Credit Score Monitoring Apps: Boost Your Financial Health Today

In today’s fast-paced financial world, keeping track of your credit score is crucial. Credit score monitoring apps make this task easier and more efficient.

Understanding your credit score can lead to better financial decisions and opportunities. Credit scores affect many aspects of life, from loan approvals to interest rates on credit cards. Monitoring your credit score regularly can help you stay on top of your financial health, detect any unusual activity, and improve your credit over time. With the right tools, such as credit score monitoring apps, you can gain insight into your financial standing and take proactive steps to maintain or improve it. Let’s explore how these apps can be a game-changer for your financial journey. For those dealing with debt, consider checking out the Mitigately Debt Consolidation Program. It offers a seamless way to manage and reduce debt, making your financial path smoother.

Introduction To Credit Score Monitoring Apps

Keeping track of your credit score is crucial for financial health. Credit score monitoring apps help you stay on top of your credit score and manage debts efficiently.

Understanding Credit Scores

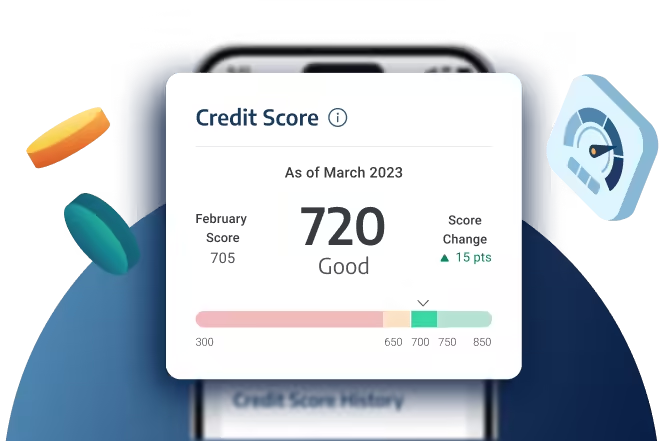

Credit scores are numerical representations of your creditworthiness. They range from 300 to 850. Higher scores indicate better credit health.

Several factors influence your credit score:

- Payment history

- Credit utilization

- Length of credit history

- Types of credit accounts

- Recent credit inquiries

Understanding these factors helps you make informed financial decisions.

Importance Of Monitoring Your Credit Score Regularly

Regular credit score monitoring helps you detect inaccuracies or fraud early. It also provides insights into your financial health and helps you plan better.

Credit monitoring apps offer several benefits:

- Instant alerts for changes in your credit report

- Detailed analysis of your credit history

- Personalized tips to improve your score

Using these apps, you can stay proactive and avoid potential financial pitfalls.

Key Features Of Credit Score Monitoring Apps

Credit score monitoring apps have become essential tools for individuals aiming to maintain and improve their credit health. These apps offer numerous features that help users stay informed and make better financial decisions. Below are the key features that make these apps indispensable.

Real-time Credit Score Updates

One of the most valuable features of credit score monitoring apps is the ability to receive real-time credit score updates. This allows users to track their credit score regularly and understand the impact of their financial activities.

- Instant notifications of any changes in credit score

- Monthly reports summarizing credit score trends

- Alerts for significant changes that might affect loan approvals

Credit Report Analysis

Credit report analysis is another crucial feature. These apps provide detailed insights into your credit report, helping you understand the factors influencing your score.

| Feature | Description |

|---|---|

| Breakdown of Credit Factors | Understanding the impact of payment history, credit utilization, and more. |

| Error Detection | Identifying and disputing errors on your credit report. |

| Score Simulation | Simulating how different actions will affect your credit score. |

Fraud Alert Notifications

Fraud alert notifications are a vital feature for protecting your financial health. Credit score monitoring apps promptly alert you to suspicious activities that may indicate identity theft or fraud.

- Alerts for new credit inquiries

- Notifications for unusual account activities

- Guidance on steps to take if fraud is detected

Personalized Financial Advice

Many credit score monitoring apps, like Mitigately, offer personalized financial advice to help you improve your credit score and manage your finances better.

- Custom tips based on your credit report

- Debt consolidation options and savings calculators

- Recommendations for improving credit health

Mitigately’s AI-powered agent can match you with the best debt solution in just 6½ minutes, potentially saving you an average of 35% on your debts.

How Each Feature Benefits Users

Credit score monitoring apps offer numerous features that help users stay on top of their financial health. Each feature is designed to provide specific benefits, making it easier for individuals to manage their credit effectively.

Staying Informed With Real-time Updates

Real-time updates are crucial in a credit score monitoring app. They ensure that users are always aware of any changes to their credit score. These updates can alert users to new credit inquiries, changes in account balances, or missed payments.

- Immediate notifications about credit changes

- Helps avoid late payment penalties

- Monitors all credit activities continuously

Understanding Your Credit Report

A comprehensive credit report provides detailed information about a user’s credit history. Understanding this report is vital for managing credit wisely. Credit score monitoring apps break down the report into simpler terms.

- Explains credit history in easy-to-understand language

- Identifies factors affecting credit score

- Highlights areas for improvement

Early Detection Of Fraud

One of the most significant benefits of credit score monitoring is fraud detection. The app alerts users to suspicious activities, helping them act quickly to prevent fraud.

- Detects unauthorized credit inquiries

- Alerts about unfamiliar accounts

- Provides tips on safeguarding personal information

Improving Your Financial Health With Personalized Advice

Credit score monitoring apps often include personalized advice for improving financial health. This advice is tailored to the user’s specific credit profile.

- Offers tips for boosting credit scores

- Recommends the best financial practices

- Provides guidance on debt management

For instance, Mitigately offers a debt consolidation service. It uses an AI-powered agent to match users with the best debt solution in an average of 6½ minutes. This helps users manage debts more efficiently, combining multiple payments into one and potentially saving 35% on debts.

| Feature | Benefits |

|---|---|

| AI-Powered Agent | Matches best debt solution quickly |

| Debt Consolidation | Combines multiple debts into one |

| Savings | Average savings of 35% on debts |

| Debt Repayment Calculator | Calculates potential savings |

By understanding these features, users can take control of their financial health, detect fraud early, and make informed decisions about their credit.

Pricing And Affordability

Understanding the cost of credit score monitoring apps is essential. The right app can offer significant benefits. But it’s important to weigh the costs and features. Let’s dive into the pricing and affordability of these apps.

Free Vs Paid Apps

There are both free and paid credit score monitoring apps. Free apps offer basic features. These might include free credit scores and reports. Paid apps provide more advanced features. These can include identity theft protection and credit score simulators.

Mitigately, for instance, offers a cost-free service until the accounts are settled. This can be very appealing for users looking to save money while managing their debts.

Cost-benefit Analysis

Choosing between free and paid apps involves a cost-benefit analysis. Here’s a quick breakdown:

| Feature | Free Apps | Paid Apps |

|---|---|---|

| Basic Credit Score | Yes | Yes |

| Credit Reports | Limited | Unlimited |

| Identity Theft Protection | No | Yes |

| Credit Score Simulators | No | Yes |

Mitigately offers a debt repayment calculator. This helps users calculate potential savings and compare monthly payments. This feature can be particularly useful for those looking to save on debts.

Subscription Plans And Features

Paid apps often come with various subscription plans. These plans can range from monthly to yearly payments. Here are some common features offered in different plans:

- Monthly Credit Score Updates

- Detailed Credit Reports

- Identity Theft Insurance

- Personalized Financial Advice

Mitigately stands out with its AI-powered agent. This agent matches users with the best debt solution in an average of 6½ minutes. Users can save an average of 35% on their debts through consolidation.

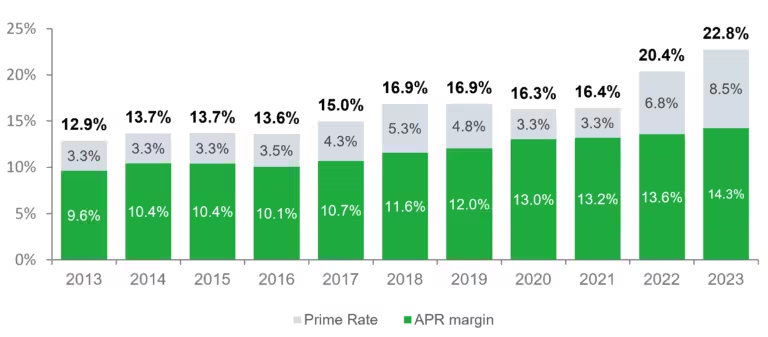

Mitigately also offers a service fee of $0 until the accounts are settled. This ensures that users do not incur costs until they see tangible benefits. Additionally, the debt consolidation interest rate is 16.90%, which is lower than the average debt interest rate of 24.99%.

For users looking for a secure and efficient way to manage their debts, Mitigately provides significant savings and benefits. The service is also highly rated, with a rating of 4.9 stars from over 400 reviews.

Pros And Cons Of Credit Score Monitoring Apps

Credit score monitoring apps are tools that help you keep track of your credit score. These apps offer several benefits but also come with some drawbacks. Let’s take a closer look at the advantages and potential limitations of using these apps.

Advantages Of Using Credit Score Monitoring Apps

- Real-Time Alerts: Get instant notifications of any changes in your credit score.

- Easy Access: Check your credit score anytime, anywhere from your smartphone.

- Educational Resources: Learn tips and tricks to improve your credit score.

- Financial Planning: Understand how your credit score affects loan approvals and interest rates.

These benefits can help you stay on top of your financial health. Mitigately’s AI-powered agent, for instance, matches users with the best debt solution quickly. This integration can save users money and help them become debt-free faster.

Potential Drawbacks And Limitations

- Data Privacy: Sharing personal information always carries some risk.

- Subscription Fees: Some apps may charge for premium features.

- Limited Credit Bureau Data: Not all apps access data from all three major credit bureaus.

- False Sense of Security: Over-reliance on apps may lead to neglecting other financial aspects.

It’s essential to weigh these drawbacks against the benefits. While Mitigately offers a cost-free service until accounts are settled, other apps may require a subscription fee. Be mindful of the data privacy policies and the scope of credit bureau data coverage.

Ideal Users And Scenarios

Credit score monitoring apps like Mitigately are invaluable tools for managing financial health. These apps help users stay informed about their credit status, identify potential issues, and take steps to improve their scores. Understanding who can benefit the most from these apps and the best situations to use them can guide users to make informed decisions.

Who Can Benefit The Most?

Mitigately is ideal for individuals seeking to manage and eliminate debt efficiently. The app is especially beneficial for:

- Young Adults: Those new to credit and looking to build a strong credit history.

- Debt Holders: Individuals with multiple debts looking for consolidation options.

- Credit Rebuilders: People aiming to improve poor credit scores.

- Home Buyers: Potential homeowners needing to maintain a high credit score for mortgage approval.

- Frequent Borrowers: Those who regularly take out loans or use credit cards.

Best Situations To Use Credit Score Monitoring Apps

There are several scenarios where using a credit score monitoring app like Mitigately makes perfect sense:

- Debt Management: Consolidate multiple debts into one payment, making it easier to manage finances.

- Credit Improvement: Regularly monitor credit scores to take proactive steps in improving them.

- Loan Applications: Keep track of credit scores to ensure eligibility for loans or mortgages.

- Identity Protection: Detect any unusual activity that may indicate identity theft.

- Financial Planning: Use insights from credit reports to make informed financial decisions.

Using Mitigately can provide significant savings and peace of mind through efficient debt consolidation and credit monitoring.

Conclusion: Boost Your Financial Health With Credit Score Monitoring Apps

Credit score monitoring apps are vital tools for managing your financial well-being. These apps provide real-time updates, helping you make informed decisions about your credit and debts. They can also alert you to potential fraud, ensuring your financial information remains secure.

Recap Of Benefits

Credit score monitoring apps offer several benefits:

- Real-Time Updates: Receive instant updates on your credit score and report changes.

- Fraud Alerts: Get notified of any suspicious activity on your accounts.

- Financial Insights: Access tools and tips to improve your credit score.

- Convenient Access: Monitor your credit score from your smartphone or computer.

With these features, you can keep your financial health in check and take proactive steps to improve your credit score.

Final Thoughts And Recommendations

Credit score monitoring apps, like Mitigately, are essential for anyone looking to manage their debts and improve their credit score. By using these apps, you can stay informed and make better financial decisions.

We recommend using a reliable app that offers comprehensive features, such as:

- Real-Time Updates: Ensure the app provides instant alerts on credit changes.

- Security: Choose an app that uses advanced encryption to protect your information.

- Ease of Use: The app should be user-friendly and easily accessible.

By selecting the right credit score monitoring app, you can boost your financial health and achieve your financial goals.

For more information on debt management, consider the Mitigately Debt Consolidation Program. This service can help you consolidate your debts, save money, and become debt-free faster.

Frequently Asked Questions

What Are Credit Score Monitoring Apps?

Credit score monitoring apps help you track your credit score. They provide updates and alerts about changes. These apps can also offer insights to improve your score.

How Do Credit Score Monitoring Apps Work?

These apps pull data from credit bureaus to monitor your score. They notify you of any significant changes. They also provide personalized tips to maintain or improve your score.

Are Credit Score Monitoring Apps Secure?

Yes, reputable credit score monitoring apps use encryption to protect your data. They comply with industry standards to ensure your information is safe. Always choose apps with good reviews and security certifications.

Can I Improve My Credit Score Using These Apps?

Yes, these apps offer personalized advice to help improve your credit score. They can identify factors lowering your score. Following their tips can positively impact your credit rating.

Conclusion

Monitoring your credit score is crucial for financial health. Credit score apps offer a simple solution. They help track changes and improve scores. For those managing debts, consider Mitigately. It consolidates debts and saves money. Learn more about Mitigately’s services at Mitigately. Taking control of your credit has never been easier. Start today for a better financial future.