Credit Report Disputes: How to Fix Your Credit Score Fast

Navigating the world of credit reports can be confusing. Disputes add another layer of complexity.

Understanding how to dispute errors on your credit report is crucial. Incorrect information can harm your credit score, affecting loan approvals and interest rates. This guide will help you navigate credit report disputes, offering tips and insights to ensure your report accurately reflects your financial history. Keep reading to learn how to protect your credit and improve your financial health. For businesses, tools like the FairFigure Capital Card can be invaluable. It offers real-time credit monitoring, helps build business credit, and provides same-day funding access. Learn more about FairFigure’s offerings here.

Introduction To Credit Report Disputes

Credit report disputes are essential for maintaining an accurate credit score. Mistakes can lower your credit score, affect loan approvals, and increase interest rates. Understanding how to dispute errors can help you protect your financial health.

Understanding The Importance Of Your Credit Score

Your credit score is a numerical representation of your creditworthiness. Lenders use it to assess your risk level. A high credit score can lead to better loan terms and lower interest rates. Conversely, a low credit score can limit your financial options.

Errors on your credit report can negatively impact your credit score. Correcting these errors is crucial. FairFigure Capital Card provides tools to monitor and correct your business credit report. This can improve your credit score by up to 60%.

Common Errors Found In Credit Reports

Several types of errors can appear on credit reports. These include:

- Incorrect personal information: Wrong name, address, or Social Security number.

- Account status errors: Closed accounts reported as open, or incorrect account balances.

- Duplicate accounts: Same debt reported multiple times.

- Fraudulent accounts: Accounts opened in your name without your knowledge.

- Incorrect payment history: Late payments incorrectly reported.

FairFigure Capital Card offers a unique credit correction tool. It helps identify and correct wrong information on your business credit report.

To dispute errors, you need to gather supporting documents. Submit a dispute to the credit bureau reporting the error. The bureau will investigate and correct any mistakes.

Identifying Errors On Your Credit Report

Your credit report is a crucial document. It impacts your financial decisions and opportunities. Identifying errors on it is essential for maintaining a healthy credit score. Let’s explore how to obtain your credit report, the types of errors to look for, and the impact these errors can have on your credit score.

How To Obtain Your Credit Report

Obtaining your credit report is the first step in identifying errors. You can request a free copy from each of the three major credit bureaus once a year. Here’s how:

- Visit AnnualCreditReport.com.

- Provide your personal information to verify your identity.

- Select the bureau (Equifax, Experian, TransUnion) from which you want the report.

Reviewing these reports regularly helps you spot any inaccuracies and address them promptly.

Types Of Errors To Look For

Errors on credit reports can vary. Here are the most common types to watch out for:

- Personal Information: Incorrect name, address, or social security number.

- Account Information: Accounts that you did not open.

- Payment History: Late payments that you made on time.

- Balance Errors: Incorrect account balances.

- Duplicate Accounts: The same account listed more than once.

Ensuring this information is accurate can prevent potential issues with lenders and creditors.

The Impact Of Errors On Your Credit Score

Errors on your credit report can significantly impact your credit score. Here’s how:

| Error Type | Potential Impact |

|---|---|

| Incorrect Payment History | Can lower your score significantly. |

| Wrong Account Information | May result in higher debt calculations. |

| Personal Information Errors | Can lead to identity theft risks. |

Correcting these errors promptly helps maintain an accurate credit score, which is essential for obtaining favorable credit terms.

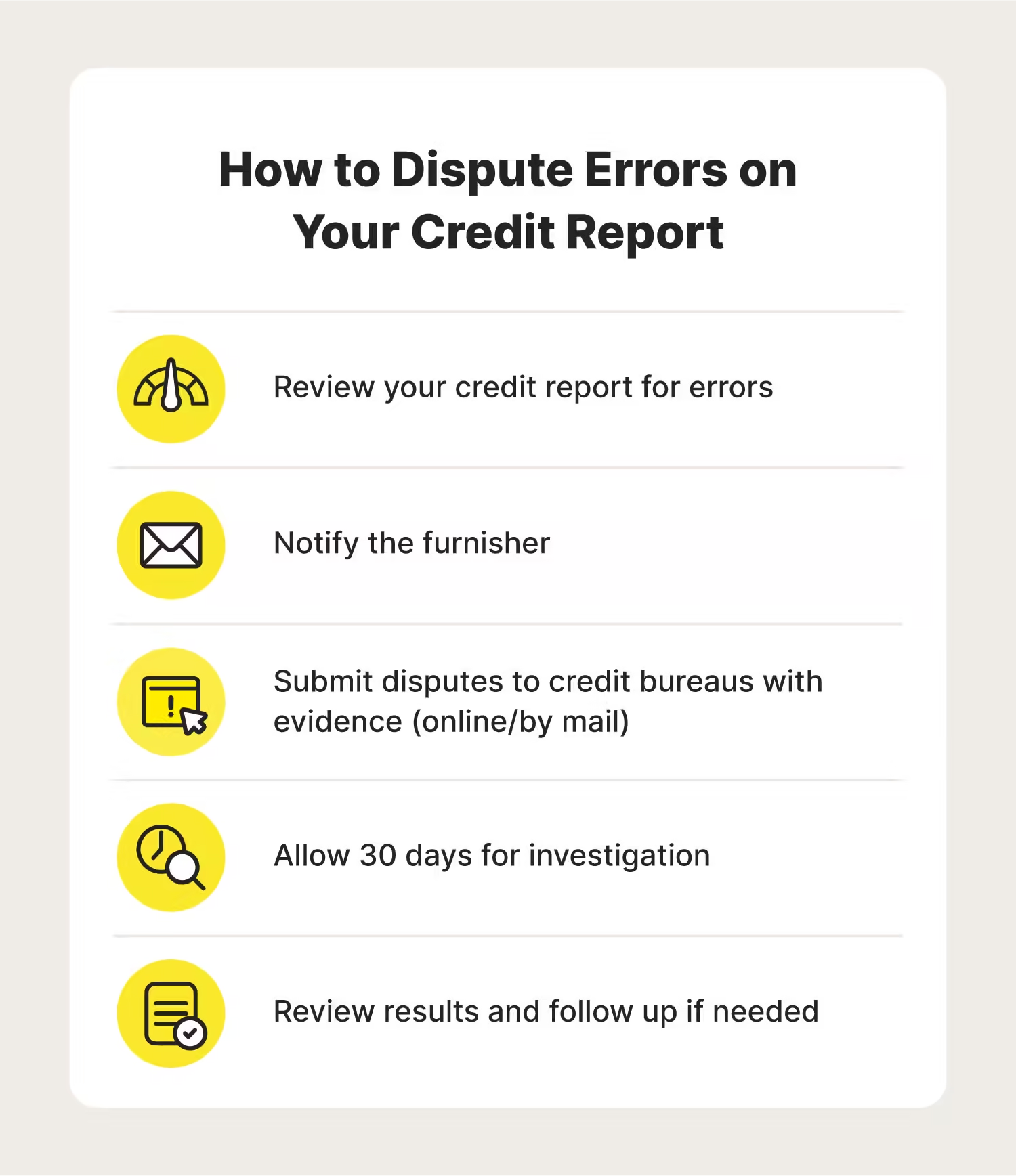

Steps To Dispute Credit Report Errors

Disputing errors on your credit report is crucial for maintaining a healthy credit score. Follow these steps to effectively resolve inaccuracies and ensure your credit report reflects accurate information.

Gathering Necessary Documentation

Start by collecting all relevant documents. These can include:

- Credit report from each bureau

- Proof of the error (e.g., statements, receipts)

- Personal identification (driver’s license, Social Security card)

Having these documents ready will streamline the dispute process.

Contacting Credit Bureaus

Next, reach out to the credit bureaus. Here is their contact information:

| Credit Bureau | Contact Information |

|---|---|

| Equifax | Equifax Dispute Page |

| Experian | Experian Dispute Page |

| TransUnion | TransUnion Dispute Page |

Visit their dispute pages to start the process online.

Writing A Dispute Letter

Write a clear and concise dispute letter. Include:

- Your full name and contact information

- A description of the error

- Supporting documents proving the error

- Request for correction

Here’s a sample template:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Credit Bureau Name]

[Address]

[City, State, ZIP Code]

Re: [Your Account Number]

Dear [Credit Bureau Name],

I am writing to dispute an error on my credit report. The item in question is [describe the item and the error]. Enclosed are copies of [describe any enclosed documents] supporting my position. Please correct this information as soon as possible.

Thank you for your assistance.

Sincerely,

[Your Name]

Following Up On Your Dispute

After submitting your dispute, follow up to ensure resolution. The credit bureau must investigate within 30 days. Keep track of:

- Response deadlines

- Communication records

- Updated credit reports

If the error persists, consider reaching out to the FairFigure Capital Card for additional support in correcting your business credit report.

Using Credit Repair Services

Credit repair services can be a valuable tool for individuals struggling with credit report disputes. These services offer expertise and resources to help correct inaccuracies on your credit report, potentially improving your credit score. Understanding when and how to use these services can make a significant difference in managing your financial health.

When To Consider Professional Help

Consider professional help if you feel overwhelmed by the credit dispute process or have limited time. Credit repair services can be particularly useful if you’ve tried resolving issues on your own without success. They have experience dealing with credit bureaus and can often expedite the process. If you’re unfamiliar with credit laws or need expert advice, professional help might be beneficial.

Evaluating Credit Repair Companies

When choosing a credit repair company, it’s essential to do thorough research. Look for companies with a proven track record and positive customer reviews. Verify their credentials and ensure they comply with the Credit Repair Organizations Act (CROA). It’s also wise to check if they offer transparent pricing and a clear explanation of their services.

| Criteria | Questions to Ask |

|---|---|

| Reputation | Do they have positive reviews and testimonials? |

| Compliance | Are they compliant with CROA? |

| Transparency | Do they offer clear pricing and service details? |

The Benefits And Drawbacks Of Using A Service

Using a credit repair service has several benefits. They save you time and effort by handling the dispute process. Experts can identify and correct errors more efficiently. They also provide guidance on improving your credit score.

- Benefits:

- Time-saving

- Expertise in credit laws

- Efficient error correction

However, there are also drawbacks to consider. Credit repair services can be costly, and not all companies deliver on their promises. Some may engage in unethical practices, which can harm your credit further. It’s crucial to choose a reputable company and understand the potential risks involved.

- Drawbacks:

- High costs

- Potential for unethical practices

- Not all disputes may be resolved

By weighing the benefits and drawbacks, you can make an informed decision on whether using a credit repair service is right for you.

Additional Tips To Improve Your Credit Score Fast

Improving your credit score can open doors to better loan rates and financial opportunities. Here are some effective tips to boost your credit score quickly.

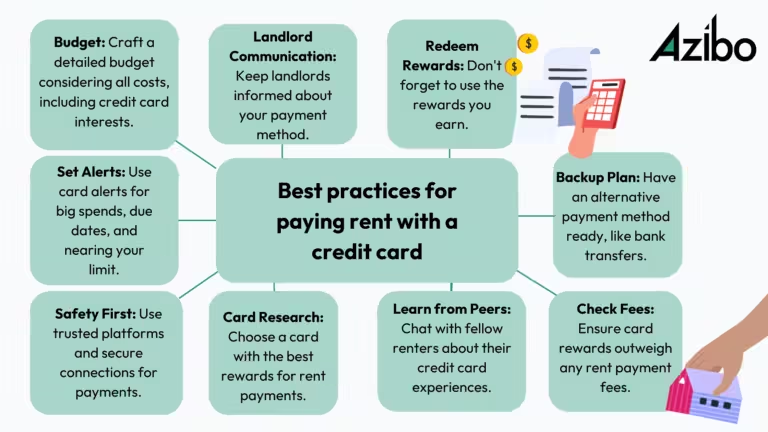

Paying Down Balances

One of the fastest ways to improve your credit score is by paying down balances. High balances on credit cards can negatively impact your credit utilization ratio. Aim to reduce your credit card balances to less than 30% of your credit limit. This demonstrates responsible credit usage and can lead to quick score improvements.

Avoiding New Credit Inquiries

Each time you apply for new credit, an inquiry appears on your credit report. Too many inquiries in a short period can lower your score. Instead, focus on managing your existing credit responsibly. This will show lenders that you are a stable borrower.

Building A Positive Credit History

Consistently making on-time payments is key to building a positive credit history. Over time, this will significantly boost your credit score. Consider using tools like the FairFigure Capital Card, which reports your payment history to commercial bureaus. This can help enhance your business credit score by up to 60%.

| Action | Impact on Credit Score |

|---|---|

| Paying down balances | Reduces credit utilization ratio |

| Avoiding new credit inquiries | Prevents score reduction from multiple inquiries |

| Building a positive credit history | Shows responsible borrowing behavior |

Using these strategies can help you improve your credit score quickly. Remember, tools like the FairFigure Capital Card can be a valuable asset in your credit-building journey.

Monitoring Your Credit After Disputes

After disputing errors on your credit report, it’s crucial to monitor your credit closely. This ensures that corrections are accurately reflected and no new mistakes appear. Regular monitoring can help you maintain a healthy credit score, which is essential for securing funding and building business credit.

Setting Up Credit Monitoring Services

Setting up credit monitoring services is a proactive step in managing your credit health. Services like FairFigure offer real-time monitoring of business tri-bureau scores. This includes detailed reports that help you stay informed about your credit status.

- Real-time monitoring: Keep track of your credit score changes as they happen.

- Detailed reports: Understand your credit status with comprehensive insights.

- Error detection: Identify and correct any inaccuracies promptly.

Using a service like FairFigure ensures that you receive instant alerts about any changes. This allows you to address potential issues quickly, preventing them from impacting your credit.

Regularly Reviewing Your Credit Report

Regularly reviewing your credit report is essential for maintaining accurate information. You should check your report from all three major bureaus: Equifax, Experian, and TransUnion.

- Request your credit report from each bureau.

- Review each section for inaccuracies or outdated information.

- Dispute any errors with the respective credit bureau.

It’s recommended to review your credit report at least once every four months. This ensures that you catch any errors early and maintain an accurate credit history.

Staying Informed On Credit Score Changes

Staying informed on credit score changes helps you understand how different actions affect your score. This can include new accounts, credit inquiries, or changes in your credit utilization.

| Action | Impact on Credit Score |

|---|---|

| Opening a new account | Slight decrease initially |

| Paying off a debt | Potential increase |

| High credit utilization | Decrease |

Services like FairFigure provide real-time insights into your credit score changes. This helps you make informed decisions to improve your credit health continually.

Frequently Asked Questions

What Is A Credit Report Dispute?

A credit report dispute is when you challenge incorrect information on your credit report. It involves contacting credit bureaus to correct inaccuracies.

How To Dispute A Credit Report Error?

To dispute a credit report error, contact the credit bureau with supporting documents. Follow their instructions to submit your dispute.

How Long Do Credit Disputes Take?

Credit disputes typically take 30 days to resolve. The credit bureau investigates and updates you with the results.

Can Disputing Errors Improve My Credit Score?

Yes, disputing errors can improve your credit score. Correcting inaccuracies can lead to a more accurate and potentially higher score.

Conclusion

Improving your credit report takes effort but is achievable. Dispute errors promptly. Use tools like FairFigure Capital Card to monitor and build your business credit. This card offers fast funding and accurate credit reporting. Learn more about it here. Stay proactive to ensure a strong credit profile. Your financial future depends on it.