Credit Restoration: Unlock Your Path to Financial Freedom

Are you struggling with poor credit? Credit restoration can be your pathway to financial stability.

Credit restoration involves steps to improve your credit score, making it easier to get loans and better interest rates. It can help you regain control over your financial future. Whether you have faced unexpected financial setbacks or have been dealing with long-term debt, credit restoration can offer a fresh start. One effective way to achieve this is through services like Mitigately. Mitigately is a debt consolidation service that uses AI to help manage and reduce your debt efficiently. With Mitigately, you can consolidate multiple debt payments into one, making it easier to become debt-free faster and save money. Start your journey to better credit today and explore options that can simplify your financial life. Learn more about Mitigately and how it can help you restore your credit.

Introduction To Credit Restoration

Credit restoration is a vital process in the financial recovery journey. It involves improving a person’s credit score, which can help them secure better financial opportunities. Let’s delve deeper into what credit restoration entails and its importance.

What Is Credit Restoration?

Credit restoration is the process of fixing poor credit standing. This involves addressing errors on credit reports and negotiating with creditors to remove negative items. The goal is to improve the credit score and financial reputation of an individual.

Credit restoration often requires a detailed review of credit reports from major credit bureaus. Common steps include disputing inaccuracies, paying off debts, and managing existing credit accounts wisely.

Why Is Credit Restoration Important?

Credit restoration is crucial for several reasons:

- Better Loan Terms: Higher credit scores lead to lower interest rates.

- Employment Opportunities: Some employers check credit as part of the hiring process.

- Improved Financial Health: Good credit can lead to better financial habits.

Restoring credit can help individuals achieve their financial goals and provide peace of mind.

Who Can Benefit From Credit Restoration?

Various individuals can benefit from credit restoration:

- People with Bad Credit: Those with low scores can see significant improvements.

- Recent Graduates: New graduates can start their financial life positively.

- Individuals Recovering from Financial Hardship: Those who faced financial challenges can rebuild their credit.

Anyone looking to improve their financial standing can benefit from credit restoration.

Understanding Your Credit Score

Knowing your credit score is vital for managing your finances. It affects your ability to get loans, credit cards, and even jobs. Let’s break down the key components and impacts of a credit score.

Components Of A Credit Score

Your credit score is made up of several factors. Each factor has its own weight in calculating your overall score. Here’s a breakdown:

| Component | Percentage |

|---|---|

| Payment History | 35% |

| Amounts Owed | 30% |

| Length of Credit History | 15% |

| New Credit | 10% |

| Types of Credit Used | 10% |

Payment History is the most significant factor. It shows if you pay your bills on time. Amounts Owed shows how much debt you have. Length of Credit History reflects how long you’ve been using credit. New Credit includes recent credit inquiries. Types of Credit Used looks at the mix of credit accounts you have.

How Credit Scores Impact Your Financial Health

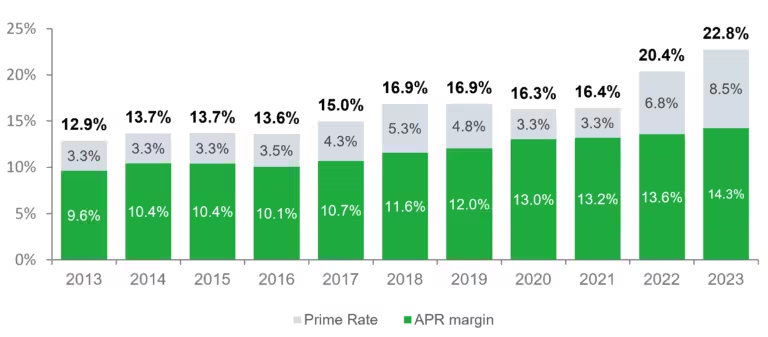

Credit scores have a huge impact on your financial health. They determine the interest rates you get on loans and credit cards. A higher score can save you money. Here’s how:

- Lower Interest Rates: With a good score, you get lower interest rates.

- Loan Approvals: A high score increases your chances of loan approval.

- Credit Card Offers: Better scores unlock premium credit card offers.

- Job Opportunities: Some employers check credit scores during hiring.

Common Misconceptions About Credit Scores

Many people have misconceptions about credit scores. Here are a few common ones:

- Checking Your Score Lowers It: Checking your own score is a soft inquiry. It does not affect your score.

- All Debt is Bad: Not all debt is harmful. Responsible use of credit can improve your score.

- Closing Accounts Raises Your Score: Closing old accounts can shorten your credit history. This may lower your score.

- Income Affects Score: Your income does not directly impact your credit score.

Understanding these misconceptions can help you manage your credit more effectively.

For those struggling with debt, consider using services like Mitigately. Mitigately consolidates multiple debt payments into one, making it easier to become debt-free faster.

Key Features Of Credit Restoration Services

Credit restoration services offer a comprehensive approach to improving your credit score. These services include analyzing credit reports, resolving disputes, providing counseling, and managing debt. Each feature plays a crucial role in helping individuals regain financial stability.

Credit Report Analysis

The first step in credit restoration is credit report analysis. Experts review your credit report to identify errors or negative items. This process helps uncover inaccuracies that may be affecting your credit score.

| Feature | Benefit |

|---|---|

| Detailed Review | Identifies inaccuracies |

| Personalized Insights | Highlights areas for improvement |

Dispute Resolution With Credit Bureaus

Dispute resolution involves challenging incorrect or unfair entries on your credit report. Credit restoration services contact credit bureaus on your behalf. They provide evidence and follow up until the issue is resolved.

- Submit disputes to credit bureaus

- Provide necessary documentation

- Monitor dispute status

Credit Counseling And Education

Credit counseling and education are vital components of credit restoration. Experts provide guidance on managing finances and improving credit habits. This education empowers individuals to make informed financial decisions.

- Personalized financial advice

- Workshops and webinars on credit management

- Resources for budgeting and saving

Debt Management Plans

Debt management plans help individuals repay their debt more efficiently. These plans consolidate multiple payments into one, making it easier to manage debt. Services like Mitigately offer AI-powered solutions for faster debt repayment.

- Consolidate multiple payments into one

- Estimate savings with a debt repayment calculator

- Secure and private handling of information

Mitigately is a highly-rated service that uses AI to match users with suitable debt solutions. The service is free until accounts settle, offering potential savings of up to 35% on debt owed.

Pricing And Affordability Of Credit Restoration Services

Understanding the pricing and affordability of credit restoration services is crucial. Many factors influence the costs, and comparing providers ensures you get the best value for your money.

Typical Costs Involved

Credit restoration services often have varying price points. These typically include:

- Initial setup fees: $19 – $99

- Monthly fees: $59 – $129

- One-time fees for specific actions: $50 – $150

| Service Type | Cost Range |

|---|---|

| Initial setup | $19 – $99 |

| Monthly maintenance | $59 – $129 |

| One-time actions | $50 – $150 |

Comparing Different Service Providers

Comparing different service providers helps in identifying the most cost-effective option. Here are some aspects to consider:

- Reputation: Check online reviews and ratings.

- Service offerings: Ensure the provider offers comprehensive services.

- Customer support: Look for responsive and helpful customer service.

- Pricing transparency: Opt for providers with clear and upfront pricing.

For example, Mitigately offers a unique service by consolidating multiple debt payments into one. They use an AI-powered platform to match users to suitable debt solutions in approximately 6½ minutes. This service is free until your accounts settle, making it an affordable option for many.

Value For Money: What To Expect

When evaluating the value for money of credit restoration services, consider the following:

- Debt reduction: Aim for services that help reduce your total debt.

- Time efficiency: Look for services that expedite the debt repayment process.

- Potential savings: Services like Mitigately can save users up to 35% on their debt owed.

- Security: Ensure the service handles personal information securely, such as Mitigately’s use of 256-bit encryption.

Mitigately stands out with its free service until debt settlement, fast debt repayment, and significant savings potential. Such features offer excellent value for money for those seeking effective debt management.

Pros And Cons Of Using Credit Restoration Services

Credit restoration services can offer valuable assistance in improving your credit score. However, like any service, they come with both advantages and potential drawbacks. It is important to weigh these factors carefully to make an informed decision.

Advantages Of Professional Credit Restoration

Using a professional credit restoration service like Mitigately can offer several benefits:

- Expertise: Credit restoration professionals have the knowledge and experience to navigate complex credit issues efficiently.

- Time-Saving: They handle the legwork, allowing you to focus on other financial priorities.

- Personalized Solutions: Services like Mitigately use AI to match you with suitable debt solutions quickly.

- Comprehensive Support: From consolidating payments to negotiating with creditors, they provide end-to-end assistance.

Potential Drawbacks To Consider

Despite the advantages, there are some drawbacks to consider:

- Cost: Some services may have fees, though Mitigately offers free service until accounts are settled.

- Dependence: Relying too much on external help may prevent you from learning important financial skills.

- Expectations: Results can vary, and complete restoration may take time.

Real-world Experiences: Success Stories And Cautions

Many users have had positive experiences with credit restoration services:

| Success Stories | Cautions |

|---|---|

| Significant debt reduction and improved financial situations reported. | Some users may find the process slower than expected. |

| Quick qualification and substantial savings via Fresh Start Loan Program. | Not all debts may be eligible for consolidation. |

Overall, users have found services like Mitigately to be a valuable resource for managing and reducing debt.

Specific Recommendations For Ideal Users Or Scenarios

Credit restoration can be a vital step in regaining financial health. Understanding who should consider these services and the best situations to use them can help you make an informed decision. Let’s explore these points in more detail.

Who Should Consider Credit Restoration?

Credit restoration is ideal for individuals with poor credit scores due to past financial mistakes. If you have missed payments, bankruptcies, or high levels of debt, this service can help. Those looking to buy a home, secure a loan, or improve their financial standing should consider credit restoration.

| Ideal Candidates | Reasons |

|---|---|

| Home Buyers | Improve chances of mortgage approval |

| Loan Seekers | Get better loan rates |

| High Debt Holders | Manage and reduce debt effectively |

Best Situations To Use Credit Restoration Services

There are specific scenarios where credit restoration services can be particularly beneficial. If you are planning a major purchase, such as a house or car, improving your credit score beforehand can save you money. Those who have recently undergone financial hardships, such as divorce or medical emergencies, can also benefit.

- Major purchases (e.g., homes, cars)

- Post-financial hardship recovery

- Preparing for future financial stability

Diy Credit Restoration Vs. Professional Help

Choosing between DIY credit restoration and professional help depends on your situation. DIY methods involve disputing errors on credit reports, negotiating with creditors, and developing a repayment plan. This can be time-consuming and requires knowledge of credit laws.

Professional services, such as Mitigately, offer expert assistance. They provide an AI-powered platform that matches you to suitable debt solutions in about 6½ minutes. This can lead to faster debt repayment and significant savings.

- DIY Methods

- Disputing errors

- Negotiating with creditors

- Creating a repayment plan

- Professional Help

- AI-powered debt solutions

- Consolidation of payments

- Expert negotiation and support

Mitigately’s approach can save you up to 35% on debt owed and speeds up repayment. Their service is free until accounts are settled, ensuring that you only pay for results.

Steps To Take After Credit Restoration

Congratulations on restoring your credit! The journey does not end here. Ensuring your credit stays healthy requires ongoing effort and strategic planning. Here are some crucial steps to take after credit restoration to maintain and improve your financial health.

Maintaining A Healthy Credit Score

Consistency is key to keeping a healthy credit score. Follow these tips:

- Pay bills on time: Timely payments are crucial for a good credit score.

- Keep credit card balances low: High balances can negatively affect your credit score.

- Avoid opening too many new accounts: Too many new accounts can lower your score.

- Monitor your credit report: Regularly check for errors and disputes if necessary.

Financial Planning For The Future

Planning your finances is essential for long-term stability. Consider these strategies:

- Create a budget: Track income and expenses to manage your finances effectively.

- Build an emergency fund: Save for unexpected expenses to avoid future debt.

- Invest wisely: Consider long-term investments to grow your wealth.

- Use tools like Mitigately: Mitigately helps consolidate debts and manage payments efficiently.

Mitigately can assist in managing your debt post-restoration. The AI-powered platform offers tailored solutions and consolidates multiple payments into one.

Resources For Continued Credit Education

Staying informed is vital for maintaining good credit. Utilize these resources:

- Credit education websites: Websites like Mitigately offer valuable information on debt management and credit improvement.

- Financial blogs and articles: Read blogs and articles on budgeting, credit, and taxes to stay updated.

- Debt repayment calculators: Use calculators to estimate savings and repayment time.

- Financial advisors: Consult with advisors for personalized advice and strategies.

Mitigately also provides a blog with articles on debt consolidation and financial planning, helping you stay informed and proactive.

Frequently Asked Questions

What Is Credit Restoration?

Credit restoration involves improving your credit score by removing errors and negative items from your credit report.

How Does Credit Restoration Work?

Credit restoration works by disputing inaccuracies on your credit report, negotiating with creditors, and implementing strategies to improve your credit score.

Is Credit Restoration Legal?

Yes, credit restoration is legal. Consumers have the right to dispute inaccurate information on their credit reports under the Fair Credit Reporting Act.

How Long Does Credit Restoration Take?

Credit restoration typically takes between three to six months. However, the duration can vary based on the complexity of your credit issues.

Conclusion

Restoring your credit can be challenging but achievable with the right help. Consider using Mitigately to manage your debt efficiently. Its AI-powered platform simplifies payments and speeds up debt reduction. Take control of your finances and start your journey toward a better credit score today. A secure and private solution awaits you. Start now and see the difference.