Credit Score Benchmarks: Essential Guide to Boost Your Rating

Understanding credit score benchmarks is crucial. They help gauge financial health and borrowing potential.

Credit scores determine a lot in personal finance. They influence loan approvals, interest rates, and even job prospects. Knowing the benchmarks can guide financial decisions and credit improvement strategies. Scores typically range from poor to excellent, each with distinct implications. Whether you’re starting or rebuilding, understanding where you stand is key. Tools like Boost Your Score can aid in enhancing your score. This service offers structured credit builder loans and secured credit cards, reporting positive credit history. Let’s dive deeper into what each credit score range means and how you can improve yours.

Introduction To Credit Score Benchmarks

Understanding credit score benchmarks is crucial. These benchmarks help you know where you stand financially. They also guide you on improving your credit score. Let’s dive into what credit scores are, why they matter, and the purpose of these benchmarks.

What Is A Credit Score?

A credit score is a number that represents your creditworthiness. This number ranges from 300 to 850. It is calculated based on your credit history. Factors include your payment history, amounts owed, length of credit history, new credit, and types of credit used.

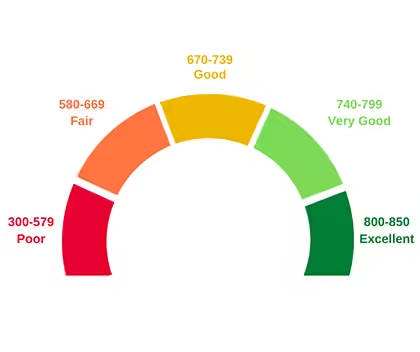

Here’s a quick overview of credit score ranges:

| Credit Score | Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Excellent |

Why Credit Scores Matter

Credit scores matter for several reasons. A higher credit score can lead to better loan terms and interest rates. This can save you money over time. Lenders, landlords, and even some employers check your credit score to assess your reliability.

Here are some key benefits of having a good credit score:

- Lower interest rates on loans and credit cards

- Better chances of loan approval

- Higher credit limits

- More favorable insurance rates

- Potential rental and employment opportunities

Purpose Of Credit Score Benchmarks

Credit score benchmarks serve as a reference point. They help you understand how your score compares to others. This can motivate you to improve your score. Benchmarks also guide lenders in making decisions about your creditworthiness.

Products like Boost Your Score can help you improve your credit score. They offer structured programs designed to build positive credit history. These programs include regular payments and secured credit cards. Consistent, on-time payments can lead to a higher credit score over time.

Here’s a quick look at their pricing options:

| Plan | Monthly Cost | Total Payment | Amount Received | Estimated APR |

|---|---|---|---|---|

| Mini Boost | $30 | $360 | $300 | 34.82% |

| Boost | $64 | $768 | $650 | 31.76% |

| Mega Boost | $82 | $984 | $850 | 27.76% |

Understanding and using credit score benchmarks can lead to better financial decisions and improved credit health.

Understanding Credit Score Ranges

Understanding credit score ranges is essential for anyone looking to improve their financial health. These ranges help lenders determine your creditworthiness, influencing loan approvals and interest rates. Let’s break down the different credit score ranges and what they mean for you.

Excellent Credit Scores

An excellent credit score usually falls between 750 and 850. Having an excellent score shows lenders you are very reliable with credit. This score range can help you get the best interest rates and loan terms.

Benefits of an excellent credit score:

- Lowest interest rates on loans and credit cards

- Higher chances of loan approval

- Better negotiating power for credit terms

Good Credit Scores

A good credit score is typically between 700 and 749. This range indicates you manage credit well but may have some minor issues in your credit history. Lenders view you as a low-risk borrower.

Benefits of a good credit score:

- Reasonable interest rates on loans and credit cards

- High chances of loan approval

- Access to a variety of credit products

Fair Credit Scores

A fair credit score ranges from 650 to 699. This range suggests you have some credit issues but are working to improve. Lenders may see you as a moderate risk.

Benefits of a fair credit score:

- Moderate interest rates on loans and credit cards

- Potential for loan approval with some conditions

- Opportunities to improve with responsible credit use

Poor Credit Scores

A poor credit score is usually below 650. This range indicates significant credit issues and high risk to lenders. Improving this score should be a priority.

Consequences of a poor credit score:

- High interest rates on loans and credit cards

- Low chances of loan approval

- Limited access to credit products

To improve a poor credit score, consider using services like Boost Your Score. This program helps build a positive credit history through structured loans and secured credit cards.

Key Factors Influencing Your Credit Score

Understanding the factors that influence your credit score is crucial. These factors impact your ability to secure loans, credit cards, and better interest rates. Let’s explore the key elements that affect your credit score.

Payment History

Payment history is the most significant factor in determining your credit score. It accounts for 35% of your score. Consistently making on-time payments shows that you are reliable and responsible with credit. Late or missed payments can significantly lower your score.

Credit Utilization Ratio

The credit utilization ratio is the amount of credit you are using compared to your total available credit. It makes up 30% of your credit score. A lower ratio indicates responsible credit management. Aim to keep your credit utilization below 30%.

Length Of Credit History

The length of credit history is another important factor, contributing to 15% of your credit score. A longer credit history shows stability and experience with credit. This includes the age of your oldest account, the age of your newest account, and the average age of all your accounts.

Types Of Credit

Having a mix of credit types, such as credit cards, mortgages, and auto loans, can positively impact your score. Types of credit account for 10% of your score. Lenders like to see that you can manage different kinds of credit responsibly.

Recent Credit Inquiries

Recent credit inquiries make up 10% of your credit score. Each time you apply for new credit, an inquiry is made on your report. Too many inquiries in a short period can lower your score. Be mindful of how often you apply for new credit.

How To Improve Your Credit Score

Improving your credit score is essential for better financial opportunities. A higher score can lead to lower interest rates and better loan options. Here are some practical steps to help you improve your credit score.

Paying Bills On Time

One of the most effective ways to improve your credit score is by paying bills on time. Payment history makes up 35% of your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

Reducing Credit Card Balances

Keeping your credit card balances low can positively impact your credit score. Aim to use less than 30% of your available credit. Paying down your balances can reduce your credit utilization ratio, which is a key factor in your score calculation.

Avoiding New Credit Applications

Each new credit application can result in a hard inquiry on your credit report. Too many inquiries can lower your score. Try to avoid applying for new credit unless necessary, as this can help maintain your score stability.

Checking Credit Reports For Errors

Regularly checking your credit reports for errors is crucial. Mistakes on your report can negatively affect your score. Dispute any inaccuracies you find with the credit bureaus to ensure your report is accurate.

| Credit Improvement Tips | Actions |

|---|---|

| Paying Bills on Time | Set up automatic payments |

| Reducing Credit Card Balances | Keep usage under 30% |

| Avoiding New Credit Applications | Limit new credit requests |

| Checking Credit Reports for Errors | Dispute inaccuracies |

For additional support, consider using services like Boost Your Score. They offer a structured credit builder loan program, which includes positive credit history reporting and access to a secured credit card. This can help individuals establish a positive payment history and improve their credit score.

Common Credit Score Myths Debunked

Many people have misconceptions about credit scores. These myths can lead to poor financial decisions. Let’s debunk some common credit score myths.

Myth: Checking Your Own Credit Hurts Your Score

Many believe checking their own credit score will hurt it. This is a myth. Checking your own credit is considered a “soft inquiry.” Soft inquiries do not affect your credit score. You can check your credit score as often as you like. It’s a good habit to stay informed about your credit status.

Myth: Closing Old Accounts Improves Your Score

Another common myth is that closing old accounts improves your credit score. In reality, closing old accounts can actually harm your score. Older accounts contribute to the length of your credit history. A longer credit history is beneficial for your credit score. Also, closing accounts reduces your available credit, which can increase your credit utilization ratio. A higher credit utilization ratio can negatively impact your credit score.

Myth: Income Directly Affects Your Credit Score

Many people think their income directly affects their credit score. This is not true. Credit scores are based on your credit history and behavior, not your income. Factors like payment history, credit utilization, and length of credit history matter. While having a higher income can help you manage debts better, it does not directly influence your credit score.

To summarize, these credit score myths can mislead you. Staying informed is crucial for maintaining a healthy credit score. Consider using services like Boost Your Score to help improve your credit through responsible financial practices.

Tools And Resources For Monitoring Your Credit Score

Monitoring your credit score is essential for maintaining financial health. Staying informed can help you make better financial decisions. Here are some tools and resources to help you keep track of your credit score.

Credit Monitoring Services

Credit monitoring services provide regular updates on your credit report. They alert you to any changes or suspicious activities. Boost Your Score offers monthly FICO score updates.

These services can track your credit score over time. They offer insights into factors affecting your score. Some popular credit monitoring services include:

- Experian

- TransUnion

- Equifax

- Boost Your Score

Free Credit Report Access

You are entitled to one free credit report annually from each major credit bureau. Use AnnualCreditReport.com to access these reports. Reviewing your credit report helps identify errors or fraudulent activities.

Regularly checking your credit report can help you understand your financial standing. It ensures your credit information is accurate. Key points to review in your credit report include:

- Personal Information

- Credit Accounts

- Inquiries

- Public Records

Financial Advisors And Credit Counselors

Financial advisors and credit counselors offer personalized advice. They help create a plan to improve your credit score. Boost Your Score can be part of this plan through its credit builder loan program.

Credit counselors can negotiate with creditors on your behalf. They provide strategies for debt management. Benefits of consulting with financial advisors and credit counselors include:

- Personalized financial plans

- Debt management strategies

- Credit score improvement tips

Boost Your Score offers a structured program to help improve your credit score. It includes a credit builder loan and a secured credit card. Positive credit reporting with each on-time payment can improve your credit score.

For more information, visit Boost Your Score or contact them at 1 (800) 259-1270.

Pros And Cons Of Different Credit Score Improvement Strategies

Improving your credit score can open doors to better financial opportunities. There are various strategies to enhance your credit score, each with its unique advantages and disadvantages. Understanding these can help you make informed decisions.

Debt Consolidation

Debt consolidation combines multiple debts into a single payment. This can simplify your financial life and potentially lower your interest rates.

| Pros | Cons |

|---|---|

|

|

Credit Repair Services

Credit repair services can help identify and dispute errors on your credit report. They offer professional assistance but come with costs.

| Pros | Cons |

|---|---|

|

|

Diy Credit Improvement

DIY credit improvement involves taking personal steps to enhance your credit score. It can be cost-effective but requires effort and knowledge.

| Pros | Cons |

|---|---|

|

|

Boost Your Score offers a structured approach to credit improvement. With features like a credit builder loan and secured credit card, it provides consistent positive credit reporting. This can be a valuable tool for those looking to improve their credit history.

Specific Recommendations For Different Scenarios

Understanding credit score benchmarks is essential for various life stages. Different scenarios require tailored approaches to improve and maintain your credit score. Below are specific recommendations for young adults starting credit, individuals recovering from bankruptcy, and homebuyers preparing for a mortgage.

For Young Adults Starting Credit

Young adults often have limited credit history. Building a solid foundation is key.

- Open a secured credit card to start establishing credit.

- Utilize services like Boost Your Score to create positive credit history.

- Make small purchases and pay off the balance in full each month.

- Avoid applying for multiple credit cards at once to prevent hard inquiries.

| Product | Monthly Cost | Est. APR |

|---|---|---|

| Mini Boost | $30/month | 34.82% |

| Boost | $64/month | 31.76% |

| Mega Boost | $82/month | 27.76% |

For Individuals Recovering From Bankruptcy

Recovering from bankruptcy requires patience and strategic planning.

- Start with a credit builder loan to re-establish your credit.

- Consider the Boost Your Score program for structured credit rebuilding.

- Make all payments on time to show financial responsibility.

- Keep credit utilization low, ideally below 30% of your credit limit.

Boost Your Score offers a secured credit card after four loan payments, which can further help improve your credit score.

For Homebuyers Preparing For A Mortgage

Preparing for a mortgage means optimizing your credit score.

- Check your credit reports and dispute any errors.

- Pay down high-interest debt to reduce your debt-to-income ratio.

- Use services like Boost Your Score to demonstrate consistent payment history.

- Avoid opening new credit accounts before applying for a mortgage.

Monthly updates on your FICO score, as provided by Boost Your Score, can help you track your progress and make necessary adjustments.

Conclusion: Achieving And Maintaining A Healthy Credit Score

Achieving and maintaining a healthy credit score is crucial for financial stability. A good credit score opens doors to better loan rates, credit cards, and financial opportunities. Here, we will discuss the long-term benefits of a good credit score, ongoing habits for credit health, and final tips for credit score success.

Long-term Benefits Of A Good Credit Score

A good credit score offers numerous long-term benefits. Here are some key advantages:

- Lower Interest Rates: Enjoy lower interest rates on loans and credit cards.

- Higher Credit Limits: Access higher credit limits due to your creditworthiness.

- Better Loan Terms: Secure better terms on mortgages, auto loans, and personal loans.

- Rental Opportunities: Higher chances of approval for rental applications.

- Insurance Premiums: Potentially lower insurance premiums.

Ongoing Habits For Credit Health

Maintaining a healthy credit score requires consistent effort. Here are some ongoing habits to help:

- Timely Payments: Always make payments on time, including loans and credit cards.

- Low Credit Utilization: Keep your credit card balances low, ideally below 30% of your limit.

- Regular Monitoring: Check your credit report regularly for errors and monitor your score.

- Diverse Credit Mix: Maintain a mix of credit types, such as loans and credit cards.

- Minimal New Accounts: Avoid opening too many new credit accounts within a short period.

Final Tips For Credit Score Success

Here are some final tips to help you achieve and maintain a good credit score:

- Use Credit Builder Programs: Consider services like Boost Your Score to improve your credit score.

- Set Up Automatic Payments: Automate payments to ensure you never miss a due date.

- Stay Informed: Keep up with changes in credit scoring models and financial tips.

- Seek Professional Advice: If needed, consult a financial advisor for personalized guidance.

Remember, achieving a healthy credit score takes time, but with disciplined habits and the right tools, you can enjoy long-term financial benefits.

Frequently Asked Questions

What Is A Good Credit Score?

A good credit score typically ranges from 670 to 739. It indicates reliable creditworthiness and can help secure better loan terms.

How Can I Check My Credit Score?

You can check your credit score through free online services or directly from credit bureaus like Experian, Equifax, and TransUnion.

What Affects My Credit Score?

Your credit score is affected by payment history, credit utilization, length of credit history, new credit, and credit mix.

How Often Should I Check My Credit Score?

It’s recommended to check your credit score at least once a year. Regular monitoring helps catch errors and detect fraud early.

Conclusion

Understanding credit score benchmarks is crucial for financial health. Regularly check your credit score to stay informed. Consider services like Boost Your Score to help improve your credit. Visit Boost Your Score to learn more. Good credit opens doors to better financial opportunities. Take proactive steps today for a brighter financial future.