history shows you have managed credit responsibly over time.

- Improves Credit Utilization: Closing accounts reduces available credit, increasing your credit utilization ratio. A higher ratio can lower your score.

- Preserves Account Mix: A diverse mix of credit accounts (credit cards, loans) can positively influence your score.

Credit Sesame, a platform offering free credit score checks, helps users understand these factors. Their personalized actions guide you to maintain and improve your credit score effectively.

| Benefit | Description |

|---|---|

| Free Credit Score and Report | Access to credit score and report summary for free. |

| Improved Credit Understanding | Sesame Grade helps users understand score impacts. |

| Actionable Insights | Personalized actions to help improve credit scores. |

| High Approval Offers | Confidence in applying for credit with high approval odds. |

Using Credit Sesame, you can monitor your credit score daily, get customized credit offers, and build credit using everyday purchases. Keeping old accounts open and following personalized recommendations can lead to a stronger credit profile.

Myth 3: Paying Off A Debt Removes It From Your Credit Report

Many believe that once a debt is paid off, it vanishes from their credit report. This is a common misconception. Paying off a debt does not erase its history. Understanding how debts are reported can help manage expectations and credit health.

Understanding How Debts Are Reported

Credit reports include detailed information about your credit history. This includes open and closed accounts, payment history, and settled debts. Even after paying off a debt, it remains on your report.

Credit Sesame offers free credit score checks and credit report summaries. These tools help users monitor their credit health and understand the impact of their actions. Utilizing these resources can provide clarity on how debts are reported.

| Type of Debt | Reporting Duration |

|---|---|

| Paid Off Debt | 7 years from the payoff date |

| Unpaid Debt | 7 years from the first missed payment |

How Long Paid Off Debts Stay On Your Credit Report

Even after settling a debt, it remains on your credit report for 7 years. This period helps lenders see your past financial behavior. It shows that you paid off the debt, which can be positive for your credit score.

Credit Sesame’s Sesame Grade provides a clear letter grade for your credit. This grading helps users understand the factors impacting their score. Tracking these factors helps in managing your credit report more effectively.

Credit Sesame also offers personalized actions to help users improve their credit scores. These recommendations are based on the user’s unique credit profile. By following these actions, users can work towards a healthier credit score.

The Truth About Building And Maintaining A Good Credit Score

Building and maintaining a good credit score is essential for financial health. Misconceptions can often lead to poor credit management. Understanding the truth about credit scores can help you make informed decisions to improve your financial standing.

Key Factors That Affect Your Credit Score

Several factors influence your credit score. Knowing these can help you focus on what matters most.

- Payment History: A significant factor that shows if you pay your bills on time.

- Credit Utilization: The amount of credit you use compared to your credit limit. Keeping this ratio low is beneficial.

- Length of Credit History: The age of your credit accounts. Older accounts contribute positively.

- Types of Credit: A mix of credit types, such as credit cards and loans, can boost your score.

- Recent Inquiries: Multiple credit applications in a short time can negatively impact your score.

Best Practices For Improving And Maintaining Your Credit

To improve and maintain a good credit score, follow these best practices:

- Pay Bills on Time: Ensure all your payments are made before the due date.

- Keep Credit Utilization Low: Use less than 30% of your available credit.

- Limit New Credit Applications: Avoid applying for multiple credit accounts simultaneously.

- Monitor Your Credit Regularly: Use platforms like Credit Sesame to check your credit score and report.

- Build Credit with Small Purchases: Use a credit builder like Credit Sesame’s Credit Builder feature. It helps build credit through everyday purchases without a security deposit.

By following these practices, you can steadily build and maintain a good credit score. Understanding and managing the key factors affecting your credit is crucial for financial health.

Frequently Asked Questions

What Is A Credit Score?

A credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850. Lenders use it to assess your risk.

Does Checking My Credit Score Lower It?

No, checking your own credit score does not lower it. This is considered a soft inquiry. It has no impact on your score.

Can Closing A Credit Card Hurt My Score?

Yes, closing a credit card can hurt your score. It reduces your available credit. This can increase your credit utilization ratio.

Do Late Payments Affect My Credit Score?

Yes, late payments can significantly impact your credit score. Payment history is a crucial factor. Always pay your bills on time.

Conclusion

Credit score myths can lead to confusion and poor financial decisions. By understanding the facts, you can take control of your credit health. For free credit score checks and personalized advice, visit Credit Sesame. They offer tools to help you improve your credit score and make informed choices. Remember, knowledge is power in managing your finances. Avoid the myths and take steps toward better credit today.