Credit Score Checklist: Essential Steps to Boost Your Rating

Improving your credit score can seem like a daunting task. But with the right tools, it’s achievable.

A solid credit score opens doors to better financial opportunities. That’s why we’ve created a detailed Credit Score Checklist. This checklist provides actionable steps to boost your credit score. Understanding your credit score and how to improve it is crucial for financial health. Each step in the checklist aims to simplify the process. From paying bills on time to managing credit card balances, every action counts. With dedication and the right strategy, you can see significant improvements. Ready to take control of your credit score? Let’s dive into the essential steps you need to follow. And don’t forget to check out Boost Your Score for additional help.

Introduction To Credit Scores

Understanding and managing your credit score is crucial for financial health. Credit scores impact your ability to get loans, credit cards, and even jobs. To navigate personal finance effectively, you need to grasp the essentials of credit scores.

Understanding What A Credit Score Is

A credit score is a numerical representation of your creditworthiness. It is based on your credit history, including loans, credit cards, and payment behavior. The score typically ranges from 300 to 850, with higher scores indicating better creditworthiness.

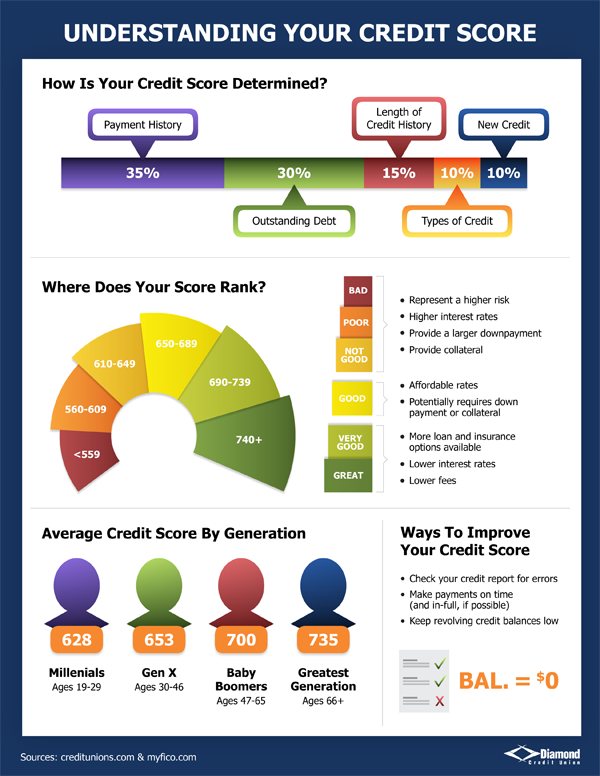

Here is a table to help you understand the score ranges:

| Score Range | Rating |

|---|---|

| 300 – 579 | Poor |

| 580 – 669 | Fair |

| 670 – 739 | Good |

| 740 – 799 | Very Good |

| 800 – 850 | Excellent |

Factors influencing your credit score include:

- Payment history: Timely payments boost your score.

- Credit utilization: Lower utilization is better.

- Credit history length: Longer histories are favorable.

- New credit: Multiple recent inquiries can lower your score.

- Credit mix: A variety of credit types is beneficial.

The Importance Of A Good Credit Score

A good credit score opens doors to better financial opportunities. Here are some benefits:

- Lower interest rates on loans and credit cards.

- Higher approval chances for loans and rentals.

- Better insurance premiums.

- Increased negotiating power with lenders.

- Access to higher credit limits.

Boost Your Score can help improve your credit score. It offers tools like a Credit Builder Loan and a secured credit card. Regular payments are reported to credit bureaus, which helps build a positive credit history. After four payments, you receive a secured credit card to further enhance your score.

With Boost Your Score, you can also set up automatic payments. This ensures timely payments and reduces the risk of missing a payment. Monthly FICO score updates are provided for tracking progress.

The program offers three pricing options:

| Plan | Monthly Cost | Total Payment | Amount Back | Est. APR | Est. Interest Rate |

|---|---|---|---|---|---|

| Mini Boost | $30/mo for 12 months | $360 | $300 | 34.82% | 35.56% |

| Boost | $64/mo for 12 months | $768 | $650 | 31.76% | 32.41% |

| Mega Boost | $82/mo for 12 months | $984 | $850 | 27.76% | 28.31% |

Boost Your Score is a convenient and effective way to build and improve your credit score. For more details, visit Boost Your Score.

Assessing Your Current Credit Score

Understanding your current credit score is the first step in improving your financial health. By assessing your credit score, you can identify areas that need improvement and take actionable steps to enhance your financial standing.

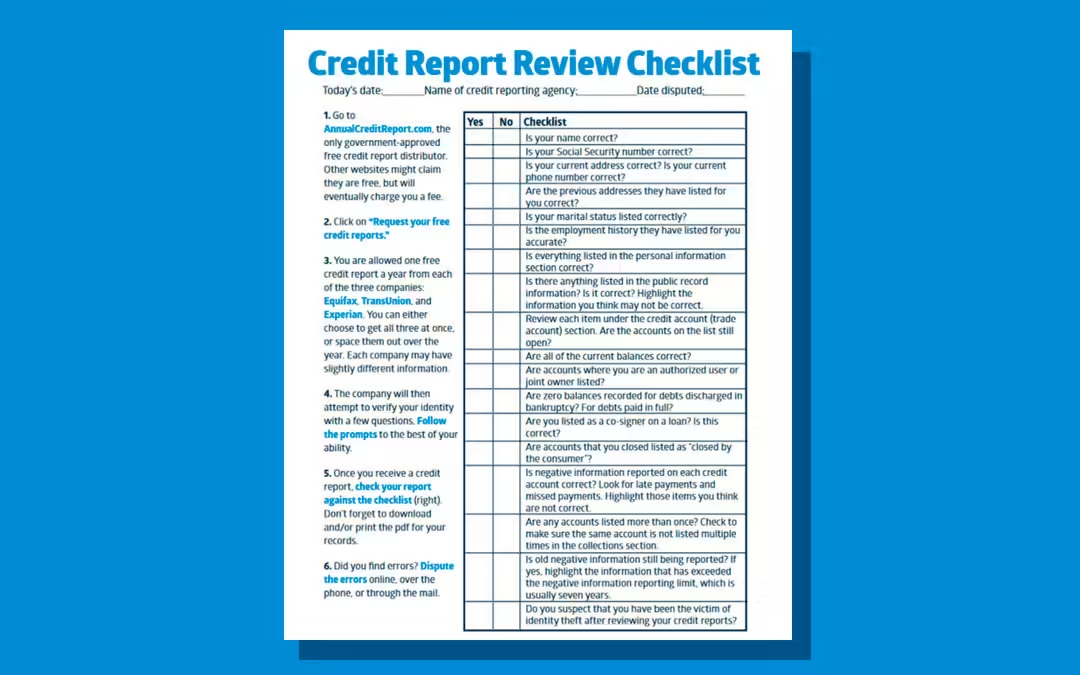

How To Check Your Credit Score

Checking your credit score is a simple process. You have multiple options to obtain your credit score:

- Free Annual Credit Reports: You can get a free credit report from each of the three major credit bureaus once a year at AnnualCreditReport.com.

- Credit Card Issuers: Many credit card companies provide free credit score updates to their customers.

- Credit Monitoring Services: Services like Boost Your Score offer free monthly FICO score updates.

Once you have your credit report, it’s essential to understand the information it contains.

Interpreting Your Credit Report

Your credit report is a detailed summary of your credit history. It includes:

| Section | Description |

|---|---|

| Personal Information | Name, address, Social Security number, and employment information. |

| Credit Accounts | Details of your credit cards, loans, and payment history. |

| Credit Inquiries | List of companies that have checked your credit. |

| Public Records | Bankruptcies, foreclosures, and other legal matters. |

Understanding these sections helps you identify errors and areas for improvement. For example, if you find inaccurate information, you can dispute it with the credit bureau to have it corrected.

By regularly checking and interpreting your credit report, you can take proactive steps to enhance your credit score. This will lead to better financial opportunities, such as lower interest rates and higher credit limits.

Steps To Improve Your Credit Score

Improving your credit score can open doors to better financial opportunities. Following a checklist can help in achieving a better score. Here are some essential steps to consider:

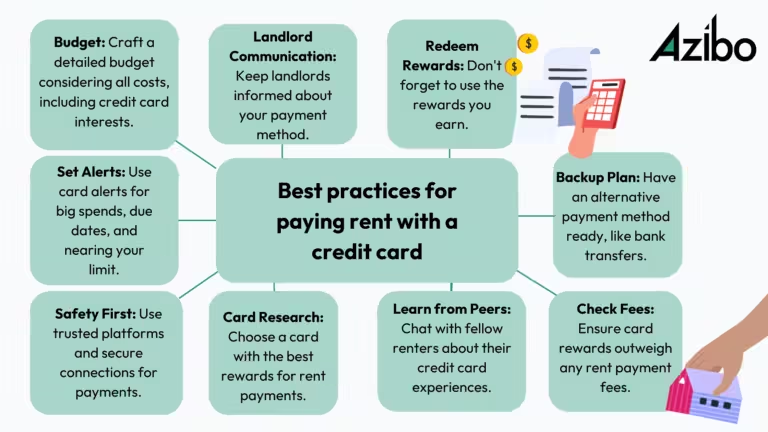

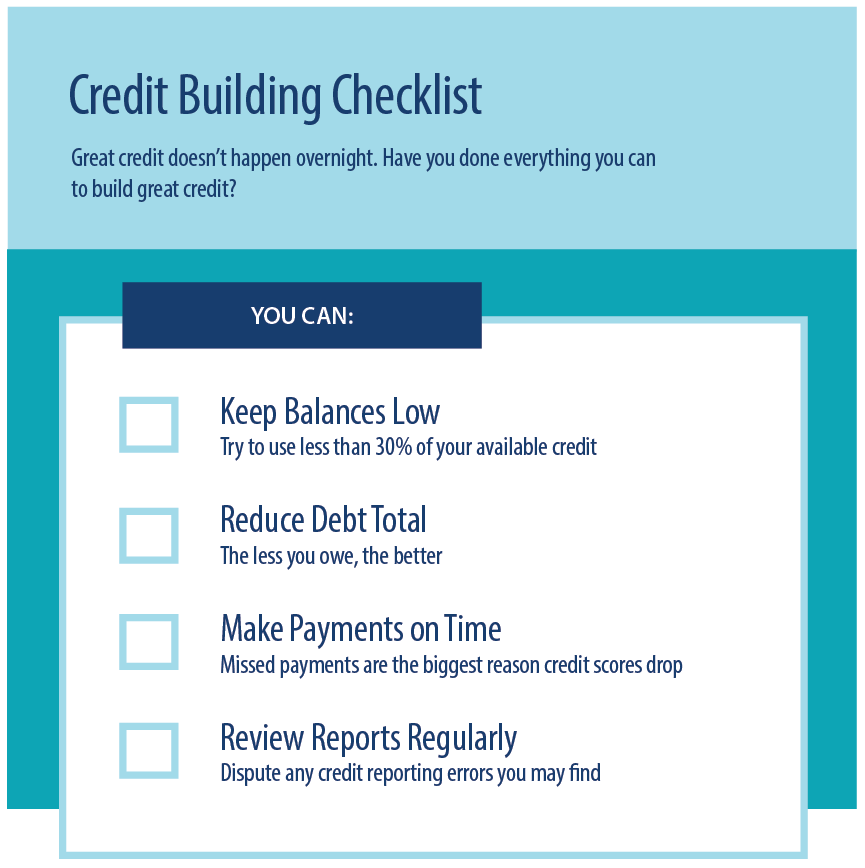

Paying Bills On Time

Paying your bills on time is crucial. Late payments can negatively impact your credit score. Set up automatic payments to ensure you never miss a payment. This shows lenders that you are reliable and responsible.

Reducing Outstanding Debt

High outstanding debt can lower your credit score. Focus on paying down your debts. Create a budget and prioritize your debts. Paying off credit cards can be a good start.

Avoiding New Credit Applications

Applying for new credit can lead to multiple hard inquiries. These inquiries can lower your credit score. Avoid applying for new credit unless absolutely necessary. Each application can have a temporary negative effect.

Correcting Credit Report Errors

Errors on your credit report can hurt your score. Regularly check your credit reports for inaccuracies. Dispute any errors you find with the credit bureau. This can help ensure your credit report is accurate.

Keeping Old Accounts Open

Closing old accounts can reduce your credit history length. Keep old accounts open to maintain a longer credit history. This can positively influence your credit score.

For a structured way to improve your credit score, consider using Boost Your Score. This product offers a Credit Builder Loan and a secured credit card. Regular payments are reported to credit bureaus, helping to build a positive credit history.

| Plan | Monthly Cost | Total Payment | Amount Back | Est. APR | Est. Interest Rate |

|---|---|---|---|---|---|

| Mini Boost | $30/mo for 12 months | $360 | $300 | 34.82% | 35.56% |

| Boost | $64/mo for 12 months | $768 | $650 | 31.76% | 32.41% |

| Mega Boost (Best Value) | $82/mo for 12 months | $984 | $850 | 27.76% | 28.31% |

Contact Boost Your Score at 1 (800) 259-1270 or email at easy@boostyourscore.com for more information.

Key Features Of A High Credit Score

A high credit score opens doors to better financial opportunities. Understanding the key features can help you maintain or improve your score. Below are the essential elements that contribute to a high credit score.

Consistent Payment History

Your payment history accounts for a significant portion of your credit score. Making payments on time shows lenders that you are reliable. Late or missed payments can negatively impact your score.

- Ensure all bills are paid on time.

- Set up automatic payments to avoid missing due dates.

- Monitor your payment history regularly.

Low Credit Utilization Ratio

Credit utilization refers to the amount of credit you use compared to your credit limit. A lower ratio is better for your credit score. Aim to use less than 30% of your available credit.

- Keep credit card balances low.

- Pay off debt rather than moving it around.

- Increase your credit limit if possible.

Diverse Credit Mix

A diverse credit mix shows that you can handle different types of credit responsibly. This includes credit cards, installment loans, and mortgages. Lenders view this positively.

- Maintain a mix of credit types.

- Don’t open new accounts just for the sake of diversity.

- Manage existing accounts well.

Length Of Credit History

The length of your credit history also impacts your score. Older accounts with a good payment history boost your credit score. New accounts can lower the average age of your accounts.

- Keep older accounts open.

- Limit opening new credit accounts.

- Regularly check your credit report for accuracy.

For more information about improving your credit score, visit Boost Your Score. They offer services like the Credit Builder Loan and secured credit card to help you build a positive credit history.

Common Pitfalls To Avoid

Understanding the common pitfalls that can damage your credit score is crucial. Avoiding these mistakes can help you maintain a healthy credit profile. Let’s dive into the key areas to watch out for.

Missing Payments

One of the most critical errors is missing payments. Payment history makes up 35% of your credit score. A single missed payment can significantly impact your score. Set up automatic payments to ensure you never miss a due date. Boost Your Score offers automatic payment options to help manage this effectively.

Maxing Out Credit Cards

Using up your entire credit limit can be detrimental. High credit utilization indicates financial distress. Aim to keep your credit usage below 30%. For instance, if your credit limit is $1,000, try not to exceed $300. The secured credit card from Boost Your Score can provide an additional credit line, helping you maintain a lower utilization ratio.

Applying For Too Much Credit At Once

Each new credit application results in a hard inquiry on your credit report. Multiple inquiries within a short period can lower your score. Avoid applying for several credit accounts simultaneously. Boost Your Score ensures no hard credit pull, preventing unnecessary inquiries that can harm your credit.

Ignoring Credit Report Errors

Credit report errors are more common than you think. These errors can unfairly lower your score. Regularly check your credit reports from all three bureaus. Dispute any inaccuracies you find. Boost Your Score provides free monthly FICO score updates, making it easier to track and address errors promptly.

| Common Pitfall | Impact | Solution |

|---|---|---|

| Missing Payments | 35% of credit score | Set up automatic payments |

| Maxing Out Credit Cards | High credit utilization | Keep usage below 30% |

| Applying for Too Much Credit | Multiple hard inquiries | Avoid multiple applications |

| Ignoring Credit Report Errors | Unfair score reduction | Regularly check and dispute errors |

Monitoring Your Progress

Keeping track of your credit score is crucial for maintaining financial health. Monitoring your progress helps you stay on course and make necessary adjustments. Boost Your Score offers several tools and strategies to help you stay informed and proactive. Below are some key practices to help you monitor your credit score effectively.

Regularly Checking Your Credit Score

Regular checks on your credit score can help you spot any discrepancies or signs of fraud early. Boost Your Score provides a free monthly FICO score update, allowing you to see your progress in real-time. Make it a habit to review these updates to understand how your actions are impacting your credit score.

Keeping an eye on your score helps you identify trends. If your score is improving, you know you’re on the right path. If it drops, you can investigate and address the issue promptly.

Setting Financial Goals

Setting clear, achievable financial goals is essential for credit score improvement. Decide on short-term and long-term goals, such as paying off a credit card or saving for a major purchase. Write these goals down and track your progress regularly.

Boost Your Score encourages disciplined financial habits. Use their Credit Builder Loan to plan and achieve your goals. Setting milestones helps you stay motivated and focused on your financial objectives.

Using Credit Monitoring Tools

Credit monitoring tools are vital for staying informed about changes to your credit report. Boost Your Score’s service includes automatic monthly payments and positive credit reporting to the bureaus. These features ensure your credit history is continually updated with positive information.

Consider using other credit monitoring tools that alert you to changes in your credit report. This proactive approach helps you respond quickly to any suspicious activity or errors.

By following these steps and utilizing the features of Boost Your Score, you can effectively monitor your credit score progress and achieve your financial goals.

Frequently Asked Questions

What Is A Good Credit Score?

A good credit score typically ranges from 670 to 739. It indicates responsible credit usage and timely payments. Higher scores can result in better loan terms.

How Can I Improve My Credit Score?

Improve your credit score by paying bills on time, reducing debt, and avoiding new credit inquiries. Regularly check your credit report for errors.

How Often Should I Check My Credit Score?

Check your credit score at least once a year. Regular monitoring can help detect errors or fraudulent activity early.

Does Checking My Credit Score Lower It?

No, checking your own credit score is a soft inquiry. It does not affect your credit score.

Conclusion

Improving your credit score is crucial for financial health. Follow the checklist and see results. Consistent efforts pay off over time. For an effective boost, consider using the Boost Your Score service. It offers a Credit Builder Loan and a secured credit card. Make regular payments and enjoy positive credit reporting. This tool helps you build credit responsibly. Visit their site for more details. Start your journey to a better credit score today!