Credit Score Management: Top Tips for Financial Success

Credit Score Management is crucial for financial health. A good credit score opens doors to better loan rates and financial opportunities.

Managing your credit score can seem daunting, but it’s essential for your financial well-being. A strong credit score can save you money on interest rates and give you access to better financial products. This blog will guide you through practical steps to manage your credit score effectively. You will learn about the factors that impact your score and how to improve it. Understanding these principles can help you make informed financial decisions. Whether you’re looking to buy a home, secure a loan, or just maintain good financial habits, this guide will be your roadmap to better credit score management. For those dealing with debt, tools like SoloSuit can be invaluable. SoloSuit helps individuals respond to debt lawsuits and settle debts outside of court. Learn more about SoloSuit here.

Introduction To Credit Score Management

Maintaining a good credit score is crucial in today’s financial world. Credit score management is about understanding, monitoring, and improving your credit score. A good credit score opens doors to better financial opportunities. Let’s explore the basics of credit score management.

Understanding Credit Scores

A credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850. Lenders use this score to decide if you qualify for loans or credit cards. The higher your score, the better your credit profile.

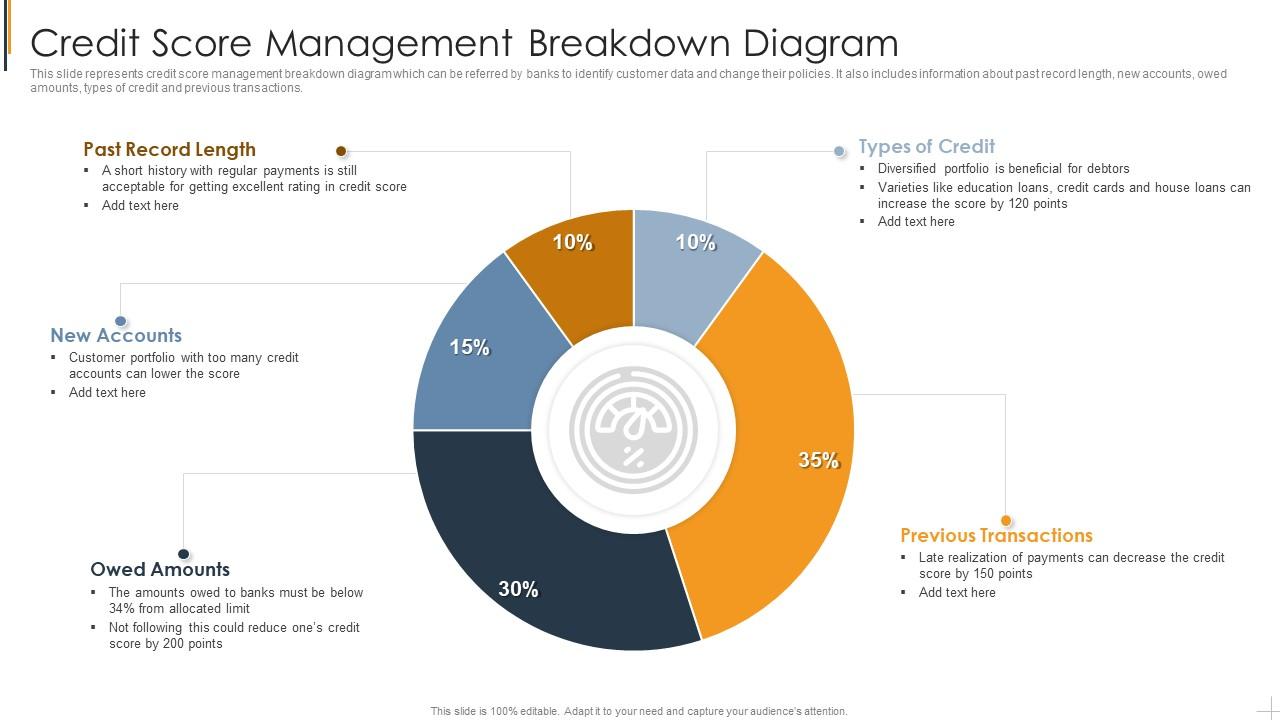

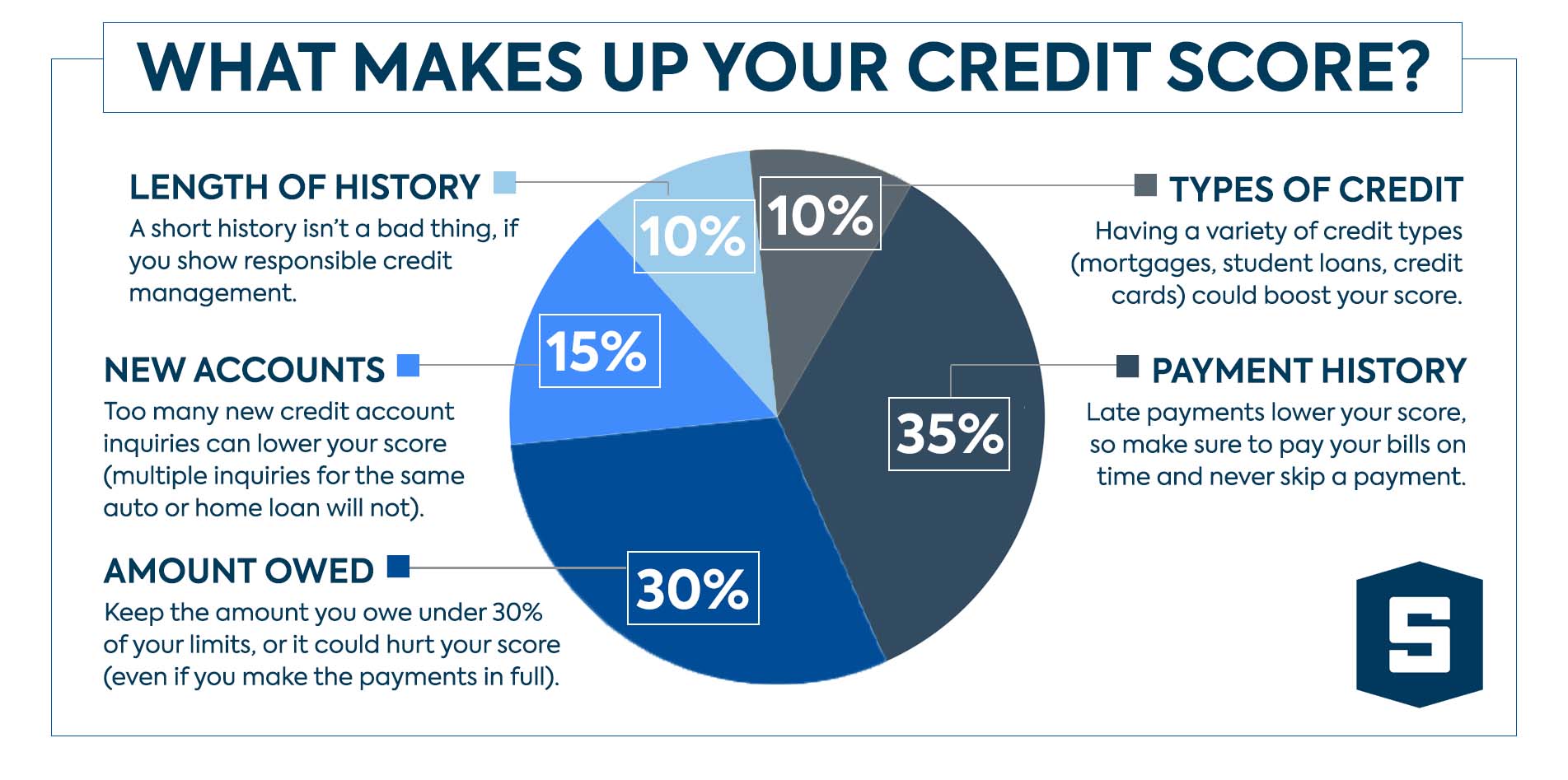

Several factors influence your credit score:

- Payment History: Timely payments boost your score.

- Credit Utilization: Keeping your credit usage low is beneficial.

- Credit History Length: Longer credit history can improve your score.

- Credit Mix: A mix of credit types can positively affect your score.

- New Credit: Too many new accounts can lower your score temporarily.

Understanding these factors helps in managing your credit score better.

Importance Of Credit Score Management

Managing your credit score has several benefits. It can lead to better loan terms, lower interest rates, and higher credit limits. A good credit score can also make it easier to rent an apartment or get a job.

Here are some key benefits:

- Lower Interest Rates: High credit scores often qualify for lower interest rates.

- Better Loan Approval Chances: Lenders are more likely to approve loans for those with high scores.

- Higher Credit Limits: Good scores can lead to higher credit limits.

- Improved Rental Opportunities: Landlords may prefer tenants with good credit scores.

- Job Opportunities: Some employers check credit scores during hiring.

By effectively managing your credit score, you can save money and access more financial opportunities.

For those dealing with debt disputes, products like SoloSuit can be invaluable. SoloSuit helps individuals respond to debt lawsuits and settle debts outside of court. It offers a practical solution to managing debt and protecting your credit score.

| Main Features | Details |

|---|---|

| Reply to a Debt Lawsuit | Assists in responding to a debt lawsuit within 14-30 days, compiles response, attorney reviews and files the response. |

| Settle a Debt | Helps arrange settlements with collectors outside of court, often for less than the debt’s face value. |

Using tools like Solo can help in managing and resolving debt disputes efficiently, which is essential for maintaining a good credit score.

Key Features Of Effective Credit Score Management

Managing your credit score is vital for financial health. A good credit score can help you secure loans, mortgages, and better interest rates. Here are some key features to ensure effective credit score management.

Regularly Monitoring Your Credit Report

Regularly checking your credit report helps you spot errors and fraud. The three major credit bureaus, Experian, TransUnion, and Equifax, offer free annual reports. Look for inaccuracies and dispute them promptly.

Monitoring your credit report also allows you to track your credit score progress. Understanding what affects your score can help you make informed financial decisions.

Maintaining A Low Credit Utilization Rate

Credit utilization is the ratio of your credit card balances to your credit limits. Keeping this ratio below 30% is advisable. For example, if you have a credit limit of $10,000, try to keep your balance under $3,000.

A low credit utilization rate indicates responsible credit management. It shows lenders that you are not over-relying on credit, which can positively impact your credit score.

Making Timely Payments

Payment history is one of the most critical factors in your credit score. Always pay your bills on time. Late payments can significantly damage your credit score.

Set up automatic payments or reminders to ensure you never miss a due date. Consistent, timely payments build a positive credit history over time.

Diversifying Your Credit Mix

Having a variety of credit accounts can benefit your credit score. This includes credit cards, installment loans, mortgages, and retail accounts. A diverse credit mix shows lenders you can manage different types of credit responsibly.

However, only open new credit accounts when necessary. Too many new accounts can lower your average account age, which may negatively affect your score.

| Key Feature | Importance |

|---|---|

| Regularly Monitoring Your Credit Report | Helps spot errors and track progress |

| Maintaining a Low Credit Utilization Rate | Indicates responsible credit management |

| Making Timely Payments | Builds a positive credit history |

| Diversifying Your Credit Mix | Shows ability to manage different credit types |

Effective credit score management involves a combination of consistent monitoring, responsible usage, and timely payments. By following these key features, you can maintain a healthy credit score and enjoy the financial benefits that come with it.

Pricing And Affordability Of Credit Score Management Tools

Managing your credit score effectively can save you money and open doors to better financial opportunities. Choosing the right tools for managing your credit score is crucial. Let’s explore the pricing and affordability of various credit score management tools.

Free Credit Monitoring Services

Free credit monitoring services offer a cost-effective way to keep track of your credit score. These services typically provide:

- Regular updates on your credit score

- Alerts for significant changes in your credit report

- Basic credit report summaries

Many financial institutions and credit card companies offer free credit monitoring as a part of their services. This is a great option if you are just starting to monitor your credit or have a limited budget.

Paid Credit Management Tools: Are They Worth It?

Paid credit management tools often come with advanced features that go beyond basic monitoring. These tools may include:

- Detailed credit reports

- Credit score simulators

- Identity theft protection

- Personalized advice on improving your credit score

The cost of these tools varies, but they can provide significant value if you need more comprehensive credit management. Paid services might be worth it if you are actively working to improve your credit score or if you need additional protection against identity theft.

Comparing Costs Of Various Tools

| Service Type | Features | Cost |

|---|---|---|

| Free Credit Monitoring | Basic updates and alerts | $0 |

| Paid Credit Management | Detailed reports, simulators, theft protection | $10 – $30/month |

It’s essential to compare the features and costs of different tools before making a decision. Free services are ideal for basic monitoring, while paid tools offer more comprehensive features for those who need them.

Pros And Cons Of Different Credit Score Management Strategies

Managing your credit score effectively requires a clear understanding of various strategies. Each strategy has its own pros and cons. In this section, we’ll explore the benefits and drawbacks of using credit management tools, the limitations of relying solely on these tools, and how to balance DIY approaches with professional help.

Pros Of Using Credit Management Tools

Credit management tools can simplify the process of monitoring and improving your credit score. Here are some key benefits:

- Automated Monitoring: These tools track your credit report and notify you of any changes.

- Detailed Insights: They provide an in-depth analysis of your credit score, highlighting areas for improvement.

- Convenience: Many tools are user-friendly and accessible via mobile apps.

- Cost-Effective: Some tools offer free basic services, making them affordable for most users.

Cons Of Relying Solely On Tools

While credit management tools offer many advantages, there are some drawbacks to consider:

- Limited Scope: Tools may not cover all aspects of credit score management.

- Potential Costs: Advanced features often come with a subscription fee.

- Over-Reliance: Relying solely on tools can prevent you from understanding the underlying factors affecting your credit score.

- Data Privacy: Sharing sensitive financial information with third-party tools poses privacy risks.

Balancing Diy Approaches With Professional Help

Combining DIY strategies with professional assistance can provide a more comprehensive approach to credit score management. Here are some tips on finding the right balance:

| DIY Approaches | Professional Help |

|---|---|

| Regularly reviewing your credit report | Hiring a credit counselor for personalized advice |

| Disputing errors on your own | Using services like SoloSuit to manage debt disputes |

| Paying bills on time | Consulting a financial advisor for long-term planning |

By integrating these methods, you can better manage your credit score and make informed financial decisions.

Specific Recommendations For Ideal Users

Managing your credit score is crucial for financial stability. Different users have unique needs, so tailored advice is important. Here are some specific recommendations to help various groups manage their credit scores effectively.

Best Practices For Young Adults

Young adults often start building their credit history. It’s important to begin with the right habits. Here are some best practices:

- Use Credit Wisely: Start with a secured credit card or a student credit card.

- Pay on Time: Always pay your bills on time to build a positive payment history.

- Keep Balances Low: Maintain low balances on credit cards and other revolving credit.

- Monitor Your Credit: Regularly check your credit report for errors or signs of identity theft.

Strategies For Families

Families often have complex financial situations. Managing credit wisely can help maintain financial health. Consider these strategies:

- Create a Budget: Establish a family budget to track income and expenses.

- Consolidate Debts: Consider debt consolidation to manage multiple credit accounts more effectively.

- Emergency Fund: Build an emergency fund to cover unexpected expenses without relying on credit.

- Teach Financial Literacy: Educate children about credit and financial responsibility early.

Advice For Individuals With Bad Credit

Individuals with bad credit need a focused approach to rebuild their credit scores. Here are some tips:

- Pay Off Debts: Focus on paying off existing debts, starting with the highest interest rates.

- Settle Disputes: Use tools like Solo to settle debt disputes and negotiate better terms.

- Secure Credit: Obtain a secured credit card to begin rebuilding your credit history.

- Limit New Applications: Avoid applying for new credit frequently, as each application can lower your score.

Implementing these strategies can help different user groups manage their credit scores effectively. Remember, consistent and responsible credit behavior is key to long-term financial health.

Frequently Asked Questions

What Is A Good Credit Score?

A good credit score typically ranges from 670 to 739. Higher scores can result in better loan terms and interest rates.

How Can I Improve My Credit Score?

To improve your credit score, pay bills on time, reduce debt, and avoid applying for new credit frequently.

How Often Should I Check My Credit Score?

It’s recommended to check your credit score at least once a year. Regular monitoring helps identify errors and track progress.

Does Checking My Credit Score Lower It?

Checking your own credit score, known as a soft inquiry, does not lower your credit score. It’s a good practice.

Conclusion

Managing your credit score is essential for financial health. Regularly check your credit report. Pay bills on time. Keep your credit utilization low. Avoid opening too many new accounts quickly. Need help with debt disputes? Consider using SoloSuit. It assists in replying to debt lawsuits and settling debts. SoloSuit offers a practical, cost-effective solution. Take control of your credit and debt today. Healthy credit opens doors to better financial opportunities. Stay informed, stay proactive, and protect your financial future.