Credit Report Dispute: Step-by-Step Guide to Fixing Errors

Credit Report Dispute Errors on your credit report can harm your financial health. Resolving these mistakes is crucial.

Disputing items on your credit report might seem daunting, but it’s an important step towards maintaining a healthy credit score. Understanding how to effectively dispute inaccuracies can save you money and improve your financial standing. Having a clean and accurate credit report is essential for securing loans, mortgages, or even renting a home. Mistakes happen, and they can appear on your credit report without warning. By learning the process of disputing these errors, you can take control of your financial future. In this blog post, we will guide you through the steps needed to dispute your credit report effectively, ensuring you have the knowledge and tools to keep your credit in check. For those interested in real estate investing, learning about creative financing can be a game-changer. Explore educational resources like Subto to gain valuable insights and join a community of investors. Subto offers comprehensive courses, community support, and essential documents to help you succeed in real estate.

Introduction To Credit Report Disputes

Your credit report plays a vital role in your financial life. It affects your ability to get loans, credit cards, and even rental agreements. Sometimes, errors in your credit report can harm your credit score. Disputing these errors is crucial to maintaining a healthy credit profile.

Understanding The Importance Of Your Credit Report

A credit report is a detailed summary of your credit history. It includes information about your credit accounts, payment history, and outstanding debts. Lenders use this report to assess your creditworthiness.

Maintaining an accurate credit report is essential. It can impact:

- Interest rates on loans and credit cards

- Approval for mortgages and rental applications

- Employment opportunities, as some employers check credit reports

Common Errors Found In Credit Reports

Credit report errors are more common than you might think. These mistakes can significantly impact your credit score.

Some common errors include:

- Incorrect personal information (name, address, etc.)

- Accounts that do not belong to you

- Duplicate accounts

- Incorrect account status (e.g., showing an account as open when it is closed)

- Outdated information

- Incorrect payment history

Identifying and disputing these errors is essential for maintaining a good credit score.

Gathering Necessary Information

Disputing errors on your credit report involves several key steps. The first step is gathering necessary information. This process ensures that you have all the needed details to support your claim. Here’s how to do it effectively:

Reviewing Your Credit Report

Start by obtaining a copy of your credit report from major credit bureaus. Review each section thoroughly. Look at personal details, credit accounts, and any public records.

Ensure all information is accurate. Note any discrepancies or unfamiliar accounts. This initial review is crucial for identifying errors.

Identifying Errors And Inaccuracies

Once you review your report, focus on finding specific errors. Common errors include:

- Incorrect personal information like name or address.

- Accounts that do not belong to you.

- Incorrect account status (e.g., showing as open when it is closed).

- Duplicate accounts listed multiple times.

- Incorrect balances or credit limits.

Document each error precisely. Note the type of error, the creditor’s name, and the date of the transaction.

Collecting Supporting Documentation

Gather supporting documentation to back up your dispute. This might include:

- Copies of statements showing the correct balance.

- Proof of payments, such as receipts or bank statements.

- Any correspondence with creditors.

- Identification documents to confirm your identity.

Organize these documents logically. Ensure they are clear and legible. This helps in processing your dispute quickly and efficiently.

By thoroughly gathering necessary information, you can effectively challenge errors on your credit report. This step is crucial for a successful dispute.

Initiating The Dispute Process

Disputing errors on your credit report is crucial for maintaining a healthy credit score. Initiating the dispute process is straightforward but requires attention to detail. This section will guide you through the steps to ensure your dispute is handled efficiently.

How To Contact Credit Bureaus

To start the dispute, you must contact the credit bureaus. There are three main credit bureaus in the United States: Equifax, Experian, and TransUnion. Each bureau has its own process for handling disputes.

| Credit Bureau | Contact Information |

|---|---|

| Equifax | Equifax Dispute Department P.O. Box 740256 Atlanta, GA 30374-0256 Phone: 1-800-685-1111 www.equifax.com |

| Experian | Experian Dispute Department P.O. Box 4500 Allen, TX 75013 Phone: 1-888-397-3742 www.experian.com |

| TransUnion | TransUnion Dispute Department P.O. Box 2000 Chester, PA 19016 Phone: 1-800-916-8800 www.transunion.com |

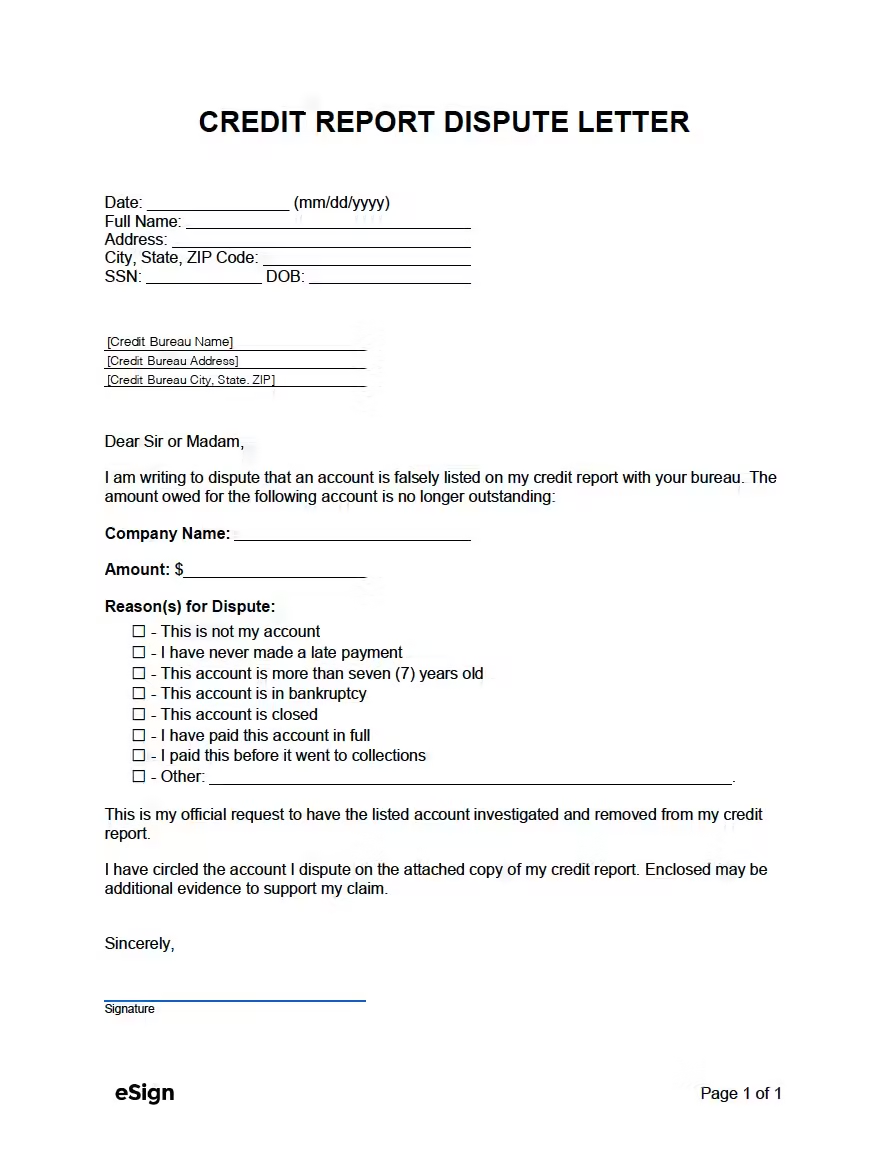

Writing An Effective Dispute Letter

An effective dispute letter is essential. It should be clear, concise, and include all necessary details. Here are the steps to write a strong dispute letter:

- Identify the errors: Clearly state the errors you found on your credit report.

- Provide evidence: Include copies of documents that support your claim.

- State your request: Specify what action you want the credit bureau to take.

- Include your contact information: Provide your full name, address, and phone number.

- Use a polite tone: Be respectful and professional in your communication.

Here is a sample dispute letter format:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Phone Number]

[Date]

[Credit Bureau Name]

[Address]

[City, State, ZIP Code]

Dear [Credit Bureau Name],

I am writing to dispute the following information on my credit report. The items I am disputing are (identify the items disputed by name, account number, and reason for dispute).

Enclosed are copies of (use this sentence to describe any enclosed information, such as payment records, court documents) supporting my position. Please investigate these matters and correct the disputed items as soon as possible.

Thank you for your assistance.

Sincerely,

[Your Name]

Submitting Your Dispute Online

Submitting your dispute online is often faster and more convenient. Each credit bureau offers an online dispute process. Here is how you can submit your dispute online:

- Equifax: Visit Equifax Disputes and follow the instructions.

- Experian: Go to Experian Disputes and submit your dispute.

- TransUnion: Access TransUnion Disputes and complete the online form.

Ensure you have all necessary documents ready to upload. This includes identification and any evidence supporting your dispute. This will help expedite the resolution process.

What To Expect After Filing A Dispute

Filing a dispute on your credit report can be a crucial step in maintaining your financial health. Understanding what to expect after filing a dispute is essential for managing your expectations and ensuring a smooth resolution process.

Timeline For Dispute Resolution

After you file a dispute, the credit bureau typically has 30 days to investigate the claim. They will contact the creditor or lender to verify the information. Here is a general timeline:

| Time Frame | Action |

|---|---|

| Day 1-5 | Credit bureau notifies the creditor |

| Day 6-25 | Credit bureau investigates the dispute |

| Day 26-30 | Credit bureau provides results |

Possible Outcomes Of A Dispute

After the investigation, the outcome can vary:

- Information Updated: If the disputed information is found to be incorrect, it will be updated or removed.

- Information Unchanged: If the information is verified as accurate, it will remain on your report.

- Dispute Rejected: If the bureau cannot verify the dispute, it may be rejected.

How To Follow Up On Your Dispute

Following up on your dispute is important to ensure proper resolution:

- Keep a record of all communications, including dates and names of representatives.

- Check your credit report regularly for updates or changes.

- If the dispute is not resolved to your satisfaction, you can escalate it by contacting the creditor directly or filing a complaint with the Consumer Financial Protection Bureau (CFPB).

By being proactive and informed, you can effectively manage your credit report disputes and maintain your financial well-being.

Dealing With Disputed Items

Disputing items on your credit report can be a crucial step in maintaining a healthy credit score. Whether you are new to real estate investing through SubTo or a seasoned investor, understanding how to handle disputed items is vital. Let’s explore what to do if your dispute is successful, steps to take if your dispute is rejected, and how to escalate your dispute to higher authorities.

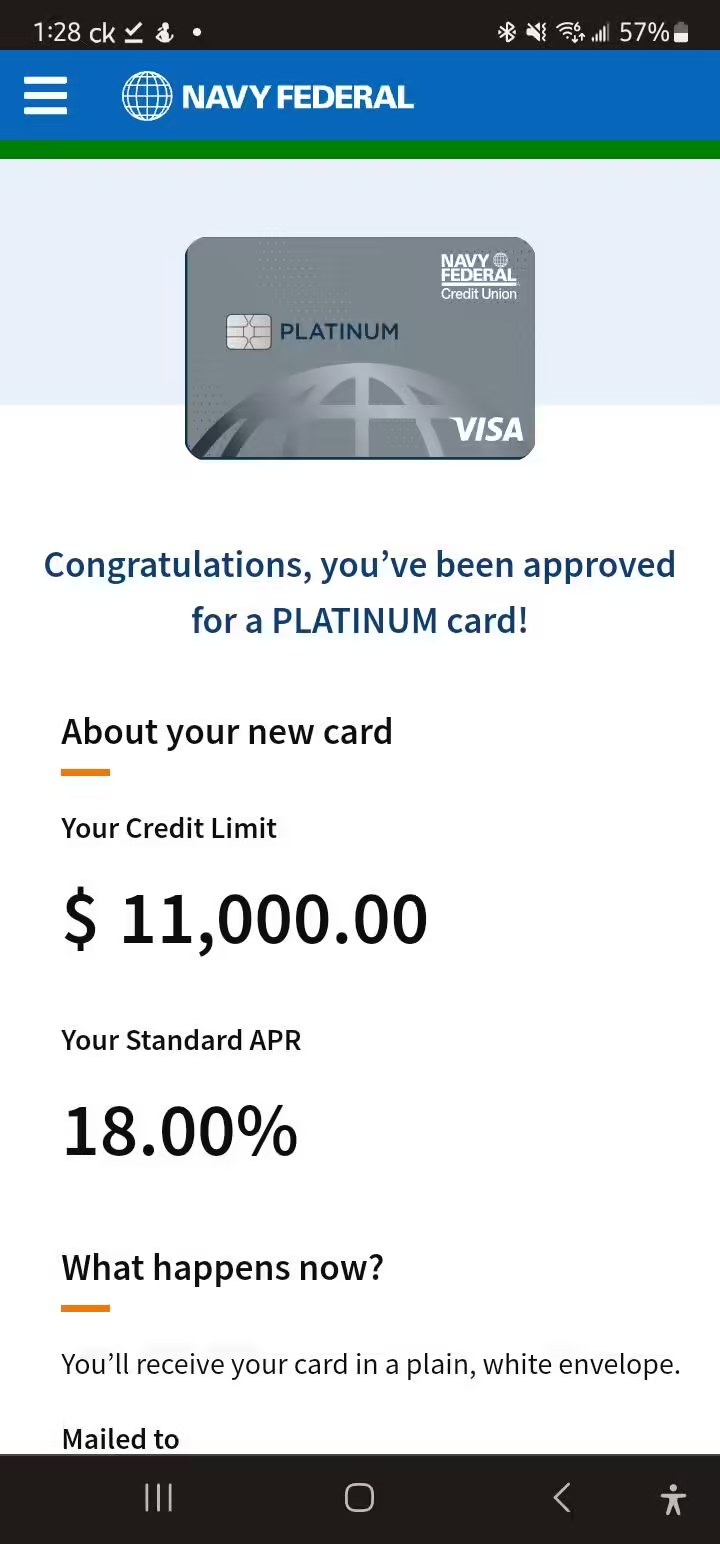

What To Do If Your Dispute Is Successful

If your dispute is successful, your credit report will be updated. The credit bureau will remove or correct the disputed item. Here are the steps to follow:

- Verify Changes: Ensure the updated information is reflected in your credit report.

- Request a New Report: Ask for a free copy of your updated credit report.

- Monitor Your Credit: Keep an eye on your credit report for accuracy.

Steps To Take If Your Dispute Is Rejected

If your dispute is rejected, don’t panic. Follow these steps:

- Review the Response: Understand why the dispute was rejected.

- Gather Evidence: Collect additional documentation to support your claim.

- Resubmit the Dispute: File the dispute again with the new evidence.

Escalating Your Dispute To Higher Authorities

If your dispute is still unresolved, escalate the issue. Consider the following:

- Contact the Creditor: Reach out directly to the creditor or lender.

- File a Complaint: Submit a complaint to the Consumer Financial Protection Bureau (CFPB).

- Seek Legal Advice: Consult with a credit repair attorney for further assistance.

Tips For Avoiding Credit Report Errors In The Future

Credit report errors can be a major setback. They can affect your financial health and future opportunities. By following a few simple tips, you can avoid these errors and keep your credit report accurate.

Regularly Monitoring Your Credit Report

Regularly checking your credit report is essential. It allows you to spot errors early and address them promptly. You can obtain a free credit report from major bureaus annually. Set reminders to review your credit report every few months.

Maintaining Accurate Personal Information

Keeping your personal information up-to-date ensures accuracy. Update your address, phone number, and other details whenever they change. This helps prevent mix-ups and ensures all information is current and correct.

Steps To Take For Identity Theft Prevention

Identity theft can lead to credit report errors. Protect yourself by following these steps:

- Use strong passwords and change them regularly.

- Enable two-factor authentication for your accounts.

- Shred sensitive documents before disposing of them.

- Monitor your financial accounts for suspicious activities.

By taking these steps, you can reduce the risk of identity theft and maintain an accurate credit report.

For more detailed guidance on managing your finances and credit, consider exploring educational resources like SubTo. SubTo provides comprehensive courses on creative financing, essential documents, and a supportive community for both seasoned and novice investors.

Frequently Asked Questions

What Is A Credit Report Dispute?

A credit report dispute is when you challenge inaccurate information on your credit report. You contact the credit bureau to correct errors.

How Do I Dispute My Credit Report?

To dispute, gather evidence of errors. Contact the credit bureau online or by mail. Provide necessary documentation.

How Long Does A Dispute Take?

Disputes typically take 30 days to resolve. The credit bureau investigates and responds within this timeframe.

Can Disputes Improve My Credit Score?

Yes, correcting errors through disputes can improve your credit score. Accurate information positively impacts your credit report.

Conclusion

Disputing your credit report can improve your financial health. It’s essential to monitor your credit regularly. By addressing inaccuracies, you can boost your credit score. Need more resources on financial strategies? Check out Subto. Subto offers educational content on creative financing. Both novices and experts will find valuable insights. Stay proactive and informed for better financial decisions.