Credit Score Boost: Top Tips to Improve Your Rating Fast

A high credit score can unlock many financial opportunities. It can help you secure loans, get better interest rates, and even land a job.

But what if your credit score is less than stellar? Boosting your credit score might seem challenging, but it’s entirely possible with the right steps. Many people struggle with debt, and dealing with debt lawsuits can be overwhelming. SoloSuit offers a solution to this problem by providing an automated software to help individuals navigate debt disputes. With SoloSuit, you can respond to debt lawsuits and settle debts out of court, making the process much more manageable. This tool is designed to streamline the process, offering a structured approach to legal issues. By using SoloSuit, you can take control of your debt situation and work towards improving your credit score. Interested in learning more? Check out SoloSuit here.

Introduction To Credit Score Boost

Welcome to our comprehensive guide on boosting your credit score! Whether you are looking to make a significant purchase or simply improve your financial health, understanding and improving your credit score is crucial. In this section, we will delve into the basics of credit scores, why they are important, and how they impact your financial life.

Understanding The Importance Of A Good Credit Score

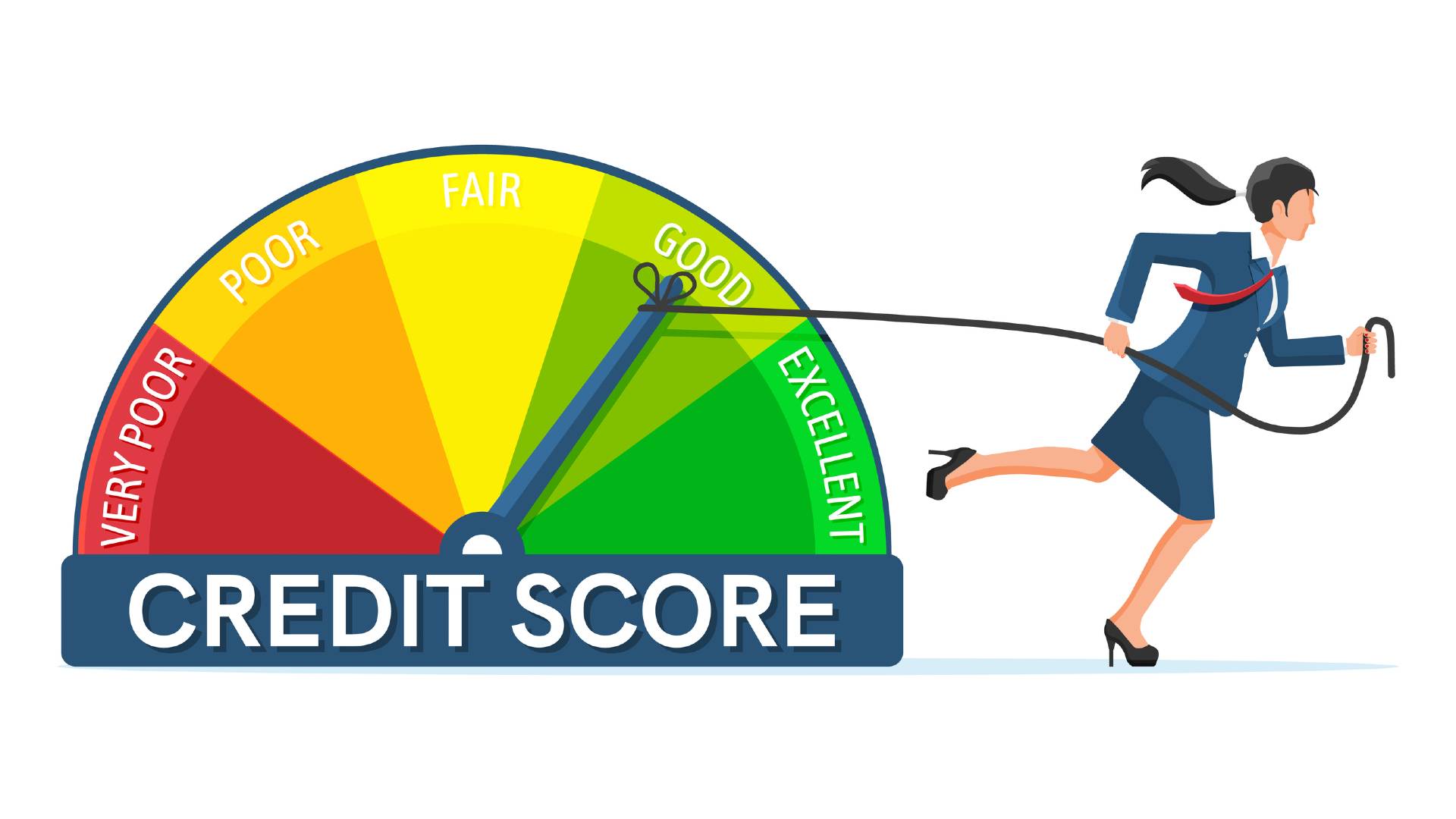

A good credit score opens many financial doors. It helps you secure loans, credit cards, and better interest rates. A higher score indicates to lenders that you are a responsible borrower. This can lead to lower interest rates and better terms.

Credit scores range from 300 to 850. A score above 700 is generally considered good. Maintaining a high score can save you money in the long run. It can also make it easier to rent an apartment or get a job.

How Credit Scores Impact Your Financial Life

Your credit score affects many aspects of your financial life. Here are some key areas impacted by your credit score:

- Loan Approvals: A high credit score increases your chances of getting approved for loans.

- Interest Rates: Better credit scores often lead to lower interest rates, saving you money.

- Credit Card Offers: Higher scores can qualify you for credit cards with better rewards and terms.

- Housing: Landlords may check your credit score before approving rental applications.

- Employment: Some employers review credit scores as part of their hiring process.

Improving your credit score can have a positive ripple effect across your financial landscape. It can lead to more opportunities and financial stability.

| Credit Score Range | Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Excellent |

Understanding these ranges helps you know where you stand and what you need to improve. Let’s work together to boost your credit score and open up new financial opportunities!

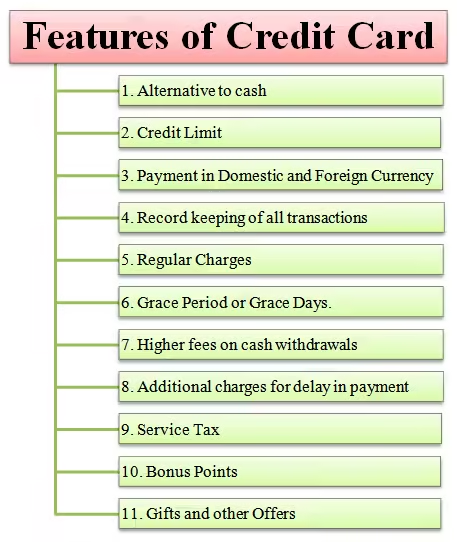

Key Features Of Credit Score Improvement

Improving your credit score can open doors to better financial opportunities. Understanding the key features of credit score improvement is essential. Here are the crucial aspects to focus on:

Paying bills on time is one of the most significant factors in improving your credit score. This includes credit card bills, loans, and utility payments. Set up automatic payments or reminders to ensure you never miss a due date.

High credit card balances can negatively impact your credit score. Aim to keep your credit utilization ratio below 30%. This means if your credit limit is $10,000, try to keep your balance under $3,000. Paying down balances can help boost your score.

Each time you apply for new credit, a hard inquiry is made on your credit report. Multiple inquiries can lower your score. Avoid applying for new credit unless absolutely necessary. This includes new credit cards, loans, and other lines of credit.

Having a mix of credit types can positively affect your credit score. This includes a combination of credit cards, installment loans, and retail accounts. A diverse credit portfolio demonstrates responsible credit management.

For more assistance with managing debt and improving your financial health, consider using SoloSuit. SoloSuit offers tools to help you respond to debt lawsuits and settle debts. Visit SoloSuit for more information.

Timely Bill Payments

Making timely bill payments is crucial for boosting your credit score. By paying your bills on time, you can build a positive payment history and avoid late payment penalties. Let’s explore the benefits and importance of timely bill payments in detail.

Benefit: Building A Positive Payment History

Paying bills on time helps build a positive payment history. Lenders look at your payment history to assess creditworthiness. A strong payment history demonstrates reliability and trustworthiness. It shows you can manage finances responsibly.

Problem Solved: Preventing Late Payment Penalties

Timely bill payments prevent late payment penalties. These penalties can include late fees and increased interest rates. Avoiding these penalties saves money and maintains financial health. Timely payments also prevent negative marks on your credit report.

Importance: Major Factor In Credit Score Calculation

Timely bill payments are a major factor in credit score calculation. Payment history accounts for 35% of your credit score. Consistently paying bills on time improves your score significantly. It is the most important factor in determining your creditworthiness.

| Benefit | Details |

|---|---|

| Building a Positive Payment History | Shows reliability and improves creditworthiness |

| Preventing Late Payment Penalties | Avoids late fees and negative credit marks |

| Major Factor in Credit Score Calculation | Accounts for 35% of your credit score |

SoloSuit is an excellent tool for managing debt and ensuring timely payments. Solo provides automated software to help individuals navigate debt disputes. It assists users in responding to debt lawsuits and settling debts out of court.

SoloSettle helps users negotiate with collectors to settle debts for less than the face value. This ensures you can manage payments effectively and avoid the negative impacts of missed payments.

Reducing Credit Card Balances

Managing your credit card balances is crucial for improving your credit score. By reducing your credit card balances, you can positively impact your financial health. Let’s explore the benefits, problems solved, and the importance of reducing credit card balances.

Benefit: Improving Credit Utilization Ratio

One of the main benefits of lowering your credit card balances is improving your credit utilization ratio. This ratio is the amount of credit you’re using compared to your total credit limit. A lower ratio shows lenders you are managing your credit responsibly.

- Keep your utilization below 30% of your credit limit.

- Pay off balances in full each month if possible.

Reducing your balances can lead to a better credit utilization ratio, which directly impacts your credit score.

Problem Solved: Reducing Debt Burden

Reducing your credit card balances also helps in reducing your debt burden. Carrying high balances can lead to higher interest payments and financial stress. Lower balances mean less debt and more manageable payments.

- Create a budget to track your spending.

- Focus on paying down high-interest debt first.

- Consider using automated tools like SoloSuit to manage debt disputes.

Using tools like SoloSuit can aid in negotiating and settling debts, making your financial journey smoother.

Importance: Significant Impact On Credit Score

Reducing your credit card balances has a significant impact on your credit score. It is one of the most influential factors in credit scoring models. A lower balance shows you are not over-reliant on credit, which lenders view positively.

Here are some key points to keep in mind:

| Action | Impact |

|---|---|

| Paying off balances | Improves credit score |

| Maintaining low utilization | Shows responsible credit management |

| Using tools like SoloSuit | Helps in debt settlement |

By focusing on reducing your balances, you not only improve your financial health but also boost your credit score significantly.

Avoiding New Credit Inquiries

It’s crucial to avoid new credit inquiries to boost your credit score. Each new inquiry can impact your score. So, careful management of credit applications is essential.

Benefit: Maintaining Stable Credit History

New credit inquiries can destabilize your credit history. This makes your score unpredictable. By avoiding new inquiries, you ensure a stable credit history. This stability is vital for long-term credit health.

Problem Solved: Preventing Unnecessary Score Dips

Every new credit inquiry can cause a small dip in your credit score. Over time, these small dips add up. Avoiding new inquiries prevents these unnecessary score dips. This keeps your score high and steady.

Importance: Reflects Responsible Credit Behavior

Avoiding new credit inquiries shows that you use credit responsibly. Lenders see this as a sign of good financial management. It reflects that you do not rely on frequent new credit to manage your finances. This responsible behavior is rewarded with a higher credit score.

Diversifying Credit Types

Diversifying your credit types is a strategic way to boost your credit score. By showing that you can handle various forms of credit, you enhance your credit profile. This approach is key in demonstrating versatility and sends a positive signal to lenders. Let’s delve deeper into the benefits and importance of diversifying credit types.

Benefit: Enhancing Credit Profile

Having a mix of credit types, such as credit cards, installment loans, and mortgages, can enhance your credit profile. This shows creditors that you can manage different kinds of credit responsibly. The more diverse your credit portfolio, the better your credit score can be.

- Credit Cards: Revolving credit that helps manage short-term expenses.

- Installment Loans: Fixed payments that show long-term commitment.

- Mortgages: Significant loans that indicate financial stability.

Problem Solved: Demonstrating Versatility In Credit Management

Diversifying your credit types solves the problem of demonstrating versatility in credit management. Lenders want to see that you can handle different forms of credit. Successfully managing diverse credit types proves your financial responsibility and capability.

- Shows ability to manage multiple credit lines.

- Indicates financial maturity and responsibility.

- Reduces risk perception for lenders.

Importance: Positive Signal To Lenders

A well-diversified credit portfolio sends a positive signal to lenders. It shows that you are not reliant on a single type of credit. This is crucial for gaining lender trust. It can also lead to better loan terms and lower interest rates.

| Type of Credit | Positive Signal |

|---|---|

| Credit Cards | Shows ability to manage revolving credit. |

| Installment Loans | Indicates long-term financial planning. |

| Mortgages | Demonstrates significant financial stability. |

Incorporating different credit types into your financial strategy is a simple yet effective method to boost your credit score. It not only enhances your credit profile but also demonstrates your versatility in credit management, making you a more appealing candidate to lenders.

Pricing And Affordability Breakdown

Understanding the costs associated with boosting your credit score is crucial. Below, we will break down the pricing and affordability of various services and strategies that can help improve your credit score. This includes a comparison of free vs. paid credit monitoring services and cost-effective strategies for enhancing your credit profile.

Free Vs. Paid Credit Monitoring Services

Credit monitoring services can be a valuable tool in managing and improving your credit score. These services alert you to changes in your credit report, helping you to catch errors or potential fraud early.

| Feature | Free Services | Paid Services |

|---|---|---|

| Monitoring Frequency | Monthly or Quarterly | Daily or Real-time |

| Credit Reports | Limited Access | Full Access |

| Alerts | Basic Alerts | Detailed Alerts |

| Identity Theft Protection | Basic Protection | Comprehensive Protection |

| Cost | Free | Ranges from $10 to $30 per month |

Free services offer basic monitoring and alerts, suitable for those who are just starting. Paid services provide more comprehensive monitoring, identity theft protection, and detailed alerts, which can be beneficial for those needing in-depth management.

Cost-effective Strategies For Improving Credit

Improving your credit score doesn’t always require expensive services. Here are some cost-effective strategies to consider:

- Review Your Credit Reports: Obtain your free annual credit reports from the three major bureaus (Equifax, Experian, and TransUnion) and check for errors.

- Pay Bills on Time: Set up reminders or automatic payments to ensure you pay all your bills on time.

- Reduce Debt: Focus on paying down high-interest debt first to reduce your overall debt-to-credit ratio.

- Keep Credit Card Balances Low: Aim to use less than 30% of your available credit limit to improve your score.

- Avoid New Credit Applications: Each new application can cause a small, temporary drop in your score.

These strategies can help you improve your credit score without spending a lot of money. By being proactive and mindful of your financial habits, you can make significant progress in boosting your credit score.

Pros And Cons Of Credit Score Improvement Methods

Improving your credit score has both advantages and disadvantages. It is essential to understand both aspects to make informed decisions. Below, we discuss the pros and cons of credit score improvement methods.

Pros: Long-term Financial Benefits

Enhancing your credit score offers numerous long-term financial benefits:

- Lower Interest Rates: Better credit scores lead to lower interest rates on loans.

- Higher Loan Approval Chances: A higher score increases your chances of loan approval.

- Better Credit Card Offers: You may qualify for better credit card offers and rewards.

- Improved Insurance Rates: Insurance companies often offer better rates to those with high credit scores.

- Greater Financial Flexibility: A good score provides more financial options and flexibility.

These benefits can significantly improve your financial health over time.

Cons: Potential Short-term Sacrifices

While there are many benefits, improving your credit score may require short-term sacrifices:

- Reduced Spending: You may need to cut back on spending to pay off debts.

- Increased Payments: Higher monthly payments might be necessary to reduce debt faster.

- Credit Limit Adjustments: Lowering your credit utilization might involve reducing your credit limit.

- Time and Effort: Improving your score requires time and effort, including monitoring your credit report regularly.

These sacrifices can be challenging but are often necessary for long-term financial health.

Specific Recommendations For Ideal Users

Boosting your credit score can seem daunting, but tailored advice can help. Below, find specific recommendations for different users. Whether you are a young adult, rebuilding credit, or a homebuyer, these tips can guide you.

For Young Adults Starting Their Credit Journey

Young adults often face challenges when building credit from scratch. Here are some steps to follow:

- Open a Secured Credit Card: This type of card requires a deposit and can help establish credit.

- Become an Authorized User: Being added to a family member’s credit card can boost your score.

- Use Credit Wisely: Make small purchases and pay off the balance monthly.

- Monitor Your Credit Report: Regular checks ensure accuracy and help spot errors early.

For Individuals Rebuilding Credit After Financial Setbacks

Rebuilding credit after setbacks requires patience and a strategic approach. Consider these actions:

- Pay Bills on Time: Timely payments are crucial for improving your credit score.

- Settle Outstanding Debts: Use tools like Solo to negotiate and settle debts, which can positively impact your score.

- Limit New Credit Applications: Each hard inquiry can lower your score, so apply sparingly.

- Use a Credit-Builder Loan: These loans can help establish a positive payment history.

For Homebuyers Needing A Higher Score For Mortgage Approval

Homebuyers often need a higher credit score to secure favorable mortgage rates. Follow these tips:

- Pay Down Debt: Reducing your debt-to-income ratio can improve your score.

- Correct Credit Report Errors: Dispute any inaccuracies found in your credit report.

- Avoid New Debt: Do not take on new debt before applying for a mortgage.

- Maintain Low Credit Utilization: Keep credit card balances low relative to your credit limits.

Frequently Asked Questions

How Can I Quickly Boost My Credit Score?

You can quickly boost your credit score by paying down credit card balances, disputing errors on your credit report, and making on-time payments.

Does Paying Off Debt Increase Credit Score?

Yes, paying off debt can increase your credit score. It reduces your credit utilization ratio, which positively impacts your score.

How Often Should I Check My Credit Score?

You should check your credit score at least once a month. Regular monitoring helps you spot errors and track your progress.

Can Late Payments Affect My Credit Score?

Yes, late payments can significantly affect your credit score. Timely payments are crucial for maintaining a good credit score.

Conclusion

Improving your credit score takes time and effort. Small steps matter. Paying bills on time and reducing debt are key strategies. Regularly monitor your credit report. Correct any errors you find. For more complex debt issues, SoloSuit can help. This platform provides tools for managing debt disputes. Get legal assistance without high costs. Visit SoloSuit to learn more. Remember, a better credit score opens new financial opportunities. Stay committed to your goals and watch your credit score improve.