Credit Reporting Solutions: Unlocking Your Financial Potential

Credit reports are essential for financial health. They impact loans, credit cards, and more.

Understanding credit reporting solutions can help manage your finances better. Credit reporting solutions offer tools to track and improve your credit score. They provide insights into your financial behavior, helping you make informed decisions. With these solutions, you can monitor your credit report regularly, identify errors, and take steps to correct them. This proactive approach not only helps in securing better loan rates but also in maintaining a healthy credit score. Whether you are an individual or a business, utilizing a reliable credit reporting solution like Fabrick can be a significant step towards financial stability. Stay informed, stay ahead with the right credit reporting tools.

Introduction To Credit Reporting Solutions

Credit reporting solutions are tools that help businesses and individuals manage their credit information. These solutions provide a comprehensive view of credit history, which is crucial for making informed financial decisions. Understanding how these solutions work can greatly benefit both personal and business financial management.

Understanding Credit Reporting

Credit reporting involves the collection and analysis of credit information from various sources. This data is compiled into a credit report, which provides a detailed overview of an individual’s or a business’s credit history. Key elements of a credit report include:

- Personal information

- Credit accounts and loans

- Payment history

- Credit inquiries

- Public records

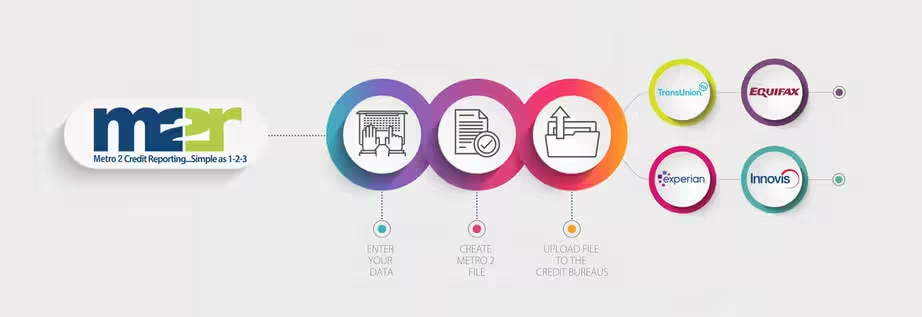

Credit reporting agencies, such as Equifax, Experian, and TransUnion, gather this information and update it regularly. They ensure that the credit reports are accurate and up-to-date, which is essential for maintaining a good credit score.

Importance Of Credit Reports In Financial Management

Credit reports play a vital role in financial management. They help lenders assess the creditworthiness of potential borrowers. A good credit report can lead to better interest rates and loan terms. Conversely, a poor credit report can result in higher interest rates or loan denials.

For businesses, credit reports are essential for evaluating the financial health of partners and clients. They provide insights into the payment habits and financial stability of other companies, which can prevent financial losses.

Individuals can also use credit reports to monitor their credit health. Regularly checking credit reports helps identify errors or fraudulent activities. Early detection of issues can prevent long-term financial damage.

In summary, credit reporting solutions like Fabrick offer valuable tools for both personal and business financial management. They provide the information needed to make informed financial decisions and maintain good credit health.

Key Features Of Credit Reporting Solutions

Credit reporting solutions like Fabrick offer a range of features that help individuals and businesses manage their credit health. Understanding these key features is essential for making informed financial decisions.

Comprehensive Credit Score Tracking

One of the standout features of credit reporting solutions is comprehensive credit score tracking. This feature allows you to monitor your credit score over time. You can see how different actions affect your score. This helps you make better financial decisions.

Detailed Credit History Analysis

Another vital feature is detailed credit history analysis. This feature breaks down your credit history. You can see past loans, credit card usage, and payment history. This detailed view helps you understand your financial behavior.

Real-time Credit Monitoring Alerts

Real-time credit monitoring alerts are crucial for staying on top of your credit status. These alerts notify you about any changes in your credit report. This can include new accounts, credit inquiries, or changes in your credit score. Real-time alerts help you respond quickly to potential issues.

Personalized Financial Advice And Recommendations

Credit reporting solutions also provide personalized financial advice and recommendations. Based on your credit data, the service offers tailored advice. This can help you improve your credit score and manage your finances better. Personalized tips can guide you towards better financial habits.

Identity Theft Protection

Lastly, identity theft protection is a critical feature. This service monitors your credit for suspicious activity. If any unusual activity is detected, you get notified immediately. This helps protect your identity and financial information from fraud.

How Each Feature Benefits You

Understanding the benefits of each feature in credit reporting solutions helps you make better financial decisions. Fabrick offers various features that cater to your financial needs. Let’s explore how each feature can benefit you.

Enhancing Financial Awareness Through Credit Score Tracking

Tracking your credit score is crucial for financial health. Fabrick provides real-time credit score updates. This feature helps you stay aware of your financial standing. Regular updates let you see how your actions impact your score. This awareness can guide you in maintaining or improving your creditworthiness.

Identifying Credit Improvement Opportunities With History Analysis

Fabrick’s history analysis feature reviews your credit history. It identifies areas where you can improve. This analysis pinpoints negative items that might be affecting your score. By understanding these factors, you can take steps to address them. This proactive approach helps you enhance your credit profile over time.

Staying Informed With Real-time Monitoring Alerts

Real-time monitoring alerts keep you updated on any changes. Fabrick sends instant notifications for any significant activity. These alerts help you detect unusual or suspicious activities. Staying informed helps you respond quickly, preventing potential fraud or identity theft.

Making Informed Decisions With Personalized Advice

Fabrick offers personalized advice based on your credit profile. This feature provides tailored recommendations to improve your credit score. Personalized advice helps you make informed decisions. It guides you on actions to take for better financial health.

Safeguarding Your Identity And Financial Information

Protecting your identity is paramount. Fabrick employs advanced security measures to safeguard your data. It ensures your financial information remains confidential. By using secure systems, Fabrick helps prevent identity theft and financial fraud. This security gives you peace of mind, knowing your data is protected.

These features offer practical benefits, making Fabrick a valuable tool for managing your credit and financial health.

Pricing And Affordability Of Credit Reporting Solutions

Credit reporting solutions provide essential insights to businesses and individuals. Understanding the pricing and affordability of these tools is crucial. This section breaks down the costs and features of these solutions, helping you make an informed decision.

Subscription Plans And Costs

Most credit reporting solutions offer various subscription plans. These plans cater to different needs and budgets. Below is a table summarizing common subscription plans:

| Plan | Monthly Cost | Annual Cost | Features |

|---|---|---|---|

| Basic | $10 | $100 | Basic credit reports, limited support |

| Standard | $25 | $250 | Advanced reports, email support |

| Premium | $50 | $500 | All features, priority support |

Choosing the right plan depends on your needs. The basic plan is affordable. The premium plan offers more features.

Free Vs Paid Features

Free features provide limited insights. Paid features offer comprehensive data. Below is a comparison:

- Free Features:

- Basic credit score

- Monthly updates

- Email alerts

- Paid Features:

- Detailed credit reports

- Daily updates

- 24/7 customer support

- Advanced analytics

Free features are useful for general monitoring. Paid features provide deeper insights and support.

Value For Money: Comparing Different Solutions

Comparing different credit reporting solutions helps you find the best value. Here are key factors to consider:

- Features: Compare the features each solution offers. Look for the ones that match your needs.

- Cost: Compare the costs of each plan. Ensure the features justify the price.

- Support: Consider the level of customer support. Premium plans often offer better support.

Each solution has its strengths. Some offer better value for money. Evaluate based on your requirements.

Pros And Cons Of Using Credit Reporting Solutions

Credit reporting solutions, such as Fabrick, offer valuable tools for managing credit effectively. They enable users to stay informed about their credit status, but also come with some drawbacks. Below, we explore the advantages and disadvantages of using these solutions.

Advantages: Proactive Financial Management

Credit reporting solutions empower users to take control of their financial health. By providing detailed credit reports, these tools help individuals monitor their credit scores regularly. This proactive approach allows users to identify and address issues before they escalate.

Users can track their spending habits and make informed financial decisions. Regular updates on credit status also alert users to any suspicious activity, enhancing security and preventing fraud.

- Monitor credit scores regularly

- Identify and address issues early

- Track spending habits

- Enhance security and prevent fraud

Disadvantages: Potential Costs And Limitations

Credit reporting solutions often come with subscription fees, which can be a burden for some users. While the costs vary, it is essential to assess whether the benefits outweigh these expenses.

Another limitation is the accuracy of the data provided. Inaccurate or outdated information can lead to misguided financial decisions. Users should verify the data regularly and report any discrepancies to ensure the information is correct.

| Potential Costs | Limitations |

|---|---|

| Subscription fees | Inaccurate data |

| Additional charges for premium features | Outdated information |

Balancing Benefits And Drawbacks

Finding the right balance between the benefits and drawbacks of credit reporting solutions is crucial. Users should evaluate their financial needs and consider whether the advantages of proactive financial management justify the costs involved.

Regularly reviewing credit reports helps ensure the information is accurate. Users should also compare different solutions to find one that offers the best value for their needs.

- Evaluate financial needs

- Justify costs with benefits

- Review credit reports regularly

- Compare different solutions

Ideal Users For Credit Reporting Solutions

Credit reporting solutions like Fabrick cater to various user needs. These tools offer detailed financial insights and help users manage their credit scores. They are useful for individuals and consumers wanting to make informed financial decisions. Below are the ideal users for credit reporting solutions.

Individuals Looking To Improve Credit Scores

People aiming to enhance their credit scores find credit reporting solutions invaluable. These tools provide insights into credit utilization, payment history, and outstanding debts. Users receive personalized tips to boost their scores.

Consumers Seeking Detailed Financial Insights

Credit reporting solutions offer comprehensive financial snapshots. Consumers can see spending patterns, credit inquiries, and detailed account activities. This helps them make better financial choices and track their progress.

Those Concerned About Identity Theft

Identity theft is a growing concern. Credit reporting solutions alert users to suspicious activities. They monitor credit reports for unauthorized changes and provide peace of mind.

People Planning Major Financial Decisions

Making large financial decisions, like buying a house or car, requires a good credit score. Credit reporting solutions help users understand their creditworthiness. They prepare users for significant purchases by ensuring their credit profiles are in top shape.

| Ideal Users | Benefits |

|---|---|

| Individuals Improving Credit Scores | Personalized tips, Credit utilization insights |

| Consumers Seeking Financial Insights | Spending patterns, Credit inquiries tracking |

| Concerned About Identity Theft | Alerts for suspicious activities, Monitoring for unauthorized changes |

| Planning Major Financial Decisions | Creditworthiness understanding, Preparing for large purchases |

Conclusion: Unlocking Your Financial Potential

Credit reporting solutions, like Fabrick, play a vital role in your financial health. They help you understand your credit profile, offering insights and tools to improve it. This empowers you to make informed financial decisions, paving the way for a stable and secure future.

Summarizing The Benefits

Credit reporting solutions provide several benefits. These include:

- Improved Credit Scores: Regular monitoring helps identify errors, leading to better scores.

- Informed Financial Decisions: Access to detailed credit reports aids in making wise choices.

- Early Fraud Detection: Alerts on suspicious activities protect you from fraud.

- Better Loan and Credit Card Offers: A good credit score can result in favorable terms.

Encouraging Proactive Credit Management

Proactive credit management is key to unlocking your financial potential. Here are some tips:

- Regularly Review Your Credit Report: Identify and correct errors promptly.

- Pay Bills on Time: Late payments can negatively impact your score.

- Limit New Credit Applications: Frequent applications can lower your score.

- Maintain a Healthy Credit Utilization Ratio: Keep it below 30% for optimal scores.

Credit reporting solutions offer a path to better financial management. By leveraging tools like Fabrick, you can enhance your credit health and secure a brighter financial future.

Frequently Asked Questions

What Are Credit Reporting Solutions?

Credit reporting solutions provide services to assess and improve your credit score. They offer detailed credit reports, monitoring, and identity theft protection.

How Do Credit Reporting Solutions Work?

Credit reporting solutions gather data from financial institutions. They analyze your credit history and provide reports. These solutions also offer tools to improve your credit score.

Why Use Credit Reporting Solutions?

Using credit reporting solutions helps you monitor your credit score. They can detect errors and identity theft, helping maintain a healthy credit profile.

Are Credit Reporting Solutions Accurate?

Most credit reporting solutions are accurate. They use data from major credit bureaus. Regularly checking your report ensures it remains correct.

Conclusion

Effective credit reporting solutions can greatly benefit your business. Fabrick offers reliable tools for managing credit data. These solutions help you make informed decisions. Improve your credit management today. Visit the Fabrick website for more details. Click here to explore Fabrick’s offerings. Take control of your credit reporting needs with confidence.