Credit Repair Testimonials: Real Stories of Financial Revival

Credit repair testimonials offer real insights into the effectiveness of services like Mitigately. These firsthand accounts highlight the transformative power of debt consolidation.

Struggling with debt can be overwhelming. Finding a trustworthy service to help manage and reduce debt is crucial. Mitigately, an AI-powered debt consolidation service, has received rave reviews from users. These testimonials provide valuable information on the experiences of real people who have used Mitigately to regain control of their finances. By consolidating multiple payments into one, Mitigately saves users time and money, helping them become debt-free faster. With a high rating from satisfied customers, it’s worth exploring how Mitigately can help you achieve financial freedom. Read on to discover inspiring credit repair testimonials. Learn more about Mitigately here and see how it can help you.

Introduction To Credit Repair

Having a good credit score is vital. It impacts your financial health and opportunities. Many people struggle with debt and low credit scores. This is where credit repair services, like those offered by Mitigately, come into play.

Understanding Credit Scores And Their Impact

Credit scores range from 300 to 850. Higher scores signify good creditworthiness. Several factors affect your credit score:

- Payment history

- Amounts owed

- Length of credit history

- New credit

- Types of credit used

A low credit score can lead to higher interest rates and loan denials. Improving your credit score can help you qualify for better financial products and lower interest rates. This is where credit repair services are crucial.

The Importance Of Credit Repair

Credit repair involves identifying and fixing errors on your credit report. It also includes adopting better financial habits. Here are some benefits of credit repair:

| Benefit | Description |

|---|---|

| Lower Interest Rates | Improve your score to qualify for lower rates |

| Loan Approvals | Higher scores increase your chances of approval |

| Better Financial Products | Access to better credit cards and loans |

Mitigately offers services to help you repair your credit. Their AI-powered agent matches you with the best debt solutions. This service is free until your accounts are settled. Users report saving up to 35% on their debt. They also appreciate the quick and secure process. Over 400 users have rated Mitigately 4.9 stars.

If you are struggling with debt, consider credit repair services. They can help you achieve financial freedom and peace of mind.

Real Stories Of Financial Revival

Reading credit repair testimonials can be inspiring. They show that financial revival is possible. Here are some real stories of individuals who turned their financial lives around with the help of Mitigately.

John’s Journey From Bankruptcy To Financial Stability

John faced bankruptcy. His debts piled up and he felt overwhelmed. Using Mitigately’s debt consolidation service, he combined his multiple debts into one manageable payment.

- AI-Powered Matching: Matched him with the right debt solution in just 6½ minutes.

- Free Service: No upfront charges.

- Debt Repayment Calculator: Helped him understand his savings and repayment timeline.

Today, John enjoys financial stability. His testimonial highlights the effectiveness of Mitigately’s service in helping users become debt-free faster.

Sarah’s Path To Home Ownership

Sarah dreamt of owning a home. But her credit score was a barrier. She turned to Mitigately for help.

Using their AI-Powered Matching, Sarah found a debt consolidation plan that suited her needs. She saved 35% on her debt and improved her credit score. Within a year, Sarah was able to secure a mortgage and buy her dream home.

| Feature | Benefit |

|---|---|

| Debt Consolidation | Single payment, easier management |

| Savings | 35% reduction on total debt |

| Quick Service | Matched in 6½ minutes |

Sarah’s story is a testament to how Mitigately can transform financial dreams into reality.

Mike’s Experience With Debt Consolidation

Mike struggled with multiple debts. High-interest rates made it hard to keep up. He chose Mitigately to consolidate his debts.

Here’s what Mike experienced:

- Secure Information Input: His data was protected with 256-bit encryption.

- Perfect Plan: Matched quickly with a suitable plan.

- Follow Through: Mitigately handled negotiations with creditors, reducing his total debt.

Mike now enjoys lower monthly payments. His debt is under control, and he feels financially secure. His experience shows the real benefits of using Mitigately’s debt consolidation service.

These testimonials prove that with the right help, anyone can achieve financial revival. Mitigately offers a path to financial freedom. Their services are highly rated, making them a trusted choice for debt management.

Key Features Of Effective Credit Repair Services

Effective credit repair services provide essential features to help individuals improve their credit scores and achieve financial stability. These services are tailored to meet specific needs and offer comprehensive support throughout the credit repair process. Below are the key features to look for:

Personalized Credit Analysis

A personalized credit analysis is crucial for effective credit repair. This involves a detailed examination of your credit report to identify errors and areas for improvement. Mitigately utilizes AI-powered matching to provide a customized debt consolidation plan that fits your unique financial situation. This personalized approach ensures you receive the most suitable solution for your credit issues.

Dispute Resolution And Negotiation

Dispute resolution and negotiation are essential components of credit repair services. These processes involve challenging inaccuracies on your credit report and negotiating with creditors to remove negative items. Mitigately handles these tasks, working directly with your creditors to settle accounts efficiently. This service is free until your accounts are settled, ensuring you only pay for successful results.

Credit Education And Counseling

Credit education and counseling help you understand how to manage your credit and avoid future issues. Mitigately offers guidance on debt management, consolidating multiple debts into a single payment to simplify your financial obligations. With their support, you can learn strategies to maintain a healthy credit score and achieve financial freedom faster.

By leveraging these key features, Mitigately ensures a comprehensive and effective approach to credit repair, helping users become debt-free quickly and efficiently.

Pricing And Affordability Of Credit Repair Services

Understanding the pricing and affordability of credit repair services is crucial. Many people seek these services to improve their credit scores and financial health. Knowing the costs involved helps in making informed decisions. Let’s dive into the details.

Cost Breakdown Of Popular Credit Repair Services

Credit repair services vary in pricing. Here is a breakdown of common costs associated with these services:

| Service | Initial Fee | Monthly Fee |

|---|---|---|

| Basic Credit Repair | $50 – $100 | $50 – $100 |

| Advanced Credit Repair | $100 – $150 | $75 – $150 |

| Premium Credit Repair | $150 – $200 | $100 – $200 |

These fees cover different levels of service. Basic plans usually include credit report analysis and dispute letters. Advanced plans offer more personalized strategies. Premium plans provide comprehensive services, including identity theft protection.

Value For Money: Comparing Services And Results

Assessing the value for money involves comparing the services offered and the results achieved. Here are some key points to consider:

- Service Quality: Look for services that offer detailed credit analysis and personalized plans.

- Customer Reviews: Read testimonials from other users to gauge the effectiveness of the service.

- Success Rate: Consider the percentage of successful credit score improvements.

- Additional Features: Some services offer extra features like identity theft protection or financial education resources.

For instance, Mitigately is a debt consolidation service that offers unique features:

- AI-Powered Matching: Matches users with suitable debt solutions quickly.

- Free Service: No charges until accounts are settled.

- Debt Consolidation: Combines multiple debts into one payment.

- Savings: Users can save an average of 35% on their debt.

Mitigately’s service is highly rated, with an average rating of 4.9 stars from over 400 reviews. This indicates a high level of customer satisfaction and effective results.

Choosing the right credit repair service involves considering both cost and value. By comparing different options and their results, you can find a service that meets your needs and budget.

Pros And Cons Of Using Credit Repair Services

Choosing a credit repair service can be a significant decision. It is important to understand both the advantages and potential drawbacks. This section explores the pros and cons of using credit repair services.

Advantages Of Professional Credit Repair

Credit repair services can offer several benefits to those struggling with debt.

- Expertise: Professionals understand credit laws and can navigate complex systems. They can identify errors and remove negative items from your report.

- Time-Saving: Services handle the legwork, allowing you to focus on other financial goals. This can save you countless hours.

- Improved Credit Score: Removing inaccuracies can lead to a higher credit score. This can open doors to better interest rates and loan opportunities.

- Personalized Plans: Services like Mitigately offer tailored solutions. Their AI-powered agent matches users with the best debt solutions in under 7 minutes.

Potential Drawbacks And Risks

While there are clear benefits, there are also some potential drawbacks and risks involved with credit repair services.

- Cost: Some services can be expensive. Mitigately offers a free service until accounts are settled, but others may charge high fees.

- Scams: The industry has many scams. It is crucial to research and choose reputable services.

- Temporary Solutions: Some fixes may only be temporary. It is important to adopt good financial habits for long-term success.

- No Guarantees: Credit repair services cannot guarantee results. Improvements depend on individual credit situations.

Understanding these pros and cons can help you make an informed decision about using credit repair services. Assess your needs and research thoroughly before proceeding.

Recommendations For Ideal Users Or Scenarios

Credit repair services are essential for many individuals. They can help improve financial health and open doors to better opportunities. Let’s explore who can benefit most from these services and the situations where credit repair becomes essential.

Who Can Benefit Most From Credit Repair Services?

- Individuals with Poor Credit Scores: Those struggling with low credit scores can benefit greatly. Improved scores can lead to better loan approvals and interest rates.

- First-Time Credit Users: People new to credit can avoid common pitfalls. Building good credit from the start can save them from future financial issues.

- People with High Debt: High debt can damage credit scores. Debt management services like Mitigately can consolidate multiple debts into a single manageable payment.

- Individuals Facing Financial Hardship: Those experiencing financial difficulties can find relief. Credit repair can provide a structured plan to regain financial stability.

Situations Where Credit Repair Is Essential

| Situation | Why Credit Repair is Essential |

|---|---|

| High-Interest Debt | Consolidating debt can reduce interest rates and monthly payments. This makes it easier to manage finances. |

| Loan or Mortgage Denials | Improving credit scores can enhance loan approval chances. This is crucial for those needing significant financial products. |

| Identity Theft | Repairing credit after identity theft is crucial. It ensures that fraudulent activities do not impact creditworthiness. |

| Job Applications | Some employers check credit scores. A good credit score can improve employment prospects. |

Using services like Mitigately can provide an efficient solution. Mitigately’s AI-Powered Matching and Debt Consolidation features make it easier to manage debt and improve credit scores. The service is free until accounts are settled, ensuring users only pay when they see results.

Frequently Asked Questions

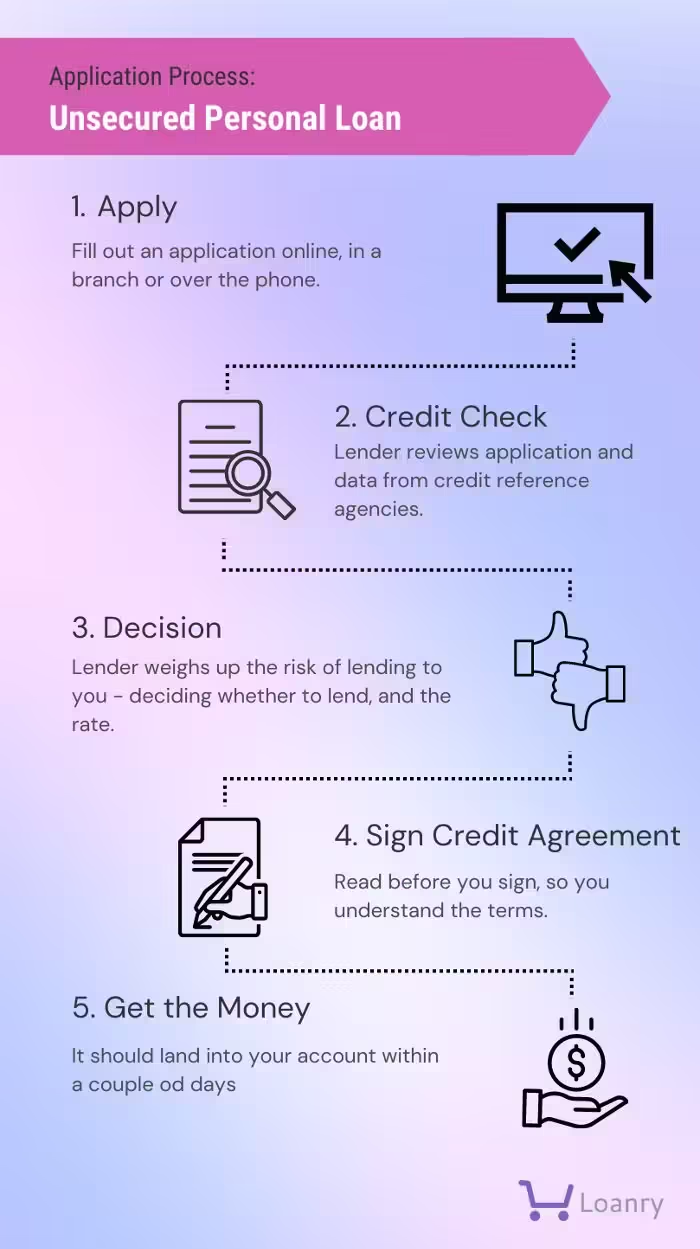

What Is Credit Repair?

Credit repair involves fixing your bad credit report. It ensures improving your overall credit score. It includes disputing errors, negotiating with creditors, and managing debts.

How Long Does Credit Repair Take?

Credit repair usually takes three to six months. The timeframe can vary based on individual circumstances. Prompt actions and consistent follow-ups can speed up the process.

Are Credit Repair Testimonials Reliable?

Credit repair testimonials can be reliable if they come from verified sources. Always check for authenticity and cross-reference multiple reviews. Verified testimonials provide a clearer picture of service effectiveness.

Can I Repair My Credit Myself?

Yes, you can repair your credit yourself. It involves disputing errors, negotiating with creditors, and managing debts. However, professional services can simplify and expedite the process.

Conclusion

Reading these credit repair testimonials, it’s clear: Mitigately works. Many users have shared their positive experiences. They appreciated the quick, AI-powered matching service. They saved time and money. Debt consolidation became easy and stress-free. Try Mitigately today to see how you can benefit. Visit Mitigately for more information. Your financial freedom could be just a few clicks away.