Credit Reporting For Businesses: Unlocking Financial Success

Credit reporting for businesses is crucial for financial health. Understanding how it works can safeguard your company’s future.

Every business needs to monitor its credit report. Your company’s credit report impacts your ability to secure loans, negotiate better terms, and attract investors. Business credit reports are a reflection of your financial responsibility and stability. Keeping a good credit report can be challenging, but it is essential for growth. Tools like the Flex Financial Platform can help. Flex integrates banking, payments, and expense management into one app. It offers significant benefits, including simplified financial management and enhanced security. Learn how to manage your business credit effectively and explore tools like Flex to support your financial growth. For more information, check out Flex here.

Introduction To Credit Reporting For Businesses

Credit reporting for businesses is vital. It helps organizations understand their creditworthiness. This process involves gathering, analyzing, and presenting credit-related information. Accurate credit reports are essential for making informed financial decisions.

Understanding Business Credit Reports

Business credit reports offer a detailed view of a company’s financial health. They include:

- Credit history: Payment records, outstanding debts, and credit utilization.

- Public records: Bankruptcies, liens, and judgments.

- Business details: Ownership, business type, and operational data.

- Financial stability: Profitability, revenue, and cash flow.

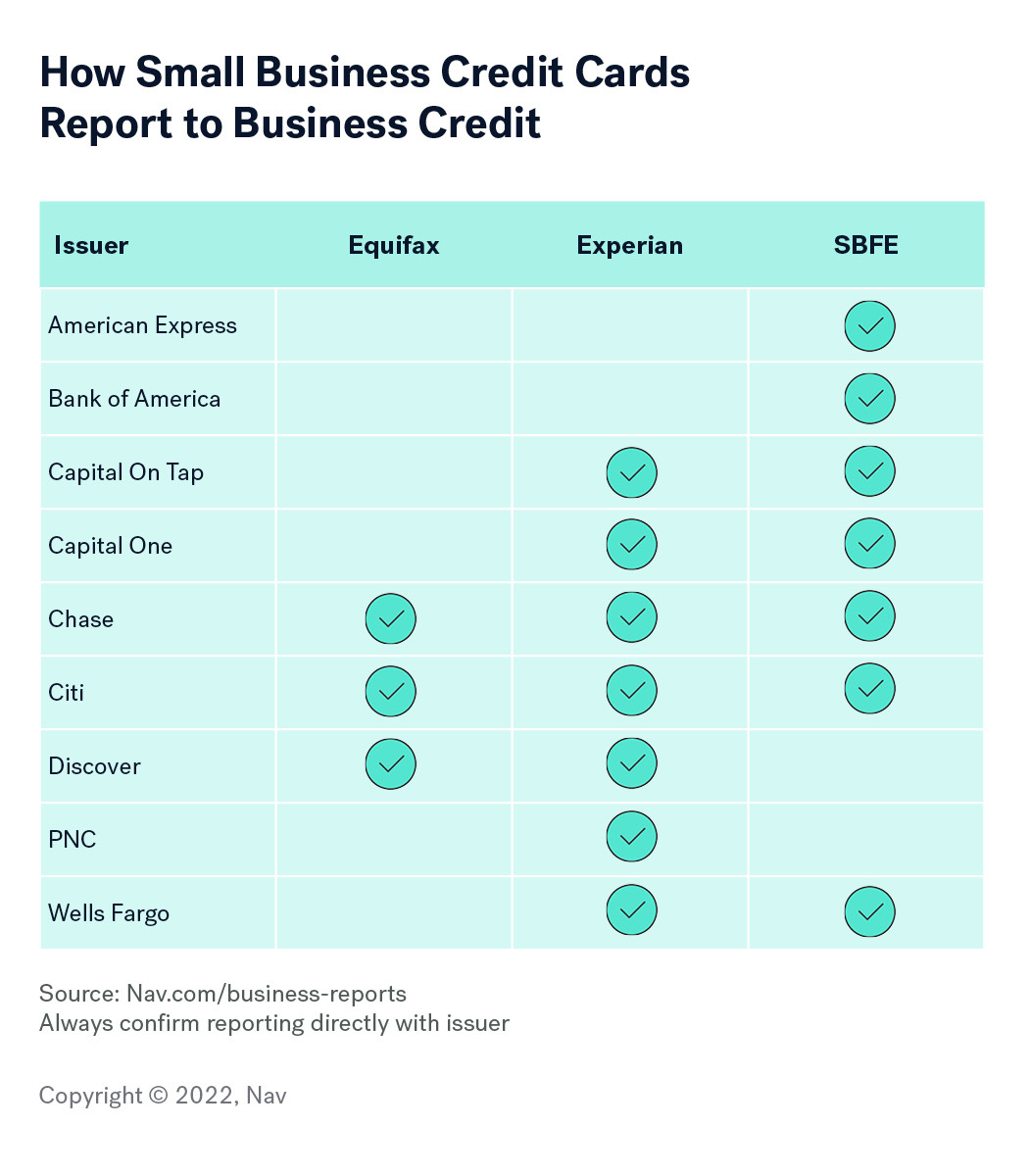

These reports come from credit bureaus like Dun & Bradstreet, Experian, and Equifax. Each bureau may have different information and scoring models.

Purpose And Importance Of Business Credit Reporting

Business credit reporting serves multiple purposes. It helps businesses:

- Evaluate financial health: Understand creditworthiness and manage finances better.

- Secure financing: Lenders use credit reports to decide on loan approvals.

- Build credibility: A good credit report boosts trust with suppliers and partners.

- Manage risks: Identify potential financial risks and take preventive actions.

Using a platform like Flex can enhance these benefits. Flex offers integrated back-office functionalities, simplifying financial management. Its features include:

| Feature | Description |

|---|---|

| Flex Banking | Simplified banking, payments, and expense management. Earn up to 2.99% APY on idle cash. |

| Flex Credit Card | Net-60 on all business purchases. 0% interest for 60 days (if balance is paid within the grace period). |

| Security Features | Proactive protection, industry-standard encryption, automated fraud monitoring. |

Flex enhances cash flow and financial security for businesses. It’s a comprehensive tool for managing and improving business credit.

Key Features Of Business Credit Reports

Understanding the key features of business credit reports is crucial for managing your company’s financial health. These reports provide a detailed snapshot of your business’s creditworthiness. They help in making informed financial decisions and fostering better relationships with lenders and suppliers.

Detailed Financial History

A business credit report includes a detailed financial history. This section covers important aspects like:

- Past financial performance

- Revenue trends

- Profit margins

- Debt levels

It provides insights into how well a business manages its finances over time.

Credit Score And Rating

The credit score and rating are essential components of a business credit report. These scores are calculated based on:

- Payment history

- Credit utilization

- Outstanding debts

- Length of credit history

Higher scores indicate better creditworthiness, making it easier to secure loans and favorable terms.

Trade Credit Information

The report also includes trade credit information. This section details:

- Trade lines

- Payment terms

- Supplier relationships

- Credit limits

It helps businesses understand their trade credit practices and improve their credit standing.

Public Records And Legal Filings

Public records and legal filings are crucial for assessing potential risks. This section includes:

- Bankruptcies

- Liens

- Judgments

- UCC filings

Keeping an eye on this information helps businesses avoid legal issues and maintain a clean credit record.

How Business Credit Reporting Benefits Your Company

Understanding the importance of business credit reporting is crucial for any company. It provides numerous advantages that can propel your business forward. Let’s explore how.

Improving Loan And Credit Approvals

A strong business credit report enhances your chances of getting loans and credit approvals. Lenders assess your creditworthiness based on your credit history. A favorable report indicates reliable financial behavior.

With Flex Financial Platform, you can improve your credit with features such as:

- Net-60 on all business purchases

- 0% interest for 60 days (if balance is paid within the grace period)

- Credit limits that grow with your business

Enhancing Business Relationships

Suppliers and vendors often check business credit reports before extending credit terms. A positive credit report builds trust and strengthens relationships. It shows your ability to pay on time and manage finances responsibly.

Using Flex, you can manage expenses effectively with:

- Individual employee cards at no extra cost

- Simplified banking, payments, and expense management

Mitigating Financial Risks

Business credit reports help in assessing financial risks. By monitoring your credit report regularly, you can detect and address potential issues early. This proactive approach safeguards your business from financial pitfalls.

Flex provides robust security features, including:

- Industry-standard encryption for data security

- Automated fraud monitoring and compliance

- Proactive protection like phishing deterrence and device verification

Attracting Investors And Partners

Investors and partners look at your business credit report to evaluate stability and potential. A strong credit report can attract more investors and form lucrative partnerships. It reflects your business’s financial health and reliability.

With Flex, you can showcase financial strength through features like:

- Earn up to 2.99% APY on idle cash

- FDIC insurance up to $3M through Thread Bank

- Treasury product offering up to $75M in FDIC insurance

In summary, utilizing the Flex Financial Platform can significantly benefit your company’s credit reporting. This, in turn, improves loan approvals, enhances relationships, mitigates risks, and attracts investors.

Pricing And Affordability Of Business Credit Reports

Understanding the pricing and affordability of business credit reports is crucial for businesses. It helps in budgeting and ensures the right decisions for financial growth. With various credit reporting services available, it’s essential to know the cost breakdown and value each option offers.

Cost Breakdown Of Different Credit Reporting Services

The cost of business credit reports varies significantly. Here’s a breakdown of the most common pricing structures:

- Basic Reports: These typically range from $30 to $50 per report. They include fundamental information such as credit scores and payment history.

- Comprehensive Reports: These can cost between $100 to $200. They offer detailed insights into financial health, credit risk, and public records.

- Subscription Plans: Many services offer monthly or annual subscription plans. Prices range from $50 per month to $600 annually, providing unlimited access to credit reports.

Free Versus Paid Reports

Businesses can opt for free or paid credit reports. Each option has its pros and cons:

| Feature | Free Reports | Paid Reports |

|---|---|---|

| Cost | $0 | $30 – $200 |

| Detail Level | Basic | Comprehensive |

| Frequency | Limited | Unlimited (with subscription) |

| Support | Minimal | Dedicated |

Value For Money: What You Get For Your Investment

Investing in paid business credit reports can offer significant value. Here’s what you get:

- Accurate Data: Paid reports provide more accurate and detailed information.

- Timely Updates: Regular updates ensure you have the latest financial insights.

- Enhanced Features: Access to tools for monitoring credit health and alerts for any changes.

- Customer Support: Dedicated support to help interpret and utilize the reports effectively.

In summary, while free reports can provide a basic overview, paid reports offer comprehensive data and support. This can be invaluable for making informed business decisions.

Pros And Cons Of Business Credit Reporting

Business credit reporting plays a crucial role in maintaining a company’s financial health. Understanding the pros and cons can help businesses make informed decisions. This section explores the advantages, potential drawbacks, and how to balance the costs and benefits.

Advantages Of Monitoring Your Business Credit

Monitoring your business credit offers several significant benefits:

- Improved Financing Options: A strong credit profile can lead to better loan terms and higher credit limits.

- Better Vendor Relationships: Vendors may offer more favorable terms and conditions to businesses with good credit.

- Enhanced Cash Flow Management: With tools like the Flex Financial Platform, businesses can streamline expense management and improve cash flow.

- Risk Mitigation: Regular credit monitoring helps identify potential fraud early, protecting your business from financial losses.

Using a platform like Flex can simplify these processes, integrating banking, payments, and credit management.

Potential Drawbacks And Limitations

While monitoring business credit has many benefits, there are some drawbacks to consider:

- Cost: Some credit monitoring services come with fees, which can add up over time.

- Time-Consuming: Regularly checking credit reports and managing discrepancies can be time-intensive.

- Incomplete Information: Not all transactions and financial activities may be reported, potentially leading to an incomplete credit profile.

It’s important to weigh these limitations against the potential benefits to determine if credit monitoring is right for your business.

Balancing Costs And Benefits

Businesses should evaluate the costs associated with credit reporting and monitoring:

| Cost Factor | Benefits |

|---|---|

| Service Fees | Improved loan terms, better vendor relationships |

| Time Investment | Enhanced cash flow, risk mitigation |

| Incomplete Reports | Proactive fraud detection, financial management |

Platforms like Flex can help streamline these processes by integrating back-office functions into a single, user-friendly system. This can make balancing the costs and benefits more manageable.

Recommendations For Ideal Users And Scenarios

The Flex Financial Platform is a comprehensive tool for various business scenarios. It integrates banking, credit, and expense management into a single, user-friendly platform. Here are the ideal users and scenarios where Flex can be most beneficial.

Small Businesses And Startups

Small businesses and startups can greatly benefit from the Flex Financial Platform. The Flex Credit Card offers net-60 terms, providing interest-free credit for up to 60 days. This feature helps in managing cash flow efficiently.

- Simplified banking and expense management.

- Issue individual employee cards at no extra cost.

- Secure transactions with Multi-Factor Authentication.

Established Companies Looking To Expand

For established companies aiming to expand, Flex offers significant advantages. Its high FDIC insurance coverage and treasury product options provide security for larger funds.

- Earn up to 2.99% APY on idle cash.

- Access to $75M in FDIC insurance through ADM.

- Streamlined payments with free ACH/wire transfers.

Businesses Seeking Investors Or Loans

Businesses seeking investors or loans can leverage Flex’s robust financial management features. Accurate financial records and streamlined expense tracking can enhance investor confidence.

- Detailed expense tracking and management.

- Automated fraud monitoring for security.

- High credit limits that grow with the business.

Companies With High Trade Credit Activity

Companies with high trade credit activity will find Flex’s credit card features particularly useful. The net-60 terms allow for better cash flow management and reduced financial stress.

- 0% interest for the first 60 days if the balance is paid in full.

- Secure transactions with robust encryption.

- Enhanced financial security with automated fraud monitoring.

For more information about Flex, visit the official Flex website.

Frequently Asked Questions

What Is Business Credit Reporting?

Business credit reporting involves tracking a company’s financial history. It assesses creditworthiness and provides insights for lenders and suppliers.

How To Check Business Credit Report?

To check your business credit report, contact major credit bureaus. You can request a report online through their websites.

Why Is Business Credit Important?

Business credit is important for securing loans, attracting investors, and establishing vendor relationships. It affects terms and rates offered.

How To Build Business Credit?

To build business credit, register your business, obtain an EIN, and open credit lines. Ensure timely payments and monitor credit reports.

Conclusion

Understanding credit reporting for businesses is crucial for financial health. Good credit can open doors to better financing options. Regularly monitor and manage your business credit reports. This proactive approach ensures financial stability and growth. For an efficient financial management tool, consider using the Flex Financial Platform. Flex simplifies banking, expense management, and offers valuable credit options. It’s a comprehensive solution to streamline your business finances.