Credit Report Repair: Boost Your Score Fast and Effectively

Your credit report holds significant power over your financial life. A poor credit score can limit your opportunities.

Repairing your credit report is essential for financial health. Many people struggle with credit issues. They face high interest rates, loan rejections, and financial stress. The good news is that credit report repair is possible. It involves identifying errors, paying off debts, and making smarter financial choices. This process helps improve your score and access better financial opportunities. Understanding how to repair your credit can open doors to better loans, credit cards, and even job prospects. For those seeking personal loans to manage debt or finance needs, services like Personal Loans® connect borrowers with a network of lenders. Let’s explore how credit report repair works and why it’s vital for your financial future.

Introduction To Credit Report Repair

Understanding credit report repair is essential for maintaining a healthy financial life. Your credit report impacts your ability to get loans, credit cards, and even jobs. Poor credit can lead to higher interest rates and fewer financial opportunities. This guide will help you understand credit report repair and its importance.

What Is Credit Report Repair?

Credit report repair involves fixing errors on your credit report. It also includes improving your credit score through various strategies. These errors can include incorrect personal information, inaccurate account statuses, and unauthorized transactions.

Credit report repair services identify and dispute these errors. They also provide guidance on improving your credit habits. Some common steps in credit report repair are:

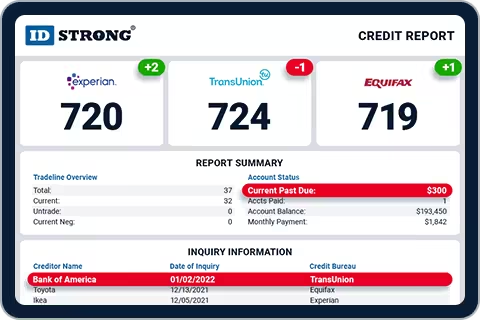

- Reviewing your credit reports from all three major bureaus

- Identifying errors and inconsistencies

- Filing disputes with the credit bureaus

- Following up on dispute resolutions

Why Is Credit Report Repair Important?

Credit report repair is crucial for several reasons. First, it helps you ensure your credit report is accurate. This accuracy is vital for lenders who assess your creditworthiness.

Second, an improved credit score can lead to better loan terms. Lower interest rates save you money in the long run. For example:

| Loan Amount | Term | APR | Monthly Payment | Total Payment |

|---|---|---|---|---|

| $8,500 | 2 Years | 6.99% | $380.53 | $9,132.68 |

| $10,000 | 3 Years | 8.34% | $314.93 | $11,337.64 |

| $15,000 | 4 Years | 10.45% | $383.69 | $18,417.05 |

| $20,000 | 5 Years | 8.54% | $410.72 | $24,646.98 |

| $30,000 | 6 Years | 7.99% | $525.85 | $37,861.25 |

Lastly, good credit is essential for various life events. This includes renting an apartment, buying a car, or starting a business. Repairing your credit report can open doors to these opportunities.

Key Features Of Effective Credit Report Repair Services

Effective credit report repair services can help you improve your credit score and financial health. These services offer various features to ensure your credit report is accurate and up-to-date. Below are some key features to look for in a credit report repair service.

Comprehensive Credit Analysis

A thorough comprehensive credit analysis is the first step in the credit repair process. This involves a detailed review of your credit report to identify errors and areas for improvement. Key elements include:

- Reviewing all three major credit bureau reports

- Identifying inaccuracies and outdated information

- Highlighting areas where your credit score can be improved

Customized Dispute Process

An effective credit repair service offers a customized dispute process. This means they tailor their approach based on your specific credit report issues. Key components include:

- Drafting personalized dispute letters to credit bureaus

- Following up on disputes to ensure errors are corrected

- Working with creditors to resolve inaccuracies

Credit Counseling And Education

Another important feature is credit counseling and education. These services provide you with the knowledge and tools to manage your credit better. Key elements include:

- Offering financial education resources

- Providing tips for maintaining a good credit score

- Guidance on budgeting and debt management

Ongoing Credit Monitoring

Effective credit repair services also offer ongoing credit monitoring. This ensures that any changes to your credit report are tracked and addressed promptly. Key components include:

- Regular updates on your credit report status

- Alerts for any new entries or changes

- Continuous monitoring to prevent future inaccuracies

| Feature | Description |

|---|---|

| Comprehensive Credit Analysis | Detailed review of credit reports to identify errors and areas for improvement |

| Customized Dispute Process | Tailored approach to resolving credit report inaccuracies |

| Credit Counseling and Education | Resources and guidance for managing and improving credit |

| Ongoing Credit Monitoring | Continuous tracking of credit report changes |

How Each Feature Benefits You

Repairing your credit report can feel overwhelming. Understanding the key features and their benefits can simplify the process. Let’s dive into the essential elements of credit report repair and how they can help you.

Understanding Comprehensive Credit Analysis

A comprehensive credit analysis breaks down your credit report to identify inaccuracies. This step is crucial because even small errors can affect your credit score. By understanding each element, you get a clear picture of your financial status and areas that need improvement.

- Identify negative items affecting your score

- Highlight discrepancies and errors

- Provide a detailed overview of your credit history

The Importance Of A Customized Dispute Process

A customized dispute process ensures that your specific credit issues are addressed. This tailored approach improves the chances of successfully removing inaccuracies from your report.

| Benefit | Description |

|---|---|

| Targeted Disputes | Focus on the most impactful errors first |

| Personalized Strategy | Adjust dispute tactics based on your unique situation |

Gains From Credit Counseling And Education

Credit counseling and education provide valuable knowledge to manage your finances better. Understanding how credit works can prevent future issues and improve your financial habits.

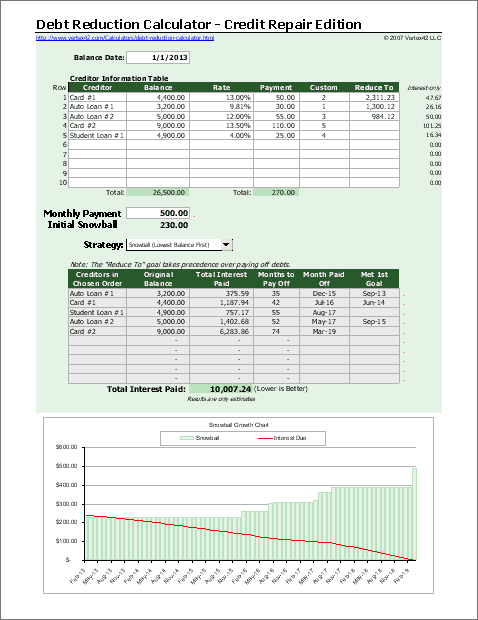

- Learn effective budgeting techniques

- Understand how to maintain a healthy credit score

- Receive advice on debt management

Advantages Of Ongoing Credit Monitoring

Ongoing credit monitoring keeps you informed about changes in your credit report. This proactive measure helps you detect potential problems early and take action before they escalate.

- Receive alerts for new inquiries or accounts

- Track improvements in your credit score

- Stay updated with monthly credit report summaries

These features collectively provide a robust framework to repair and maintain a healthy credit report. By leveraging these benefits, you can take control of your financial future.

Pricing And Affordability Of Credit Repair Services

Choosing the right credit repair service depends on many factors. Pricing and affordability are key considerations. Understanding the cost breakdown and comparing providers can help you make an informed decision.

Typical Cost Breakdown

Credit repair services vary in cost. Below is a typical breakdown of charges you might encounter:

| Service | Cost Range |

|---|---|

| Initial Setup Fee | $19 – $199 |

| Monthly Fee | $49 – $129 |

| Pay-Per-Deletion | $25 – $125 per item |

Initial setup fees cover the cost of starting your service. Monthly fees are ongoing charges for maintaining your account. Pay-per-deletion fees are charged for each negative item removed from your report.

Comparing Different Service Providers

Different providers offer various packages and pricing models. Here are some tips to compare:

- Read reviews to understand customer satisfaction.

- Check for hidden fees that might not be disclosed upfront.

- Evaluate the range of services offered. Some providers offer additional benefits like credit monitoring.

- Look at refund policies in case you are not satisfied with the service.

Personal Loans® is one such service that connects borrowers with lenders. Though primarily focused on loans, they also offer credit-related products. Their service is free, but lenders may charge fees. Always check these details before committing.

By understanding the typical costs and comparing providers, you can choose a service that fits your needs and budget.

Pros And Cons Of Credit Report Repair Services

Credit report repair services can help improve your credit score. But, it’s crucial to weigh the pros and cons before opting for these services. Below, we will discuss the advantages and potential drawbacks of using professional credit report repair services.

Advantages Of Using Professional Services

- Expertise and Knowledge: Professionals understand credit laws and how to dispute errors effectively.

- Time-Saving: Repairing credit can be time-consuming. Professionals handle the process for you, saving precious time.

- Stress Reduction: The process of fixing credit issues can be stressful. Experts can alleviate this burden.

- Access to Resources: They have access to advanced tools and resources that can expedite the repair process.

- Long-Term Benefits: Improved credit scores can lead to better loan terms and lower interest rates in the future.

Potential Drawbacks To Consider

- Cost: Professional services can be expensive. Fees vary depending on the service provider.

- No Guaranteed Results: No service can guarantee a specific outcome. Results depend on the accuracy of disputes and the creditor’s response.

- Scams: The market has many fraudulent companies. It is essential to research and choose reputable services.

- Time Commitment: Even with professional help, the repair process can take several months.

Recommendations For Ideal Users

Credit report repair can be a vital service for those struggling with their credit scores. Understanding who can benefit most from these services is crucial. This section highlights the ideal users of credit report repair services and the best scenarios for their use.

Who Should Consider Credit Report Repair?

Individuals with poor or fair credit scores are the primary candidates for credit report repair. If your credit report contains errors, negative items, or outdated information, credit repair services may help. Those denied loans or credit cards due to credit issues should consider these services.

People aiming to improve their creditworthiness for significant financial decisions, like buying a home or starting a business, might also benefit. Credit repair services can provide the necessary tools and guidance to help improve credit scores.

Best Scenarios For Using Credit Repair Services

Credit repair services are ideal in several scenarios. Errors on your credit report can significantly lower your score. These errors might include incorrect personal information, accounts that aren’t yours, or outdated negative items.

Another suitable scenario is identity theft victims. If your identity has been stolen, your credit report might contain fraudulent accounts and transactions. Credit repair services can help rectify these issues and restore your credit profile.

Lastly, if you’re planning a major purchase, like a home or car, having a good credit score is essential. Improving your credit score through repair services can lead to better loan terms and interest rates, saving you money in the long run.

Frequently Asked Questions

How Can I Repair My Credit Report?

To repair your credit report, review it for errors, dispute inaccuracies, pay off outstanding debts, and make timely payments.

How Long Does Credit Repair Take?

Credit repair typically takes between three to six months, but it depends on the complexity of your situation.

Can I Fix My Credit Report Myself?

Yes, you can fix your credit report yourself by reviewing it, disputing errors, and improving your financial habits.

What Errors Should I Look For On My Credit Report?

Look for incorrect personal information, outdated accounts, duplicate debts, and unauthorized transactions on your credit report.

Conclusion

Repairing your credit report takes time and effort. Stay patient and persistent. Small steps can lead to big improvements. Always check your credit report for errors. Dispute inaccuracies right away. Consider using services like Personal Loans® for financial needs. They offer flexible loan options. This can help manage your debts better. A good credit score opens many doors. Keep working towards your financial goals. Success is within reach.